Wildfire Speculation: Analyzing The Market For Los Angeles Wildfire Bets

Table of Contents

The Nature of Wildfire Bets in Los Angeles

Wildfire bets in Los Angeles aren't about placing a wager on a specific fire's ignition. Instead, they involve speculating on various aspects of the wildfire season. These can include:

- Predicting the severity of the fire season: Bets might focus on the total acreage burned, the number of fires ignited, or the overall economic damage caused.

- Speculating on specific locations affected: Some bets might target specific geographic areas within Los Angeles County, predicting the likelihood of major fire events in those zones.

- Insurance claim estimations: This involves predicting the total value of insurance claims resulting from wildfire damage.

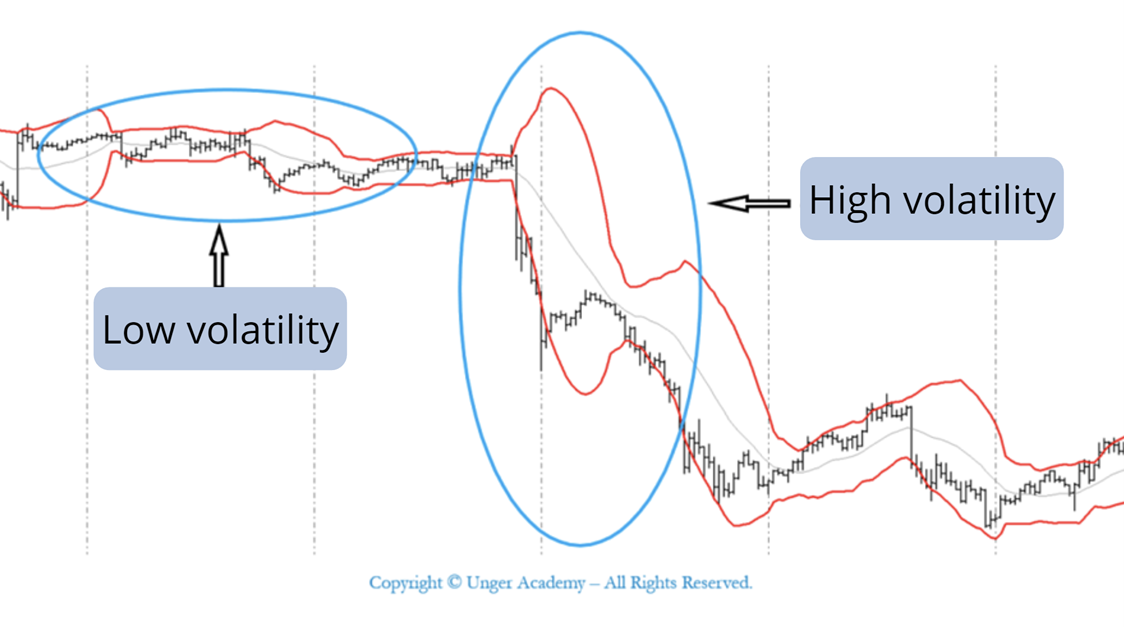

This market is inherently speculative, characterized by high risk and potentially high reward.

- High-Risk, High-Reward: The potential for significant payouts attracts investors, but the unpredictable nature of wildfires makes it a highly volatile market.

- Weather Forecasting & Predictive Models: Sophisticated weather forecasting models, combined with historical fire data, play a significant role in informing these bets. Accurate prediction is key, but limitations exist.

- Ethical Considerations: The ethical implications of profiting from natural disasters are undeniable. Critics argue it's insensitive to capitalize on the suffering of others.

The Players Involved: Who is Betting on Wildfires?

Several players participate in this emerging market, each with distinct motivations:

- Individuals: Some individuals might place small bets driven by curiosity or a belief in their predictive abilities.

- Insurance Companies: Major insurance companies use complex models to assess risk and potentially hedge against wildfire-related payouts. They analyze data to better manage their exposure.

