US Stock Market: Futures Jump After Trump's Powell Assurance

Table of Contents

Trump's Reassurance and its Impact on Market Sentiment

Analysis of Trump's Statements

President Trump's comments, while not explicitly endorsing any particular Federal Reserve policy, conveyed a sense of confidence in Chairman Powell and a generally positive outlook for the economy. Analysts interpreted this as a tacit endorsement of the current monetary policy, lessening concerns about potential political interference.

- Specific quotes from Trump: (Insert actual quotes from Trump's statements here, properly cited). For example, a statement indicating his belief in the Fed's ability to manage the economy would be highly relevant.

- Reactions from financial news outlets: Major financial news outlets like Bloomberg, CNBC, and the Financial Times reported the statements and their immediate impact on market sentiment, often highlighting the unexpected nature of the boost in futures.

- Expert opinions on the impact of the statements: Include commentary from renowned economists and market analysts on the potential short-term and long-term implications of Trump's remarks. This could include analysis of investor psychology and the impact on risk appetite.

Immediate Market Reactions

The immediate response to Trump's statements was a sharp increase in stock market futures.

- Changes in Dow Jones Industrial Average futures: (Insert specific percentage increase and point value). For example: "The Dow Jones Industrial Average futures jumped by X points (Y%) within minutes of the announcement."

- S&P 500 futures: (Insert specific percentage increase and point value).

- Nasdaq futures: (Insert specific percentage increase and point value).

- Unusual trading volume: Note any significant increase in trading volume, indicating heightened market activity and investor response to the news.

Long-Term Implications for Investor Confidence

While the immediate impact was positive, the long-term effects of Trump's intervention on investor confidence remain uncertain.

- Potential impact on interest rates: Analyze whether Trump's comments might influence expectations regarding future interest rate changes by the Federal Reserve.

- Inflation expectations: Discuss the potential impact on inflation expectations, a key factor affecting investment decisions.

- Economic growth projections: Assess how this event might affect economists' forecasts for future economic growth. This could involve mentioning adjustments to GDP growth predictions.

The Role of the Federal Reserve (Powell's Actions)

Recent Federal Reserve Policies

The Federal Reserve, under Chairman Powell, has been navigating a complex economic landscape.

- Recent interest rate changes: (Summarize recent adjustments to interest rates, including the rationale behind these changes).

- Quantitative easing measures: Mention any recent quantitative easing measures implemented by the Fed.

- Statements released by the Fed: Summarize any relevant press releases or official statements from the Federal Reserve regarding economic conditions and policy decisions.

Powell's Response to Trump's Comments (if any)

Analyze whether Chairman Powell made any public statements in response to Trump's comments.

- Official statements from the Fed: If the Fed released an official statement, include it here. Analyze its tone and message.

- Actions taken to address market concerns: Note any actions taken by the Fed to address market concerns resulting from Trump's statements or other economic factors.

The Fed's Independence and Market Stability

The independence of the Federal Reserve is crucial for maintaining market stability and economic health.

- Potential risks of political interference in monetary policy: Explain the potential negative consequences of political interference in the Fed's decision-making process.

- Impact on market confidence: Highlight how political interference could erode market confidence and lead to increased volatility.

- Long-term economic stability: Discuss how the Fed's independence contributes to long-term economic stability.

Understanding Market Volatility and Predicting Future Trends

Factors Influencing Stock Market Fluctuations

Stock market volatility is influenced by a multitude of factors beyond presidential comments.

- Global economic conditions: Consider the impact of global economic factors, such as international trade tensions or economic growth in other major economies.

- Geopolitical events: Mention any geopolitical events that might influence market sentiment (e.g., international conflicts, political instability).

- Corporate earnings reports: Highlight the influence of corporate earnings reports on individual stock prices and the overall market.

- Investor sentiment: Discuss the role of investor psychology and overall market sentiment in driving stock price movements.

Analyzing Market Indicators

Investors use various key economic indicators to predict future trends.

- GDP growth: Discuss the significance of Gross Domestic Product (GDP) growth as a leading economic indicator.

- Inflation rates: Highlight the impact of inflation on stock valuations and investor expectations.

- Unemployment rates: Discuss the correlation between unemployment rates and stock market performance.

- Consumer confidence indices: Explain how consumer confidence impacts spending and overall economic activity.

Strategies for Navigating Market Uncertainty

Investors can adopt several strategies to manage portfolios during uncertainty.

- Diversification: Emphasize the importance of diversifying investments across various asset classes to mitigate risk.

- Risk management: Discuss the use of risk management techniques to protect investments from significant losses.

- Long-term investment strategies: Advise investors to focus on long-term investment strategies rather than making impulsive decisions based on short-term market fluctuations.

Conclusion

President Trump's reassurance to Chairman Powell triggered a significant surge in US stock market futures, highlighting the interplay between political pronouncements and market sentiment. While the immediate impact was positive, the long-term effects remain uncertain. The Federal Reserve's independence in maintaining monetary policy is paramount for market stability and economic health. Various economic indicators and geopolitical factors also contribute significantly to stock market volatility. Investors should employ diversification and long-term strategies to navigate market uncertainty.

