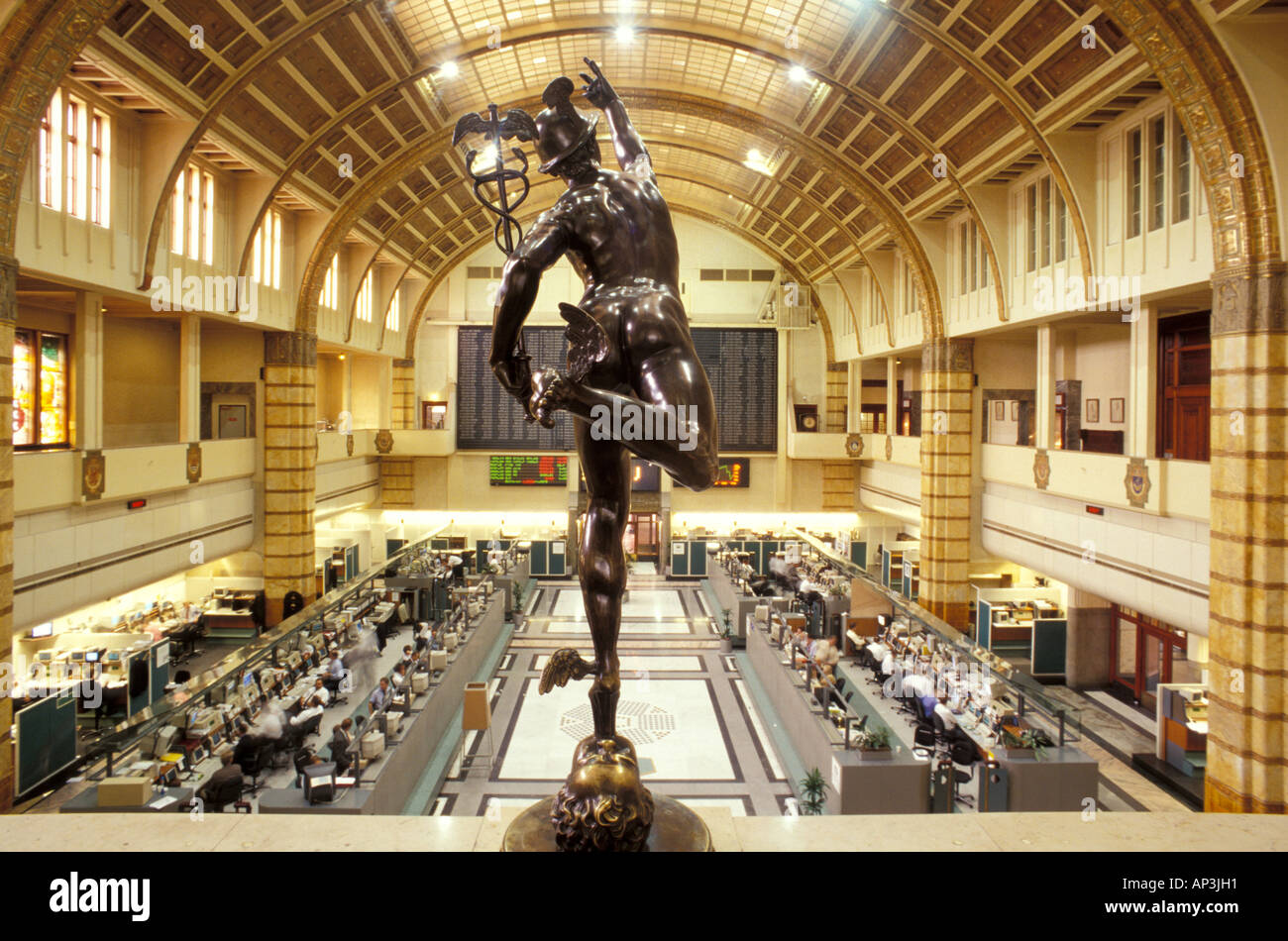

Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points

Table of Contents

Key Factors Contributing to the DAX Decline

Several intertwined factors contributed to the recent DAX decline, creating a perfect storm of negative market sentiment.

