XRP Commodity Classification: Implications Of Ripple's SEC Settlement

Table of Contents

The Ripple-SEC Settlement: A Summary

The long-running legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) culminated in a settlement that partially resolved the SEC's allegations that Ripple's sales of XRP constituted unregistered securities offerings. The lawsuit, filed in December 2020, centered on whether XRP is a security or a commodity. The SEC argued that Ripple's various sales of XRP, including programmatic sales, constituted the offering and sale of unregistered securities, violating federal securities laws.

-

Summary of the SEC's allegations against Ripple: The SEC alleged that Ripple engaged in an unregistered securities offering by selling XRP to institutional investors and the public. They argued that the expectation of profit derived from Ripple's efforts, coupled with the nature of the sales, constituted an investment contract, defining XRP as a security.

-

Key points of the settlement agreement: While the details remain complex, the settlement avoided a full trial. Crucially, it didn't definitively declare XRP a security or a commodity across the board.

-

Judge's ruling on XRP's classification (programmatic sales vs. other sales): The judge's decision acknowledged a nuanced view of XRP. Programmatic sales of XRP were considered not to be securities, while other sales were subject to further clarification and potential future litigation. This partial victory for Ripple left the classification murky for some sales channels.

-

Ripple's response and future plans: Ripple has expressed relief at the settlement, viewing it as a step towards greater clarity. They continue to focus on developing its payment solutions and fostering the XRP ecosystem. However, the legal uncertainty surrounding the XRP classification remains.

Implications for XRP's Regulatory Status

The Ripple-SEC settlement's impact on XRP's regulatory status is far from clear-cut. The decision's nuanced nature introduces considerable uncertainty regarding how XRP will be treated in different jurisdictions. The outcome is not universally binding and leaves ample room for varying interpretations of the ruling, creating a complicated legal environment for XRP.

-

Uncertainty surrounding XRP's classification in different countries: The ruling primarily applies within the US legal framework. Other countries may adopt different approaches towards classifying XRP, potentially leading to regulatory arbitrage.

-

Potential for future regulatory challenges: Despite the settlement, the possibility of future legal challenges remains, especially concerning those XRP sales not explicitly covered by the ruling. The lack of consistent global classification poses an ongoing risk.

-

Comparison with other cryptocurrencies and their regulatory status: The Ripple case sets a significant precedent, influencing how regulators approach other cryptocurrencies and their classification as securities or commodities. This creates a ripple effect (pun intended) across the entire crypto space.

-

The role of future court precedents and legislation: The evolving legal landscape will significantly influence the long-term classification of XRP. Future court cases and regulatory legislation could further clarify or complicate the situation.

Market Impact and Investor Sentiment

The Ripple-SEC settlement immediately impacted XRP's price, trading volume, and market capitalization. The initial reaction was a surge in price, reflecting some market relief. However, the long-term effects are more uncertain.

-

Immediate market reaction to the settlement news: The price of XRP experienced a significant short-term price increase following the announcement.

-

Long-term price predictions and analysis: Long-term price predictions vary wildly depending on the interpretation of the settlement and future regulatory developments.

-

Impact on investor confidence and trading activity: Investor sentiment improved initially, but the lingering legal uncertainties continue to impact trading confidence and activity.

-

Changes in liquidity and accessibility of XRP: Some exchanges initially delisted XRP, creating temporary liquidity issues. However, it has since been relisted on the majority of major exchanges.

The Future of XRP and its Ecosystem

The future of XRP and its ecosystem hinges on several factors, including Ripple's continued development, regulatory clarity, and community support. Despite the legal challenges, the XRP Ledger continues to show promise as a payment technology.

-

Ripple's continued development and innovation: Ripple continues to invest in and develop the XRP Ledger and its associated technologies.

-

Potential for wider adoption in payment solutions: Ripple actively pursues partnerships to integrate XRP into cross-border payment systems. The success of these efforts will significantly influence XRP's future.

-

The role of community support and development: The active community around XRP plays a significant role in its ongoing development and adoption.

-

Opportunities and challenges in the evolving regulatory landscape: Navigating the evolving regulatory landscape will be crucial for XRP's long-term success.

Conclusion

The Ripple-SEC settlement has profoundly affected the XRP commodity classification, creating both opportunities and challenges. While the settlement offers some clarity, significant uncertainty remains concerning XRP's regulatory future and its global implications. The ruling underscores the intricacies of navigating the regulatory landscape for cryptocurrencies. The legal battle highlighted the need for clear, consistent, and internationally harmonized regulations for digital assets.

Call to Action: Stay informed about the ongoing developments surrounding the XRP commodity classification and its implications for the cryptocurrency market. Continue researching and understanding the evolving regulatory environment to make informed decisions regarding your XRP investments. Further analysis of the XRP classification is essential for navigating this dynamic space.

