Understanding The D-Wave Quantum (QBTS) Stock Drop In 2025

Table of Contents

2. Main Points:

2.1. Market Sentiment and Investor Confidence: The Ripple Effect on QBTS

H3: Negative News and Market Volatility: The quantum computing sector, while promising, is highly susceptible to broader market trends. A general downturn in the tech sector or negative news cycles impacting investor confidence can significantly affect a relatively young company like D-Wave. This ripple effect can lead to significant sell-offs, regardless of a company's individual performance.

- Increased interest rates leading to decreased investment in high-growth, high-risk sectors.

- Negative media coverage related to technological setbacks in the quantum computing field as a whole.

- A broader market correction impacting technology stocks disproportionately.

H3: Investor Expectations vs. Reality: Investor sentiment is heavily influenced by whether a company meets its projected targets. D-Wave Quantum, like any publicly traded company, operates under the scrutiny of investor expectations. Failure to meet these expectations regarding revenue growth, technological breakthroughs, or market adoption could directly impact the stock price.

- Missed revenue projections for the year, particularly compared to competitor growth.

- Delays in the delivery of promised technological advancements or product launches.

- Lower-than-anticipated customer acquisition and contract wins compared to forecast.

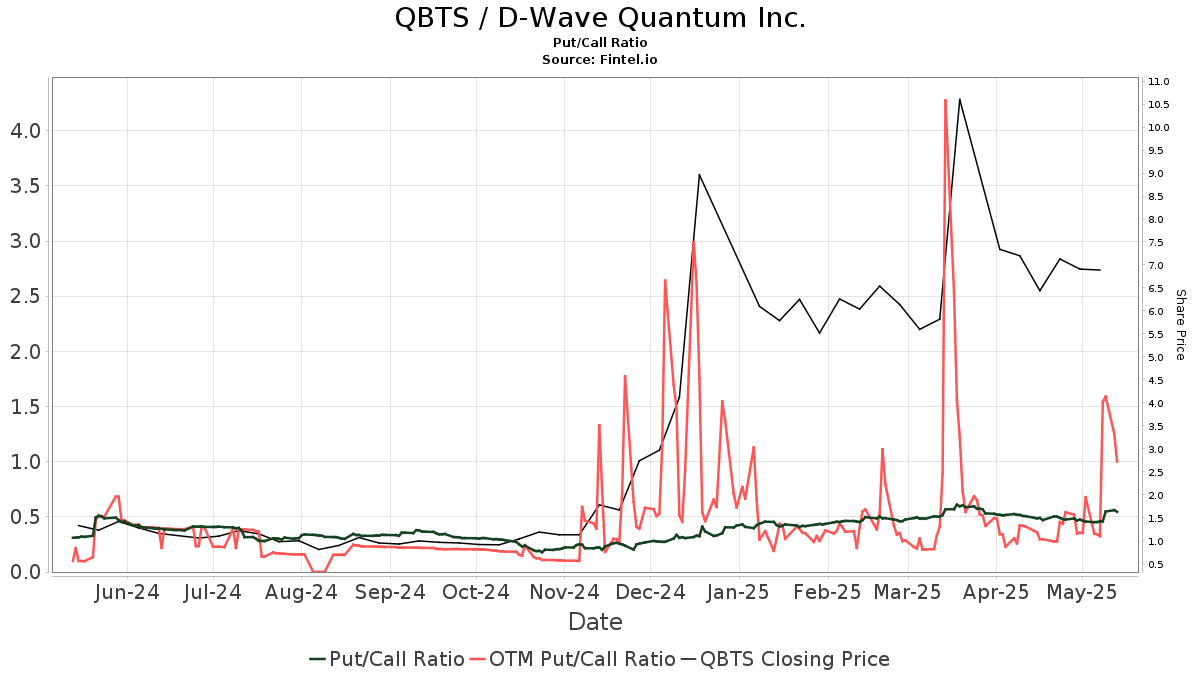

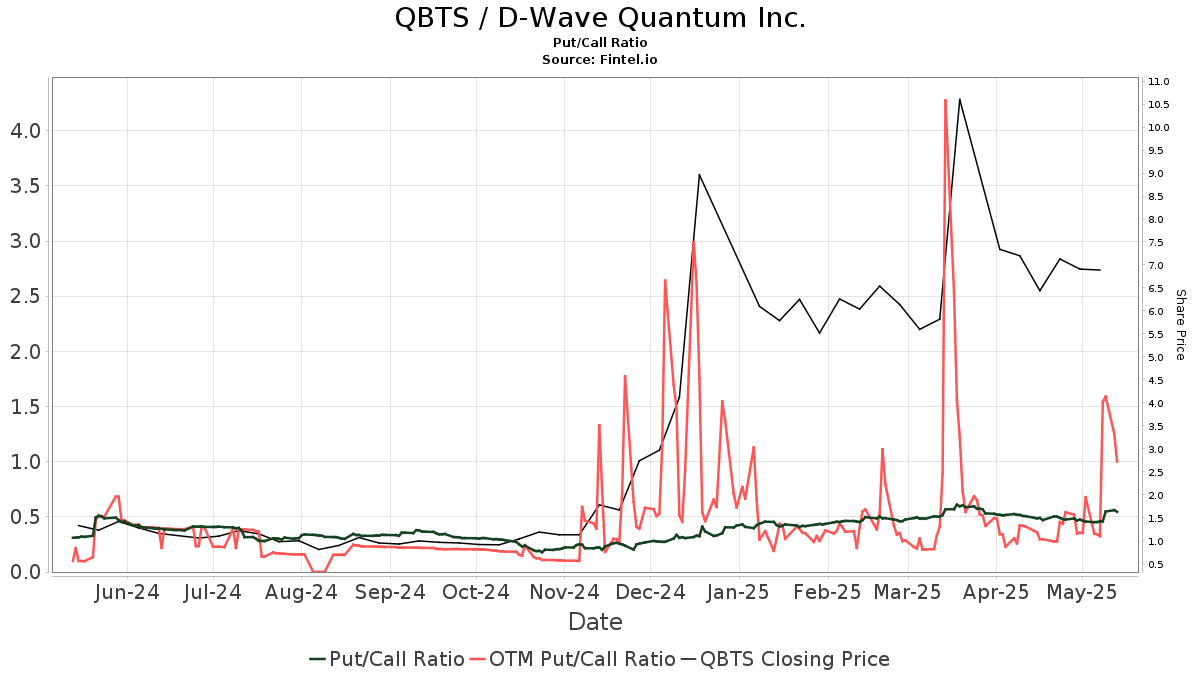

H3: Short-Selling and Speculative Trading: The volatile nature of QBTS, coupled with the inherent risks associated with quantum computing investments, makes it susceptible to short-selling and speculative trading. These activities can significantly amplify price declines, creating a downward spiral.

- Increased short interest indicating a lack of confidence in the company's future performance.

- Speculative trading based on market rumors and predictions, irrespective of fundamental analysis.

