XRP Price Prediction: Assessing The Risks And Rewards After SEC Developments

Table of Contents

The Ripple vs. SEC Lawsuit and Its Impact on XRP Price

The SEC's lawsuit against Ripple, alleging that XRP is an unregistered security, has significantly impacted the cryptocurrency's price. The lawsuit, filed in December 2020, marked a pivotal moment for XRP, causing immediate price volatility and uncertainty within the market. The legal battle has unfolded in phases, each impacting XRP's price differently.

- Initial price drop following the lawsuit filing: The initial announcement triggered a sharp decline in XRP's value as investors reacted to the uncertainty.

- Price fluctuations following positive and negative court rulings: Subsequent court decisions and filings have resulted in significant price swings, demonstrating the market's sensitivity to legal developments. Positive news generally leads to price increases, while negative developments cause drops.

- Impact of legal uncertainty on investor sentiment and trading volume: The ongoing legal uncertainty has significantly impacted investor sentiment. This uncertainty has led to decreased trading volume on some exchanges, reflecting hesitation among traders.

- Ripple's ongoing legal strategy and its influence on market perception: Ripple's defense strategy and public statements have played a crucial role in shaping market perception. A strong defense and positive developments in court can help boost investor confidence and potentially drive the price upward.

Analyzing Factors Influencing XRP Price Prediction

Several factors beyond the lawsuit influence XRP price predictions. These include technological advancements, the regulatory landscape, and overall market sentiment.

Technological Advancements and RippleNet Adoption

RippleNet, Ripple's payment solution, plays a vital role in XRP's utility and potential price appreciation. Its growth and global adoption are key indicators of XRP's future.

- Increased transaction speed and efficiency: RippleNet offers faster and more efficient cross-border transactions compared to traditional banking systems. This efficiency is a key selling point.

- Expansion into new markets and partnerships: The expansion of RippleNet into new markets and partnerships with financial institutions strengthens its position and increases demand for XRP.

- Development of new features and functionalities: Continuous development and improvements to RippleNet's technology could further enhance its appeal and boost XRP's utility.

Regulatory Landscape and Global Adoption

The regulatory environment significantly impacts the price of cryptocurrencies, including XRP. Regulatory clarity (or lack thereof) can greatly influence investor confidence.

- Varying regulatory stances across different jurisdictions: Different countries have varying regulatory approaches towards cryptocurrencies. A favorable regulatory environment in key markets could positively impact XRP's price.

- The potential for positive regulatory developments: Positive regulatory developments, such as clear guidelines for cryptocurrencies, could increase investor confidence and drive up prices.

- The risks associated with continued regulatory uncertainty: Conversely, continued uncertainty and negative regulatory actions can lead to price declines and reduced investor interest.

Market Sentiment and Investor Confidence

Market sentiment plays a crucial role in shaping XRP's price. News, events, and social media significantly influence investor confidence.

- Bitcoin's price movements and correlation with XRP: XRP often shows correlation with Bitcoin's price movements. A bullish Bitcoin market can positively influence XRP's price, while a bearish Bitcoin market can have the opposite effect.

- General crypto market trends and their effect on XRP: Overall trends in the cryptocurrency market significantly impact XRP's performance. A bull market generally benefits XRP, while a bear market typically leads to price drops.

- Impact of social media sentiment and news coverage on XRP price: Social media sentiment and news coverage can significantly influence investor perception and, consequently, XRP's price. Positive news and social media sentiment can drive prices up, while negative news can have the opposite effect.

Potential XRP Price Scenarios and Predictions

Predicting the future price of XRP is inherently challenging, but we can outline potential scenarios based on different factors.

Bullish Scenarios

Several factors could contribute to a significant rise in XRP's price:

- Positive resolution of the SEC lawsuit: A favorable court ruling could significantly boost investor confidence and drive up XRP's price.

- Widespread adoption of RippleNet: Increased adoption of RippleNet by financial institutions globally could increase demand for XRP and its price.

- Increased institutional investment: Large-scale investments from institutional investors could propel XRP's price higher.

Bearish Scenarios

Conversely, several factors could lead to a decline in XRP's price:

- Negative resolution of the SEC lawsuit: An unfavorable ruling could severely damage XRP's price and investor confidence.

- Increased regulatory scrutiny: Increased regulatory pressure and stricter regulations could negatively impact XRP's price.

- Decline in overall crypto market capitalization: A general downturn in the cryptocurrency market would likely negatively affect XRP's price.

