Will Trump's Policies Boost Bitcoin Above $100,000? A Price Prediction Analysis

Table of Contents

Trump's Economic Policies and Their Impact on Cryptocurrencies

Deregulation and its Potential Effect on Bitcoin Adoption

A key aspect of a potential return to Trump-era policies would be a renewed focus on deregulation. This could significantly impact the cryptocurrency market, particularly Bitcoin.

- Reduced Regulatory Uncertainty: Less stringent regulations could lead to increased institutional investment in Bitcoin. The current regulatory landscape in many countries presents hurdles for large-scale institutional adoption. Easing these restrictions could unlock significant capital inflows.

- Increased Market Capitalization: Deregulation could fuel a surge in Bitcoin's market capitalization as more investors, both institutional and retail, gain easier access to the market. This influx of capital could drive up the price significantly.

- Boosted Bitcoin Adoption: A more permissive regulatory environment would likely foster greater mainstream adoption, further increasing demand and potentially pushing the price higher.

The relationship between regulatory clarity and investor confidence is crucial. Clear, predictable rules encourage investment; ambiguity creates hesitation. While historical data on direct deregulation impacts on Bitcoin is limited (as significant deregulation during Trump’s first term wasn’t specifically targeted at crypto), the contrast between periods of regulatory uncertainty and relative clarity in the crypto market strongly suggests a positive correlation between less restrictive policies and price appreciation.

Fiscal Policy and Inflation's Influence on Bitcoin

Trump's fiscal policies, characterized by significant government spending and tax cuts, could potentially lead to inflationary pressures. This is where Bitcoin's role as a potential inflation hedge comes into play.

- Inflationary Hedge: If inflation rises significantly, investors might seek refuge in alternative assets like Bitcoin, viewing it as a store of value that is less susceptible to currency devaluation than fiat currencies. This increased demand could push prices up.

- Weakening Dollar: Increased government spending and potential trade deficits could weaken the US dollar, making Bitcoin, a globally accessible asset, a more attractive investment.

- Historical Correlation (or Lack Thereof): Analyzing inflation rates during Trump's presidency and comparing them to Bitcoin's price performance can reveal correlations, though these should be interpreted carefully, as other factors can influence Bitcoin's price simultaneously. A thorough econometric analysis would be needed to isolate the impact of inflation alone.

While a direct causal link isn't definitively established, the theoretical potential for inflation to drive Bitcoin demand remains significant.

Geopolitical Factors and Bitcoin's Safe-Haven Status

International Trade and Bitcoin's Role as a Decentralized Asset

Trump's "America First" approach to international trade resulted in significant trade disputes. Such geopolitical instability often increases the appeal of Bitcoin.

- Safe-Haven Asset: In times of global uncertainty, investors often flock to assets perceived as safe havens. Bitcoin's decentralized nature, not being subject to government control or manipulation, makes it attractive during periods of geopolitical risk.

- Trade Wars and Bitcoin Prices: Examining historical data on Bitcoin's price movements during periods of international trade tensions can reveal potential correlations. However, isolating the impact of trade wars from other concurrent factors is essential.

- Decentralized Protection: Bitcoin's inherent resistance to censorship and geopolitical interference is a key factor driving its appeal as a hedge against uncertainty.

Trump's Stance on Global Power Dynamics and Bitcoin's Potential

Trump's foreign policy decisions, including his challenges to existing international alliances and his stance on global power dynamics, could indirectly influence cryptocurrency markets.

- Emerging Market Adoption: Countries with unstable currencies or governments might see increased Bitcoin adoption as a way to protect assets and participate in a global financial system independent of their own potentially volatile political climates.

- Increased Demand in Unstable Regions: Geopolitical instability can create demand for alternative financial systems, potentially boosting Bitcoin's adoption and price in specific regions.

- Unpredictability and Volatility: The very unpredictability of a Trump administration's foreign policy could fuel uncertainty in traditional markets, which, in turn, could drive investors towards more stable alternatives like Bitcoin.

Market Sentiment and Bitcoin's Price Prediction

Analyzing Investor Confidence Under a Trump Presidency

Gauging investor sentiment towards Bitcoin during Trump's previous term is crucial for predicting future behavior.

- News Sentiment Analysis: Analyzing news articles, social media trends, and investor surveys from Trump's first term can provide insights into past market sentiment.

- Shifting Opinions: Identifying how investor opinions on Bitcoin evolved in response to specific policy announcements or events during his first presidency could help predict future reactions.

- Media Coverage Impact: The tone and focus of media coverage can significantly influence public perception and therefore, investor confidence.

This sentiment analysis will help in understanding how potential policy shifts could influence investor behavior.

