Wall Street's Palantir Prediction: Should You Buy Before May 5th?

Table of Contents

H2: Analyzing the Bullish Sentiment Surrounding Palantir

H3: Recent Financial Performance and Growth Projections:

Palantir's recent financial performance has fueled much of the bullish sentiment surrounding the stock. While the company hasn't always met lofty expectations, recent earnings reports show promising signs of growth. Key metrics to consider include:

- Revenue Growth: Palantir has demonstrated consistent revenue growth, exceeding analyst expectations in several quarters. Analyzing this growth trajectory is crucial for understanding the company's long-term potential. [Cite source: e.g., Palantir's quarterly earnings reports].

- Profitability: While Palantir hasn't yet achieved sustained profitability, improvements in operating margins suggest a path toward profitability. Examining these margins is crucial for assessing the company's financial health. [Cite source: e.g., Palantir's quarterly earnings reports].

- Customer Acquisition: The addition of new high-value clients, particularly within the government and commercial sectors, is a key driver of growth. Tracking this metric highlights the strength and expansion of Palantir's client base. [Cite source: e.g., Palantir's investor presentations].

These positive trends in Palantir revenue growth, improving profitability, and strong customer acquisition contribute to the optimistic outlook expressed in some Wall Street predictions. Understanding the “Palantir revenue growth” narrative is key to assessing this prediction's validity.

H3: Key Catalysts for Potential Stock Price Increase:

Several catalysts could trigger a surge in Palantir's stock price before May 5th. These include:

- New Contract Announcements: The securing of significant new government or commercial contracts could significantly boost investor confidence. The value and scope of these contracts would be crucial in driving a stock price increase.

- Successful Product Launches: The introduction of new products or upgrades to existing platforms could demonstrate Palantir's innovation and enhance its competitive advantage. Positive market response to these launches would likely positively influence the PLTR stock price prediction.

- Strategic Partnerships: Collaborations with other technology giants could expand Palantir's market reach and access to new technologies. Such alliances could inject significant momentum into the Palantir growth drivers.

The confluence of these "Palantir catalysts" could indeed contribute to a significant increase in the PLTR stock price prediction before May 5th. However, it's crucial to remember that these are possibilities, not guarantees.

H2: Considering the Bearish Counterarguments

H3: Potential Risks and Challenges:

While the bullish sentiment is compelling, it's crucial to acknowledge the potential risks associated with investing in Palantir:

- Increased Competition: The data analytics market is highly competitive. New entrants and established players could pose challenges to Palantir's market share and growth.

- Economic Slowdown: A broader economic slowdown could reduce spending on enterprise software, impacting Palantir's revenue growth. This risk is particularly relevant given the current global economic climate.

- Geopolitical Instability: Geopolitical uncertainties can negatively impact government spending and disrupt international business operations, posing a significant risk to Palantir's business.

Understanding these "Palantir risks" and the potential for a PLTR stock downside is critical for any prospective investor.

H3: Alternative Investment Strategies:

For investors hesitant about the risks associated with Palantir, diversification is always a prudent strategy. Consider exploring alternative investments in the technology sector or other asset classes to reduce overall portfolio risk. Diversification strategies allow for a more balanced approach to investment, reducing reliance on any single stock's performance. Exploring "tech stock alternatives" is advisable before committing significant capital to a single investment.

H2: Evaluating the May 5th Deadline: Fact or Fiction?

H3: Importance of Fundamental Analysis:

