Will Climate Change Affect My Ability To Buy A Home?

Table of Contents

Rising Insurance Costs and Climate Risk

Insurers are increasingly factoring climate risk into their assessments, leading to significant changes in the cost and availability of homeowners insurance.

Increased Premiums in High-Risk Areas

Areas prone to floods, wildfires, or hurricanes are seeing dramatic increases in insurance premiums. Insurers utilize flood maps from FEMA (Federal Emergency Management Agency) and wildfire risk assessments to determine premiums. This means that:

- Coastal communities in Florida and Louisiana are experiencing some of the steepest increases, with premiums doubling or even tripling in some cases.

- Areas in California prone to wildfires face similar challenges, as insurers weigh the increasing frequency and severity of wildfires.

- The rising cost of insurance significantly impacts affordability, potentially pricing some buyers out of the market.

Difficulty Securing Insurance

In some high-risk areas, it's becoming increasingly difficult to secure homeowners insurance altogether. This leaves homeowners vulnerable and significantly impacts property values.

- Parts of the Gulf Coast and California's wildfire zones are seeing insurers refusing to renew policies or decline new applications.

- This lack of insurance coverage can make properties unsellable, severely impacting their value and investment potential.

- Government initiatives, such as the National Flood Insurance Program (NFIP), and private solutions are emerging to address this issue, but they often have limitations and high costs.

Fluctuations in Property Values

Climate change is also causing significant fluctuations in property values, impacting both buyers and sellers.

Decreased Value in Vulnerable Locations

Properties in areas frequently affected by climate-related damage are experiencing decreased values.

- Following Hurricane Katrina, property values in New Orleans plummeted. Similar trends have been observed in areas hit by devastating wildfires and floods.

- The risk of future damage, coupled with increased insurance costs or unavailability, directly impacts a property's investment value and its future resale potential.

- This phenomenon is driving a form of "climate migration," with people moving away from high-risk areas.

Increased Value in Climate-Resilient Areas

Conversely, properties in areas considered climate-resilient are seeing potential increases in value. This reflects a growing demand for homes built to withstand the impacts of climate change.

- Homes located at higher elevations, constructed with fire-resistant materials, or featuring sustainable design elements are commanding premium prices.

- Features that enhance energy efficiency and reduce reliance on carbon-intensive resources, such as solar panels and efficient insulation, are also becoming increasingly valuable.

- This creates a market shift towards prioritizing climate resilience in new construction and home renovations.

Mortgage Availability and Lending Practices

The financial sector is also adapting to the realities of climate change, impacting mortgage availability.

Stricter Lending Criteria in High-Risk Zones

Lenders are becoming more cautious about providing mortgages in areas vulnerable to climate change.

- Risk assessments are becoming more rigorous, and lenders are scrutinizing flood maps, wildfire risk, and other climate-related factors.

- This often translates into higher interest rates, stricter loan terms, or outright denial of mortgages in high-risk areas.

- This makes it harder for buyers to secure financing, further constricting the housing market in vulnerable locations.

Government Initiatives and Green Mortgages

Some governments are starting to implement initiatives to support climate-resilient housing, including the introduction of "green mortgages."

- These mortgages often offer lower interest rates or incentives for borrowers who purchase or renovate energy-efficient homes.

- Green building standards and energy efficiency improvements are crucial elements considered by lenders offering these programs.

- The availability and accessibility of these green mortgage programs vary widely depending on location and government policy.

Conclusion

Climate change is significantly impacting the ability to buy a home through increased insurance costs, fluctuating property values, and changes in mortgage availability. Understanding how climate change will affect your ability to buy a home is crucial. Research climate risks in your desired location before buying a home and consider the long-term implications of climate change on your investment. Make informed decisions about climate-resilient homeownership. Proactive planning regarding the impact of climate change on your ability to buy a home can help you make a sound and secure investment.