Global Economic Uncertainty

Global economic uncertainty remains a primary driver of the DAX fall. Rising global inflation continues to erode consumer spending power and stifle economic growth. The risk of a global recession looms large, fueled by persistent supply chain disruptions and the ongoing energy crisis. Geopolitical instability, including the ongoing war in Ukraine, further exacerbates this uncertainty.

- Impact of Inflation: High inflation erodes purchasing power, reducing consumer spending and impacting corporate profits.

- Recession Fears: Concerns about a potential global recession are driving investors to seek safer havens, leading to capital flight from riskier assets like stocks.

- Geopolitical Tensions: The war in Ukraine and its impact on energy prices and supply chains significantly contribute to market volatility.

Sector-Specific Weakness

The DAX decline wasn't uniform across all sectors. Certain sectors experienced significantly more pronounced weakness than others. The energy sector, heavily reliant on volatile global prices, faced considerable pressure. Similarly, the technology sector, sensitive to interest rate hikes and economic slowdown, underperformed.

- Underperforming Sectors: Energy, Technology, and Automotive sectors showed particularly weak performance.

- Top-Performing Sectors (if any): [Insert specific sectors that performed relatively better, if applicable, with brief explanations]. For example, Defensive sectors like consumer staples might have shown relative resilience.

- Company Performance: [Mention specific companies and their performance. E.g., "Volkswagen experienced a significant drop in its share price due to..."].

Interest Rate Hikes

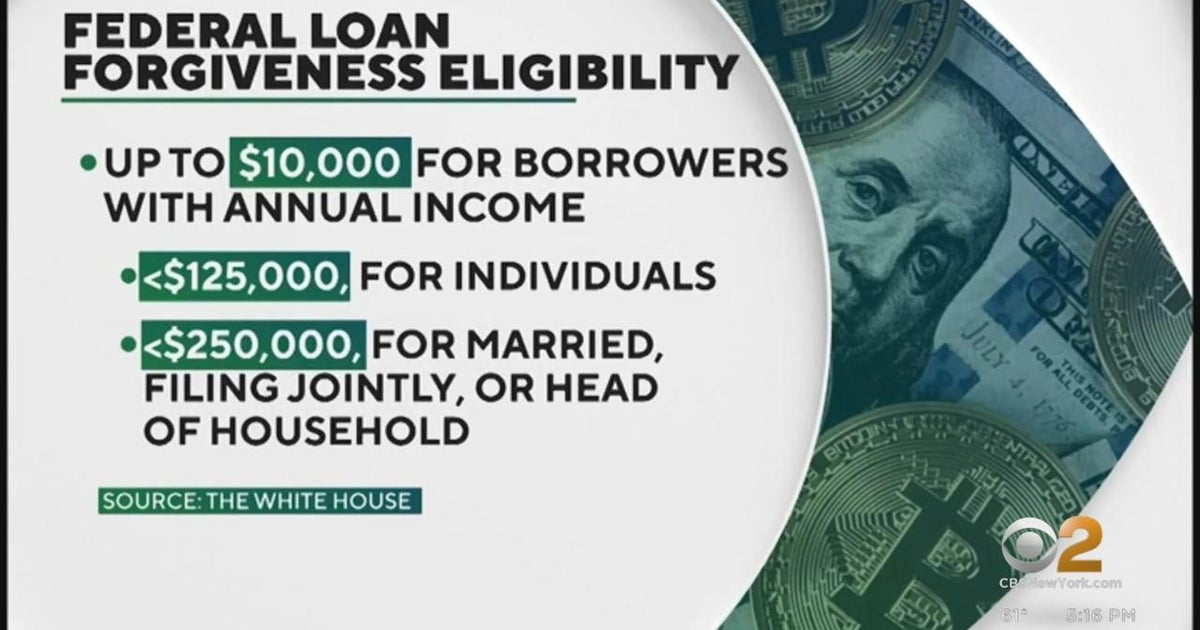

The European Central Bank (ECB)'s aggressive interest rate hikes to combat inflation are impacting investor behavior and market valuations. Rising interest rates increase borrowing costs for businesses, dampening investment and slowing economic growth. Higher rates also make bonds more attractive compared to stocks, leading to capital shifting from equities to fixed-income securities.