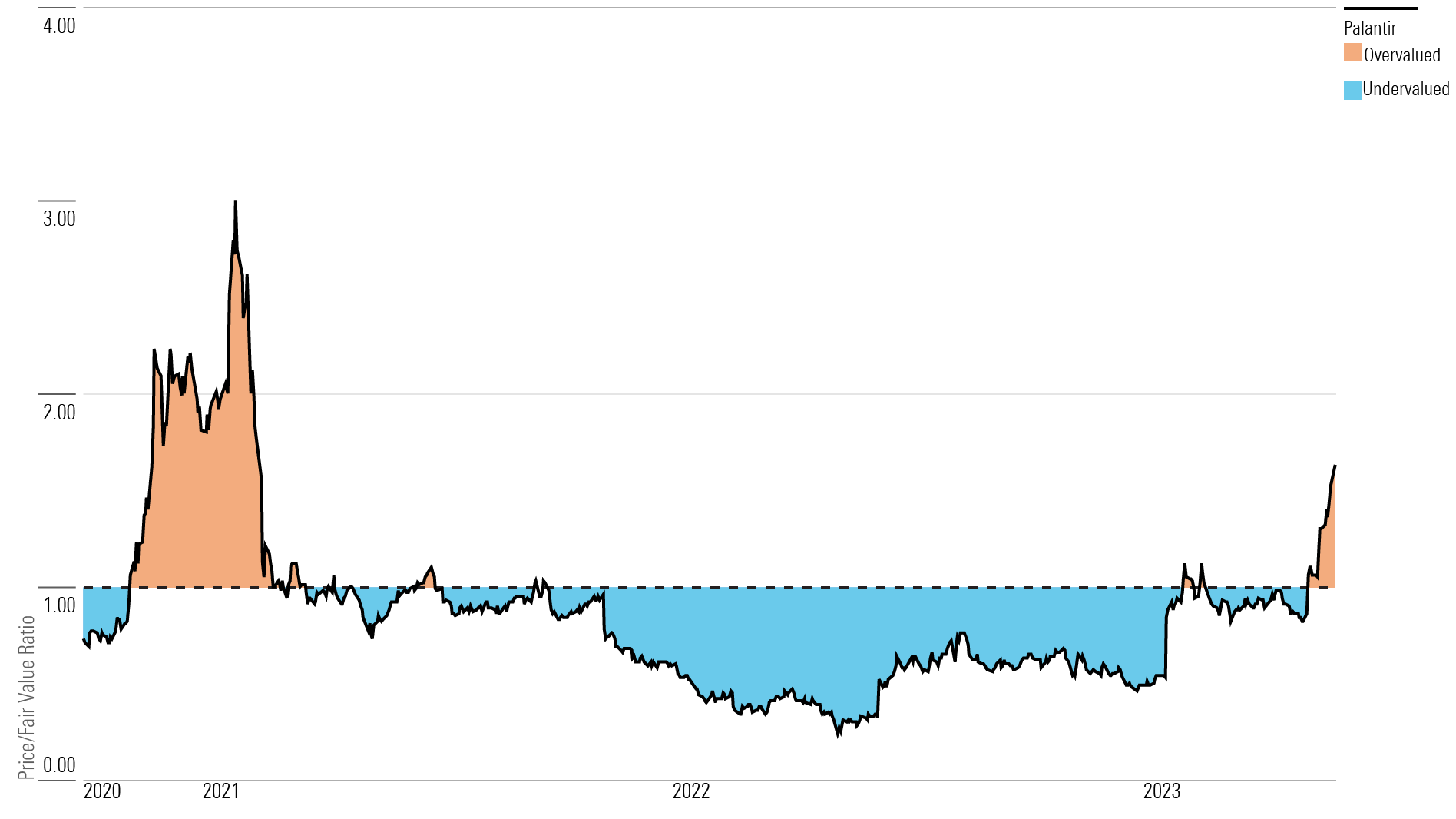

Before making any investment decisions, conduct thorough fundamental analysis of Palantir. This involves assessing the company's financial health, competitive position, and growth prospects. Don't just rely on short-term speculation; consider a long-term investment strategy. "Fundamental analysis" is key to assessing the true value of a stock and avoiding impulsive decisions based on speculation.

H3: The Role of Market Sentiment and Speculation:

Market sentiment and speculation can significantly impact Palantir's stock price, leading to short-term volatility. The May 5th date itself might be more a product of speculation than a concrete prediction based on fundamental analysis. Understanding the role of "market sentiment" and "stock market speculation" is vital to navigating the inherent risks.

3. Conclusion: Making Informed Decisions About Wall Street's Palantir Prediction

Wall Street's Palantir prediction presents a compelling but uncertain opportunity. While positive financial performance and potential catalysts suggest upside, significant risks and challenges also exist. The May 5th date should not be the sole driver of your investment decision. Thorough due diligence, including fundamental analysis and a realistic assessment of "Palantir risks," is paramount. Remember that stock market predictions are inherently uncertain. Before investing in Palantir or any other stock, conduct your own comprehensive research and consider your risk tolerance.

What are your thoughts on Wall Street's Palantir prediction? Share your insights in the comments below! And remember, always conduct thorough research before investing in Palantir or any other stock.

Featured Posts

-

Palantirs Potential A Realistic Assessment Of Its Trillion Dollar Trajectory By 2030

May 09, 2025

Palantirs Potential A Realistic Assessment Of Its Trillion Dollar Trajectory By 2030

May 09, 2025 -

Edmonton Unlimiteds Global Tech Vision A New Strategy For Innovation

May 09, 2025

Edmonton Unlimiteds Global Tech Vision A New Strategy For Innovation

May 09, 2025 -

Credit Suisse Whistleblower Payout Up To 150 Million Awaits

May 09, 2025

Credit Suisse Whistleblower Payout Up To 150 Million Awaits

May 09, 2025 -

Sto Xamilotero Epipedo 23 Eton I Krisi Xionioy Sta Imalaia

May 09, 2025

Sto Xamilotero Epipedo 23 Eton I Krisi Xionioy Sta Imalaia

May 09, 2025 -

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025