XRP: ETF Approvals, SEC Developments, And Ripple's Future

Table of Contents

The Ripple-SEC Lawsuit and its Impact on XRP

The Ripple-SEC lawsuit has cast a long shadow over XRP, significantly impacting its price and market sentiment. This legal battle centers on the SEC's claim that XRP is an unregistered security, a classification that carries significant legal and regulatory ramifications.

The Case's Background and Key Arguments

The lawsuit, filed in December 2020, alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This claim rests on the SEC's assertion that XRP sales constituted an "investment contract," meaning investors purchased XRP with the expectation of profit based on Ripple's efforts.

- SEC's Key Arguments: XRP sales were unregistered securities offerings; Ripple profited from XRP sales; investors expected profits based on Ripple's efforts.

- Ripple's Key Arguments: XRP is a decentralized digital asset; XRP sales were not investment contracts; the SEC's definition of a security is too broad.

The potential ramifications of a ruling against Ripple are substantial. A negative outcome could lead to significant fines, restrictions on XRP sales, and damage to Ripple's reputation, potentially impacting XRP's price and adoption. The "XRP security classification" debate remains central to the case's outcome.

Recent Developments and Potential Outcomes

Recent court decisions have offered some clarity, but the case's trajectory remains uncertain. The judge's summary judgment rulings have provided a partial win for Ripple, indicating certain XRP sales were not securities. However, the overall outcome is far from certain.

- Key Events: Judge Analisa Torres' summary judgment decision; ongoing legal proceedings; potential appeals.

- Potential Outcomes: A complete win for Ripple, a partial win (as seen in the summary judgment), a complete loss for Ripple, or a settlement.

Each outcome would significantly impact XRP's price and market position. A complete victory for Ripple could trigger a substantial price surge, while an unfavorable ruling could lead to a prolonged period of depressed prices. Keeping abreast of "Ripple lawsuit updates" is crucial for investors.

The Potential for XRP ETFs and their Market Impact

The approval of an XRP ETF (Exchange-Traded Fund) could revolutionize XRP's accessibility and liquidity. However, several hurdles remain before such approval becomes a reality.

The Current Landscape of Cryptocurrency ETFs

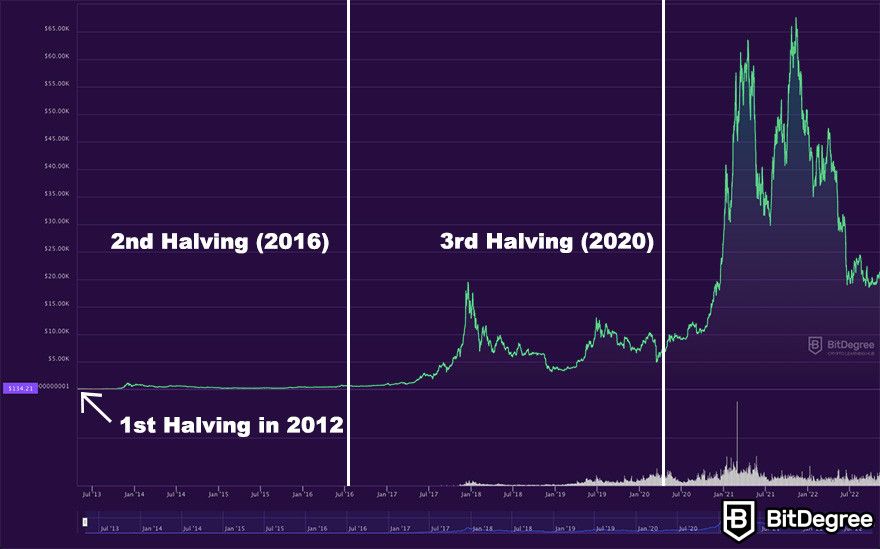

The global landscape of cryptocurrency ETFs is evolving rapidly. While several Bitcoin and Ethereum ETFs have gained approval in various jurisdictions, the regulatory climate for altcoins like XRP remains more uncertain.

- Approved/Pending Crypto ETFs: Examples include several Bitcoin ETFs approved in Canada and the US. (Specific examples should be added here based on current market conditions).

