Understanding The Dragon's Den: Investor Expectations And Deal Making

Table of Contents

The Dragons' Investment Criteria

Securing investment from shrewd investors like those featured on Dragon's Den demands a compelling business proposition. The Dragons' investment decisions are based on rigorous criteria, requiring entrepreneurs to demonstrate a clear path to profitability and sustainable growth.

Financial Projections & Market Analysis: A robust financial model is paramount. The Dragons need to see realistic projections supported by thorough market research. This means:

- Detailed financial statements: Comprehensive income statements, balance sheets, and cash flow projections are essential for demonstrating financial health and potential.

- Market sizing: Accurately assess the total addressable market (TAM) and your potential market share.

- Competitive analysis: Demonstrate a thorough understanding of your competitors and your competitive advantage.

- Revenue projections: Provide realistic and justifiable revenue forecasts based on market analysis and sales strategies.

- Expense forecasts: Detail all operational expenses, including marketing, sales, and research & development. Investors will scrutinize your cost structure for efficiency. This includes understanding keywords like investor due diligence, financial modeling, and market research.

Team & Management: The Dragons invest not just in a business idea, but in the team that will execute it. A strong, experienced, and cohesive management team is crucial.

- Team member expertise: Highlight the relevant skills and experience of each team member, emphasizing their contributions to the business's success.

- Experience in relevant fields: Demonstrate that your team possesses the necessary expertise to navigate the challenges of your industry.

- Advisory board: A strong advisory board can add credibility and provide valuable guidance.

- Management structure: Outline a clear and efficient organizational structure that facilitates effective decision-making. Keywords like management team, entrepreneurial skills, and team dynamics are vital here.

Scalability & Growth Potential: The Dragons seek businesses with significant growth potential. Demonstrating scalability is critical.

- Market expansion plans: Outline your strategies for expanding into new markets and increasing your customer base.

- Scalability of the business model: Explain how your business model can be replicated and scaled to accommodate increased demand.

- Intellectual property: Protecting your intellectual property is essential for maintaining a competitive advantage and ensuring long-term growth.

- Repeatability of success: Showcase the ability to consistently generate revenue and achieve profitability. Keywords like business scalability, growth strategy, and market penetration are critical for this section.

Negotiating the Deal: Strategies & Tactics

Beyond a strong business plan, effective negotiation is crucial for securing a favorable deal.

Understanding Investor Valuation: Understanding different valuation methods is key to justifying your asking price.

- Discounted Cash Flow (DCF): A common valuation method that considers the present value of future cash flows.

- Comparable company analysis: Compare your company's valuation to similar businesses that have recently secured funding.

- Precedent transactions: Analyze similar deals to understand market trends and comparable valuations. Keywords like business valuation, equity stake, and negotiation tactics will help search engines understand this section.

Structuring the Deal: Choosing the right deal structure is paramount.

- Equity dilution: Understand the impact of giving up equity in your company.

- Control considerations: Maintain control over key decisions in your company.

- Preferred stock: Negotiate terms that offer favorable returns to investors while maintaining your control.

- Terms and conditions: Carefully review and understand all terms and conditions of the investment agreement. Keywords like term sheet, investment agreement, and legal considerations are crucial for this section.

Presenting Your Offer Confidently: Your pitch is your most powerful tool.

- Storytelling: Craft a compelling narrative that resonates with the Dragons and captures their attention.

- Clear and concise presentation: Deliver a well-structured presentation that clearly communicates your business proposition.

- Handling tough questions: Anticipate challenging questions and prepare thoughtful responses.

- Demonstrating passion: Showcase your enthusiasm and belief in your business. Keywords like pitch deck, investor presentation, and communication skills will improve search engine optimization.

Common Pitfalls to Avoid in the Dragon's Den

Even the most promising businesses can falter if they make critical mistakes.

- Overestimating the Market: Unrealistic projections will quickly raise red flags. Thorough market research is essential.

- Underestimating Costs: Accurate cost projections and contingency planning are critical to avoid financial setbacks.

- Lack of a Clear Exit Strategy: Investors need to see a clear path for exiting their investment, whether through acquisition or an IPO.

- Poor Communication & Presentation: A muddled or unconvincing presentation will likely lead to rejection.

Conclusion

Securing investment on shows like Dragon's Den demands a multifaceted approach. It requires a strong business plan supported by robust financial projections, a capable team, a scalable business model, and the ability to effectively negotiate a favorable deal. Remember that thorough preparation and a clear understanding of investor expectations are the cornerstones of success. Master the art of securing investment; learn more about preparing your pitch for securing a deal on shows like Dragon’s Den. Contact a business advisor to refine your strategy and maximize your chances of success.

