Uber's Driverless Ambitions: A Look At Potential ETF Returns

Table of Contents

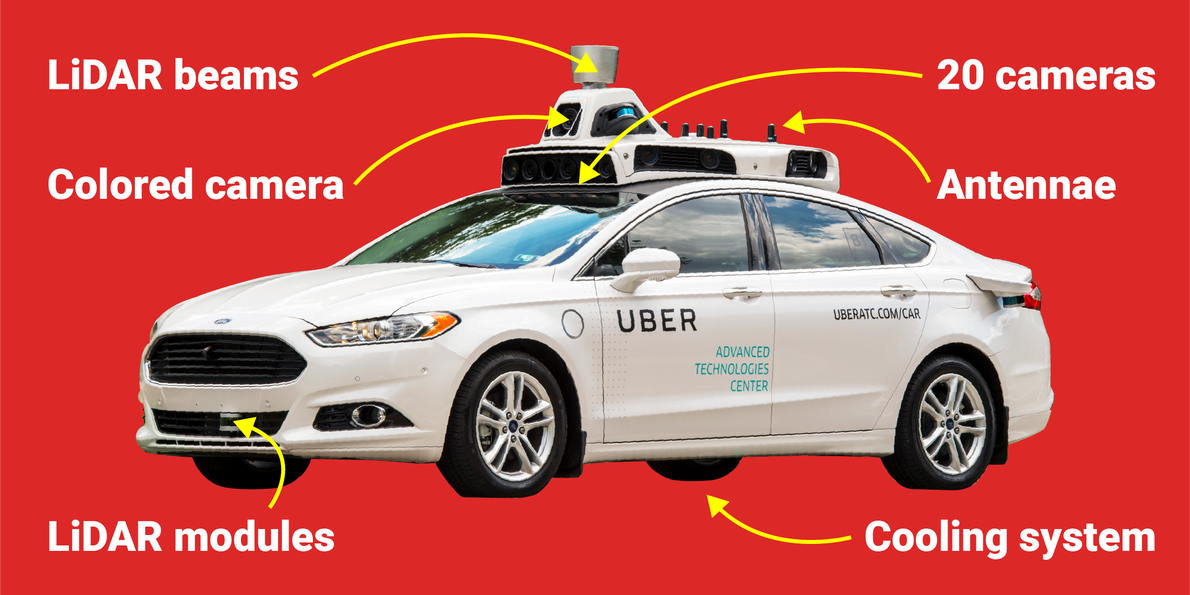

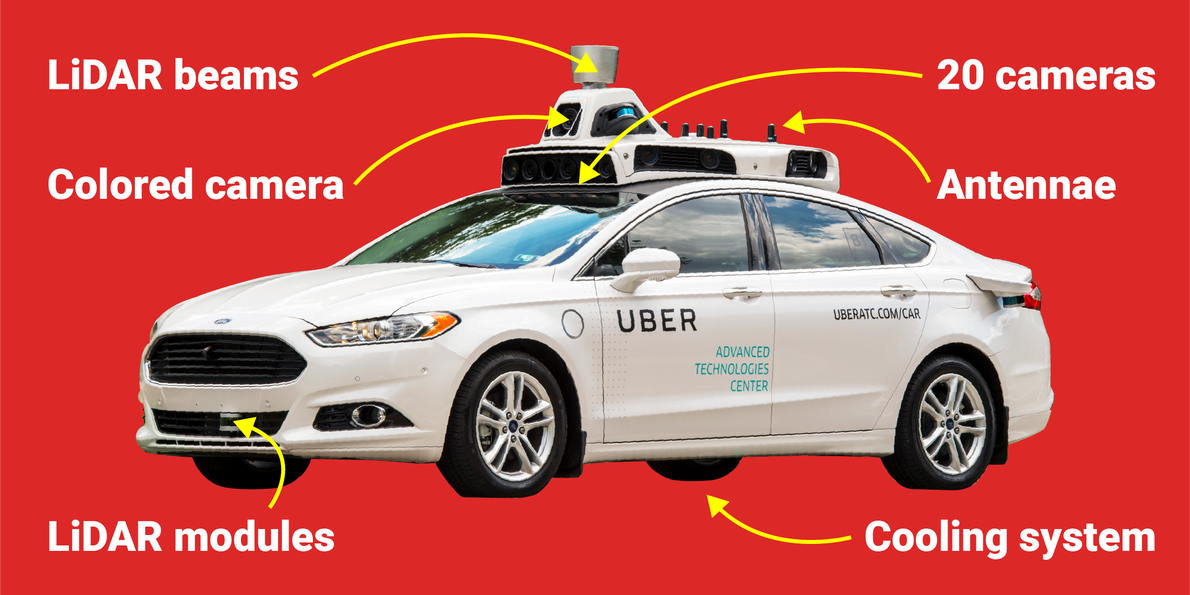

Understanding Uber's Autonomous Vehicle Technology

Uber's foray into self-driving technology is ambitious and multifaceted. The company has made significant strides, investing heavily in research and development, and forging key partnerships and acquisitions to accelerate its progress. This pursuit positions Uber as a major player in the fiercely competitive autonomous vehicle market, alongside giants like Waymo and Cruise.

