US-China Trade Surge: Deadline Fuels Export Rush

Table of Contents

The Looming Deadline and its Impact

The current export rush is largely fueled by an impending deadline: the expiration of a temporary trade agreement on December 31st, 2024 (hypothetical date used for illustrative purposes). This agreement temporarily suspended certain tariffs, and its expiration threatens to reinstate significant import duties. This looming deadline has created immense pressure on businesses to expedite shipments before the tariffs take effect. Failing to meet this deadline has severe consequences:

- Increased shipping costs and logistical challenges: The sudden surge in demand for shipping containers and cargo space has driven prices sky-high, increasing the cost of goods for businesses. Port congestion and logistical bottlenecks are further exacerbating these issues.

- Potential for delays and lost revenue: Delays in shipping can lead to missed deadlines, impacting contracts and potentially resulting in significant financial losses for both exporters and importers. Products arriving after the deadline will face increased tariffs, eroding profit margins.

- Impact on supply chains and consumer prices: Disruptions to supply chains stemming from the export rush will inevitably impact consumer prices. Increased shipping costs and potential product shortages are likely to lead to inflation.

Key Sectors Driving the Trade Surge

Several key sectors are at the forefront of this US-China trade surge. Technology, agricultural products, and manufacturing are experiencing the most significant increases in trade volume.

- Technology: The export of semiconductors and other advanced technology components has seen a dramatic rise, fueled by both the need to meet existing demand and a desire to avoid future tariff increases. Growth in this sector has exceeded 30% in the last three months.

- Agriculture: Soybeans, corn, and other agricultural products are among the goods experiencing a significant increase in exports. China's growing demand for agricultural inputs, coupled with the deadline, is pushing up exports considerably. Year-on-year growth is estimated at 15%.

- Manufacturing: Various manufactured goods, from textiles to machinery, are part of this surge. Companies are attempting to ship large quantities of goods to avoid higher tariffs. Growth here is currently at around 18%.

Geopolitical Factors Influencing Trade Dynamics

The current US-China trade dynamics are heavily influenced by a complex interplay of geopolitical factors.

- Impact of US-China relations on trade: The overall relationship between the two countries significantly impacts trade volumes. Periods of increased tension often lead to trade restrictions, while periods of cooperation encourage greater trade.

- Influence of global economic conditions: Global economic uncertainty is also a contributing factor. Businesses might be looking to secure supplies and exports from China before broader economic shifts further complicate international trade.

- Role of international trade agreements: Existing and future trade agreements between the US, China, and other countries are playing a substantial role in shaping trade flows.

Challenges and Opportunities Presented by the Trade Surge

This rapid increase in US-China trade presents both significant challenges and exciting opportunities for businesses.

- Risks associated with rapid trade growth: The rapid increase in trade volume creates logistical complexities, increases the risk of errors, and exposes businesses to potential financial losses due to unforeseen circumstances.

- Opportunities for expansion and market share gains: For businesses able to effectively navigate the complexities, the surge presents opportunities to expand their market share and solidify their position in the US-China trade relationship.

- Strategies for mitigating risks and seizing opportunities: Companies need robust supply chain management strategies, diversification of suppliers, and effective risk assessment to minimize potential losses.

Conclusion: Understanding the US-China Trade Surge

The current surge in US-China trade is largely a response to the impending deadline of a temporary trade agreement. This has led to significant increases in exports across key sectors, influenced by geopolitical factors and creating both challenges and opportunities. The technology, agricultural, and manufacturing sectors are experiencing the most profound impacts. Understanding these dynamics is critical for businesses to effectively navigate this complex situation.

Stay informed about future shifts in US-China trade relations to effectively manage the ongoing risks and opportunities presented by future trade surges. Careful planning and proactive strategies are key to successfully navigating the intricacies of US-China trade and leveraging the potential for growth amidst the current complexities.

