Understanding ING Group's 2024 Financial Statements: Form 20-F Explained

Table of Contents

Key Highlights of ING Group's 2024 Performance as Reported in Form 20-F

ING Group's 2024 Form 20-F will reveal the company's overall financial performance for the year. This section will summarize the key findings, providing a snapshot of profitability, revenue growth, and significant events impacting the results. While specific numbers will be available only after the official filing, we can anticipate insights into several key areas:

- Overall Performance: We expect to see a summary of ING Group's overall performance, highlighting whether the year showed growth or decline compared to previous years. This will likely include commentary on the impact of macroeconomic factors, such as interest rate changes and global economic conditions.

- Significant Events: The 2024 Form 20-F will detail any significant events during the year that impacted ING Group's financial results. These could include major acquisitions, divestitures, regulatory changes, or unexpected economic shocks.

Key Figures (projected, based on previous years' trends and market expectations):

- Net Income: [Insert projected range once 20-F is released]

- Revenue: [Insert projected range once 20-F is released]

- Return on Equity (ROE): [Insert projected range once 20-F is released]

- Key Financial Ratios: Liquidity ratios (e.g., Current Ratio, Quick Ratio) and leverage ratios (e.g., Debt-to-Equity Ratio) will provide insights into ING Group's financial stability and risk profile. [Insert projected ranges once 20-F is released]

Understanding ING Group's Revenue Streams and Business Segments in Form 20-F

ING Group operates across several key business segments. The Form 20-F will break down the revenue contribution of each, allowing for a detailed analysis of their individual performance. We expect to find data on:

- Wholesale Banking: This segment likely includes activities such as corporate lending, investment banking, and trading.

- Retail Banking: This segment probably encompasses consumer lending, mortgages, and other retail banking products and services.

- Other Business Segments: ING Group may have other segments, such as asset management or insurance, which will also be detailed in the Form 20-F.

Segment Performance (projected, awaiting official data from Form 20-F):

- Growth Rates: We anticipate seeing year-over-year growth rates for each business segment, revealing areas of strength and weakness.

- Profitability Margins: The Form 20-F will showcase the profitability margins of each segment, offering insights into operational efficiency.

- Significant Trends and Challenges: Any significant trends, challenges, or opportunities within each segment will be discussed.

Analyzing ING Group's Risk Factors and Financial Position in the 20-F Filing

The Form 20-F will dedicate a section to outlining the significant risks faced by ING Group. Understanding these risks is vital for a comprehensive assessment of the company's financial position.

- Liquidity and Capital Adequacy: A crucial aspect will be the assessment of ING Group's liquidity and capital adequacy, indicating their ability to meet their financial obligations. This will involve examining key ratios and metrics detailed in the 20-F.

Key Risks (as generally applicable to large financial institutions):

- Credit Risk: The risk of borrowers defaulting on their loans.

- Market Risk: The risk of losses due to adverse movements in market prices (e.g., interest rates, exchange rates).

- Operational Risk: The risk of losses due to inadequate or failed internal processes, people, and systems.

- Regulatory Risk: The risk associated with changes in regulations and compliance requirements.

- Geopolitical Risks: Risks stemming from global political instability and economic uncertainty.

Decoding the Key Financial Metrics and Ratios within ING Group's Form 20-F

The Form 20-F will present numerous financial ratios and metrics crucial for understanding ING Group's financial health. Analyzing these ratios provides crucial context and insights.

Key Ratios and Interpretations:

- Debt-to-Equity Ratio: This ratio reveals the proportion of debt financing relative to equity financing, indicating the company's financial leverage.

- Earnings Per Share (EPS): This metric shows the portion of a company's profit allocated to each outstanding share, indicating profitability per share.

- Price-to-Earnings Ratio (P/E): This ratio compares a company's stock price to its earnings per share, providing insights into market valuation.

- Dividend Payout Ratio: This ratio represents the proportion of earnings paid out as dividends to shareholders.

Conclusion: Mastering the Insights from ING Group's 2024 Form 20-F

Analyzing ING Group's 2024 Form 20-F provides a comprehensive understanding of the company's financial performance, revealing key highlights, revenue streams, risk factors, and crucial financial metrics. Understanding these aspects is crucial for making informed investment decisions and assessing the overall health of the institution. Regularly reviewing ING Group's 20-F filings is essential for staying abreast of their financial performance and long-term strategy. We strongly encourage you to delve deeper into the actual Form 20-F filing for a complete understanding of ING Group's financial performance and to regularly review future filings for continued financial insights by understanding ING Group's financial statements and analyzing ING Group's Form 20-F.

