Understanding The Canadian Dollar's Recent Volatility Against Global Currencies

Table of Contents

Impact of Commodity Prices on CAD Volatility

The Canadian economy is heavily reliant on commodity exports, particularly oil, natural gas, and lumber. This strong correlation between commodity prices and the CAD exchange rate means that fluctuations in global commodity markets directly impact the value of the Canadian dollar. When global demand for these resources is high, prices rise, strengthening the CAD. Conversely, decreased demand or oversupply leads to lower prices and a weaker CAD.

For example, a surge in global oil prices, perhaps due to geopolitical instability or increased demand, typically boosts the CAD as Canadian oil exports become more valuable. Conversely, a global recession leading to decreased energy consumption can significantly weaken the CAD. Recent price swings in oil, exacerbated by global uncertainty, clearly illustrate this direct relationship.

- Oil price increases strengthen the CAD. Higher prices increase the demand for Canadian dollars, pushing up its value against other currencies.

- Decreased demand for Canadian resources weakens the CAD. Lower global commodity prices reduce the inflow of foreign currency, leading to a weaker CAD.

- Global economic uncertainty impacts commodity prices and thus the CAD. Uncertainty about future global demand often translates into price volatility, affecting the CAD exchange rate unpredictably.

Influence of Interest Rate Differentials

The Bank of Canada (BoC)'s monetary policy decisions significantly influence the CAD exchange rate. Interest rate differentials between the BoC and other major central banks, such as the Federal Reserve (US), play a pivotal role in attracting or repelling foreign investment. Higher interest rates offered by the BoC compared to other countries incentivize investors to move their capital to Canada, increasing demand for the CAD and strengthening its value.

Conversely, if the BoC maintains lower interest rates relative to other major economies, capital flows outward, weakening the Canadian dollar. Market expectations regarding future interest rate changes are equally important, influencing investor behavior and impacting the CAD even before any official rate adjustments are made.

- Higher BoC interest rates attract foreign investment, strengthening the CAD. Investors seek higher returns, leading to increased demand for the CAD.

- Lower interest rates relative to other countries weaken the CAD. Capital flows to countries offering higher yields, diminishing the demand for the CAD.

- Market anticipation of future interest rate changes also affects the CAD. Speculative trading based on anticipated BoC decisions can significantly influence the CAD exchange rate.

Geopolitical Factors and Their Role

Global political events and uncertainties have a considerable impact on the Canadian dollar's volatility. Trade wars, political instability in major trading partners, and global conflicts can all create uncertainty, affecting investor sentiment and consequently the CAD. For instance, trade disputes between Canada and its major trading partners, such as the US, often lead to significant fluctuations in the CAD exchange rate.

Geopolitical risk aversion, often triggered by global conflicts or political turmoil, tends to weaken the CAD as investors seek safer havens for their investments. Conversely, periods of global stability and reduced geopolitical risk can strengthen the CAD.

- Trade disputes with the US can significantly affect the CAD. Trade tensions create uncertainty and can impact the flow of goods and capital, influencing the CAD.

- Global economic uncertainty reduces investor confidence, weakening the CAD. Investors move towards safer assets, reducing demand for the CAD.

- Political stability in Canada itself is a factor affecting investor sentiment and the CAD. Domestic political stability is essential for maintaining investor confidence.

Analyzing the USD/CAD Exchange Rate

The USD/CAD exchange rate is the most significant pairing for the Canadian dollar. This pair's historical relationship reveals a complex interplay of economic and geopolitical factors. Recent fluctuations in the USD/CAD rate have been largely driven by differences in monetary policy between the US and Canada, US economic growth, and global risk sentiment. When the US economy performs well, the USD tends to strengthen, putting downward pressure on the CAD. Conversely, periods of US economic weakness can lead to a stronger CAD.

- US economic growth and the USD directly impact the USD/CAD exchange rate. Stronger US growth typically strengthens the USD, weakening the CAD.

