XRP Price Prediction: Following A 400% Increase

Table of Contents

Factors Contributing to the 400% XRP Price Increase

Several interconnected factors contributed to XRP's astonishing 400% price surge. Understanding these elements is crucial for formulating a realistic XRP price prediction.

Ripple's Legal Victory

The outcome of the Ripple vs. SEC lawsuit significantly impacted XRP's price. The partial victory for Ripple, while not a complete exoneration, removed a significant cloud of regulatory uncertainty that had hung over the cryptocurrency for years. This resulted in:

- Increased investor confidence: The positive sentiment surrounding the court decision boosted investor confidence, leading to increased buying pressure.

- Improved regulatory clarity: While the legal battle isn't entirely over, the ruling provided a degree of clarity, making XRP appear less risky to some investors.

- Resumption of trading on major exchanges: Many exchanges that had previously delisted XRP reinstated it following the court decision, further increasing liquidity and accessibility.

Growing Institutional Adoption

Institutional adoption plays a vital role in driving up demand for cryptocurrencies like XRP. While still in its early stages, the increasing use of XRP in cross-border payments is a positive indicator:

- Increased liquidity: Institutional involvement brings significant capital into the market, leading to increased liquidity and price stability.

- Stronger price support: Large institutional holders act as price supports, mitigating sharp price drops.

- Reduced volatility (potentially): Increased institutional participation can potentially reduce volatility in the long run, although short-term fluctuations are still expected.

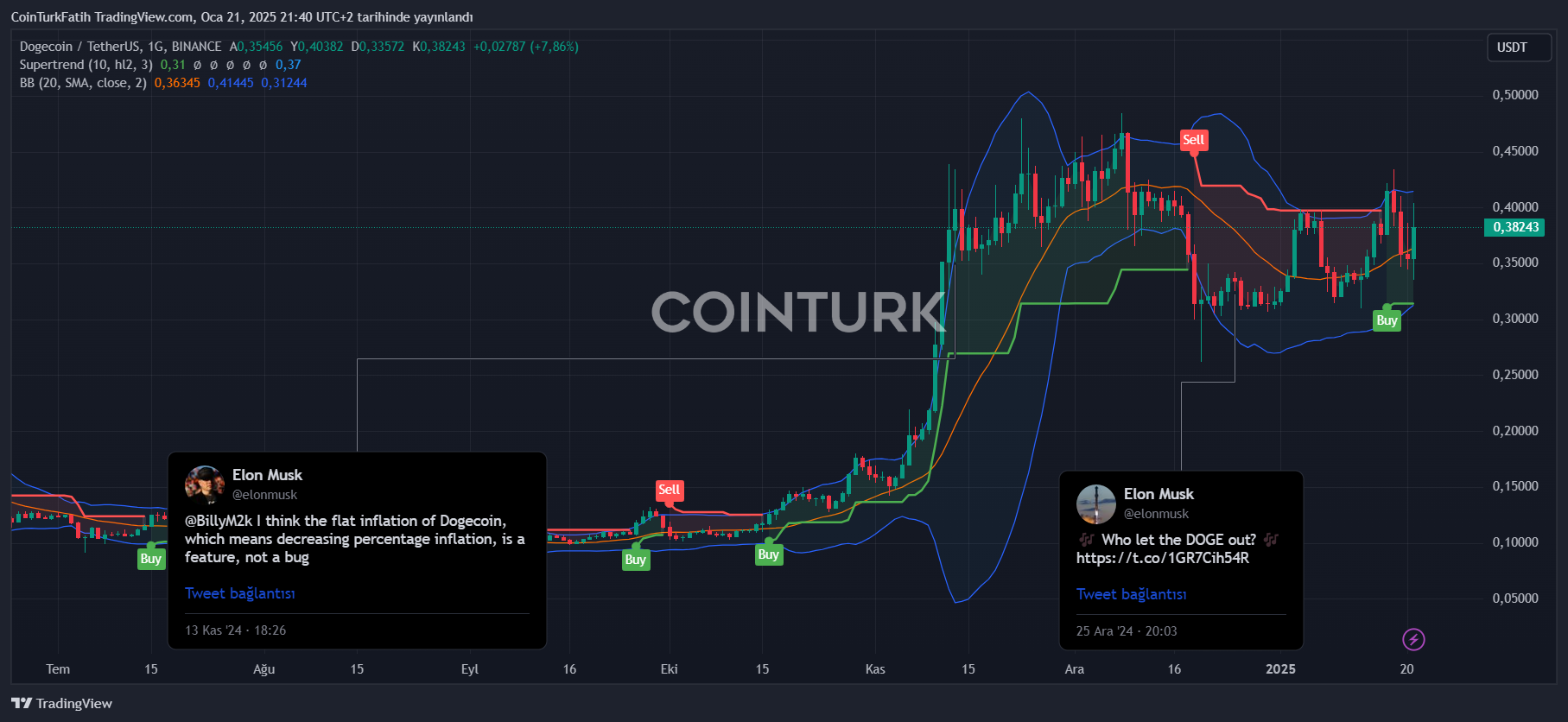

Market Sentiment and Speculation

Market sentiment and speculation significantly influence XRP's price. Positive news cycles, amplified by social media, can trigger FOMO (fear of missing out), leading to rapid price increases:

- Positive news cycles: Positive news about Ripple's partnerships or technological advancements can fuel rapid price appreciation.

