Understanding Personal Loan Interest Rates Today

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several factors significantly influence the interest rate you'll receive on a personal loan. Understanding these elements is key to securing a competitive rate and minimizing your overall personal loan costs.

Your Credit Score

Your credit score is arguably the most crucial factor determining your personal loan interest rates. Lenders use your FICO score (Fair Isaac Corporation score), a widely used credit rating system, to assess your creditworthiness. A higher credit score signifies lower risk to the lender, resulting in a more favorable interest rate.

- High credit score: Typically translates to lower personal loan interest rates and better loan terms.

- Low credit score: Usually leads to higher interest rates, potentially making the loan significantly more expensive.

- Check your credit score: Regularly monitor your credit score through free services or credit reporting agencies to identify any inaccuracies and track your progress.

- Improve your credit score: Focus on paying bills on time, reducing existing debt, and maintaining a healthy credit utilization ratio to improve your creditworthiness.

Loan Amount and Term

The amount you borrow and the repayment period (loan term) directly impact your personal loan interest rates.

- Loan amount: Larger loan amounts might come with slightly higher interest rates, reflecting increased risk for the lender.

- Loan term: A longer loan term typically results in lower monthly payments, but you'll pay significantly more interest over the life of the loan. Shorter terms mean higher monthly payments but less total interest paid. For example, a $10,000 loan over 3 years might have a lower monthly payment but higher overall interest than the same loan spread over 5 years.

Lender Type

Different lenders offer varying personal loan interest rates. Understanding the nuances of each lender type is critical for securing the best deal.

- Banks: Often offer competitive rates, particularly for borrowers with excellent credit, but may have stricter approval requirements.

- Credit Unions: Frequently offer lower interest rates than banks, particularly to their members, but their loan offerings might be limited compared to banks.

- Online lenders: Provide convenience and often faster approval processes, but it’s essential to thoroughly research their reputation and compare their fees carefully. Comparing offers from multiple lenders is crucial for finding the best rates.

Interest Rate Types (Fixed vs. Variable)

Personal loans come with either fixed or variable interest rates. Choosing the right one depends on your financial situation and risk tolerance.

- Fixed-rate loans: Offer stability. Your monthly payment remains consistent throughout the loan term, making budgeting easier.

- Variable-rate loans: Provide the potential for lower initial interest rates, but these rates can fluctuate based on market conditions. This introduces uncertainty and risk, making budgeting more challenging. Consider your risk tolerance when comparing loan rates.

Finding the Best Personal Loan Interest Rates

Securing the best possible personal loan interest rates requires proactive research and comparison shopping.

Shop Around and Compare

Don't settle for the first offer you receive.

- Use online loan comparison tools: Many websites allow you to compare offers from multiple lenders simultaneously, streamlining your research.

- Contact multiple lenders directly: Reach out to banks, credit unions, and online lenders to obtain personalized quotes.

- Don't rely on a single quote: Getting quotes from several lenders ensures you're making the best decision based on a comprehensive comparison of loan rates and terms.

Check for Fees and Charges

Beyond the advertised interest rate, be aware of additional fees that can significantly impact your overall personal loan costs.

- Origination fees: These are upfront fees charged by lenders to process your loan application.

- Prepayment penalties: Penalties for paying off your loan early.

- Late payment fees: Charges incurred if you miss a payment.

- Calculate the APR (Annual Percentage Rate): The APR reflects the true cost of your loan, incorporating all fees and interest rates. Carefully compare APRs across different lenders.

Improve Your Creditworthiness

As mentioned earlier, your credit score is paramount.

- Pay bills on time: Consistent on-time payments significantly improve your credit score.

- Reduce debt: Lowering your debt-to-income ratio enhances your creditworthiness.

- Monitor your credit report: Regularly check your credit reports for errors and to track your progress.

Steps Before Applying for a Personal Loan

Before you apply, careful planning is crucial to ensure you're making a sound financial decision.

Determine Your Needs and Budget

Clearly define your loan purpose and affordability.

- Define your loan purpose: Identify precisely why you need a personal loan.

- Calculate your monthly repayment capacity: Ensure the monthly payment fits comfortably within your budget without jeopardizing your financial stability.

Understand the Loan Terms

Thoroughly review the loan agreement before signing.

- Interest rate: Understand the type of interest rate (fixed or variable) and its implications.

- Fees: Note all associated fees and charges.

- Repayment schedule: Confirm the repayment timeline and payment amounts.