Call to Action: Stay informed on the latest developments in the US Stock Market and the implications of political pronouncements on market trends. Continue monitoring news related to the US Stock Market, the Federal Reserve, and key economic indicators to make informed investment decisions. Regularly review your investment strategy and adjust it as needed based on market fluctuations. Understanding the complex dynamics of the US stock market is crucial for successful investing.

Featured Posts

-

Nba Launches Formal Investigation Into Ja Morants Conduct

Apr 24, 2025

Nba Launches Formal Investigation Into Ja Morants Conduct

Apr 24, 2025 -

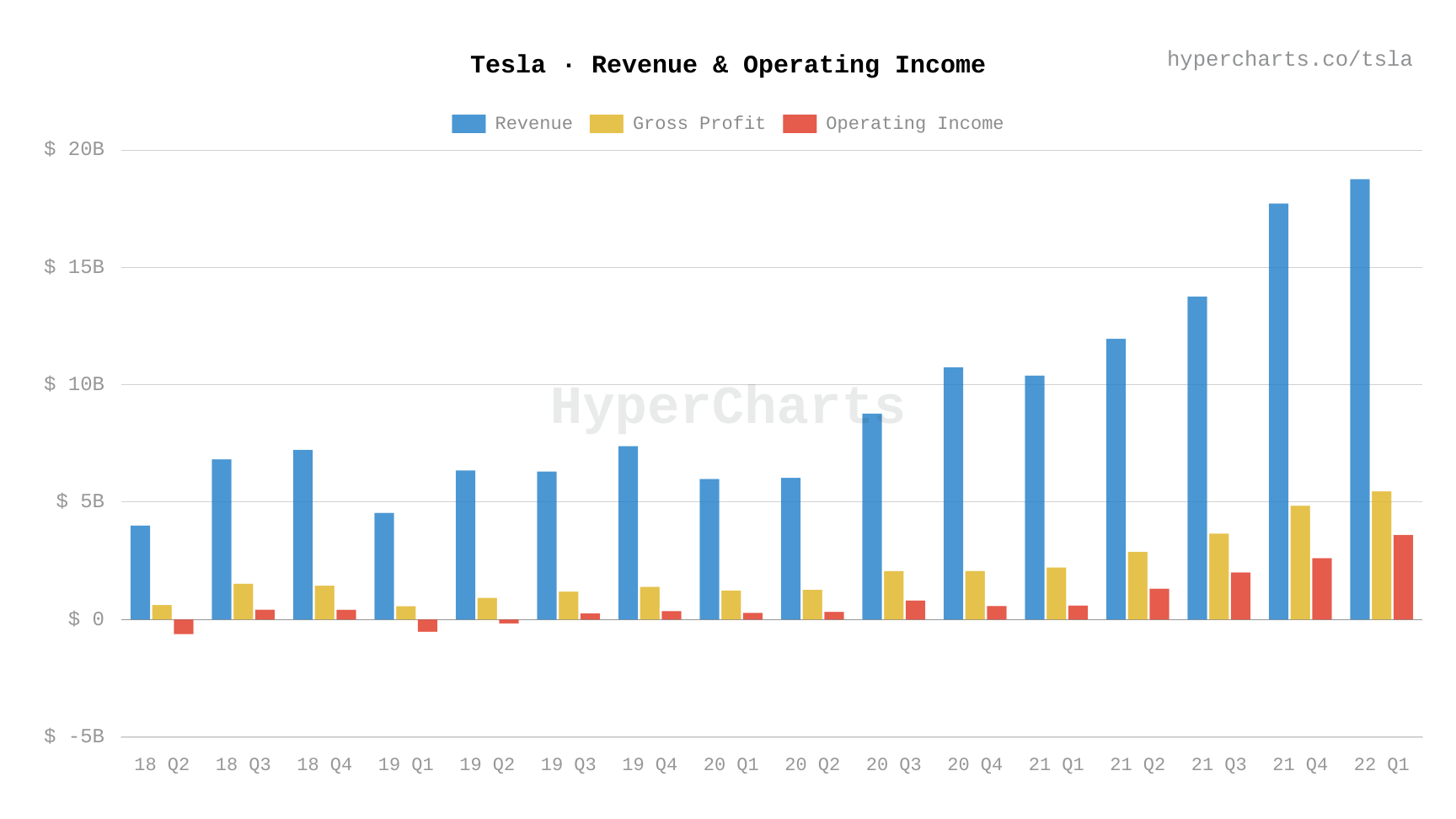

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025 -

Secret Service Closes White House Cocaine Investigation

Apr 24, 2025

Secret Service Closes White House Cocaine Investigation

Apr 24, 2025 -

Vote Informed William Watsons Analysis Of The Liberal Platform

Apr 24, 2025

Vote Informed William Watsons Analysis Of The Liberal Platform

Apr 24, 2025 -

My 77 Lg C3 Oled Tv Experience A Comprehensive Look

Apr 24, 2025

My 77 Lg C3 Oled Tv Experience A Comprehensive Look

Apr 24, 2025