- Social media hype: Social media platforms play a crucial role in shaping public opinion and driving trading volume.

- Increased trading volume driven by speculation: Speculative trading, often fueled by social media trends, can lead to dramatic price swings.

Analyzing Current Market Conditions for XRP

To accurately predict XRP's future price, we need to analyze current market conditions through both technical and fundamental lenses.

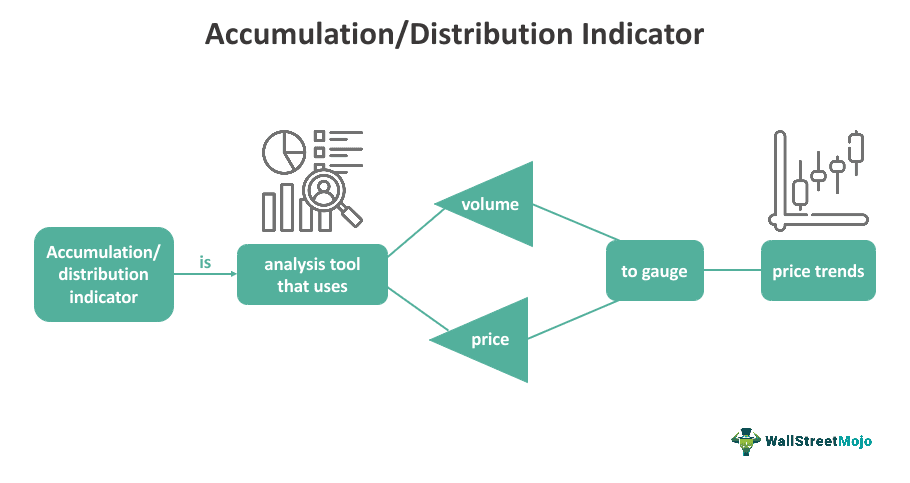

Technical Analysis

Technical analysis uses charts and indicators to predict future price movements. For XRP, we can consider:

- Support levels: Identifying support levels helps determine potential price floors.

- Resistance levels: Resistance levels indicate price ceilings where selling pressure might outweigh buying pressure.

- Trendline analysis: Analyzing trendlines can help determine the overall direction of the price.

- Moving average convergence divergence (MACD): This indicator helps identify momentum shifts and potential trend reversals.

Fundamental Analysis

Fundamental analysis assesses the underlying value of an asset. For XRP, this includes:

- Technological advancements: Ripple's ongoing development of its technology and its potential for scalability and efficiency.

- Market adoption: The increasing adoption of XRP by financial institutions and payment providers.

- Competitive landscape: How XRP compares to other cryptocurrencies in the payments sector.

- Long-term growth potential: The potential for XRP to become a significant player in the global payments ecosystem.

XRP Price Prediction: Short-Term and Long-Term Outlook

Predicting cryptocurrency prices is inherently speculative, but analyzing the factors discussed above allows for a reasoned prediction.

Short-Term Prediction (Next 6 Months)

Based on current market conditions, including the lingering legal uncertainty and the volatility of the crypto market, a cautious short-term price prediction is warranted. Significant price appreciation in the next six months is possible, but also a period of consolidation or minor correction is possible.

- Potential price targets: A range within a certain percentage increase or decrease from the current price is more realistic than a specific point.

- Factors influencing short-term price: Market sentiment, news events, and regulatory developments will be major factors.

- Risks to consider: Increased regulatory scrutiny or negative news could trigger a price correction.

Long-Term Prediction (Next 3-5 Years)

Long-term predictions are inherently more speculative. However, considering Ripple's technology, potential adoption, and the overall growth of the crypto space:

- Long-term price targets (range): A wide range of potential price targets should be considered, acknowledging the significant uncertainty.

- Factors impacting long-term growth: Widespread institutional adoption, technological improvements, and favorable regulatory developments would positively influence long-term price.

- Potential disruptive technologies: The emergence of competing technologies could negatively affect XRP's long-term prospects.

Conclusion

The recent 400% surge in XRP's price is a complex event driven by a confluence of factors, including Ripple's legal victory, growing institutional adoption, and overall market sentiment. While short-term predictions are inherently uncertain, a careful analysis of technical and fundamental indicators, coupled with an understanding of the broader market landscape, allows us to formulate a reasoned XRP price prediction. Remember to conduct your own thorough research before making any investment decisions in XRP or any other cryptocurrency. Stay informed on the latest developments to refine your understanding of the future of XRP price prediction and make informed decisions. The cryptocurrency market is dynamic; continued monitoring of relevant news and expert analyses will be crucial in your journey navigating the world of XRP price predictions.

Featured Posts

-

Ethereums Bullish Trend Analysis Of Recent Accumulation And Price Movement

May 08, 2025

Ethereums Bullish Trend Analysis Of Recent Accumulation And Price Movement

May 08, 2025 -

Thunder Grizzlies Showdown Key Players And Predictions

May 08, 2025

Thunder Grizzlies Showdown Key Players And Predictions

May 08, 2025 -

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025 -

Carneys White House Meeting A Stand For Canadian Independence

May 08, 2025

Carneys White House Meeting A Stand For Canadian Independence

May 08, 2025 -

The Unexpected Rise Of Dogecoin Shiba Inu And Sui A Market Overview

May 08, 2025

The Unexpected Rise Of Dogecoin Shiba Inu And Sui A Market Overview

May 08, 2025