- Hedge Funds and Investment Firms: These sophisticated investors use advanced data analytics and predictive models to identify potentially profitable opportunities in wildfire-related financial instruments (if such exist).

The motivations are diverse:

- Risk Mitigation: For insurers, the goal is to accurately assess and manage risk, minimizing potential financial losses.

- Profit Maximization: For investors, the aim is to profit from accurate predictions and favorable market conditions.

- Information Asymmetry: The access to sophisticated data and predictive models creates an information asymmetry, giving some players a significant advantage over others. This raises concerns about potential market manipulation.

Predicting Wildfire Risk: Data and Models

Predicting wildfire risk relies on a complex interplay of data sources and predictive models:

- Historical Fire Data: Past fire occurrences, locations, and severity provide crucial baseline information.

- Climate Models: These models incorporate factors like temperature, humidity, precipitation, and wind patterns to project future fire risk.

- Vegetation Indices: Satellite imagery and remote sensing technologies are used to monitor vegetation health and fuel load, crucial indicators of fire risk.

However, limitations exist:

- Accuracy Limitations: Current predictive models, while improving, are not perfect. Unforeseen events and the complexity of wildfire behavior limit accuracy.

- Influencing Factors: Drought conditions, wind patterns, fuel loads (dry vegetation), and human activity significantly influence wildfire risk, making accurate prediction challenging.

- Technological Advancements: Technology like advanced satellite imagery, AI-powered predictive analytics, and improved weather forecasting constantly enhance prediction capabilities.

The Legal and Ethical Implications of Wildfire Betting

The legal and ethical landscape of wildfire betting is complex and largely undefined:

- Legal Framework: Currently, the legal status of wildfire bets is unclear. Specific regulations are lacking, creating a grey area. The legality would likely depend on the specific nature of the bet and its connection to any existing financial markets.

- Ethical Concerns: The ethical concerns are significant. Profiting from the devastation caused by natural disasters raises serious moral questions. It also raises questions about the fairness of such a market.

- Legal Challenges: Inaccurate predictions leading to financial losses could result in legal challenges. Market manipulation or the use of insider information could also lead to legal repercussions.

- Societal Impact: The existence of such a market could have far-reaching societal implications, potentially influencing disaster response strategies and public perception.

The Future of Wildfire Speculation in Los Angeles

The future of wildfire speculation in Los Angeles is uncertain but depends on several factors:

- Technological Advancements: Improvements in predictive modeling and data analysis could lead to more accurate predictions, potentially increasing market participation.

- Regulatory Changes: The introduction of clear legal frameworks and regulations will shape the market's future trajectory. This will dictate the legality and the level of risk involved.

- Climate Change: The escalating impact of climate change on wildfire frequency and intensity will significantly influence the risk landscape and the demand for predictive models.

- Long-Term Societal Implications: The long-term consequences of this type of speculation need careful consideration, ensuring responsible behavior within the market and reducing potentially harmful societal effects.

Conclusion

This exploration of the Los Angeles wildfire betting market reveals a complex system driven by risk, prediction, and ethical considerations. The market’s future trajectory will hinge on technological advances, regulatory frameworks, and the evolving understanding of wildfire risk in the face of climate change. Understanding the dynamics of wildfire speculation is crucial for navigating this ethically charged market. Further research into the Los Angeles wildfire betting market is needed to mitigate potential risks and ensure responsible engagement. Learn more about the complexities of wildfire prediction and its implications for the future.