Risk Assessment and Investment Strategies

Investing in XRP involves significant risk. It's crucial to understand and manage these risks effectively.

- Volatility of the cryptocurrency market: The cryptocurrency market is inherently volatile, and XRP's price can fluctuate significantly in short periods.

- Regulatory risks and legal uncertainties: The ongoing legal battle and potential future regulatory changes pose significant risks to XRP investors.

- Potential for market manipulation: Like other cryptocurrencies, XRP is susceptible to market manipulation, which can lead to sudden price swings.

Conclusion

Predicting the XRP price with certainty is impossible, but by carefully considering the factors discussed – the Ripple vs. SEC lawsuit, technological advancements, regulatory landscape, market sentiment, and potential price scenarios – investors can make more informed decisions. Remember that the cryptocurrency market is highly volatile, and any investment in XRP carries significant risk. Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to XRP or other cryptocurrencies. Stay informed about further developments in the Ripple vs. SEC case and the evolving regulatory environment to better assess future XRP price predictions. Understanding the intricacies of XRP price prediction is key to successful investment in this dynamic asset.

Featured Posts

-

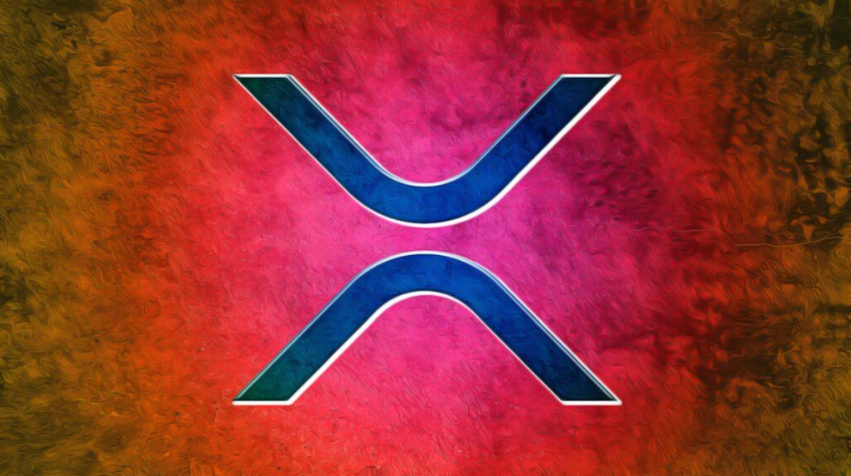

Ripple Settlement Talks Sec May Classify Xrp As A Commodity

May 02, 2025

Ripple Settlement Talks Sec May Classify Xrp As A Commodity

May 02, 2025 -

Fortnite Data Mine Suggests Lara Crofts Quick Return

May 02, 2025

Fortnite Data Mine Suggests Lara Crofts Quick Return

May 02, 2025 -

La Laport 3 20 7

May 02, 2025

La Laport 3 20 7

May 02, 2025 -

Actress Daisy May Cooper Announces Engagement To Boyfriend Anthony Huggins

May 02, 2025

Actress Daisy May Cooper Announces Engagement To Boyfriend Anthony Huggins

May 02, 2025 -

Israil Meclisi Nde Gerginlik Esir Yakinlari Ile Guevenlik Goerevlileri Karsi Karsiya

May 02, 2025

Israil Meclisi Nde Gerginlik Esir Yakinlari Ile Guevenlik Goerevlileri Karsi Karsiya

May 02, 2025

Latest Posts

-

Christina Aguileras New Photoshoot Is It Too Much Photoshop

May 03, 2025

Christina Aguileras New Photoshoot Is It Too Much Photoshop

May 03, 2025 -

Christina Aguileras Transformation Fans React To Her Changed Appearance

May 03, 2025

Christina Aguileras Transformation Fans React To Her Changed Appearance

May 03, 2025 -

Christina Aguileras Photoshopped Images Spark Online Debate

May 03, 2025

Christina Aguileras Photoshopped Images Spark Online Debate

May 03, 2025 -

Is This Christina Aguilera Fans Question Authenticity Of New Photos

May 03, 2025

Is This Christina Aguilera Fans Question Authenticity Of New Photos

May 03, 2025 -

Fans React To Christina Aguileras Heavily Edited Photoshoot Pictures

May 03, 2025

Fans React To Christina Aguileras Heavily Edited Photoshoot Pictures

May 03, 2025