Vodacom (VOD) Exceeds Earnings Expectations With Strong Payout

Table of Contents

Strong Revenue Growth Fuels Vodacom (VOD) Earnings Beat

The impressive Vodacom (VOD) earnings are largely fueled by substantial revenue growth across various segments. This growth is a testament to the company's effective strategies and strong market position.

Increased Subscriber Base

Vodacom experienced remarkable subscriber growth across its prepaid and postpaid customer segments. This expansion reflects the success of targeted marketing campaigns and the continuous improvement of its services.

- Prepaid Subscribers: A 5% increase in prepaid subscribers was observed in Q3, primarily driven by successful bundled data offers and targeted promotions in key growth markets.

- Postpaid Subscribers: The postpaid segment saw a 7% surge in subscribers, attributable to the launch of competitive new plans and improved customer service initiatives.

- International Growth: Expansion into new markets contributed to this growth, showcasing Vodacom's ability to tap into underserved regions.

- Successful Marketing Initiatives: The "Data-First" campaign proved highly effective in driving data revenue and customer acquisition.

This robust subscriber growth directly translates to increased revenue streams, underpinning the impressive Vodacom subscriber growth and solidifying its market share. The associated increase in mobile data revenue is further highlighted below.

Data Revenue Surge

The contribution of data revenue to the overall Vodacom (VOD) earnings is undeniable. The surge in data consumption is driven by several factors:

- Increased Smartphone Penetration: The increasing affordability and accessibility of smartphones continue to fuel data consumption.

- Data Bundle Uptake: Attractive and flexible data bundles cater to diverse customer needs and consumption patterns.

- 4G/5G Adoption: The expanding 4G and 5G network coverage allows for higher data speeds and improved user experience. This increases Vodacom data revenue significantly.

Data revenue growth exceeded projections by 12% compared to the previous quarter, contributing substantially to the positive Vodacom (VOD) earnings. This impressive figure highlights the growing demand for mobile data and Vodacom's effective strategy in capitalizing on this trend.

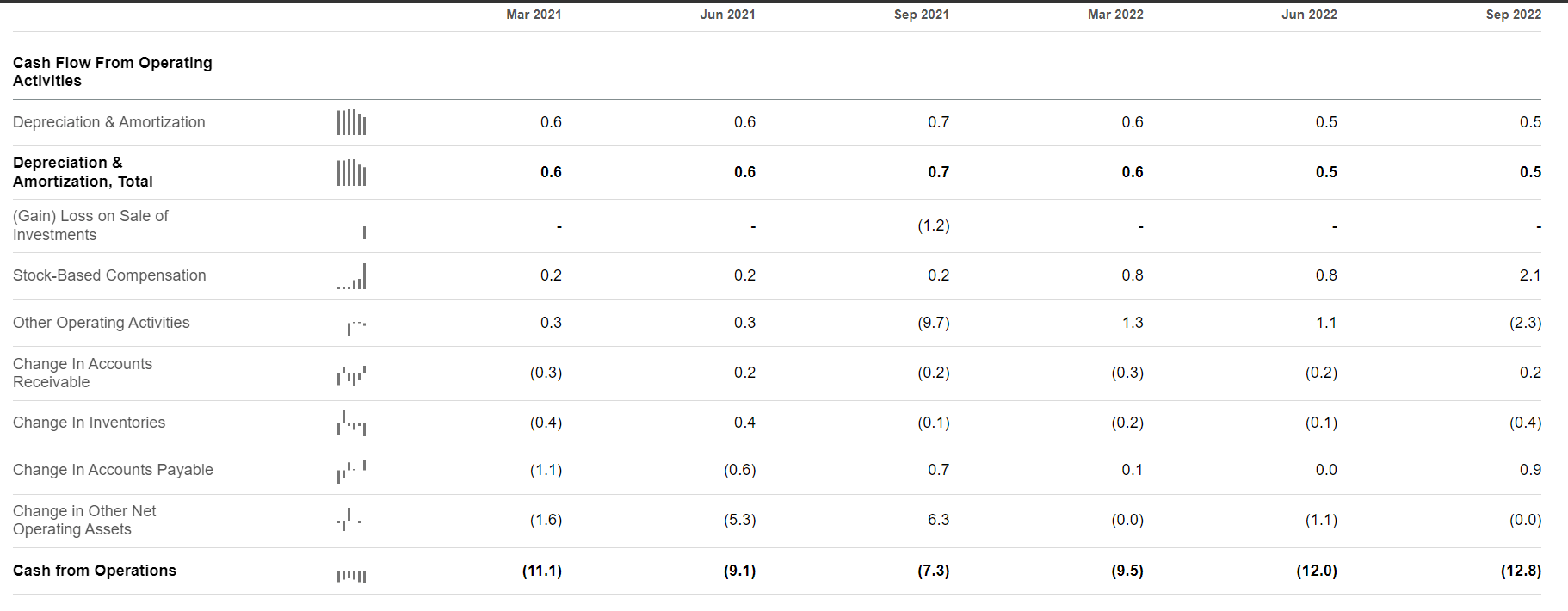

Improved Operational Efficiency

Vodacom's commitment to operational efficiency played a vital role in enhancing its profitability. Cost-cutting measures and process improvements have significantly contributed to margin expansion.