Featured Posts

-

Canada Post Strike Will Customer Loyalty Suffer

May 25, 2025

Canada Post Strike Will Customer Loyalty Suffer

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav And Its Implications

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav And Its Implications

May 25, 2025 -

Chinese Tennis Ace Advances To Wta Italian Open Quarterfinals

May 25, 2025

Chinese Tennis Ace Advances To Wta Italian Open Quarterfinals

May 25, 2025 -

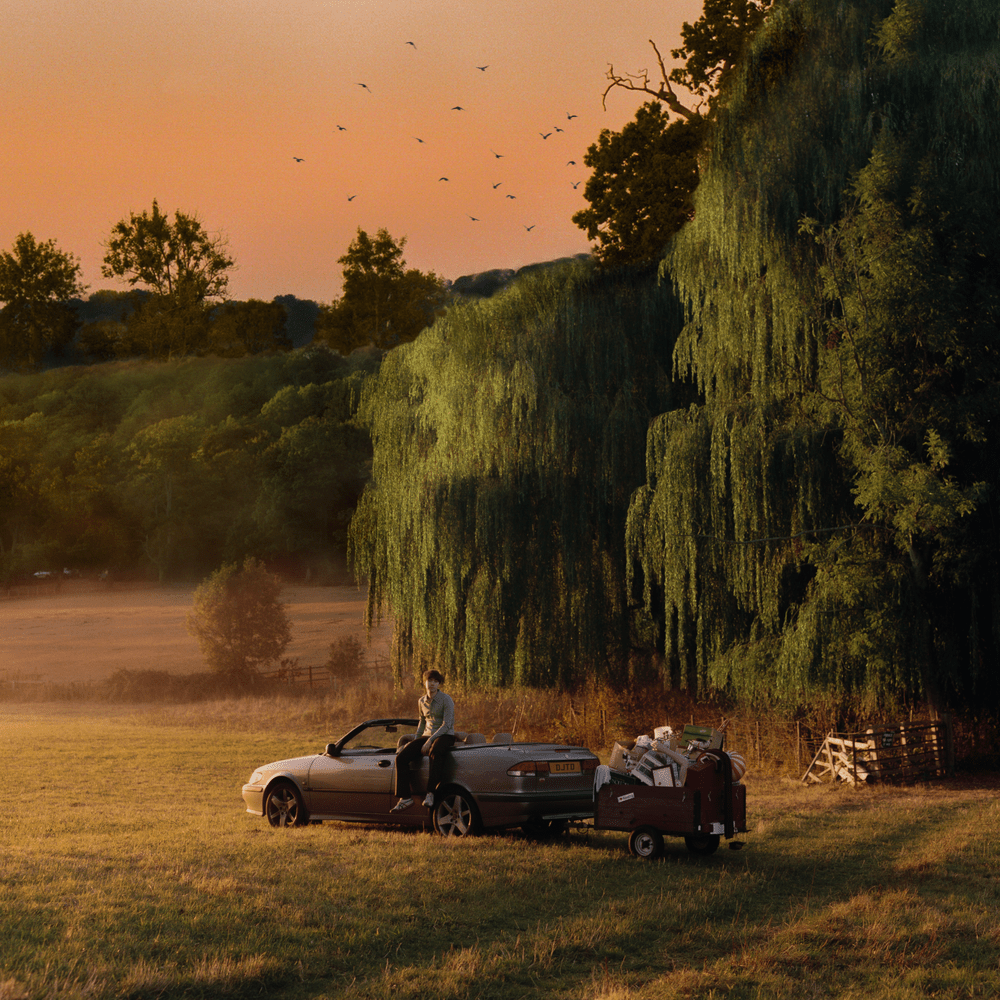

Interview Matt Maltese On Intimacy Growth And His Sixth Album Her In Deep

May 25, 2025

Interview Matt Maltese On Intimacy Growth And His Sixth Album Her In Deep

May 25, 2025 -

M6 Closure Real Time Updates On Crash And Associated Delays

May 25, 2025

M6 Closure Real Time Updates On Crash And Associated Delays

May 25, 2025

Latest Posts

-

Paris Welcomes Queen Wen Again Highlights Of The Royal Appearance

May 25, 2025

Paris Welcomes Queen Wen Again Highlights Of The Royal Appearance

May 25, 2025 -

Sabalenka Falls To Zheng In Rome Gauff To Face Zheng In Semifinals

May 25, 2025

Sabalenka Falls To Zheng In Rome Gauff To Face Zheng In Semifinals

May 25, 2025 -

Queen Wens Parisian Return A New Chapter

May 25, 2025

Queen Wens Parisian Return A New Chapter

May 25, 2025 -

Zheng Qinwens Upset Win Over Sabalenka In Rome Gauff Awaits

May 25, 2025

Zheng Qinwens Upset Win Over Sabalenka In Rome Gauff Awaits

May 25, 2025 -

Rome Open Zhengs Stunning Victory Over Sabalenka Sets Gauff Semifinal

May 25, 2025

Rome Open Zhengs Stunning Victory Over Sabalenka Sets Gauff Semifinal

May 25, 2025