Uncertainty And The Tech IPO Market: Tariffs Dampen Growth

Table of Contents

The Chill of Tariffs on Tech IPOs

Trade tariffs present a substantial hurdle for tech companies contemplating an IPO. The increased uncertainty stemming from these tariffs directly impacts their ability to accurately project revenue and profitability. The added costs associated with tariffs ripple through the entire supply chain, impacting everything from material sourcing to manufacturing and ultimately, the bottom line.

- Increased material and manufacturing costs: Tariffs inflate the cost of imported components, crucial for many tech products. This directly reduces profit margins and makes accurate financial forecasting more difficult.

- Difficulty in forecasting future revenue streams: The unpredictable nature of tariff implementations makes it challenging for companies to reliably predict future revenue, a critical factor for investors assessing IPO viability.

- Potential for reduced global market access: Tariffs can limit a company's ability to compete effectively in global markets, potentially shrinking its addressable market and impacting overall revenue potential.

- Negative impact on investor sentiment regarding long-term growth: Uncertainty surrounding future tariff policies creates a negative outlook, discouraging investors from committing capital to tech IPOs. This leads to a tech IPO slowdown and a more cautious approach by venture capitalists and other investors.

Increased Volatility and Risk Aversion in the IPO Market

Uncertainty inherently breeds risk aversion. The unpredictable nature of trade policies, coupled with broader geopolitical events, has led to increased volatility in the IPO market. Investors, faced with this uncertainty, are becoming significantly more risk-averse.

- Reduced investor appetite for riskier ventures: The tech sector, often associated with higher risk-higher reward profiles, is particularly vulnerable to this shift in investor sentiment.

- Lower IPO valuations due to increased uncertainty: The increased risk translates to lower valuations for tech IPOs, as investors demand a greater margin of safety.

- Difficulty in attracting sufficient investment capital: Companies seeking funding through IPOs find it harder to secure the necessary capital due to investor hesitancy.

- Postponement or cancellation of IPO plans: Faced with these challenges, many tech companies are postponing or even canceling their IPO plans, further contributing to the slowdown in market activity. This creates a significant impact on the IPO market and tech IPOs in particular.

Geopolitical Uncertainty and its Ripple Effect

Beyond trade tariffs, broader geopolitical uncertainties significantly impact the tech IPO market. Global events create ripples that affect investor confidence and market stability, adding another layer of complexity to the already challenging environment.

- Global political instability and its impact on market sentiment: Political instability in key regions can negatively affect investor confidence, leading to a pullback in investment across various sectors, including tech.

- Brexit and its implications for European tech companies: The UK's exit from the European Union has created significant uncertainty for European tech companies, impacting their access to markets and funding.

- Other significant geopolitical events and their influence on the IPO market: Other major global events, such as conflicts or economic crises, can further exacerbate market volatility and negatively impact investor sentiment towards tech IPOs.

Strategies for Navigating the Uncertain Tech IPO Landscape

Despite the challenges, tech companies can adopt strategies to mitigate the impact of tariffs and geopolitical risks when considering an IPO. Proactive planning and transparent communication are key.

- Diversification of supply chains: Reducing reliance on single sources of supply, particularly those in tariff-affected regions, is crucial for mitigating supply chain disruptions.

- Robust financial planning and risk management strategies: Thorough financial planning and sophisticated risk management strategies are essential for navigating uncertain market conditions.

- Transparent and proactive communication with potential investors: Open and honest communication with investors about the challenges and potential risks associated with the IPO is crucial for building trust and securing investment.

- Exploring alternative funding options: Considering alternative funding sources, such as private equity or venture capital, can provide a buffer against the challenges of the public market.

Understanding and Adapting to Uncertainty in the Tech IPO Market

The impact of tariffs and broader geopolitical uncertainty on the tech IPO market is undeniable. Tech companies face significant challenges in navigating this complex landscape, and investors must carefully assess the risks before making investment decisions. Understanding market trends, performing thorough risk assessments, and adapting to changing conditions are crucial for success. Stay informed about the latest developments in the tech IPO market, conduct thorough tech IPO analysis, and carefully evaluate the risks and opportunities before making investment decisions. The future of tech IPOs hinges on the ability of companies and investors to adapt to this new reality.

Featured Posts

-

Ramadan Taiwo Awoniyis Generous Iftar For Nottinghams Muslim Community

May 14, 2025

Ramadan Taiwo Awoniyis Generous Iftar For Nottinghams Muslim Community

May 14, 2025 -

Swiss Sneaker Company Stock Jumps Amidst Rising International Demand

May 14, 2025

Swiss Sneaker Company Stock Jumps Amidst Rising International Demand

May 14, 2025 -

Haiti En Crisis El Sociologo Danny Shaw Advierte Sobre La Gravedad De La Situacion

May 14, 2025

Haiti En Crisis El Sociologo Danny Shaw Advierte Sobre La Gravedad De La Situacion

May 14, 2025 -

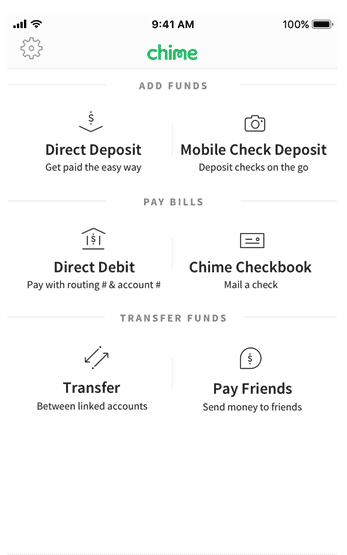

Get A 500 Instant Loan With Chime A Guide For Direct Deposit Users

May 14, 2025

Get A 500 Instant Loan With Chime A Guide For Direct Deposit Users

May 14, 2025 -

Stock Markets Surge On Renewed U S China Optimism

May 14, 2025

Stock Markets Surge On Renewed U S China Optimism

May 14, 2025