Featured Posts

-

Solve The Nyt Mini Crossword Answers For March 16 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 16 2025

May 20, 2025 -

Projet D Adressage D Abidjan Plus De 14 000 Voies Repertoriees

May 20, 2025

Projet D Adressage D Abidjan Plus De 14 000 Voies Repertoriees

May 20, 2025 -

Amazon Hercule Poirot Per Ps 5 A Meno Di 10 E Offerta Limitata

May 20, 2025

Amazon Hercule Poirot Per Ps 5 A Meno Di 10 E Offerta Limitata

May 20, 2025 -

Analiza Zasto Je Rusenje Daytonskog Sporazuma Stetno Za Sarajevo

May 20, 2025

Analiza Zasto Je Rusenje Daytonskog Sporazuma Stetno Za Sarajevo

May 20, 2025 -

Michael Strahans Big Interview Get A Ratings War Strategy

May 20, 2025

Michael Strahans Big Interview Get A Ratings War Strategy

May 20, 2025

Latest Posts

-

Updated Forecast Precise On And Off Times For Rain

May 20, 2025

Updated Forecast Precise On And Off Times For Rain

May 20, 2025 -

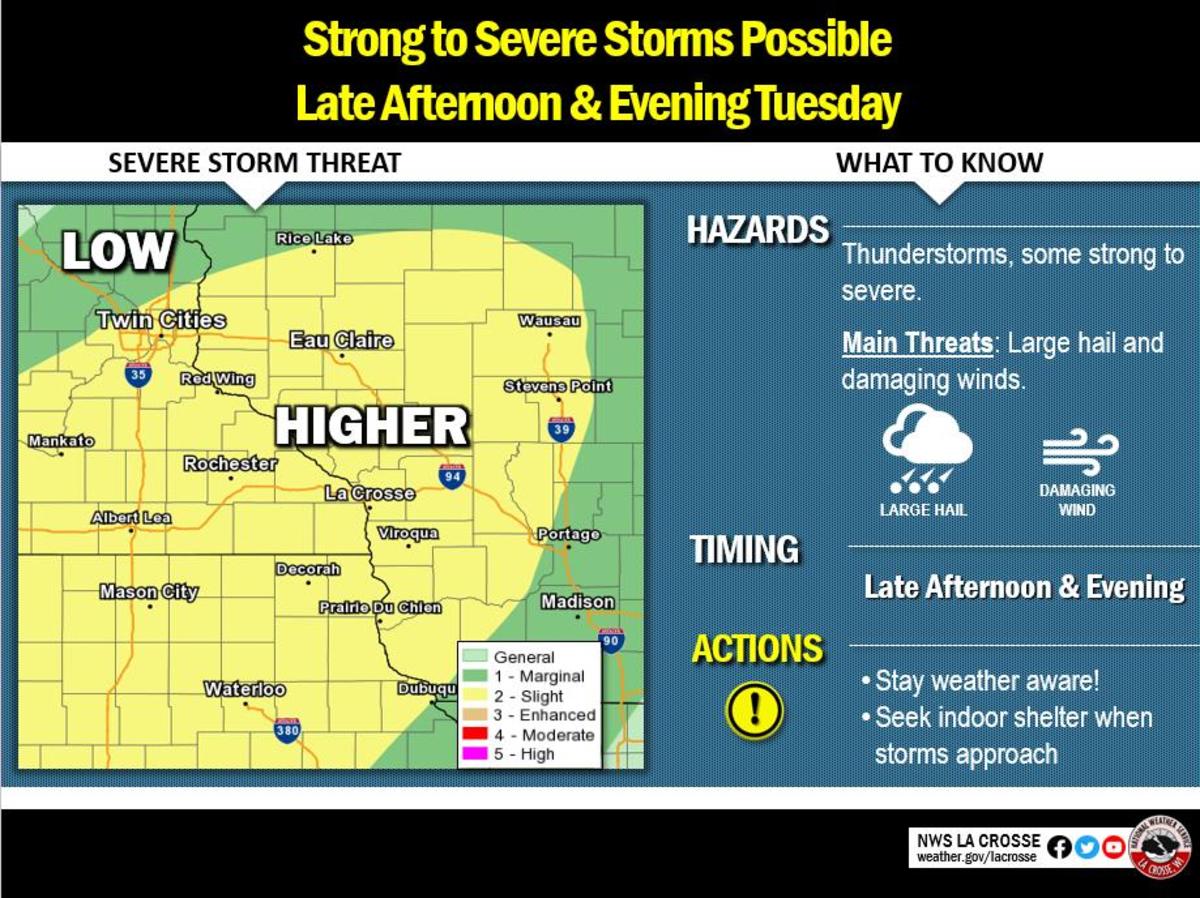

Severe Weather Alert Strong Winds And Storms Approaching

May 20, 2025

Severe Weather Alert Strong Winds And Storms Approaching

May 20, 2025 -

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025 -

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025 -

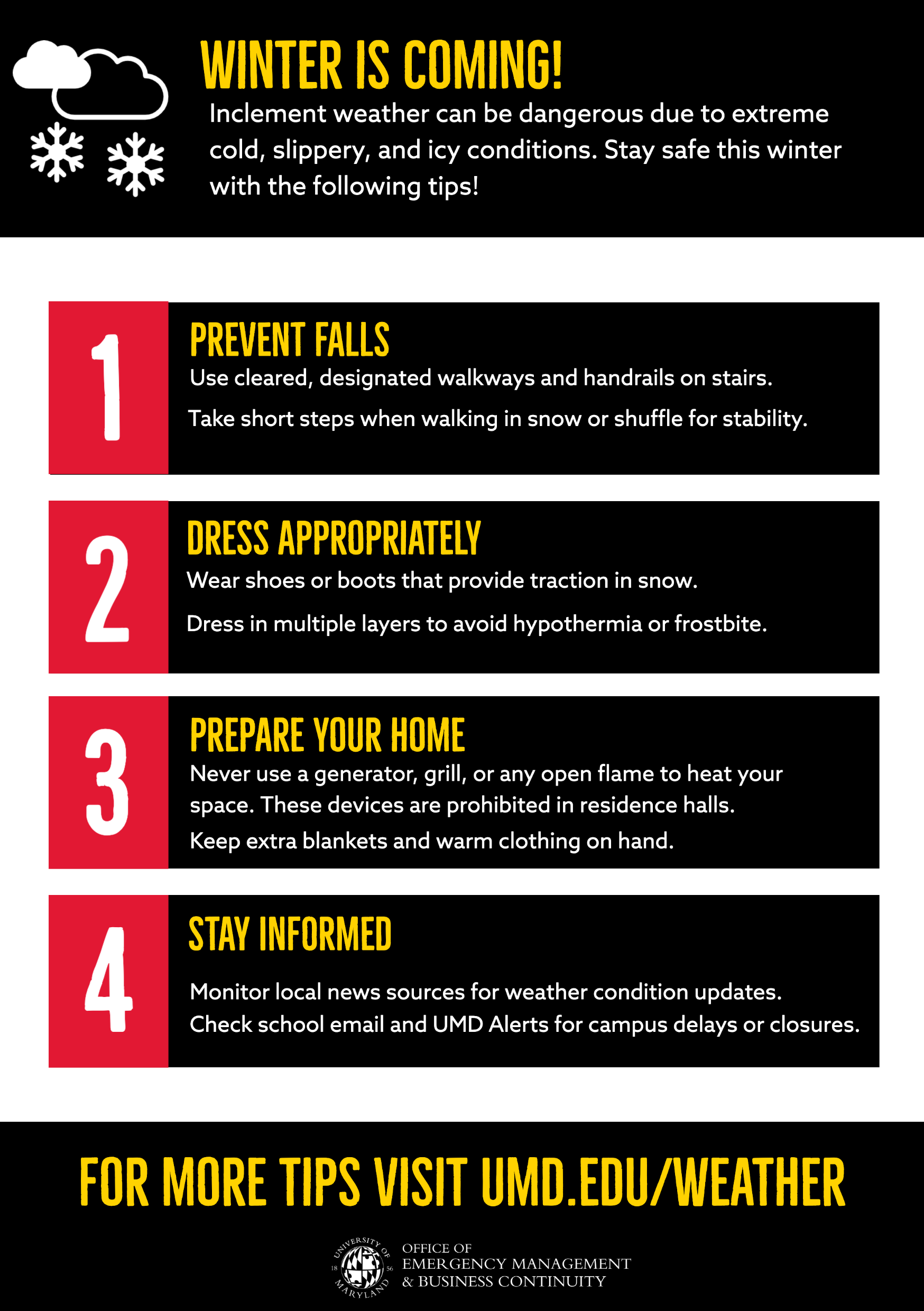

Preparing For School Delays During Winter Weather Advisories

May 20, 2025

Preparing For School Delays During Winter Weather Advisories

May 20, 2025