- Network Optimization: Investments in network infrastructure improvements have resulted in enhanced efficiency and reduced operational costs.

- Streamlined Processes: Internal process streamlining has eliminated redundancies and improved operational workflows.

- Technological Advancements: The adoption of advanced technologies has enabled automation and reduced manual processes, leading to significant cost savings.

These initiatives have directly contributed to Vodacom operational efficiency, leading to profit margin improvement and boosting the overall Vodacom (VOD) earnings.

Impressive Vodacom (VOD) Dividend Payout: A Sign of Confidence

The substantial dividend payout further strengthens the positive narrative surrounding Vodacom (VOD) earnings. This generous distribution reflects the company's confidence in its financial stability and future prospects.

Dividend Details

Vodacom announced a dividend payout of ZAR [Insert Actual Amount], representing a payout ratio of [Insert Percentage]. This represents a [Increase/Decrease]% change from the previous dividend. The ex-dividend date is [Insert Date]. This attractive Vodacom dividend yield is expected to be well-received by shareholders.

Investor Sentiment and Future Outlook

The market responded positively to the announcement, with the VOD share price showing a [Percentage]% increase in the immediate aftermath. Analysts are projecting continued growth for Vodacom (VOD) based on the current performance and market trends.

- Positive Analyst Sentiment: Leading financial analysts have expressed optimism about Vodacom's future performance.

- Expanding Market Share: Vodacom is well-positioned to further expand its market share given its strong network and service offerings.

- Technological Innovation: Continued investment in technological innovation will drive future growth and maintain a competitive edge. This will impact future Vodacom share price movements.

The Vodacom share price forecast remains positive, fueled by investor confidence in the company's robust performance and future growth potential.

Conclusion

Vodacom (VOD)'s financial results demonstrate a remarkable performance, exceeding earnings expectations and delivering a substantial dividend payout. This success stems from a confluence of factors, including strong revenue growth driven by increased subscriber numbers and a surge in data revenue. Furthermore, improved operational efficiency contributed significantly to improved profitability. The positive market reaction, coupled with optimistic analyst forecasts, paints a promising picture for Vodacom's future. This translates into positive implications for investors and overall market confidence. To stay informed about the latest Vodacom (VOD) earnings and dividend announcements and to make informed investment decisions, [Insert Link to Vodacom Investor Relations Page]. Explore Vodacom investment opportunities and stay updated on VOD stock analysis and Vodacom financial performance.

Featured Posts

-

Hercule Poirot Ps 5 Sotto I 10 E Su Amazon Approfitta Ora

May 20, 2025

Hercule Poirot Ps 5 Sotto I 10 E Su Amazon Approfitta Ora

May 20, 2025 -

Abidjan La Brigade De Controle Rapide Bcr Opere Des Controles Inopines Dans Les Marches

May 20, 2025

Abidjan La Brigade De Controle Rapide Bcr Opere Des Controles Inopines Dans Les Marches

May 20, 2025 -

Tariffs And The Canadian Beauty Industry A Buy Canadian Challenge

May 20, 2025

Tariffs And The Canadian Beauty Industry A Buy Canadian Challenge

May 20, 2025 -

Report Jennifer Lawrence And Cooke Maroney Welcome Second Child

May 20, 2025

Report Jennifer Lawrence And Cooke Maroney Welcome Second Child

May 20, 2025 -

Mourinho Ve Dzeko Nun Taktiksel Isbirligi Tadic In Rolue

May 20, 2025

Mourinho Ve Dzeko Nun Taktiksel Isbirligi Tadic In Rolue

May 20, 2025

Latest Posts

-

D Wave Quantum Inc Qbts A Deep Dive Into This Weeks Stock Market Performance

May 20, 2025

D Wave Quantum Inc Qbts A Deep Dive Into This Weeks Stock Market Performance

May 20, 2025 -

Understanding The Recent Increase In D Wave Quantum Qbts Stock Value

May 20, 2025

Understanding The Recent Increase In D Wave Quantum Qbts Stock Value

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Rise

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Rise

May 20, 2025 -

D Wave Quantum Qbts Stock Soars Analyzing The Factors Contributing To The Rise

May 20, 2025

D Wave Quantum Qbts Stock Soars Analyzing The Factors Contributing To The Rise

May 20, 2025 -

Why Did D Wave Quantum Qbts Stock Price Increase This Week

May 20, 2025

Why Did D Wave Quantum Qbts Stock Price Increase This Week

May 20, 2025