Featured Posts

-

Microsofts Email Filter Blocks Palestine Employee Backlash Explained

May 23, 2025

Microsofts Email Filter Blocks Palestine Employee Backlash Explained

May 23, 2025 -

Increased Rental Prices In La Following Fires Price Gouging Concerns

May 23, 2025

Increased Rental Prices In La Following Fires Price Gouging Concerns

May 23, 2025 -

New Claims About Dc Jewish Museum Suspect Elias Rodriguez And Psl Chicago

May 23, 2025

New Claims About Dc Jewish Museum Suspect Elias Rodriguez And Psl Chicago

May 23, 2025 -

Freddie Flintoff Opens Up About His Crash In New Disney Documentary

May 23, 2025

Freddie Flintoff Opens Up About His Crash In New Disney Documentary

May 23, 2025 -

The Kieran Culkin Michael Jackson Connection Fact Or Fiction

May 23, 2025

The Kieran Culkin Michael Jackson Connection Fact Or Fiction

May 23, 2025

Latest Posts

-

Open Ai And Jony Ive Exploring The Rumored Ai Hardware Deal

May 23, 2025

Open Ai And Jony Ive Exploring The Rumored Ai Hardware Deal

May 23, 2025 -

Orbital Crystallography Revolutionizing Drug Design And Production

May 23, 2025

Orbital Crystallography Revolutionizing Drug Design And Production

May 23, 2025 -

Jony Ives Ai Company Potential Open Ai Acquisition Analyzed

May 23, 2025

Jony Ives Ai Company Potential Open Ai Acquisition Analyzed

May 23, 2025 -

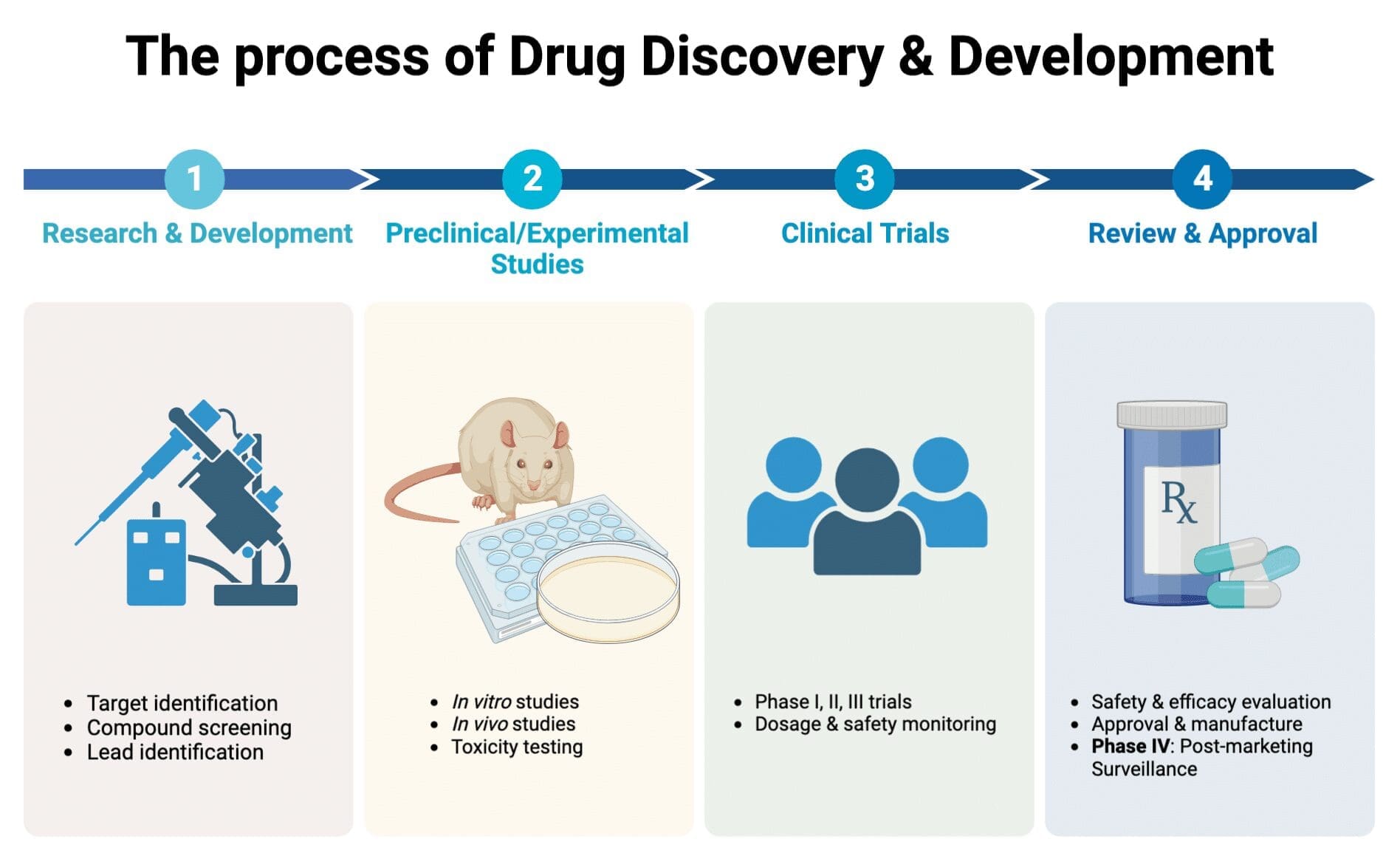

Harnessing Space Crystals A New Frontier In Drug Discovery And Development

May 23, 2025

Harnessing Space Crystals A New Frontier In Drug Discovery And Development

May 23, 2025 -

Is Open Ai Acquiring Jony Ives Ai Startup A Deep Dive

May 23, 2025

Is Open Ai Acquiring Jony Ives Ai Startup A Deep Dive

May 23, 2025