Understanding High Stock Market Valuations: BofA's Viewpoint

Table of Contents

BofA's Key Arguments on High Valuations

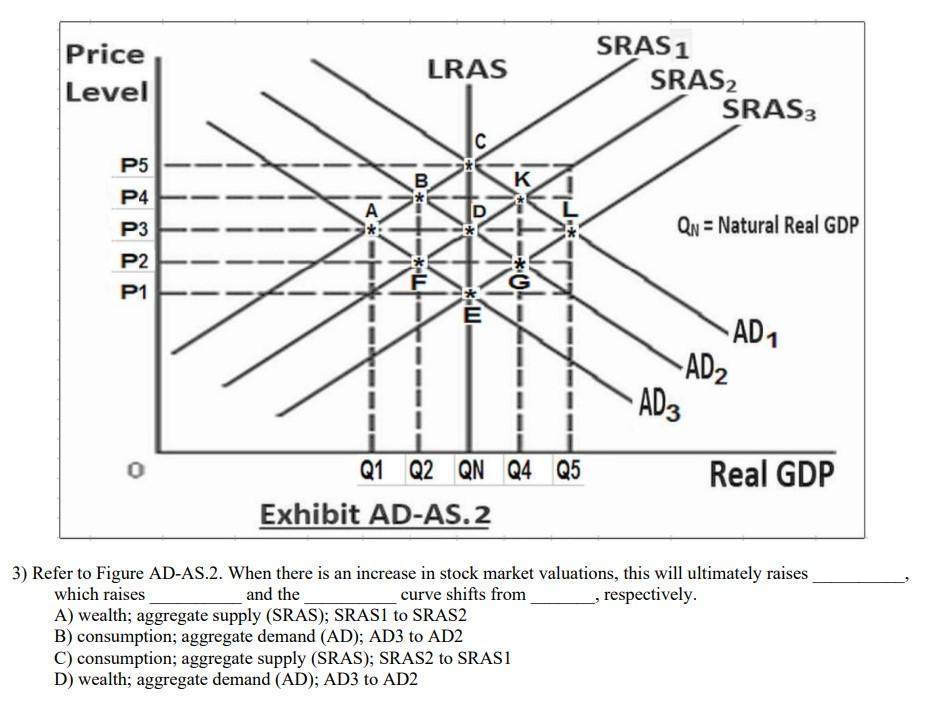

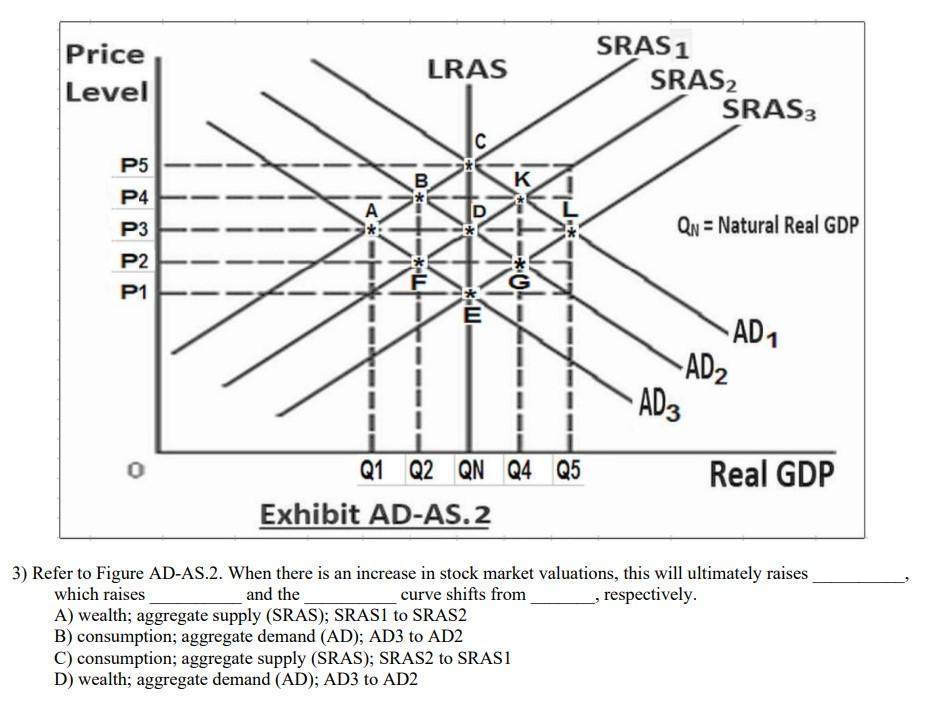

BofA generally maintains a cautious optimism regarding current stock market valuations. While acknowledging the elevated levels, their analysis doesn't necessarily signal an immediate crash, but rather a call for careful consideration and strategic adjustments in investment approaches. Their stance is nuanced, varying across sectors and factoring in macroeconomic conditions.

-

BofA's Reasoning: BofA's assessment is based on a multifaceted analysis incorporating several key metrics. They don't rely on a single indicator but rather a comprehensive evaluation.

-

Valuation Metrics: BofA utilizes various metrics to gauge market valuations, including the price-to-earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other fundamental analyses comparing earnings growth with price appreciation. These provide a more holistic picture than relying solely on one metric.

