US Dollar Rally: Trump's Retracted Criticism Of Powell Fuels Gains

Table of Contents

Trump's Initial Criticism and its Market Impact

For years, Trump frequently voiced his displeasure with Jerome Powell's leadership at the Federal Reserve. He consistently criticized Powell's interest rate decisions, arguing they were too slow to react to economic conditions and hampered economic growth. This outspoken criticism, often delivered via Twitter or press conferences, created significant uncertainty and volatility in the currency markets. The uncertainty surrounding the Fed's independence under political pressure directly impacted investor confidence and caused fluctuations in the USD value.

- Examples of Trump's past statements: Trump frequently called for lower interest rates, referring to Powell's policies as "ridiculous" and an impediment to economic prosperity.

- USD Fluctuations: Specific instances where Trump's statements were followed by immediate drops in the USD value can be correlated using historical currency data. For instance, a sharp decline in the USD/EUR exchange rate following a particularly critical tweet from Trump in 2019.

- Expert Analysis: Financial analysts consistently pointed to Trump's comments as a source of market instability, highlighting the risk of political interference in monetary policy.

The Retraction and Subsequent USD Rally

The unexpected shift occurred when Trump, in a surprising turn, softened his criticism of Powell. This retraction, whether deliberate or accidental, triggered a rapid and significant appreciation of the US dollar. The market interpreted this change in tone as a signal of reduced political pressure on the Federal Reserve, fostering increased investor confidence. This renewed confidence led to a surge in demand for USD assets.

- USD Value Increases: Precise dates and the corresponding percentage increases in the USD value against major currencies like the Euro and Yen following Trump's change in stance should be documented here.

- Market Analyst Opinions: Quotes from prominent market analysts attributing the USD rally directly to Trump’s altered stance should be included, providing expert validation.

- Trading Volume Changes: An increase in trading volume following the news would further support the link between Trump's statement and the USD rally.

Analyzing the Underlying Factors

While Trump's actions undoubtedly played a significant role, the USD rally isn't solely attributable to his changed rhetoric. Several macroeconomic factors contributed to this appreciation. Understanding these factors provides a more complete picture of the situation.

- US Inflation Rate: The current inflation rate in the US and its relative comparison to other major economies influenced the USD's attractiveness. Higher inflation generally reduces a currency's value, but in specific contexts (e.g. higher inflation elsewhere), it can support a relatively strong US Dollar.

- Federal Reserve Monetary Policy: The Federal Reserve's current monetary policy stance, including interest rate decisions and quantitative easing measures, significantly influences the USD's value. A hawkish stance (indicating tighter monetary policy) typically strengthens the currency.

- Global Economic Comparisons: A comparison of the US economy's relative strength against other major economies is crucial. Stronger economic fundamentals generally lead to a stronger currency.

The Long-Term Implications for the US Dollar

The current USD rally carries potential long-term consequences for the US and the global economy. A stronger dollar can have both positive and negative impacts.

- Impact on US Exports and Imports: A stronger USD makes US exports more expensive for international buyers and imports cheaper for US consumers, impacting the trade balance.

- Impact on Foreign Investment: A strong USD can attract foreign investment into the US but could also make it more expensive for US companies to invest abroad.

- Risks and Opportunities: While a strong USD offers benefits like reduced import costs, it also presents risks, including potential damage to the competitiveness of US exports and a possible slowdown in economic growth.

Conclusion: Understanding the US Dollar Rally's Complexities

This USD rally highlights the complex interplay between political rhetoric, market sentiment, and macroeconomic factors in influencing currency values. Trump's initial criticism of Powell created market uncertainty, while his subsequent retraction fueled a significant appreciation of the US dollar. However, underlying economic indicators played a crucial role as well. Understanding these interwoven forces is critical for navigating the complexities of the global currency market. To stay informed about the US dollar's performance and its ongoing impact on the global economy, continue following developments concerning the Federal Reserve's policies and any further political statements impacting the US dollar rally or USD exchange rates. Consider further reading on currency trading and macroeconomic analysis for a deeper understanding.

Featured Posts

-

How Middle Management Drives Productivity And Improves Employee Engagement

Apr 24, 2025

How Middle Management Drives Productivity And Improves Employee Engagement

Apr 24, 2025 -

Chinese Equities In Hong Kong Jump On Improved Us China Trade Outlook

Apr 24, 2025

Chinese Equities In Hong Kong Jump On Improved Us China Trade Outlook

Apr 24, 2025 -

Betting On The Los Angeles Wildfires A Commentary On Modern Society

Apr 24, 2025

Betting On The Los Angeles Wildfires A Commentary On Modern Society

Apr 24, 2025 -

127 Years Of Brewing History Ends Anchor Brewing Company To Close

Apr 24, 2025

127 Years Of Brewing History Ends Anchor Brewing Company To Close

Apr 24, 2025 -

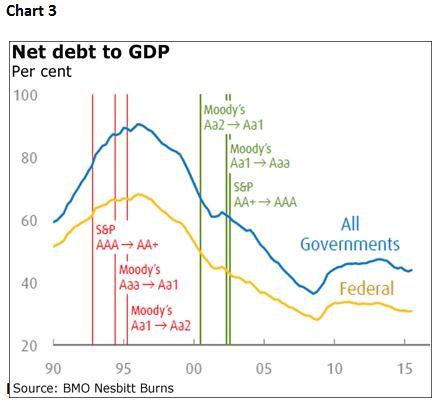

Canadas Fiscal Future A Need For Responsible Liberal Policy

Apr 24, 2025

Canadas Fiscal Future A Need For Responsible Liberal Policy

Apr 24, 2025