How US Market Fluctuations Affect Elon Musk's Billions

Table of Contents

Main Points:

2.1 Tesla's Stock Performance and Musk's Wealth

H3: Tesla Stock Volatility:

Elon Musk's net worth is inextricably tied to Tesla's stock price. He owns a substantial portion of Tesla shares, meaning any significant movement in the stock directly translates to a massive change in his personal wealth. Tesla's stock is notoriously volatile, subject to dramatic swings based on a variety of factors. Production challenges, intense competition from established automakers and new entrants, regulatory changes impacting electric vehicle (EV) adoption, and fluctuating investor sentiment all contribute to this volatility. Even positive news can be short-lived, showcasing the unpredictable nature of Tesla's stock and, by extension, Musk’s net worth.

H3: Market Sentiment and Tesla's Valuation:

Tesla's valuation, and consequently Musk's billions, are heavily influenced by overall market sentiment. During bull markets, characterized by investor optimism and rising stock prices across the board, Tesla's stock often enjoys significant gains. Conversely, bear markets, marked by pessimism and falling stock prices, can severely impact Tesla's valuation and dramatically reduce Musk's net worth. For example, the broader market downturn of 2022 significantly impacted Tesla's share price, leading to a notable decrease in Musk's personal wealth.

- Key Events Impacting Tesla Stock and Musk's Net Worth:

- Q4 2021: Strong earnings and increased deliveries led to a surge in Tesla's stock price, boosting Musk's net worth.

- Early 2022: Rising interest rates and concerns about inflation led to a significant drop in Tesla's stock price, impacting Musk's net worth.

- Mid-2022: Musk's Twitter acquisition and subsequent controversies caused further volatility in Tesla's stock.

2.2 SpaceX and Other Ventures' Indirect Influence

H3: SpaceX's Private Funding and Valuation:

While Tesla is the primary driver of Musk's net worth, SpaceX, his space exploration company, also plays a significant, albeit indirect, role. SpaceX's private funding rounds and periodic valuation updates, though not publicly traded like Tesla, contribute to Musk's overall financial picture. Increased valuations from private investment rounds directly translate to a higher net worth for Musk, even if the impact is less immediate and dramatic than Tesla's stock fluctuations.

H3: Diversification and Risk Mitigation:

Musk's diverse portfolio of ventures, including The Boring Company, Neuralink, and X (formerly Twitter), offers a degree of diversification and risk mitigation. While the US market's impact on Tesla is substantial, the performance of these other companies, although less significant in terms of direct influence on his billions, can help cushion the blow of negative market swings affecting Tesla.

- Contributions of SpaceX and Other Ventures:

- SpaceX contracts with NASA and other private entities generate substantial revenue, impacting Musk’s overall wealth.

- The Boring Company's infrastructure projects, while still in early stages, hold the potential for significant future value.

- Neuralink’s advancements in brain-computer interfaces represent long-term investment potential.

2.3 Macroeconomic Factors and Their Impact

H3: Interest Rates and Inflation:

Changes in interest rates and inflation significantly influence investor behavior and, consequently, stock market performance. Rising interest rates generally make borrowing more expensive, leading to decreased investment and potentially lower stock prices. Similarly, high inflation erodes purchasing power, impacting consumer spending and investor confidence, thus affecting Tesla's stock price and Musk’s billions.

H3: Geopolitical Events and Market Uncertainty:

Global events like wars, trade disputes, and political instability create market uncertainty, causing volatility in the stock market. These geopolitical factors can negatively impact investor sentiment, leading to decreased investment in riskier assets like Tesla stock, thus impacting Musk's net worth.

- Macroeconomic Factors and Geopolitical Events:

- The ongoing war in Ukraine significantly impacted global energy prices and supply chains, indirectly affecting Tesla's operations and stock price.

- Trade tensions between the US and China have created uncertainty in the global market, influencing investor confidence and Tesla's stock performance.

Conclusion: Understanding the Interplay Between US Markets and Elon Musk's Billions

US market fluctuations significantly influence Elon Musk's net worth, primarily through the performance of Tesla's stock but also indirectly via his other ventures. Understanding macroeconomic factors like interest rates, inflation, and geopolitical events is crucial for evaluating the impact on Musk's wealth. The volatility of Tesla's stock highlights the inherent risks associated with such substantial holdings in a single company, even one as innovative and influential as Tesla. Stay tuned for further updates on how US market fluctuations affect Elon Musk's billions!