-

Sector-Specific Views: BofA often highlights specific sectors they deem overvalued or undervalued. For instance, they might point to certain tech stocks as overvalued based on their growth projections versus current pricing, while simultaneously identifying undervalued opportunities in sectors like infrastructure or energy, depending on prevailing market conditions and their own research.

-

Geopolitical Factors: Global events heavily influence BofA's outlook. Factors such as geopolitical instability, trade wars, or unexpected economic shocks in major global economies are incorporated into their models and significantly impact their assessment of equity valuations and overall market trends.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. These are complex and interconnected, making a precise attribution challenging.

-

Low Interest Rates: Historically low interest rates globally have pushed investors towards higher-yielding assets, including stocks. This increased demand inflates stock prices, contributing to higher valuations. This effect is amplified by quantitative easing (QE) policies.

-

Quantitative Easing (QE): QE programs, implemented by central banks to inject liquidity into the market, have significantly increased the money supply. This excess liquidity often finds its way into the stock market, pushing prices higher. This is a significant contributor to inflated market valuation.

-

Strong Corporate Earnings (Conditional): If strong corporate earnings accompany high valuations, it might suggest that the market isn't entirely overvalued. However, BofA carefully analyzes whether earnings growth justifies current stock prices, and this is often a point of debate in their analysis of equity valuations. Sustained, robust earnings growth can support higher valuations, while stagnant or declining earnings indicate potential overvaluation.

-

Investor Sentiment: Positive investor sentiment, driven by factors like economic optimism or technological advancements, can fuel stock prices even in the face of potentially high valuations. Fear and greed are powerful forces affecting market trends.

-

Technological Advancements: Technological innovation has fueled the growth of certain sectors, leading to exceptionally high valuations for companies in these spaces. This is particularly relevant in the technology sector, where high-growth potential frequently justifies premium valuations, but carries higher risk of corrections.

Potential Risks Associated with High Valuations

Investing in a highly valued market comes with inherent risks. Investors must carefully consider these potential downsides.

-

Market Volatility and Corrections: High valuations often precede market corrections or even crashes. The higher the valuation, the more severe the potential fall. This increased volatility can lead to significant capital losses.

-

Higher Risk of Capital Loss: The risk of losing invested capital is significantly increased in a highly valued market. The potential for a sharp correction increases as prices deviate from fundamentals.

-

Impact of Rising Interest Rates: Rising interest rates generally decrease the attractiveness of stocks relative to bonds, potentially causing a shift in investment flows and negatively impacting stock valuations. This is a key factor in BofA's analysis.

-

Market Bubbles: High valuations in specific sectors can create bubbles, where prices are detached from fundamentals. These bubbles can burst suddenly, leading to sharp declines in those specific sectors, impacting broader market sentiment and potentially triggering wider corrections.

-

Diversification Needs: Diversification across asset classes becomes even more crucial in a high-valuation environment to mitigate the risk associated with a market downturn. A well-diversified portfolio can help cushion the impact of a correction in any particular sector.

BofA's Recommended Investment Strategies

BofA typically advocates for a cautious and diversified approach during periods of high stock market valuations.

-

Portfolio Diversification: BofA stresses the importance of diversification across various asset classes, including stocks, bonds, and potentially alternative investments like real estate, to reduce overall portfolio risk.

-

Asset Class Recommendations: The specific asset class recommendations often shift based on prevailing market conditions. They might suggest a heavier allocation to bonds or less volatile assets during periods of high equity valuations.

-

Risk Management: Thorough risk management is paramount. This includes setting realistic return expectations and having a well-defined risk tolerance.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon helps mitigate the impact of short-term market fluctuations. This is particularly crucial in high-valuation markets where short-term volatility is expected.

-

Active vs. Passive Strategies: BofA's stance on active versus passive investing strategies is nuanced and often depends on market conditions and investor profiles. Active management may be more beneficial in navigating volatile markets, while passive strategies offer simplicity and cost-effectiveness.

Conclusion

This article summarized BofA's perspective on current high stock market valuations, highlighting the contributing factors, associated risks, and suggested investment strategies. BofA's analysis emphasizes the necessity of careful consideration and a well-diversified approach when navigating this market. Understanding high stock market valuations is crucial for making informed decisions. Stay informed on market trends and consult with financial advisors to develop an investment strategy tailored to your risk tolerance and financial goals. Continue learning about high stock market valuations and their implications for your portfolio.

Featured Posts

-

Why Jeff Goldblums Role In The Fly Was Oscar Worthy

Apr 29, 2025

Why Jeff Goldblums Role In The Fly Was Oscar Worthy

Apr 29, 2025 -

Jeff Goldblum Discusses Creative Differences On The Flys Final Scene

Apr 29, 2025

Jeff Goldblum Discusses Creative Differences On The Flys Final Scene

Apr 29, 2025 -

New Willie Nelson Album Details On Oh What A Beautiful World

Apr 29, 2025

New Willie Nelson Album Details On Oh What A Beautiful World

Apr 29, 2025 -

Saudi Pif Bans Pw C From Advisory Roles For A Year

Apr 29, 2025

Saudi Pif Bans Pw C From Advisory Roles For A Year

Apr 29, 2025 -

Pw C Scandal Global Impact Of Accounting Firms Withdrawals

Apr 29, 2025

Pw C Scandal Global Impact Of Accounting Firms Withdrawals

Apr 29, 2025