White House Condemns Moody's Downgrade Of US Credit Rating

Table of Contents

Moody's Downgrade: Reasons and Justification

Moody's decision to downgrade the US credit rating from Aaa to Aa1 was not taken lightly. The agency cited a confluence of factors contributing to its assessment of increased fiscal stress. Their rationale centers on the deterioration of the US government's fiscal strength, exacerbated by rising debt levels and persistent political gridlock.

Key factors cited by Moody's include:

- Increased national debt: The soaring national debt, fueled by years of budget deficits and increased spending, poses a significant risk to the nation's long-term fiscal sustainability.

- Political gridlock and challenges in passing the budget: The recurring battles over the debt ceiling and the difficulty in reaching bipartisan consensus on fiscal policy have eroded investor confidence and highlight the challenges in managing the nation's finances.

- Erosion of governance strength: Moody's pointed to a weakening of governance effectiveness, citing the increased political polarization and the challenges in enacting effective fiscal reforms.

- Potential for further fiscal deterioration: The agency expressed concerns about the potential for further deterioration in the US fiscal outlook if current trends continue.

For Moody's full report and justification, please refer to their official press release: [Insert Link to Moody's Press Release Here]

The White House's Response and Criticism

The White House responded swiftly and forcefully to Moody's downgrade, issuing a statement that strongly criticized the agency's assessment. The administration dismissed the downgrade as inaccurate and flawed, emphasizing the underlying strength of the US economy and the administration's fiscal policies.

The White House's counterarguments include:

- Dismissal of Moody's assessment as inaccurate or flawed: The administration argued that Moody's methodology failed to adequately account for the positive economic indicators and the government's efforts to improve fiscal health.

- Emphasis on the strength of the US economy: The White House highlighted positive economic indicators such as strong job growth and low unemployment rates to counter Moody's concerns.

- Highlighting the administration's economic policies: The administration showcased its economic policies aimed at reducing the deficit and strengthening the economy as evidence of fiscal responsibility.

- Political accusations against the opposition for hindering fiscal responsibility: The White House placed blame on the opposition party, accusing them of obstructionism and hindering efforts to address the nation's fiscal challenges.

Economic and Market Implications of the Downgrade

The downgrade of the US credit rating carries significant economic and market implications, both in the short-term and long-term. The immediate impact is likely to be felt in increased borrowing costs for the US government.

Potential consequences include:

- Increased interest rates on US debt: Higher interest rates will increase the cost of servicing the national debt, putting further strain on the federal budget.

- Potential increase in borrowing costs for consumers and businesses: The increased borrowing costs for the government could ripple through the economy, leading to higher interest rates for consumers and businesses.

- Negative impact on investor confidence: The downgrade could erode investor confidence in the US economy, leading to capital flight and a decline in the value of the US dollar.

- Potential volatility in the financial markets: The downgrade could trigger increased volatility in the financial markets as investors reassess their portfolios and adjust their risk appetite.

Political Fallout and Future Outlook

The political ramifications of Moody's downgrade are substantial, particularly with upcoming elections looming. The debate over fiscal responsibility is likely to intensify, with both parties leveraging the downgrade to advance their respective agendas.

Potential future scenarios include:

- Increased pressure for fiscal reforms: The downgrade could add momentum to efforts to implement meaningful fiscal reforms, including spending cuts and tax increases.

- Potential shifts in political power dynamics: The political fallout could lead to shifts in political power dynamics, potentially influencing the outcome of upcoming elections.

- Ongoing debate about the national debt: The downgrade is likely to reignite the debate about the national debt and the best strategies for addressing the nation's long-term fiscal challenges.

- Potential for further credit rating changes: Other credit rating agencies may follow suit, potentially leading to further downgrades and increasing pressure on the US government to take action.

Conclusion: Understanding the Implications of the White House Condemnation of Moody's Downgrade

Moody's downgrade of the US credit rating, coupled with the White House's strong condemnation, marks a significant moment for the US economy and global financial markets. The reasons behind the downgrade, ranging from rising national debt to political gridlock, are multifaceted and underscore the challenges facing the US government in managing its fiscal affairs. The White House's response, while critical of Moody's assessment, highlights the deep political divisions surrounding fiscal policy and the potential for further economic consequences. The potential for increased interest rates, reduced investor confidence, and market volatility necessitates careful monitoring of the situation.

Stay updated on the evolving situation regarding the US credit rating by following reputable financial news sources and continue to monitor the White House's response to this Moody's downgrade. Understanding the implications of this decision is crucial for navigating the complexities of the current economic climate and the ongoing debate surrounding the US national debt and fiscal policy.

Featured Posts

-

Moodys Us Downgrade White House Responds With Criticism

May 18, 2025

Moodys Us Downgrade White House Responds With Criticism

May 18, 2025 -

Taylor Swift Re Recordings Ranked A Comprehensive Guide To The Taylors Version Albums

May 18, 2025

Taylor Swift Re Recordings Ranked A Comprehensive Guide To The Taylors Version Albums

May 18, 2025 -

Ftc Rests Case Against Meta Monopoly Trial Shifts To Defense

May 18, 2025

Ftc Rests Case Against Meta Monopoly Trial Shifts To Defense

May 18, 2025 -

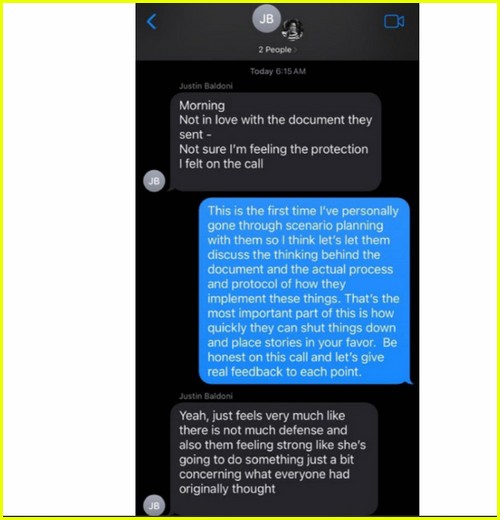

The Justin Baldoni Lawsuit And The Selena Gomez Taylor Swift Rift

May 18, 2025

The Justin Baldoni Lawsuit And The Selena Gomez Taylor Swift Rift

May 18, 2025 -

Navigating Metropolis Japan Transportation Accommodation And Local Experiences

May 18, 2025

Navigating Metropolis Japan Transportation Accommodation And Local Experiences

May 18, 2025

Latest Posts

-

Ben Joyce And Kenley Jansen A Masterclass In Pitching Refinement For The Los Angeles Angels

May 18, 2025

Ben Joyce And Kenley Jansen A Masterclass In Pitching Refinement For The Los Angeles Angels

May 18, 2025 -

Jose Sorianos Shutout Performance Delivers Angels 1 0 Win Against White Sox

May 18, 2025

Jose Sorianos Shutout Performance Delivers Angels 1 0 Win Against White Sox

May 18, 2025 -

Angels Flamethrower Ben Joyce Improves Pitching With Kenley Jansens Guidance

May 18, 2025

Angels Flamethrower Ben Joyce Improves Pitching With Kenley Jansens Guidance

May 18, 2025 -

Ben Joyces Development Learning From Kenley Jansens Closing Expertise

May 18, 2025

Ben Joyces Development Learning From Kenley Jansens Closing Expertise

May 18, 2025 -

Angels 1 0 Victory Over White Sox A Masterclass By Jose Soriano

May 18, 2025

Angels 1 0 Victory Over White Sox A Masterclass By Jose Soriano

May 18, 2025