- Conditions: Carefully review all loan conditions and ensure you understand them completely.

Read Reviews and Check Lender Reputation

Verify the lender's credibility before proceeding.

- Check online reviews: See what other borrowers have to say about their experiences.

- Verify lender licenses and affiliations: Ensure the lender is licensed and reputable.

Conclusion

Understanding personal loan interest rates is vital for securing favorable loan terms and minimizing your overall costs. By understanding factors like your credit score, loan amount, lender type, and interest rate type, you can make informed decisions. Remember to shop around, compare offers from multiple lenders, check for fees, and improve your creditworthiness before applying. Don't settle for high personal loan interest rates – start comparing personal loan interest rates today to find the best loan rates that suit your financial needs! Use reputable online loan comparison tools to begin your search. Find the best personal loan rates and secure your financial future.

Featured Posts

-

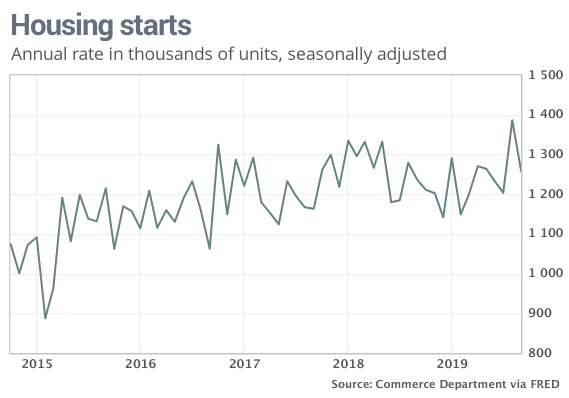

Construction Slowdown Fewer Housing Permits Issued

May 28, 2025

Construction Slowdown Fewer Housing Permits Issued

May 28, 2025 -

The Century Of Progress Chicagos 1933 Worlds Fair And Its Legacy

May 28, 2025

The Century Of Progress Chicagos 1933 Worlds Fair And Its Legacy

May 28, 2025 -

Discover The Shop Where A Winning Lotto Ticket Was Sold Is It Yours

May 28, 2025

Discover The Shop Where A Winning Lotto Ticket Was Sold Is It Yours

May 28, 2025 -

Padres Vs Opponent In Denver A High Altitude Showdown

May 28, 2025

Padres Vs Opponent In Denver A High Altitude Showdown

May 28, 2025 -

Miami Marlins Secure 9 6 Win Against Oakland Athletics Thanks To Stowers Grand Slam

May 28, 2025

Miami Marlins Secure 9 6 Win Against Oakland Athletics Thanks To Stowers Grand Slam