Featured Posts

-

The India Us Standoff Justice Vs De Escalation

May 02, 2025

The India Us Standoff Justice Vs De Escalation

May 02, 2025 -

Golden Week Boost Macau Gambling Revenue Surpasses Forecasts

May 02, 2025

Golden Week Boost Macau Gambling Revenue Surpasses Forecasts

May 02, 2025 -

A Century Of Dallas Star Passes Away

May 02, 2025

A Century Of Dallas Star Passes Away

May 02, 2025 -

Will The Sec Declare Xrp A Commodity Ripple Settlement Update

May 02, 2025

Will The Sec Declare Xrp A Commodity Ripple Settlement Update

May 02, 2025 -

80s Tv Icon Dies Dallas Star Joins Growing List Of Losses

May 02, 2025

80s Tv Icon Dies Dallas Star Joins Growing List Of Losses

May 02, 2025

Latest Posts

-

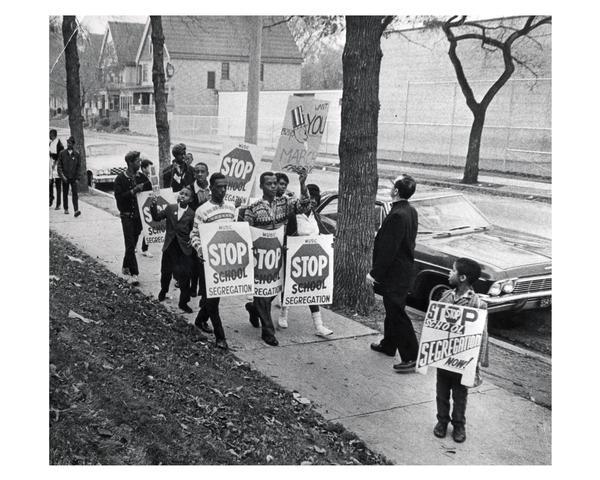

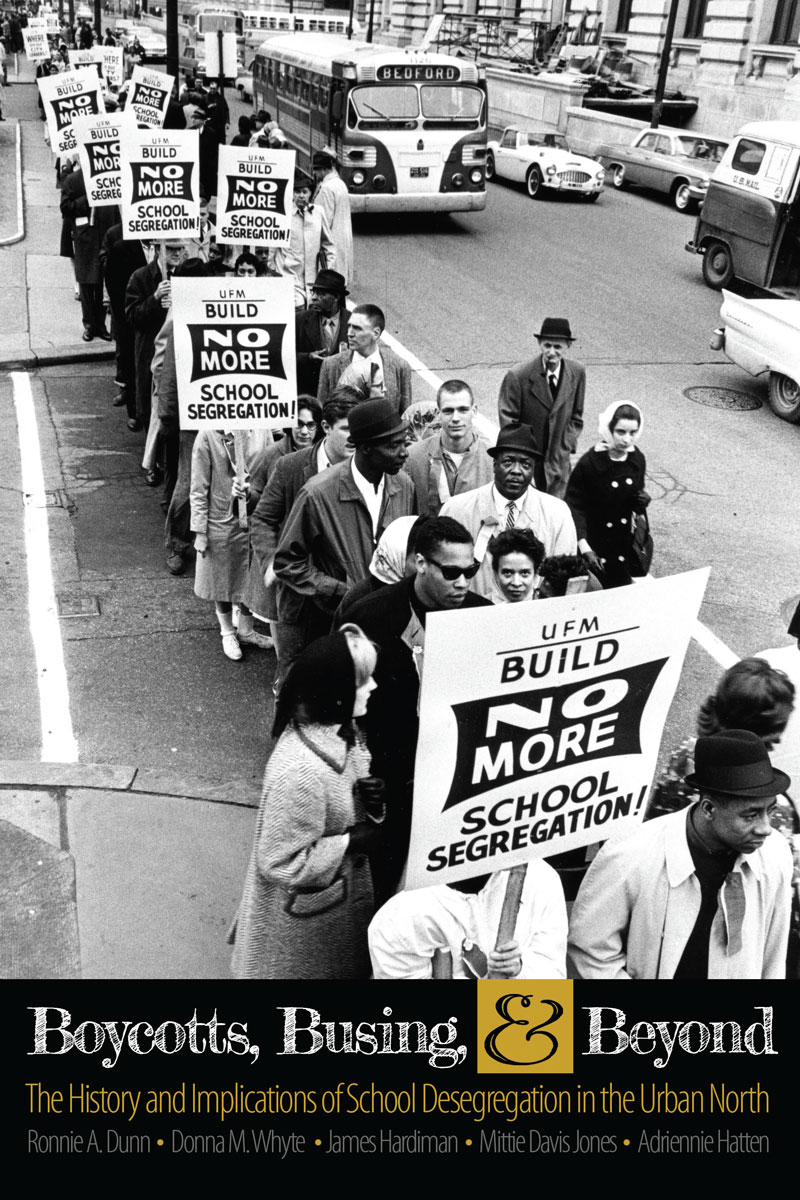

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025 -

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025 -

Justice Departments Decision A Turning Point In School Desegregation

May 02, 2025

Justice Departments Decision A Turning Point In School Desegregation

May 02, 2025 -

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025 -

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025