- Regulatory Hurdles: Concerns around market manipulation, investor protection, and the overall volatility of cryptocurrencies represent key challenges for approval. Specifically for XRP, the outcome of the SEC lawsuit heavily influences its eligibility.

These regulatory hurdles reflect the cautious approach regulators are taking towards the relatively new cryptocurrency asset class.

The Likelihood of an XRP ETF Approval

The likelihood of XRP ETF approval is intrinsically linked to the outcome of the SEC lawsuit. A favorable ruling for Ripple significantly increases the chances of approval, while an unfavorable decision would likely delay or prevent it.

- Pros of XRP ETF Approval: Increased liquidity, mainstream adoption, price stability, easier investment access.

- Cons of XRP ETF Approval: Increased regulatory scrutiny, potential for market manipulation, challenges in accurately valuing XRP.

An XRP ETF approval would likely cause a surge in XRP's price due to increased demand and institutional investment. The "XRP ETF prospects" are closely tied to the evolving regulatory landscape and the Ripple lawsuit's resolution.

Ripple's Future Strategies and Innovation

Despite the legal battles, Ripple continues to invest heavily in technological advancements and strategic partnerships. These efforts demonstrate their commitment to the long-term success of XRP, regardless of the lawsuit's outcome.

Ripple's Ongoing Development and Partnerships

Ripple is actively developing its technology and forging partnerships to expand the adoption of its payment solutions, including its On-Demand Liquidity (ODL) product, which utilizes XRP for cross-border payments.

- Key Partnerships: Ripple has partnerships with several financial institutions globally, facilitating faster and cheaper cross-border payments. (Examples should be added here based on current partnerships).

- Technological Innovations: Continuous enhancements to RippleNet and ODL technology aim to improve efficiency and reduce costs for financial transactions.

These initiatives bolster XRP's utility and enhance its potential for growth. The growing adoption of Ripple's technology strengthens the "XRP adoption" rate and improves long-term prospects.

Long-Term Outlook for XRP and its Potential

The long-term outlook for XRP is multifaceted, influenced by various factors including the outcome of the SEC lawsuit, the success of Ripple's technology, and overall market sentiment towards cryptocurrencies.

- Potential Scenarios: Significant price appreciation with positive lawsuit outcome and ETF approval; modest price growth with a neutral outcome; stagnation or decline with a negative outcome.

- Factors Contributing to Growth/Decline: Regulatory clarity, technological innovation, market demand, adoption by financial institutions, overall crypto market trends.

While the "XRP price prediction" remains speculative, its potential for growth is tied to Ripple's success and the broader adoption of cryptocurrencies.

Conclusion

The future of XRP remains uncertain, heavily reliant on the outcome of the Ripple-SEC lawsuit and the potential for ETF approvals. While the legal battle presents significant challenges, Ripple’s ongoing innovation and strategic partnerships offer a glimmer of hope for long-term growth. The possibility of an XRP ETF approval could dramatically alter the landscape, potentially boosting price and market adoption. Stay informed on the latest developments regarding the Ripple lawsuit and regulatory changes impacting the cryptocurrency industry to make informed decisions regarding your XRP investment. Continue researching the latest news on XRP, XRP ETFs, and Ripple's future to navigate this evolving market effectively.

Featured Posts

-

Bitcoin Price Prediction Trumps 100 Day Speech And The 100 000 Btc Target

May 08, 2025

Bitcoin Price Prediction Trumps 100 Day Speech And The 100 000 Btc Target

May 08, 2025 -

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025

Stream Andor Season 1 Episodes 1 3 Hulu And You Tube Availability

May 08, 2025 -

Ubers New Subscription Model A Game Changer For Drivers

May 08, 2025

Ubers New Subscription Model A Game Changer For Drivers

May 08, 2025 -

Papal Conclave Process And Significance Of Electing A New Pope

May 08, 2025

Papal Conclave Process And Significance Of Electing A New Pope

May 08, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Gelecegi Nasil Sekillendiriyor

May 08, 2025

Bitcoin Madenciliginin Azalan Karliligi Gelecegi Nasil Sekillendiriyor

May 08, 2025