UK Luxury Sector: Brexit's Contribution To Export Lag In The EU

Table of Contents

Increased Trade Barriers and Bureaucracy

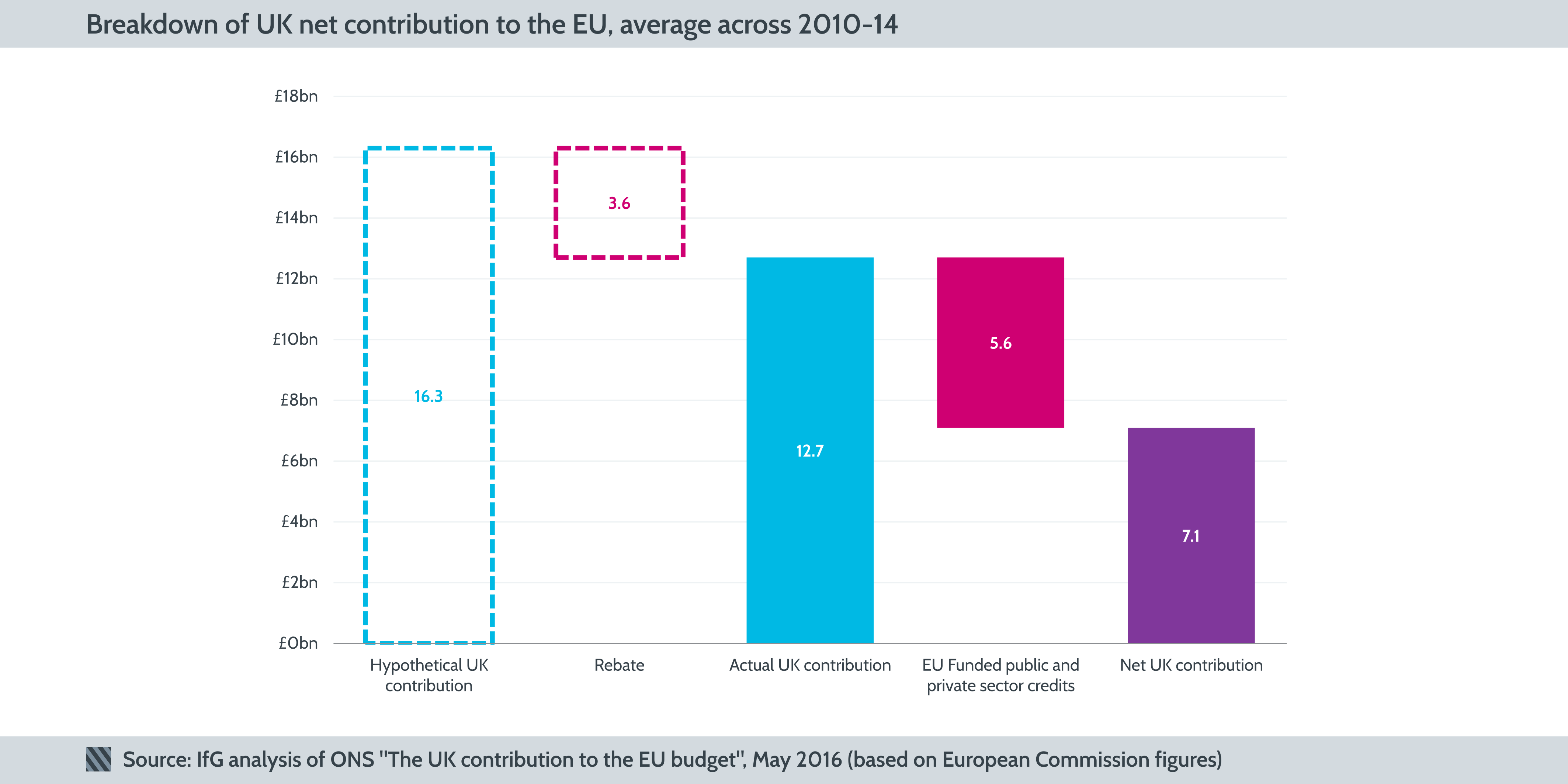

Brexit introduced a new layer of complexity to exporting luxury goods to the EU. The smooth flow of high-value items, previously unhindered by significant bureaucratic hurdles, now faces increased scrutiny and costs. These new Brexit trade barriers manifest in several ways:

- Increased shipping times and costs: Customs delays at borders have significantly extended transit times, impacting just-in-time delivery models and increasing transportation expenses. This is especially problematic for perishable luxury goods or those requiring specialized handling.

- Complex paperwork and compliance requirements: The volume and intricacy of paperwork required for luxury goods export to the EU have increased dramatically. This places a heavy administrative burden on businesses, requiring specialized expertise and diverting resources from core operations. Meeting post-Brexit regulations demands significant investment in compliance systems.

- Higher import duties: The imposition of import duties on UK luxury goods entering the EU has eroded their price competitiveness. This makes them less attractive to consumers compared to similar products from within the EU, impacting sales volumes and profitability.

- Specific luxury sectors like high-end fashion, bespoke jewellery, and luxury cars are particularly affected by these increased EU customs challenges, requiring extensive documentation and careful handling to meet stringent EU quality and safety standards.

Impact on Supply Chains and Logistics

Brexit has significantly disrupted established luxury goods supply chain networks, impacting the sector's efficiency and resilience. The reliance on streamlined, efficient processes is critical for luxury brands, and Brexit has thrown a significant wrench in these well-oiled machines.

- Increased reliance on less efficient and more expensive shipping routes: The shift away from frictionless cross-border movement has forced many businesses to rely on longer, more expensive shipping routes, impacting both time and cost.