- Specific milestones achieved by Uber in autonomous driving: Uber ATG (Advanced Technologies Group) has logged millions of miles of autonomous driving tests, showcasing advancements in sensor technology, mapping, and artificial intelligence. They've also successfully launched pilot programs in select cities, demonstrating real-world application of their technology.

- Technological challenges Uber faces in deploying driverless vehicles: Overcoming challenges like ensuring safety in unpredictable driving situations, achieving complete reliability in various weather conditions, and navigating complex ethical dilemmas remain significant hurdles.

- Regulatory hurdles and their impact on Uber's timeline: Navigating the complex regulatory landscape varies significantly across different jurisdictions. Securing necessary permits and approvals can impact the speed of deployment and commercialization of Uber's self-driving vehicles. The evolving legal frameworks surrounding liability in accidents involving autonomous vehicles also present challenges.

Identifying Relevant ETFs for Exposure to Autonomous Vehicles

Exchange-Traded Funds (ETFs) offer a diversified approach to investing in the burgeoning autonomous vehicle sector. These funds allow investors to gain exposure to multiple companies involved in various aspects of self-driving technology, mitigating the risk associated with investing in a single company.

- Top 3-5 ETFs with exposure to autonomous driving: While specific ETF holdings change dynamically, research commonly reveals ETFs like the Global X Robotics & Artificial Intelligence ETF (BOTZ), the iShares Autonomous Driving ETF (IDRV - Note: Always verify ticker symbols and ETF availability before investing), and others focusing on technology or transportation sectors often hold shares in companies indirectly or directly benefiting from Uber's success in the driverless car market.

- Breakdown of the holdings within each ETF (mention key companies): Carefully examine each ETF's fact sheet to understand its underlying holdings. Some ETFs may hold shares in companies that supply crucial components (sensors, lidar, AI software) to autonomous vehicle manufacturers, while others may directly hold shares of companies developing self-driving technology.

- Expense ratios and other relevant ETF characteristics: Compare expense ratios and other key metrics (like turnover rate and tracking error) to identify ETFs that align with your investment strategy and risk tolerance.

Analyzing Potential Returns and Risks of Investing in Autonomous Vehicle ETFs

The autonomous vehicle market holds enormous growth potential, suggesting potentially high returns for investors. However, investing in emerging technologies like autonomous driving carries significant risks.

- Historical performance of similar technology ETFs: Analyzing the historical performance of similar technology ETFs can provide insights into potential returns and volatility. Remember that past performance is not indicative of future results.

- Market predictions for the autonomous vehicle market growth: Market research reports and industry analyses offer projections for the growth of the autonomous vehicle market. These predictions, however, should be viewed with caution due to inherent uncertainties.

- Potential scenarios (best-case, worst-case) for ETF returns: Consider different scenarios—a best-case scenario where the technology rapidly advances and is widely adopted, and a worst-case scenario where technological challenges or regulatory hurdles significantly delay adoption.

Due Diligence and Investment Strategies

Before investing in any ETF, thorough research is paramount. Understanding your risk tolerance and investment goals is crucial for making informed decisions.

- Resources for conducting ETF research (e.g., Morningstar, ETF.com): Reputable financial websites provide tools and resources to research ETFs and understand their holdings, performance, and risk profiles.

- Key factors to consider before investing (risk tolerance, time horizon): Autonomous vehicle ETFs are considered higher-risk investments due to the nascent nature of the technology. Assess your risk tolerance and investment time horizon before committing capital.

- Strategies for mitigating risks (diversification, dollar-cost averaging): Diversifying your portfolio across asset classes and employing strategies like dollar-cost averaging can help mitigate potential losses.

Conclusion: Harnessing Uber's Driverless Ambitions Through Smart ETF Investing

Uber's driverless car ambitions represent a potentially lucrative investment opportunity, accessible through carefully selected ETFs. While the potential for high returns exists, the inherent risks associated with investing in emerging technologies must be acknowledged. Thorough research, a well-defined investment strategy, and a realistic understanding of your risk tolerance are essential. Conduct further research on the ETFs mentioned above and consider incorporating them into your investment portfolio to potentially benefit from Uber's driverless ambitions. Remember to search for "Uber's driverless car ETFs" or similar terms to refine your research.

Featured Posts

-

Dubay Vs Moskva Sravnenie Rynka Truda Dlya Rossiyan

May 17, 2025

Dubay Vs Moskva Sravnenie Rynka Truda Dlya Rossiyan

May 17, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Building Contamination

May 17, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Building Contamination

May 17, 2025 -

Negan In Fortnite Jeffrey Dean Morgans Interview

May 17, 2025

Negan In Fortnite Jeffrey Dean Morgans Interview

May 17, 2025 -

Key Elements Of A Proxy Statement Form Def 14 A A Practical Overview

May 17, 2025

Key Elements Of A Proxy Statement Form Def 14 A A Practical Overview

May 17, 2025 -

Missed Call In Game 4 Nbas Response And Its Impact On Pistons

May 17, 2025

Missed Call In Game 4 Nbas Response And Its Impact On Pistons

May 17, 2025