Featured Posts

-

Fast Paced Fun St Albert Dinner Theatres New Farce

May 09, 2025

Fast Paced Fun St Albert Dinner Theatres New Farce

May 09, 2025 -

Wynne Evans Breaks Silence On Life After Strictly Come Dancing

May 09, 2025

Wynne Evans Breaks Silence On Life After Strictly Come Dancing

May 09, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 09, 2025

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 09, 2025 -

The Unexpected Canadian Heir To Warren Buffetts Legacy

May 09, 2025

The Unexpected Canadian Heir To Warren Buffetts Legacy

May 09, 2025 -

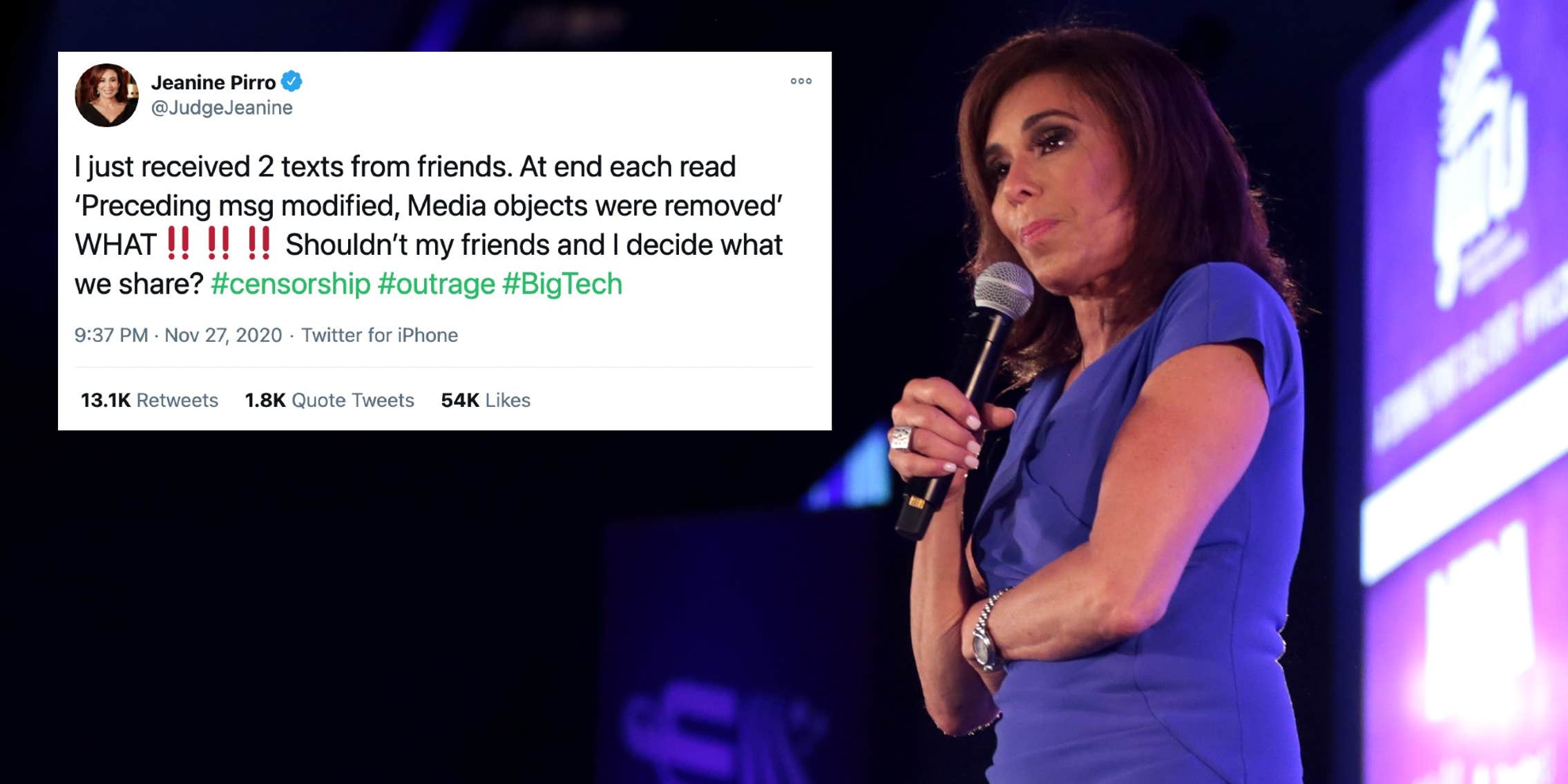

Is Jeanine Pirro Right Should You Ignore The Stock Market Now

May 09, 2025

Is Jeanine Pirro Right Should You Ignore The Stock Market Now

May 09, 2025