Understanding The Gork Meme Coin Price Spike: Elon Musk's Role

Table of Contents

Elon Musk's Influence on Cryptocurrency Markets

Elon Musk's pronouncements have a proven track record of significantly impacting cryptocurrency prices. His tweets, often cryptic yet powerfully influential, can send ripple effects through the market. While direct endorsements are rare, even indirect mentions or actions related to similar meme coins can trigger substantial price movements. His massive social media following translates to immediate market reactions, amplified by the speculative nature of the cryptocurrency world.

- Examples of past Elon Musk cryptocurrency tweets and their market impact: Musk's tweets about Dogecoin, for instance, have repeatedly caused significant price fluctuations, demonstrating his considerable sway. A single tweet can inject massive amounts of buying pressure or trigger sell-offs.

- Speculation on whether indirect influence (e.g., mentioning similar meme coins) could have affected Gork: Even without explicitly mentioning Gork, a tweet about a similar meme coin or broader cryptocurrency sentiment could inadvertently boost Gork's price due to investor association and the herd mentality prevalent in meme coin markets.

- Importance of understanding the psychological impact of Musk's pronouncements: Musk's influence transcends simple information dissemination; it taps into investor psychology. His actions generate FOMO (Fear Of Missing Out) and hype, driving speculative investment and amplifying price volatility. This psychological impact is a crucial element in understanding the Gork price spike.

Social Media Hype and the Meme Coin Effect

The rapid spread of information on social media platforms like Twitter, TikTok, and Reddit is integral to the meme coin phenomenon, and the Gork price spike is no exception. Meme coins thrive on virality; a sudden surge in popularity on these platforms directly translates to increased trading volume and price escalation. This effect is amplified by influencer marketing and online communities dedicated to specific meme coins.

- Examples of viral Gork-related posts and their impact on trading volume: Analyzing the content and reach of viral posts related to Gork can shed light on the specific catalysts driving the price increase. A sudden influx of positive sentiment or a viral meme could spark a rapid price surge.

- The significance of online communities and influencer marketing in driving meme coin prices: Online communities play a critical role in disseminating information and generating hype. Influencers promoting Gork on these platforms can significantly influence investment decisions and amplify the price effect.

- Discussion of FOMO (Fear Of Missing Out) and its role in speculative investment: FOMO is a key driver in meme coin markets. The fear of missing out on potential profits encourages rapid and often irrational investment decisions, further escalating the price.

Technical Factors and Market Manipulation

Beyond social media hype, technical factors like trading volume, whale activity (large-scale investors), and the potential for market manipulation need investigation. A sudden, abnormally high trading volume often indicates significant buying pressure. Furthermore, the actions of whales can significantly manipulate price through coordinated buying or selling.

- Analysis of Gork's trading volume during the price spike: A detailed analysis of trading data can reveal whether the volume was organic or artificially inflated through manipulative tactics.

- Identification of any large transactions or “whale” activity: Identifying large transactions can point towards potential coordinated buying or selling strategies aimed at manipulating the Gork price.

- Discussion of the regulatory challenges related to market manipulation in the cryptocurrency space: The decentralized nature of cryptocurrencies poses challenges to regulation and makes detecting and preventing market manipulation more difficult.

The Role of News and Media Coverage

News articles and media coverage play a significant role in shaping public perception and investor sentiment. Positive media attention can generate further interest in Gork, driving up the price, while negative coverage could have the opposite effect.

- Examples of news articles or media coverage related to the Gork price spike: Tracking the news cycle surrounding the Gork price increase reveals how media narratives influenced investor behavior.

- Analysis of the sentiment expressed in news reports and their influence on investor behavior: Analyzing the overall sentiment (positive, negative, or neutral) expressed in news reports can show how media framing contributed to the Gork price volatility.

Conclusion

The Gork Meme Coin's price surge showcases the unpredictable nature of the cryptocurrency market and the potent combination of social media influence, the actions of key figures like Elon Musk, and the possibility of market manipulation. While pinpointing the precise cause is complex, understanding the interaction of these factors is crucial for navigating this volatile space. Investors should approach Gork and similar meme coins with caution, performing thorough due diligence and acknowledging the inherent risks before investing. Remember to always conduct your own research before engaging with any Gork Meme Coin investments.

Featured Posts

-

Exploring Androids Updated Design Language

May 16, 2025

Exploring Androids Updated Design Language

May 16, 2025 -

Telford Steam Railway Completes Station Platform Restoration Project

May 16, 2025

Telford Steam Railway Completes Station Platform Restoration Project

May 16, 2025 -

Resultado Final Bahia 1 0 Paysandu Resumen Y Goles

May 16, 2025

Resultado Final Bahia 1 0 Paysandu Resumen Y Goles

May 16, 2025 -

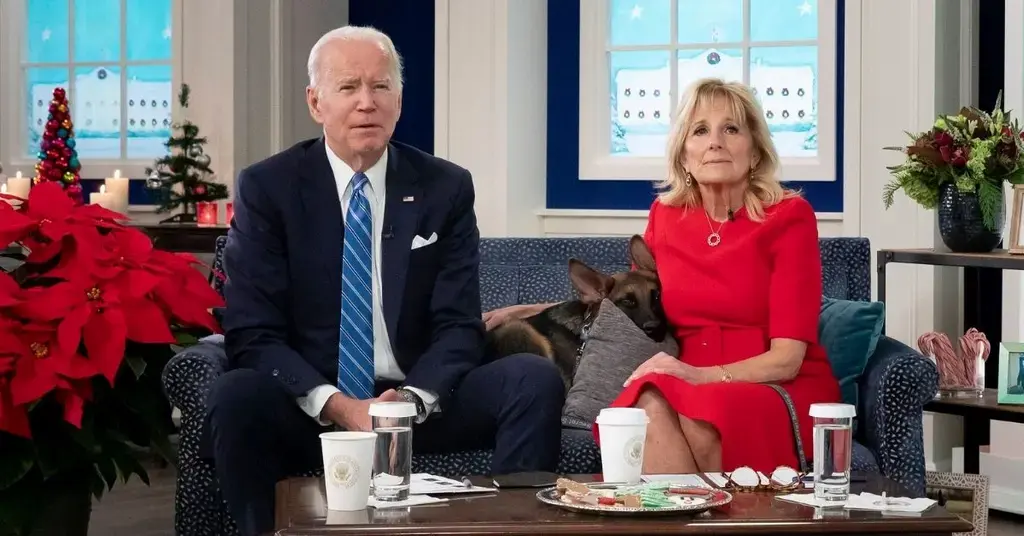

Did Jill Biden And Kamala Harris Really Clash Unpacking Their Reported Feud

May 16, 2025

Did Jill Biden And Kamala Harris Really Clash Unpacking Their Reported Feud

May 16, 2025 -

Padres Rockies Matchup A Look At The Potential For A San Diego Sweep

May 16, 2025

Padres Rockies Matchup A Look At The Potential For A San Diego Sweep

May 16, 2025