Understanding XRP's Price Movement: Derivatives Market Insights

Table of Contents

The price of XRP, Ripple's native cryptocurrency, is known for its volatility. Understanding the factors driving these price swings is crucial for anyone involved in XRP trading. This article dives into the often-overlooked yet incredibly informative world of XRP derivatives markets to uncover key insights into XRP's price movement. We'll explore how options, futures, and other derivatives impact XRP's price and how this knowledge can inform your trading strategy.

The Role of XRP Futures Contracts in Price Discovery

Futures contracts are agreements to buy or sell XRP at a predetermined price on a future date. These contracts act as a powerful tool for predicting future price movements and reflecting overall market sentiment towards XRP. Analyzing XRP futures contracts offers several advantages for understanding price dynamics.

-

Open Interest and Market Confidence: Open interest, the total number of outstanding futures contracts, is a key indicator of market confidence. High open interest suggests strong belief in a particular price direction. A rising open interest alongside a rising price indicates bullish sentiment, while a falling open interest during a price rise may suggest weakening bullish momentum. Conversely, a decreasing open interest coupled with a falling price could indicate capitulation.

-

Futures Prices as Leading Indicators: Futures prices often act as leading indicators for spot prices (the current market price of XRP). If the futures price for a future date is significantly higher than the current spot price, it can signal an expectation of future price increases. The opposite is true if the futures price is lower than the spot price.

-

Predicting Price Surges and Dips: By studying the price movements of XRP futures contracts, along with changes in open interest and volume, traders can attempt to anticipate potential price surges or dips. For example, a sudden increase in open interest combined with a rise in futures prices can signal a potential bullish breakout.

Unraveling XRP Options Market Dynamics

XRP options contracts offer another valuable lens through which to view XRP price movements. These contracts give the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a specific price (strike price) on or before a certain date (expiration date).

-

Implied Volatility and Price Swings: Implied volatility, a key metric derived from options prices, reflects the market's expectation of future price fluctuations. High implied volatility suggests a higher probability of significant price swings, while low implied volatility indicates a more stable price outlook.

-

Options Pricing and Market Expectations: The price of an option contract reveals market expectations regarding future XRP price ranges. By analyzing the prices of various call and put options with different strike prices and expiration dates, traders can glean insights into the market's assessment of potential support and resistance levels.

-

Influencing the Underlying Price: While options trading doesn't directly drive the spot price of XRP, the collective actions of options traders can influence the overall market sentiment and indirectly impact the underlying price. For instance, large purchases of call options can signal bullish sentiment, potentially leading to increased buying pressure on the spot market.

The Impact of Leverage and Margin Trading on XRP Volatility

Leverage and margin trading significantly amplify both profits and losses in XRP trading, considerably impacting price volatility. This is particularly relevant in the context of derivatives trading, where leverage is often employed.

-

Magnifying Price Swings: Leverage allows traders to control larger positions with a smaller initial investment. While this magnifies potential profits, it also significantly amplifies losses. This can lead to heightened volatility as traders scramble to cover losses or liquidate positions, creating a domino effect on the price.

-

Margin Calls and Liquidations: Margin calls, which occur when a trader's account equity falls below a certain threshold, force liquidations. These forced liquidations can trigger further price drops, especially during periods of heightened market uncertainty or panic selling.

-

Influencing the Overall XRP Market: The actions of leveraged traders in the derivatives market, including both successful and unsuccessful trades, significantly influence the overall XRP market dynamics, often contributing to periods of heightened volatility.

Analyzing XRP Derivatives Market Data for Informed Trading

Reliable data sources are paramount when analyzing XRP derivatives data for informed trading decisions. Using a reputable and reliable exchange data API is important.

-

Key Metrics to Monitor: Traders should closely monitor several key metrics, including open interest, trading volume, implied volatility, and the price difference between futures and spot prices. Real-time data is crucial for accurate analysis and timely decision-making.

-

Combining Data Sources: A holistic approach is vital. Combining derivatives market data with fundamental analysis (news, regulatory changes, adoption rates) and technical analysis (chart patterns, indicators) provides a comprehensive picture for better forecasting.