- Difficulties in sourcing materials and components from the EU: Many UK luxury brands rely on EU-sourced materials and components. New trade barriers make this sourcing more difficult, costly, and potentially unreliable. This disruption in the EU supply chain impacts production schedules and product availability.

- Challenges in managing inventory and meeting demand due to border complexities: Predicting and managing inventory has become more difficult given the unpredictable delays and disruptions at the border. This impacts the ability to meet consumer demand and can lead to lost sales opportunities.

- The effectiveness of Just-in-Time inventory management, a cornerstone of efficient luxury production, has been significantly reduced due to unpredictable delays caused by post-Brexit logistics challenges.

Diminished Brand Perception and Market Access

The uncertainty and complexities surrounding Brexit have potentially negatively impacted the perception of UK luxury brands in the EU market. This reduced market access threatens the very foundation of these brands' success.

- Concerns about product availability and timely delivery: The delays and uncertainties associated with cross-border shipping have created concerns among EU consumers about the reliability of receiving UK luxury goods in a timely manner.

- Increased uncertainty and potential risks associated with purchasing UK luxury goods: This uncertainty increases the perceived risk associated with purchasing UK goods, potentially pushing consumers towards established EU brands. This also undermines the carefully cultivated image of exclusivity and seamless experience that defines the luxury market.

- Reduced brand visibility and marketing opportunities due to trade restrictions: Trade barriers may impact the ability of UK luxury brands to participate in EU marketing campaigns and events, reducing their brand visibility and market reach.

- Loss of market share to competitors from other EU countries: As UK luxury goods become less competitive due to increased costs and logistical challenges, EU competitors are poised to capitalize on the reduced market share, further damaging the UK luxury sector's position.

Case Studies: Specific examples of luxury brands affected by Brexit.

While specific data may be commercially sensitive, anecdotal evidence suggests that several high-profile British luxury brands have experienced export slowdowns and increased costs since Brexit. For example, reports from the high-end fashion sector indicate significant increases in shipping times and associated costs. Similarly, luxury car manufacturers have reported challenges in timely delivery of bespoke vehicles to EU customers. Further research and analysis are needed to quantify the precise impact on individual brands.

Government Support and Future Outlook

The UK government has implemented several measures to mitigate the impact of Brexit on the luxury sector. These include support schemes aimed at assisting businesses with navigating the new trade regulations and boosting export competitiveness.

- Analysis of government support schemes and their effectiveness: While the government has made efforts, the effectiveness of these Government support Brexit schemes remains a subject of ongoing debate, with some businesses reporting limited benefit.

- Future predictions for the UK luxury sector's export performance to the EU: The outlook for the UK luxury sector's export performance to the EU remains uncertain, with ongoing challenges related to trade barriers and logistical complexities.

- Potential strategies for UK luxury brands to overcome Brexit-related challenges: UK luxury brands need to adapt and innovate, focusing on diversification of markets, streamlining logistics, and enhancing their brand communication to build and maintain consumer confidence and trust. Stronger engagement with post-Brexit trade policy and proactive collaborations with industry associations is crucial for long-term success.

Conclusion: Overcoming the Brexit Export Lag for the UK Luxury Sector

Brexit has undeniably contributed to an export lag for the UK luxury sector. Increased Brexit trade barriers, significant supply chain disruption, and diminished brand perception in the EU represent major challenges. Understanding and addressing these issues is paramount for the future growth and success of this vital industry. The UK government's role in providing effective support and fostering better EU trade relations is critical. Learn more about navigating the complexities of UK Luxury Sector: Brexit's Contribution to Export Lag in the EU and discover strategies for success by exploring resources from relevant government agencies and industry associations.

Featured Posts

-

Freepoint Eco Systems Secures Project Finance From Ing

May 21, 2025

Freepoint Eco Systems Secures Project Finance From Ing

May 21, 2025 -

Canadian Tire And Hudsons Bay A Strategic Fit

May 21, 2025

Canadian Tire And Hudsons Bay A Strategic Fit

May 21, 2025 -

Understanding The Love Monster Character Analysis And Themes

May 21, 2025

Understanding The Love Monster Character Analysis And Themes

May 21, 2025 -

Improved Wireless Headphones A Review Of The Best Models

May 21, 2025

Improved Wireless Headphones A Review Of The Best Models

May 21, 2025 -

Self Guided Walking Holiday In Provence Mountains To Mediterranean

May 21, 2025

Self Guided Walking Holiday In Provence Mountains To Mediterranean

May 21, 2025

Latest Posts

-

Explaining The D Wave Quantum Qbts Stock Decrease On Monday

May 21, 2025

Explaining The D Wave Quantum Qbts Stock Decrease On Monday

May 21, 2025 -

Market Analysis Deciphering The Drop In D Wave Quantum Qbts Stock On Monday

May 21, 2025

Market Analysis Deciphering The Drop In D Wave Quantum Qbts Stock On Monday

May 21, 2025 -

Understanding The Recent Decline In D Wave Quantum Qbts Stock

May 21, 2025

Understanding The Recent Decline In D Wave Quantum Qbts Stock

May 21, 2025 -

D Wave Quantum Qbts Stock Performance Monday Causes And Implications

May 21, 2025

D Wave Quantum Qbts Stock Performance Monday Causes And Implications

May 21, 2025 -

Understanding The Factors Behind D Wave Quantum Inc S Qbts 2025 Stock Drop

May 21, 2025

Understanding The Factors Behind D Wave Quantum Inc S Qbts 2025 Stock Drop

May 21, 2025