Will Soaring Federal Debt Sink Your Mortgage Dreams?

Table of Contents

How Federal Debt Influences Interest Rates

The connection between soaring federal debt and your mortgage rate is indirect but significant. When the government needs to borrow money to cover its debts, it issues government bonds. Increased government borrowing leads to higher demand for loans, putting upward pressure on interest rates. Think of it like any market: increased demand typically leads to increased prices. In this case, the "price" is the interest rate.

- Increased government borrowing leads to higher demand for loans. The government competes with private borrowers for available capital.

- Higher demand pushes interest rates up. To attract lenders, the government and other borrowers must offer higher yields, driving up interest rates across the board.

- Rising inflation often accompanies high national debt, further influencing interest rates. When the government prints more money to finance its debt, it can lead to inflation, forcing the Federal Reserve to raise interest rates to cool down the economy.

The Federal Reserve plays a crucial role. It manages interest rates through monetary policy, often raising rates to combat inflation fueled by government spending and the resulting increase in the national debt. These interest rate hikes, while aimed at stabilizing the economy, directly impact borrowing costs for mortgages.

The Impact of Higher Interest Rates on Mortgages

Rising interest rates translate directly into higher mortgage rates. This means significantly higher monthly payments for homebuyers. The impact is felt across all mortgage types:

- Higher interest rates mean higher monthly mortgage payments. A seemingly small increase in the interest rate can dramatically increase the total cost of a mortgage over its lifetime.

- Higher rates reduce borrowing power; buyers can afford less house. With higher monthly payments, potential homebuyers may need to lower their budget or make a larger down payment, potentially reducing the size or location of the home they can afford.

- ARMs (Adjustable-Rate Mortgages) become riskier as interest rates fluctuate. ARMs, which offer lower initial rates, become less predictable and potentially more expensive in a high-interest-rate environment.

The combined effect of higher interest rates and reduced affordability can lead to decreased demand in the housing market, potentially impacting home prices.

Other Factors Affecting Mortgage Approval Beyond Federal Debt

While soaring federal debt is a significant macroeconomic factor influencing mortgage rates, it's not the sole determinant of mortgage approval. Several other crucial factors come into play:

- Your personal credit score and history are crucial. Lenders assess your creditworthiness based on your credit score and payment history. A higher credit score generally leads to better interest rates and a higher chance of approval.

- A high debt-to-income ratio can hinder approval. Lenders look at your existing debt obligations relative to your income. A high ratio indicates a higher risk of default.

- A larger down payment can improve your chances. A larger down payment reduces the lender's risk, making you a more attractive borrower.

- Local housing market conditions also play a significant role. Factors like supply and demand in your local area influence mortgage availability and pricing.

- Mortgage pre-approval provides a clearer picture of your borrowing capacity before you start house hunting.

Strategies for Navigating a High-Debt Environment

Even with the concerns surrounding soaring federal debt, you can still pursue your homeownership dreams. Proactive financial planning is key:

- Improve your credit score. Check your credit report for errors and pay down existing debts.

- Reduce debt and improve your debt-to-income ratio. Focus on reducing your overall debt burden to improve your financial standing.

- Save a larger down payment. Aim for a larger down payment to reduce the loan amount and improve your chances of approval.

- Shop around for the best mortgage rates. Compare offers from multiple lenders to secure the most favorable interest rate.

- Consult a financial advisor or mortgage broker. A financial professional can guide you through the process and help you navigate the complexities of the current market.

Making Your Mortgage Dreams a Reality Despite Soaring Federal Debt

While soaring federal debt can influence mortgage rates and affordability, it's not the only factor determining mortgage approval. Responsible financial planning, a strong credit score, and a healthy debt-to-income ratio are crucial for securing a mortgage. Don't let the fear of soaring federal debt derail your mortgage dreams. Take proactive steps to improve your financial health and work with a financial professional to navigate the current market conditions and secure the best mortgage possible for your situation. Start planning your financial future today to achieve your homeownership goals despite the challenges of soaring federal debt.