Featured Posts

-

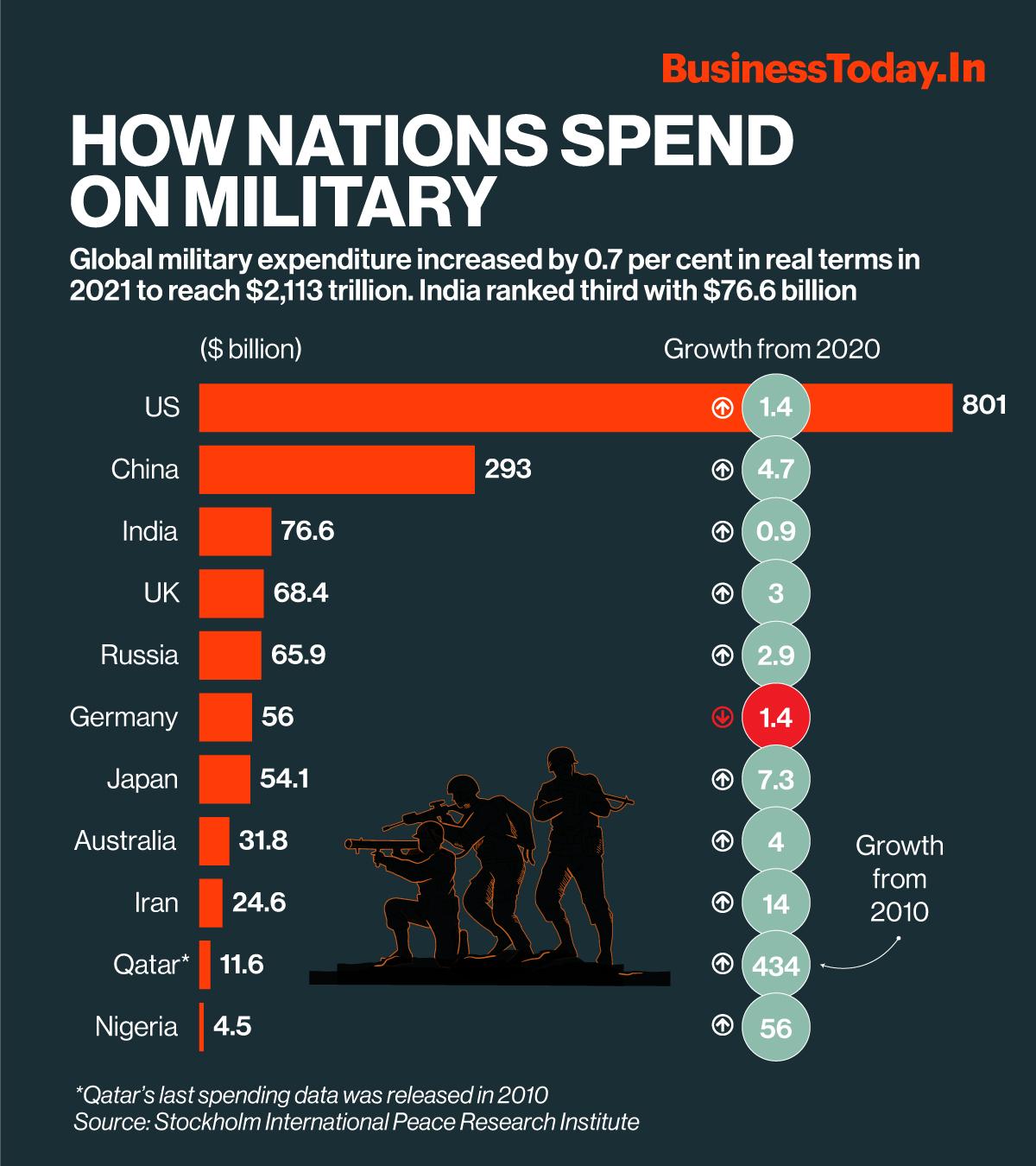

Rising Global Military Spending A Deep Dive Into Europes Security Concerns

May 01, 2025

Rising Global Military Spending A Deep Dive Into Europes Security Concerns

May 01, 2025 -

Bhart Kshmyr Pr Ntyjh Khyz Mdhakrat Kywn Kre Pakstany Rdeml

May 01, 2025

Bhart Kshmyr Pr Ntyjh Khyz Mdhakrat Kywn Kre Pakstany Rdeml

May 01, 2025 -

Xrp Classification Update Ripple Lawsuit Settlement Talks And Commodity Status

May 01, 2025

Xrp Classification Update Ripple Lawsuit Settlement Talks And Commodity Status

May 01, 2025 -

Yogun Guenlerin Ardindan Eskisehir Tip Oegrencileri Ve Boks

May 01, 2025

Yogun Guenlerin Ardindan Eskisehir Tip Oegrencileri Ve Boks

May 01, 2025 -

Sedlacek O Evrobasketu Jokicev Dolazak I Jovic Kao Slag Na Torti

May 01, 2025

Sedlacek O Evrobasketu Jokicev Dolazak I Jovic Kao Slag Na Torti

May 01, 2025

Latest Posts

-

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

May 02, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

May 02, 2025 -

End Of Ryujinx Nintendo Intervention Leads To Project Closure

May 02, 2025

End Of Ryujinx Nintendo Intervention Leads To Project Closure

May 02, 2025 -

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

May 02, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

May 02, 2025 -

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

May 02, 2025

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

May 02, 2025 -

Smart Rings And Relationship Honesty A New Approach

May 02, 2025

Smart Rings And Relationship Honesty A New Approach

May 02, 2025