- Panic selling triggered by negative news or market uncertainty, exacerbating the price drop.

2.2. Technological Advancements and Competition in the Quantum Computing Landscape

H3: Emergence of Competing Technologies: The quantum computing field is dynamic and competitive. Advancements in alternative quantum computing approaches, such as gate-based quantum computers, pose a significant challenge to D-Wave’s quantum annealing technology. The emergence of powerful competitors with different, potentially more scalable, technologies can shift investor perception.

- Significant breakthroughs by competitors in areas like qubit coherence and scalability.

- Successful demonstrations of practical applications by rival companies using different quantum computing paradigms.

- Increased funding and market share capture by competitors, potentially overshadowing D-Wave.

H3: Technological Challenges and Development Hurdles: Quantum computing is inherently complex, and significant hurdles remain in achieving fault-tolerant and scalable quantum computers. Concerns about D-Wave's progress in addressing these challenges, including qubit stability, scalability, and error correction, could impact investor confidence.

- Limitations in scaling up the number of qubits while maintaining coherence and stability.

- Difficulties in developing effective error correction techniques crucial for reliable quantum computations.

- High costs associated with manufacturing and maintaining quantum computers, impacting profitability.

H3: Lack of Scalability or Real-World Applications: D-Wave's quantum annealing approach might face limitations in scalability and demonstrating clear, real-world applications that justify the stock valuation. A perception of limited practicality compared to competing technologies could negatively impact investor sentiment.

- Difficulty in adapting quantum annealing to a wider range of computational problems.

- Lack of compelling, publicly available case studies demonstrating clear advantages over classical computing.

- Challenges in integrating quantum annealing technology with existing classical computing infrastructure.