-

Understanding Market Liquidity: Understanding market depth and liquidity in XRP derivatives is critical for managing risk effectively. Low liquidity can lead to significant price slippage and make it difficult to enter or exit positions quickly. By using data analysis to understand market liquidity traders can better anticipate potential issues related to placing and closing trades.

By effectively using this data, traders can refine their strategies and improve their chances of making profitable trades.

Conclusion

Understanding the XRP derivatives market's dynamics is key to grasping XRP's price movements. Analyzing futures contracts, options data, and the impact of leverage provides valuable insights that enhance forecasting accuracy. The combination of fundamental analysis, technical analysis, and derivatives market data creates a more complete understanding of XRP price dynamics.

Call to Action: Stay informed about the dynamic XRP market and the insights provided by its derivatives. Continue your research into XRP price prediction and utilize the power of XRP derivatives market analysis for more informed trading strategies. Learn more about XRP trading and how to effectively interpret derivatives data today!

Featured Posts

-

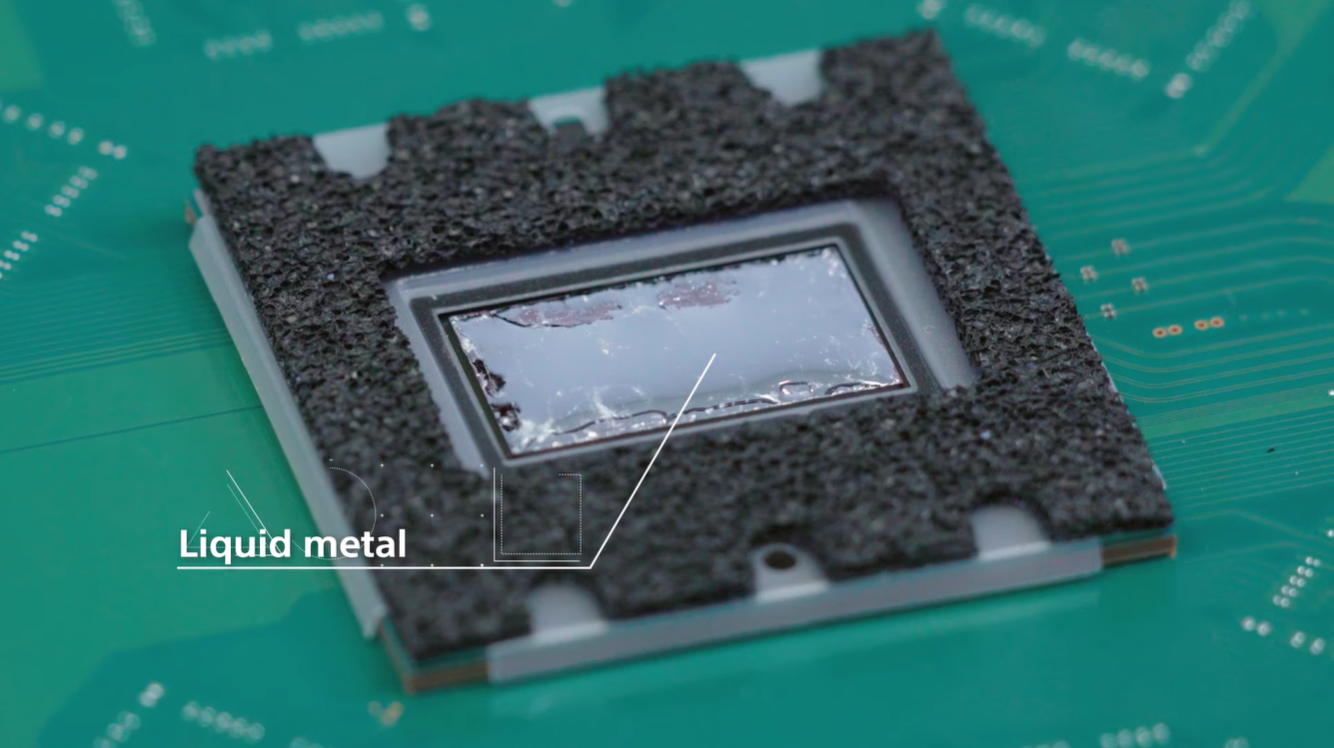

Official Sony Ps 5 Pro Teardown Shows Liquid Metal Cooling

May 07, 2025

Official Sony Ps 5 Pro Teardown Shows Liquid Metal Cooling

May 07, 2025 -

Are Ps 5 Games Stuttering Troubleshooting Common Issues