Predicting Bitcoin's Price Based on Historical Data and Market Trends

Based on the factors discussed above, a price prediction model can be developed. However, it is crucial to acknowledge limitations.

- Historical Data Analysis: Analyzing Bitcoin's price performance during periods of similar economic and geopolitical conditions can inform potential future scenarios.

- Model Assumptions and Limitations: Clearly state the assumptions and limitations of the model. This includes acknowledging unpredictable events and the inherent volatility of the cryptocurrency market.

- Price Prediction Range: Provide a price prediction range rather than a single point estimate, reflecting the uncertainty involved. For example, stating a potential range from $80,000 to $120,000 would be more realistic than a single prediction of $100,000.

Visualizing the data through charts and graphs will improve the clarity and impact of the prediction.

Conclusion: Trump's Policies and the Future of Bitcoin Above $100,000

In summary, a return to Trump-era policies could potentially boost Bitcoin's price, though no guarantee exists. Deregulation, inflationary pressures, geopolitical uncertainty, and investor sentiment all play significant roles. While our analysis suggests a potential for Bitcoin to exceed $100,000 under such a scenario, it's crucial to remember the inherent volatility of the cryptocurrency market and the numerous unforeseen factors that could influence its price. Our prediction is based on a specific set of assumptions and historical data, and deviations from this scenario could significantly alter the outcome.

Therefore, we cannot definitively answer "Will Trump's Policies Boost Bitcoin Above $100,000?" with a simple yes or no. However, our analysis indicates a plausible scenario where such a price increase could occur. It is essential to conduct your own thorough research and consider multiple perspectives before making any investment decisions. Continue researching and forming your own informed opinions on how potential future policy changes could affect the cryptocurrency market and specifically, the question: Will Trump's policies boost Bitcoin above $100,000?