May 28, 2025

Latest Posts

-

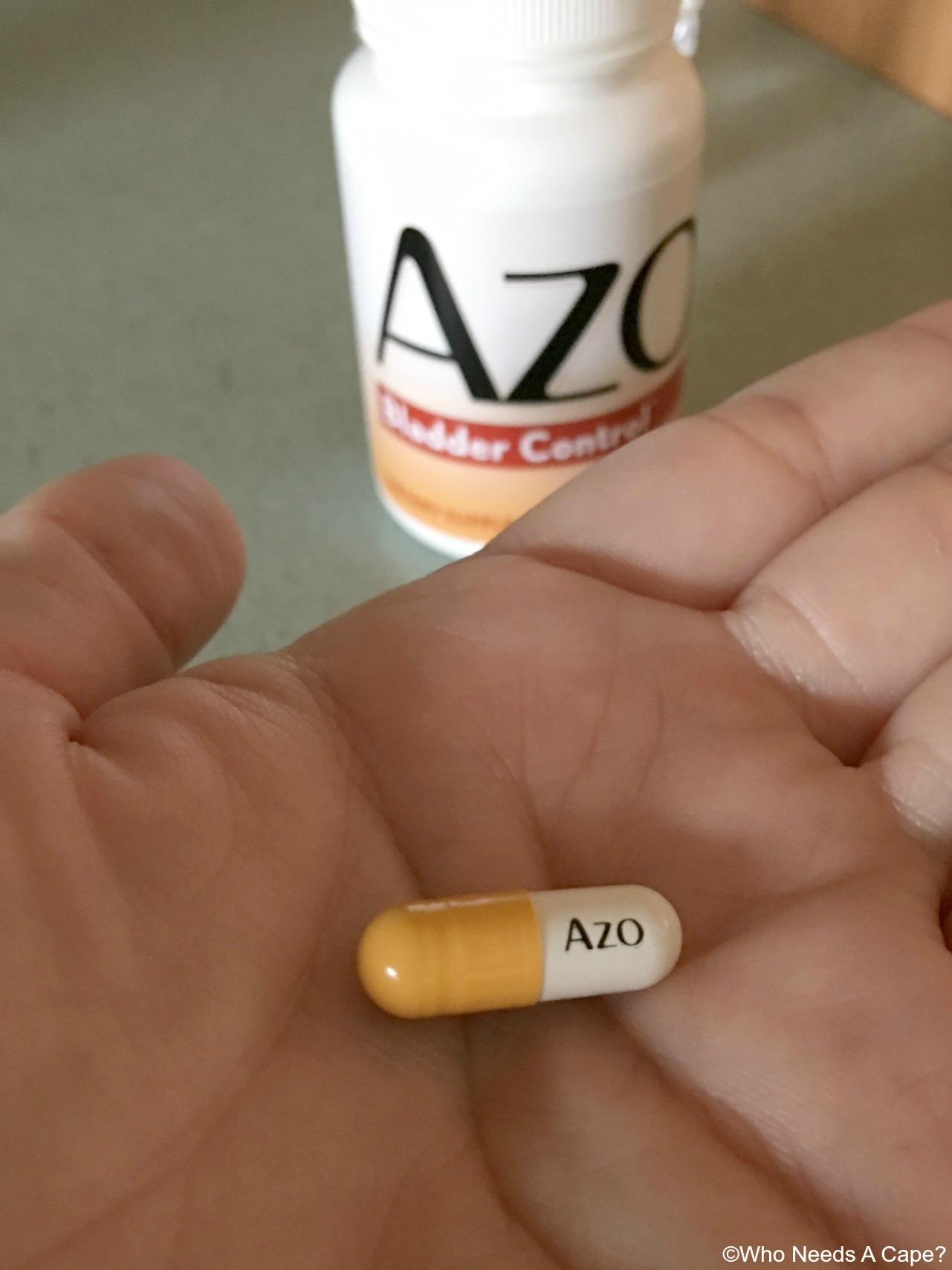

Natural Ingredients For Bladder Control The Primera Approach For Women

May 30, 2025

Natural Ingredients For Bladder Control The Primera Approach For Women

May 30, 2025 -

Primera For Women Natural Bladder Control Solutions

May 30, 2025

Primera For Women Natural Bladder Control Solutions

May 30, 2025 -

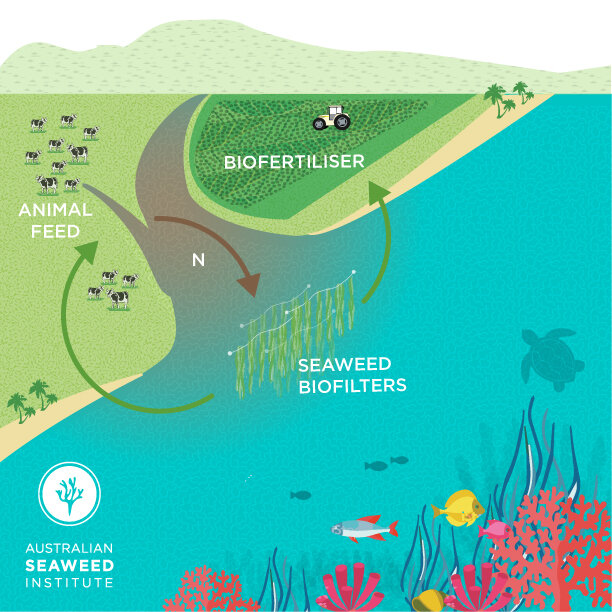

Combating The Killer Seaweed Strategies For Protecting Australias Coastal Biodiversity

May 30, 2025

Combating The Killer Seaweed Strategies For Protecting Australias Coastal Biodiversity

May 30, 2025 -

Investigating The Spread Of Killer Seaweed And Its Impact On Australian Marine Ecosystems

May 30, 2025

Investigating The Spread Of Killer Seaweed And Its Impact On Australian Marine Ecosystems

May 30, 2025 -

Killer Seaweed Threat The Urgent Need For Action To Protect Australias Marine Life

May 30, 2025

Killer Seaweed Threat The Urgent Need For Action To Protect Australias Marine Life

May 30, 2025