2.3. Financial Performance and Corporate Strategy of D-Wave Quantum

H3: Financial Reports and Earnings Disclosures: D-Wave Quantum's financial performance, as reflected in its earnings disclosures, plays a crucial role in influencing investor sentiment. Disappointing results regarding revenue, profitability, or cash flow could trigger significant stock price drops.

- Lower-than-expected revenue figures compared to previous quarters or industry benchmarks.

- Persistent losses and concerns about the company's ability to achieve profitability in the near future.

- Decreasing cash reserves and increasing reliance on further funding rounds.

H3: Strategic Decisions and Corporate Actions: D-Wave Quantum’s strategic decisions, such as new partnerships, product launches, or funding rounds, directly impact investor perceptions. Poorly received strategic shifts or perceived failures could negatively influence the stock price.

- Failed partnerships or collaborations with key industry players.

- Negative market reaction to a new product launch or significant strategic shift.

- Difficulties in securing further funding rounds to support ongoing research and development.

H3: Changes in Management or Leadership: Changes in D-Wave's management or leadership team can also impact investor confidence. Uncertainty surrounding leadership transitions or concerns about the new management's capabilities could contribute to market volatility.

- Unexpected resignation or departure of key executives.

- Appointment of a new CEO with a less-than-impressive track record.

- Internal restructuring leading to uncertainty about the company's future direction.

3. Conclusion: Understanding the QBTS Stock Drop and Future Outlook for D-Wave Quantum

The 2025 QBTS stock drop was a complex event resulting from a confluence of factors. Negative market sentiment, amplified by short-selling and speculative trading, combined with technological challenges faced by D-Wave and concerns about its financial performance and strategic direction, all contributed to the decline. While the future outlook for D-Wave Quantum remains uncertain, its pioneering role in the quantum computing space should not be discounted. Continued innovation and successful navigation of the competitive landscape will be crucial for regaining investor confidence.

To make informed investment decisions in this volatile sector, thorough due diligence is essential. Continue researching D-Wave Quantum, analyzing QBTS stock analysis reports, and staying updated on the latest developments in the quantum computing market. Understanding the risks and potential rewards associated with investing in D-Wave Quantum stock (QBTS) is vital for navigating the exciting, yet unpredictable, world of quantum computing investment.

Featured Posts

-

Michael Schumacher Helicoptero De Mallorca A Suiza Para Reencuentro Familiar

May 20, 2025

Michael Schumacher Helicoptero De Mallorca A Suiza Para Reencuentro Familiar

May 20, 2025 -

Lufthansa Flight Operated Without Pilot For 10 Minutes Report Details Co Pilots Fainting Incident

May 20, 2025

Lufthansa Flight Operated Without Pilot For 10 Minutes Report Details Co Pilots Fainting Incident

May 20, 2025 -

Second Typhon Missile Battery Headed To The Pacific Us Army Deployment

May 20, 2025

Second Typhon Missile Battery Headed To The Pacific Us Army Deployment

May 20, 2025 -

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 20, 2025 -

Big Bear Ai Bbai Growth Uncertainty Prompts Analyst Downgrade

May 20, 2025

Big Bear Ai Bbai Growth Uncertainty Prompts Analyst Downgrade

May 20, 2025

Latest Posts

-

Glen Kamara Ja Teemu Pukki Sivussa Avauskokoonpanossa

May 20, 2025

Glen Kamara Ja Teemu Pukki Sivussa Avauskokoonpanossa

May 20, 2025 -

Kaellmanin Kasvu Huuhkajissa Kentaellae Ja Sen Ulkopuolella

May 20, 2025

Kaellmanin Kasvu Huuhkajissa Kentaellae Ja Sen Ulkopuolella

May 20, 2025 -

Jalkapallo Avauskokoonpano Paljastui Kamara Ja Pukki Sivussa

May 20, 2025

Jalkapallo Avauskokoonpano Paljastui Kamara Ja Pukki Sivussa

May 20, 2025 -

Benjamin Kaellman Huippuvire Huuhkajien Avuksi

May 20, 2025

Benjamin Kaellman Huippuvire Huuhkajien Avuksi

May 20, 2025 -

Friisin Avauskokoonpano Kamara Ja Pukki Penkillae

May 20, 2025

Friisin Avauskokoonpano Kamara Ja Pukki Penkillae

May 20, 2025