Featured Posts

-

Pennsylvania Coastal Flood Advisory Wednesday Update

May 25, 2025

Pennsylvania Coastal Flood Advisory Wednesday Update

May 25, 2025 -

Dazi E Borse L Unione Europea Pronta A Reazioni Forti

May 25, 2025

Dazi E Borse L Unione Europea Pronta A Reazioni Forti

May 25, 2025 -

Escape To The Country Overcoming Challenges And Embracing Rural Life

May 25, 2025

Escape To The Country Overcoming Challenges And Embracing Rural Life

May 25, 2025 -

The Ultimate Guide To Escaping To The Country

May 25, 2025

The Ultimate Guide To Escaping To The Country

May 25, 2025 -

Amsterdam Stock Market Volatility 7 Drop At Open Due To Trade War

May 25, 2025

Amsterdam Stock Market Volatility 7 Drop At Open Due To Trade War

May 25, 2025

Latest Posts

-

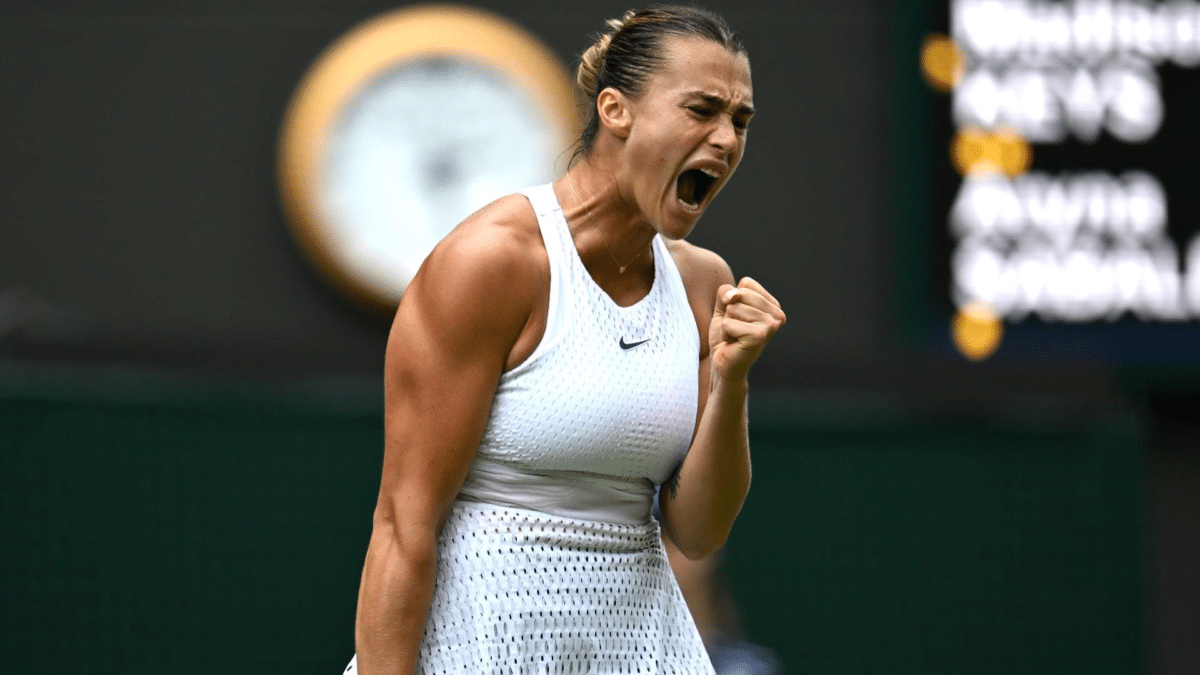

Zheng Qinwen Triumphs Over Sabalenka At Italian Open

May 25, 2025

Zheng Qinwen Triumphs Over Sabalenka At Italian Open

May 25, 2025 -

Italian Open Zheng Qinwens Semifinal Berth After Sabalenka Upset

May 25, 2025

Italian Open Zheng Qinwens Semifinal Berth After Sabalenka Upset

May 25, 2025 -

Zheng Qinwen Stuns Sabalenka Reaches Italian Open Semifinals

May 25, 2025

Zheng Qinwen Stuns Sabalenka Reaches Italian Open Semifinals

May 25, 2025 -

Ferstapen Mercedes To Mellon Tis Synergasias

May 25, 2025

Ferstapen Mercedes To Mellon Tis Synergasias

May 25, 2025 -

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025