- Differences in monetary policy between the US and Canada play a crucial role. Divergence in interest rate policies can significantly affect the USD/CAD exchange rate.

- The USD/CAD rate is a key indicator of Canadian economic health. The pair's movement often reflects the relative strength of the Canadian and US economies.

Conclusion: Navigating the Volatility of the Canadian Dollar

The Canadian dollar's volatility is influenced by a complex interplay of factors: commodity prices, interest rate differentials, and geopolitical events. Understanding these factors is essential for businesses managing international transactions, investors making investment decisions, and individuals planning international travel. The future volatility of the CAD will likely continue to depend on these interconnected forces.

To effectively navigate this volatility, it is crucial to monitor Canadian dollar exchange rates regularly. By understanding CAD volatility and staying informed about global economic events and Canadian monetary policy, you can make more informed decisions. Stay updated on Canadian dollar fluctuations by regularly checking reliable sources for currency updates and economic news. This proactive approach will help you manage the risks and opportunities associated with the dynamic Canadian dollar market.

Featured Posts

-

Trumps Immigration Policies Meet Stiff Legal Resistance

Apr 24, 2025

Trumps Immigration Policies Meet Stiff Legal Resistance

Apr 24, 2025 -

Analyzing The Business Model Why A Startup Airline Relies On Deportation Flights

Apr 24, 2025

Analyzing The Business Model Why A Startup Airline Relies On Deportation Flights

Apr 24, 2025 -

Impact Of Chinas Rare Earth Export Restrictions On Teslas Optimus Robot

Apr 24, 2025

Impact Of Chinas Rare Earth Export Restrictions On Teslas Optimus Robot

Apr 24, 2025 -

Uil State Bound Hisd Mariachis Whataburger Video Success

Apr 24, 2025

Uil State Bound Hisd Mariachis Whataburger Video Success

Apr 24, 2025 -

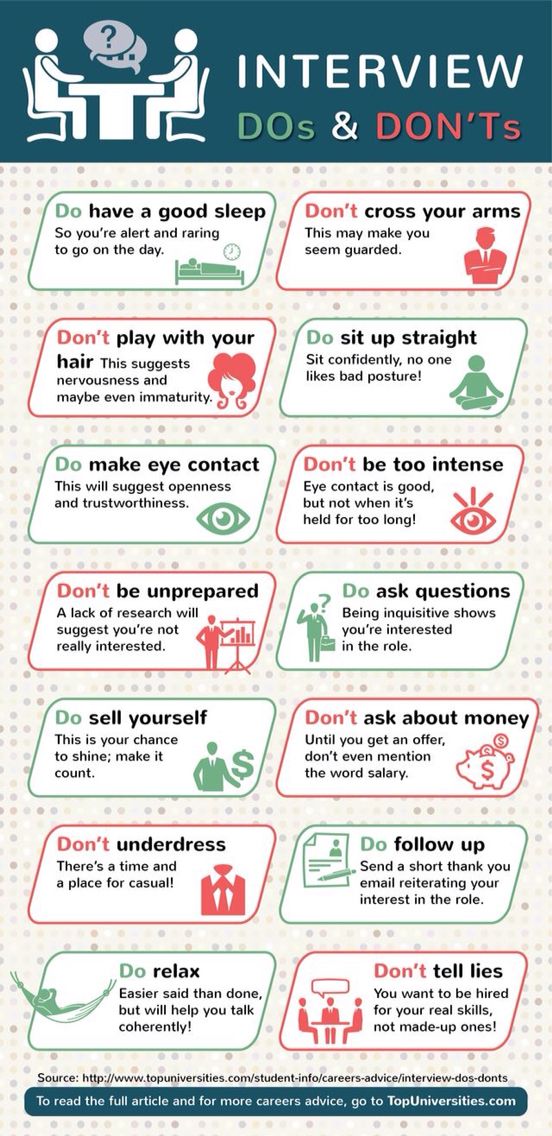

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 24, 2025