Featured Posts

-

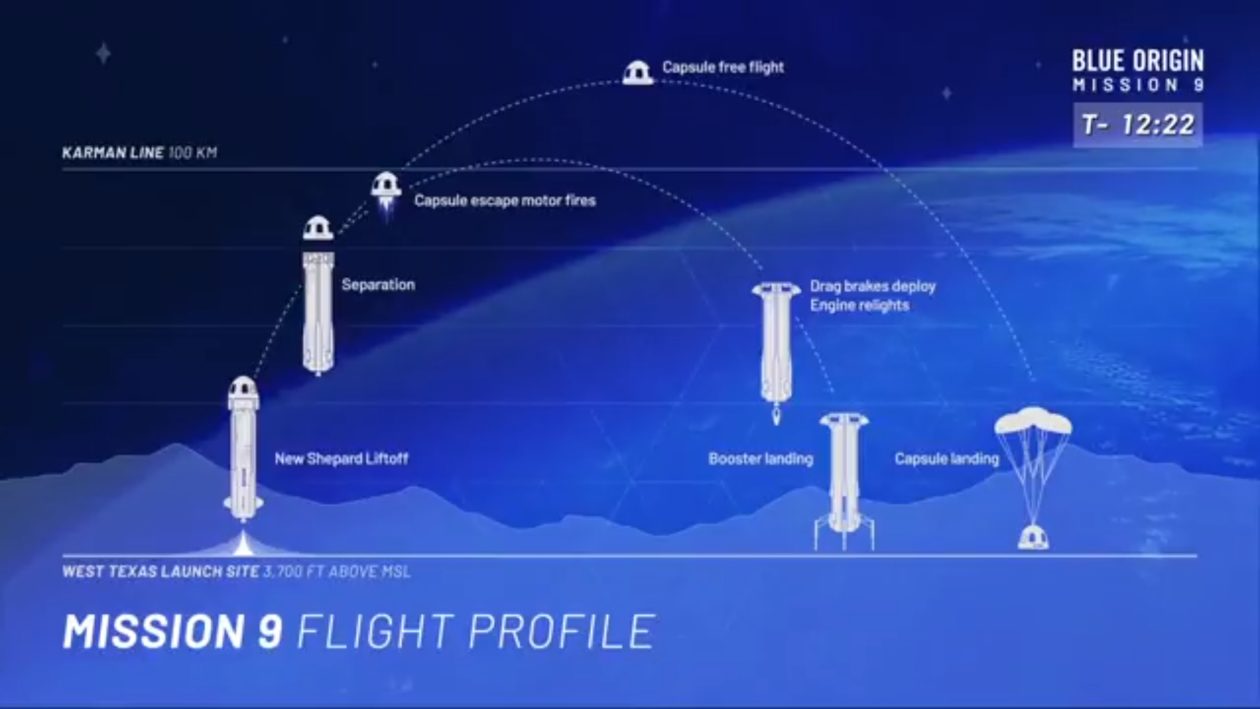

Blue Origin Flight Young Thug Debunked As Passenger

May 09, 2025

Blue Origin Flight Young Thug Debunked As Passenger

May 09, 2025 -

Oilers Vs Sharks Game Tonight Prediction Picks And Betting Odds

May 09, 2025

Oilers Vs Sharks Game Tonight Prediction Picks And Betting Odds

May 09, 2025 -

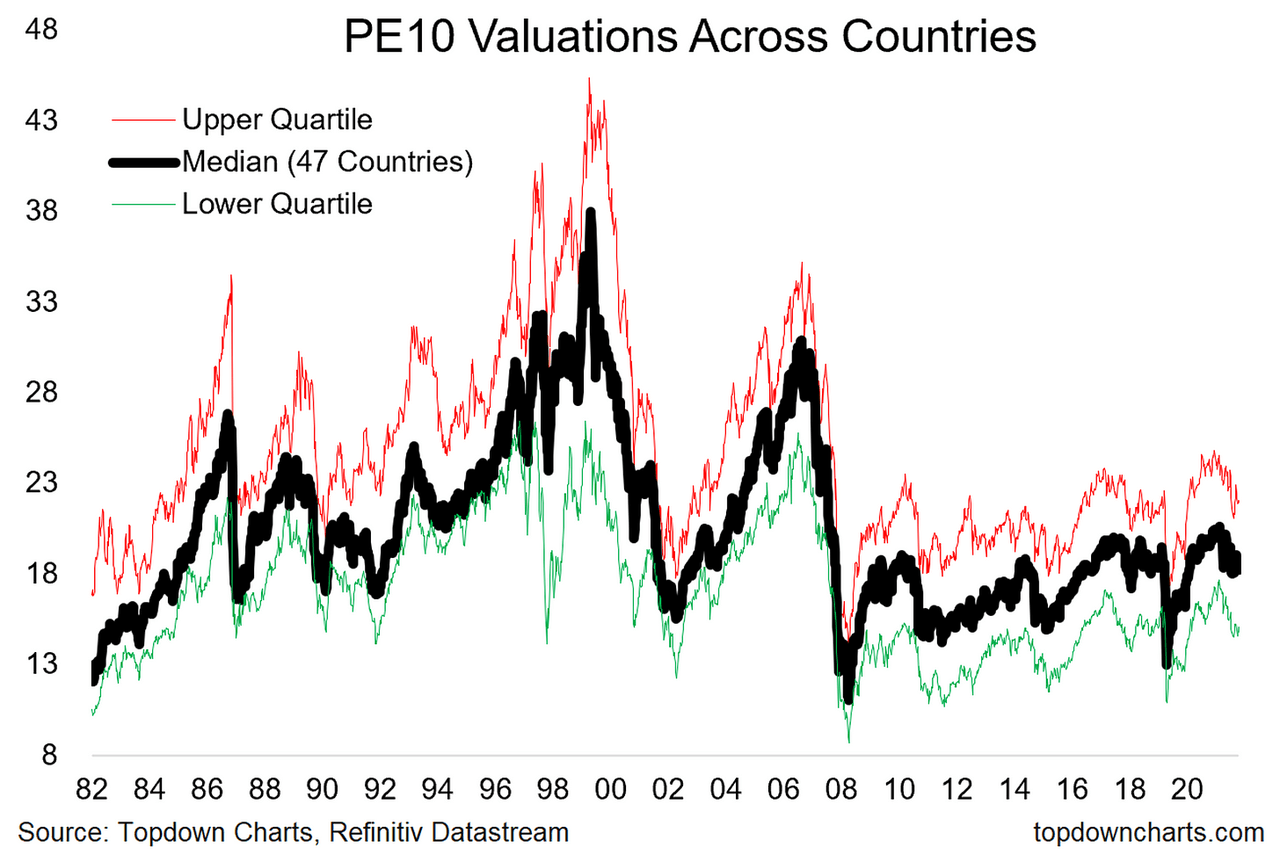

High Stock Market Valuations Bof As Analysis And Investor Reassurance

May 09, 2025

High Stock Market Valuations Bof As Analysis And Investor Reassurance

May 09, 2025 -

Barys San Jyrman Hl Hdhh Hy Snt Alttwyj Alawrwby

May 09, 2025

Barys San Jyrman Hl Hdhh Hy Snt Alttwyj Alawrwby

May 09, 2025 -

Analiz Vstrechi Zelenskogo I Trampa V Vatikane Mnenie Makrona

May 09, 2025

Analiz Vstrechi Zelenskogo I Trampa V Vatikane Mnenie Makrona

May 09, 2025