US Stock Market Attracts Record Canadian Investment: Trade War's Unexpected Effect

Table of Contents

The Weakening Canadian Dollar: A Driving Force Behind Increased US Stock Market Investment

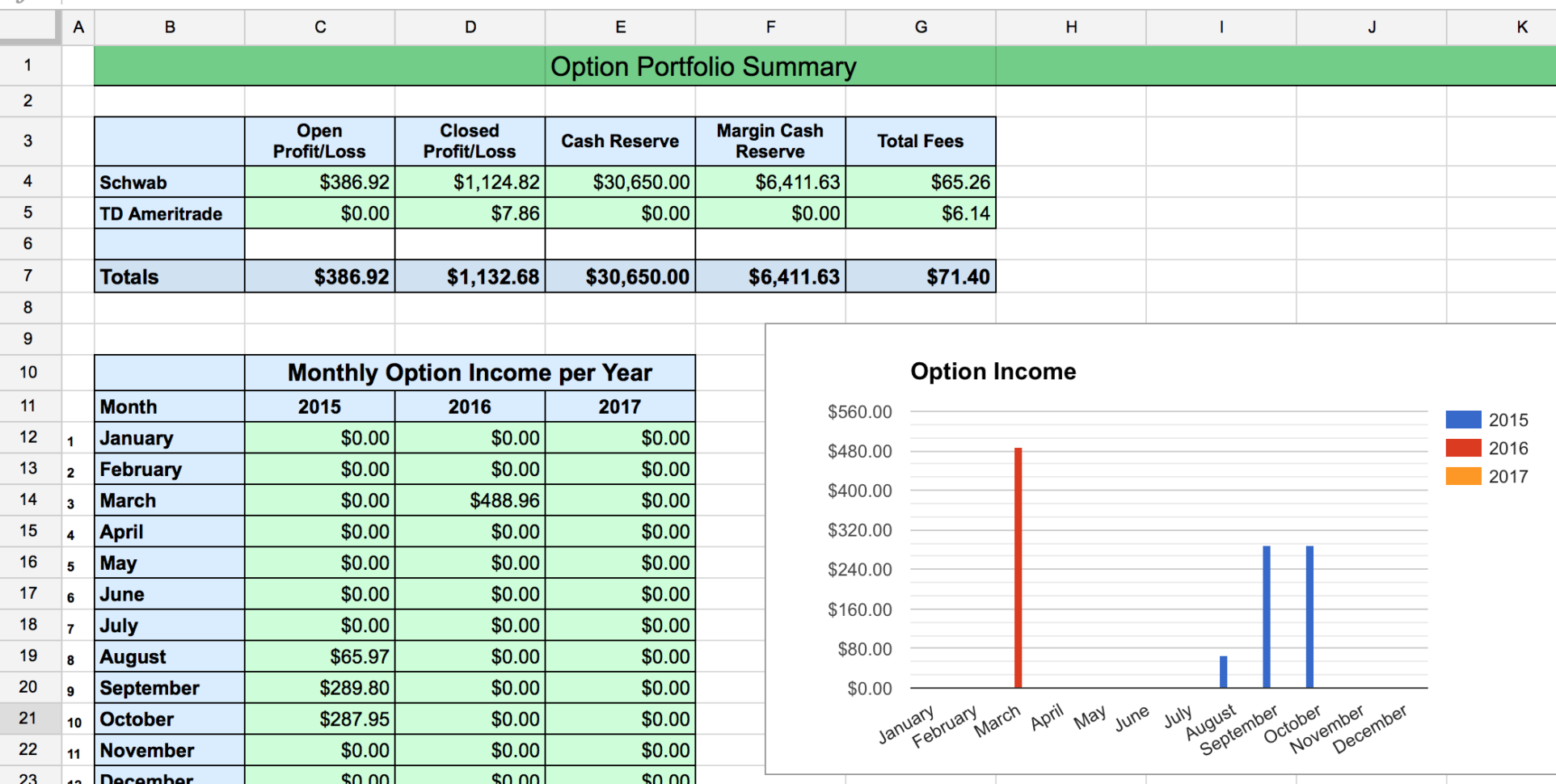

A significant factor contributing to the increased Canadian investment in the US stock market is the weakening of the Canadian dollar (CAD) against the US dollar (USD). The CAD/USD exchange rate has experienced considerable fluctuation in recent years, making US assets more affordable for Canadian investors. For instance, a weaker CAD means that a Canadian dollar buys fewer US dollars, but conversely, a given amount of US dollars buys more Canadian dollars. This dynamic directly impacts purchasing power.

Data from the Bank of Canada and other financial institutions clearly shows a correlation between CAD/USD exchange rate depreciation and the rise in Canadian investment in US equities.

- Increased affordability of US assets for Canadian investors: A weaker CAD makes US stocks, bonds, and other investments cheaper to acquire for Canadians.