Featured Posts

-

Amazon Workers Union Fight Against Warehouse Closures In Quebec

May 19, 2025

Amazon Workers Union Fight Against Warehouse Closures In Quebec

May 19, 2025 -

2025 Vermont Presidential Scholars A Complete List Of Recipients

May 19, 2025

2025 Vermont Presidential Scholars A Complete List Of Recipients

May 19, 2025 -

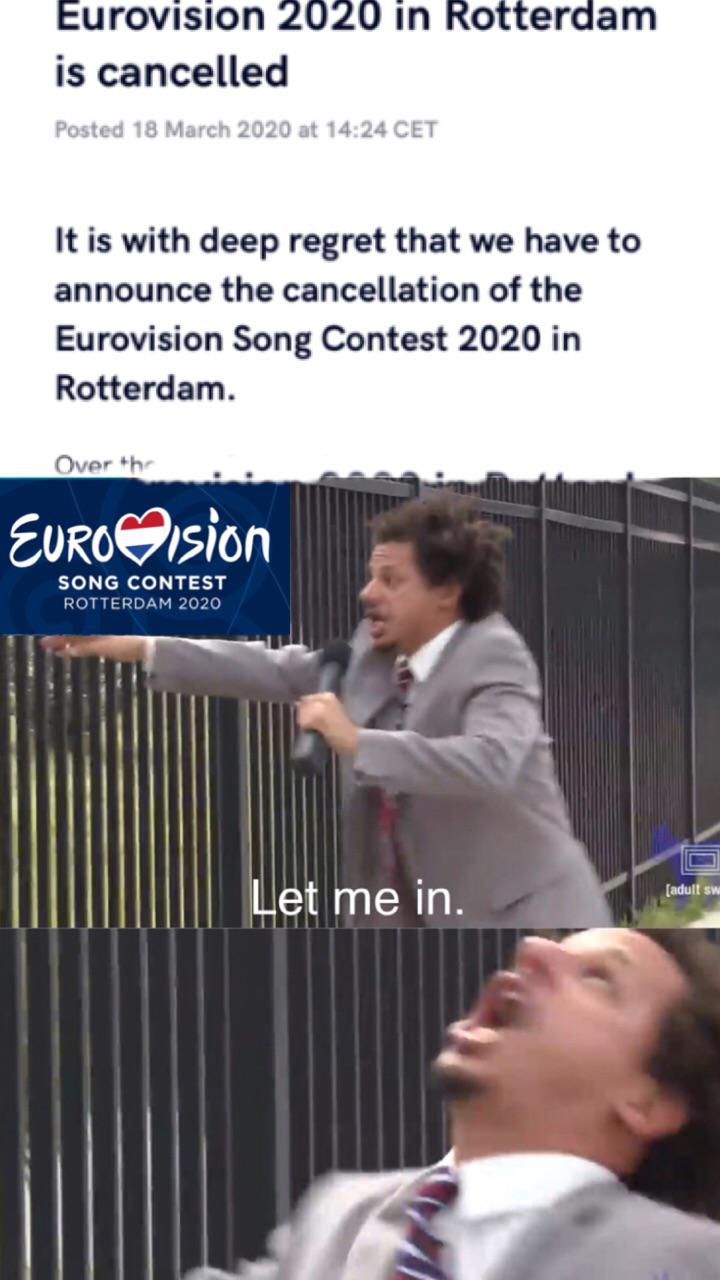

Unexpected Eurovision Host Cancellation

May 19, 2025

Unexpected Eurovision Host Cancellation

May 19, 2025 -

Addressing Stock Market Valuation Concerns Insights From Bof A

May 19, 2025

Addressing Stock Market Valuation Concerns Insights From Bof A

May 19, 2025 -

Review Of Unc Tar Heels Athletics March 10 16

May 19, 2025

Review Of Unc Tar Heels Athletics March 10 16

May 19, 2025