- Impact on Borrowing Costs: Increased borrowing costs make expansion and investment more challenging for businesses.

- Shift in Investor Preference: Higher interest rates make bonds a more appealing investment option, drawing capital away from the stock market.

- ECB Monetary Policy: The ECB's monetary policy decisions directly influence interest rates and market sentiment within the Eurozone, including Germany.

Impact on Investors and the German Economy

The DAX decline has significant ramifications for both investors and the German economy.

- Investor Sentiment: Investor confidence has plummeted, leading to portfolio losses and increased market volatility. Individual investors and institutional investors alike are feeling the pressure.

- Portfolio Losses: Many investors have experienced significant losses in their portfolios due to the DAX's fall.

- Market Volatility: The increased uncertainty is contributing to heightened market volatility, making it challenging for investors to predict market movements.

- Impact on German Economy: The decline in the DAX reflects underlying weaknesses in the German economy. Reduced consumer confidence and business investment could lead to slower economic growth. This could particularly impact export-oriented sectors.

- Potential Economic Impacts: Reduced consumer spending, decreased business investment, and potential job losses are possible consequences of the economic slowdown.

Analyst Predictions and Future Outlook for the DAX

Analyst opinions on the future performance of the DAX are mixed. Some experts remain cautious, citing persistent global economic headwinds. Others point to potential for a rebound, citing the resilience of the German economy and the ECB's efforts to manage inflation.

- Cautious Predictions: Some analysts predict further declines in the DAX, citing ongoing global uncertainty and potential for a deeper recession.

- Optimistic Predictions: Others believe the DAX may rebound in the coming months, pointing to potential easing of inflation and strong underlying fundamentals in the German economy.

- Diverse Viewpoints: The range of predictions reflects the inherent uncertainty in economic forecasting, emphasizing the need for careful risk management.

Conclusion: Navigating the Frankfurt Stock Market's Downturn

The significant drop in the DAX index below 24,000 points reflects a confluence of factors, including global economic uncertainty, sector-specific weakness, and the impact of interest rate hikes. This downturn has considerable implications for investors and the German economy. Careful risk management and a well-diversified investment strategy are crucial for navigating this period of market volatility. Stay informed about the Frankfurt Stock Market's fluctuations and the DAX performance to make sound investment decisions. For up-to-date information on DAX movements and market analysis, continue to follow our coverage of the Frankfurt Stock Market.

Featured Posts

-

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025 -

Sejarah Porsche 356 Pabrik Zuffenhausen Jerman

May 24, 2025

Sejarah Porsche 356 Pabrik Zuffenhausen Jerman

May 24, 2025 -

Annie Kilners Sparkling New Ring Is A Kyle Walker Engagement Confirmed

May 24, 2025

Annie Kilners Sparkling New Ring Is A Kyle Walker Engagement Confirmed

May 24, 2025 -

Joy Crookes Releases New Track I Know You D Kill

May 24, 2025

Joy Crookes Releases New Track I Know You D Kill

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out

May 24, 2025

Latest Posts

-

Amsterdam Exchange Suffers 11 Drop Since Wednesday

May 24, 2025

Amsterdam Exchange Suffers 11 Drop Since Wednesday

May 24, 2025 -

Amsterdam Stock Exchange Plunges Three Consecutive Days Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Plunges Three Consecutive Days Of Heavy Losses

May 24, 2025 -

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025 -

Tik Tok Tourism Backlash Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 24, 2025

Tik Tok Tourism Backlash Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025