- Diversification strategy to mitigate CAD risks: Investing in US assets helps Canadian investors diversify their portfolios and hedge against further CAD depreciation.

- Potential for higher returns in USD when converted back to CAD (if USD appreciates): If the USD strengthens against the CAD after the initial investment, Canadian investors can potentially realize even greater returns when converting their USD profits back into CAD.

This dynamic highlights the importance of considering currency fluctuations when formulating any international investment strategy, particularly regarding Canadian investment in the US stock market.

Seeking Higher Returns in the US Stock Market

Beyond currency fluctuations, the comparatively stronger performance of the US stock market compared to the Canadian market has also played a significant role in attracting Canadian investment. Over the past several years, key US indices have outperformed their Canadian counterparts, particularly in sectors like technology and healthcare.

- Stronger US economic growth compared to Canada: The generally robust US economy has fueled higher corporate earnings and stock valuations, making US equities an attractive proposition.

- Attractive valuations in certain US sectors: Specific sectors within the US market, notably technology and healthcare, have experienced significant growth, presenting opportunities for substantial returns.

- Access to a wider range of investment opportunities: The US stock market offers a far greater diversity of investment opportunities than the Canadian market, providing Canadian investors with more choices to tailor their portfolios.

Trade War Uncertainty and its Unexpected Impact on Investment Flows

Ironically, the US-China trade war, initially expected to negatively impact the US market, has, in a paradoxical way, driven some Canadian investors towards it. This can be attributed to a “flight to safety” phenomenon. While uncertainty abounds, some investors view established US companies as relatively safe havens compared to smaller or more volatile companies in other markets.

- Perception of the US market as a more stable long-term investment despite trade uncertainties: Despite trade war volatility, many see the US market as a more resilient long-term bet.

- Increased hedging strategies against trade war risks by diversifying into US assets: Diversification into US assets serves as a way to hedge against the potential negative impacts of the trade war on other global markets.

- Potential for undervalued US assets due to short-term market reactions: Short-term market reactions to trade war news can create opportunities to acquire undervalued US assets.

Regulatory and Tax Implications for Canadian Investors

Investing across borders comes with regulatory and tax considerations. Canadians investing in the US stock market should be aware of tax treaties between Canada and the US, as well as reporting requirements for foreign income and capital gains. The Canada Revenue Agency (CRA) website and other financial resources provide detailed information on these matters.

Conclusion: Understanding the Surge in Canadian Investment in the US Stock Market

The record-breaking surge in Canadian investment in the US stock market is a complex phenomenon driven by a confluence of factors. The weakening Canadian dollar, the relatively strong performance of the US stock market, and the unexpected impact of trade war uncertainty have all played significant roles. Understanding these dynamics is crucial for both Canadian and US economies. Understanding the dynamics of Canadian investment in the US stock market is crucial for informed decision-making. Learn more about navigating this landscape and maximizing your investment potential in the US stock market today! Careful planning and seeking professional financial advice are vital before making any investment decisions in the US or any other international market.

Featured Posts

-

Chronology Of The Legal Proceedings In The Karen Read Murder Case

Apr 22, 2025

Chronology Of The Legal Proceedings In The Karen Read Murder Case

Apr 22, 2025 -

Sweden And Finland Complementary Military Assets In A Pan Nordic Defense Strategy

Apr 22, 2025

Sweden And Finland Complementary Military Assets In A Pan Nordic Defense Strategy

Apr 22, 2025 -

Us And South Sudan To Collaborate On Deported Citizens Return

Apr 22, 2025

Us And South Sudan To Collaborate On Deported Citizens Return

Apr 22, 2025 -

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025 -

Robotic Limitations In Nike Sneaker Manufacturing A Deep Dive

Apr 22, 2025

Robotic Limitations In Nike Sneaker Manufacturing A Deep Dive

Apr 22, 2025

Latest Posts

-

Cbss Vma Simulcast The End Of Mtv As We Know It

May 12, 2025

Cbss Vma Simulcast The End Of Mtv As We Know It

May 12, 2025 -

The End Of An Era Thomas Muellers Emotional Allianz Arena Goodbye

May 12, 2025

The End Of An Era Thomas Muellers Emotional Allianz Arena Goodbye

May 12, 2025 -

Bayern Legend Thomas Mueller Bids Farewell After 25 Years

May 12, 2025

Bayern Legend Thomas Mueller Bids Farewell After 25 Years

May 12, 2025 -

Muellers Volgende Stap Competitie Opties Na Bayern Muenchen

May 12, 2025

Muellers Volgende Stap Competitie Opties Na Bayern Muenchen

May 12, 2025 -

25 Years At Allianz Arena Thomas Muellers Emotional Send Off

May 12, 2025

25 Years At Allianz Arena Thomas Muellers Emotional Send Off

May 12, 2025