May 07, 2025

Are Ps 5 Games Stuttering Troubleshooting Common Issues

May 07, 2025 -

Lewis Capaldi Makes Rare Public Appearance Offers Encouraging Thumbs Up

May 07, 2025

Lewis Capaldi Makes Rare Public Appearance Offers Encouraging Thumbs Up

May 07, 2025 -

Songkran Boj Z Vodo Na Ulicah Tajske

May 07, 2025

Songkran Boj Z Vodo Na Ulicah Tajske

May 07, 2025 -

Celebrity Who Wants To Be A Millionaire Behind The Scenes Look At The Shows Biggest Moments

May 07, 2025

Celebrity Who Wants To Be A Millionaire Behind The Scenes Look At The Shows Biggest Moments

May 07, 2025

Latest Posts

-

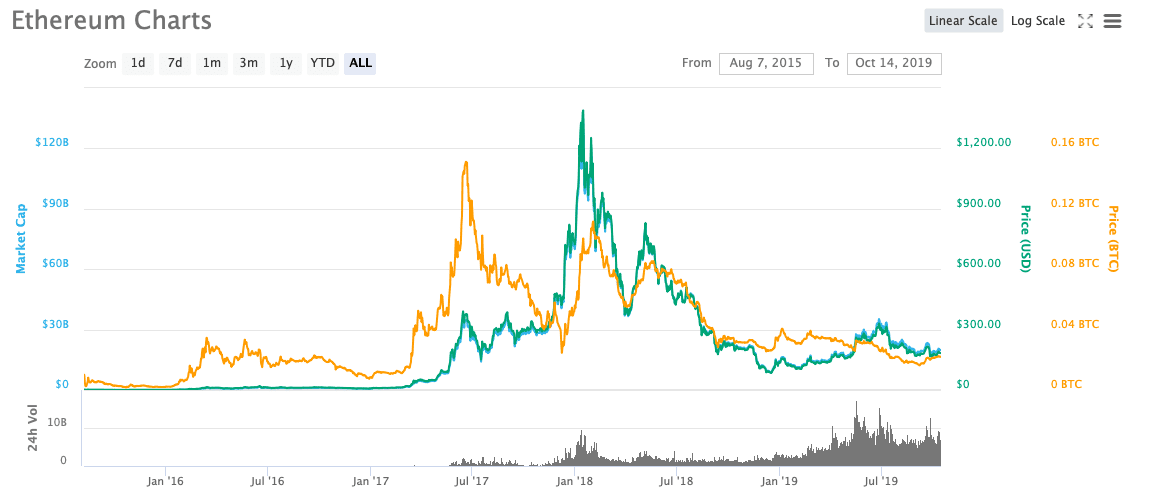

Ethereum Price Analysis Conquering Resistance Aiming For 2 000

May 08, 2025

Ethereum Price Analysis Conquering Resistance Aiming For 2 000

May 08, 2025 -

Analyzing The Ethereum Weekly Chart Buy Signal And Market Outlook

May 08, 2025

Analyzing The Ethereum Weekly Chart Buy Signal And Market Outlook

May 08, 2025 -

Ethereum Price Holding Above Support But Is A Drop To 1 500 Imminent

May 08, 2025

Ethereum Price Holding Above Support But Is A Drop To 1 500 Imminent

May 08, 2025 -

Ethereums Crucial Support Will The Price Fall To 1 500 A Price Prediction

May 08, 2025

Ethereums Crucial Support Will The Price Fall To 1 500 A Price Prediction

May 08, 2025 -

Ethereum Rebound Imminent Weekly Chart Indicator Suggests Buy

May 08, 2025

Ethereum Rebound Imminent Weekly Chart Indicator Suggests Buy

May 08, 2025