XRP Price Prediction: Impact Of Ripple's Reduced $50M SEC Settlement

Table of Contents

Ripple's Reduced Settlement: A Victory or a Pyrrhic Win?

The Terms of the Settlement and their Implications:

The settlement, while significantly reduced from the SEC's initial demands, carries implications for both Ripple and the cryptocurrency market. Key aspects include:

- No Admission of Guilt: Crucially, Ripple did not admit guilt regarding the SEC's allegations of selling unregistered securities. This is a significant win for Ripple, preserving its reputation and potentially setting a precedent for future cases.

- Focus on Past Conduct: The settlement primarily addressed Ripple's past actions, leaving the door open for future sales of XRP under potentially clearer regulatory frameworks.

- Impact on Future Regulatory Clarity: The settlement, though not a complete legal victory, could contribute to a more defined regulatory landscape for cryptocurrencies, particularly regarding how tokens are classified. This potential clarity is a significant factor in any XRP price prediction.

- SEC Concession: The SEC's willingness to negotiate a significantly reduced settlement suggests a recognition of the complexities involved in regulating cryptocurrencies. This could influence future regulatory actions and approaches.

- Ripple's Financial Position: While the $50 million settlement represents a financial burden, it's significantly less than the potential costs of a protracted legal battle. Ripple’s strong financial position post-settlement enhances investor confidence, influencing the XRP price.

Market Reaction and Immediate Price Impact:

The announcement of the settlement immediately impacted XRP's price. While initially volatile, the price showed a net positive reaction, indicating market relief.

- Price Fluctuations: [Insert Chart showing XRP price fluctuations before, during, and after the settlement announcement. Source the chart appropriately]. The chart clearly demonstrates the initial volatility followed by a more stable increase, suggesting positive market sentiment.

- Trading Volume: A surge in trading volume accompanied the news, reflecting heightened investor interest and activity.

- Market Sentiment: The overall market sentiment shifted towards optimism following the settlement, boosting confidence in XRP and influencing the XRP price prediction.

- Short-Term Volatility: Short-term volatility is to be expected following such significant news. However, the longer-term trend appears to be upward, at least in the immediate aftermath.

Long-Term XRP Price Prediction: Factors to Consider

Several key factors will influence the long-term XRP price prediction:

Regulatory Landscape and its Influence:

Regulatory uncertainty remains a significant challenge for the cryptocurrency market.

- Future Regulatory Decisions: The Ripple settlement's impact on future SEC actions and overall crypto regulation remains to be seen. Clearer regulatory guidelines could lead to greater adoption and a potentially higher XRP price.

- Impact of Other Legal Cases: Other ongoing legal battles involving cryptocurrencies will also shape the regulatory landscape and influence investor sentiment, impacting XRP's price prediction.

- Regulatory Scenarios: Different regulatory scenarios—ranging from outright bans to clear frameworks—present diverse outcomes for XRP's price.

Technological Advancements and Adoption:

Ripple's continuous development and adoption of its technology are crucial for XRP's long-term success.

- XRP Ledger and Applications: The XRP Ledger continues to evolve, offering enhanced scalability and functionality, potentially attracting more users and increasing demand for XRP.

- Cross-Border Payments: Increased adoption of XRP in cross-border payment systems could drive significant price appreciation.

- Partnerships and Collaborations: Strategic partnerships and collaborations could significantly enhance XRP's utility and adoption, thus impacting its price prediction.

Macroeconomic Factors and Market Sentiment:

Broader economic conditions and general market sentiment significantly affect cryptocurrency prices.

- Inflation, Interest Rates, and Recessionary Fears: These macroeconomic factors influence investor risk appetite, directly impacting cryptocurrency prices, including XRP.

- Overall Crypto Market Sentiment: A bullish or bearish crypto market will significantly influence XRP's price, regardless of its specific fundamentals.

- Bitcoin's Price: Bitcoin's price often acts as a benchmark for the entire crypto market. XRP's price tends to correlate with Bitcoin's performance, though not always directly.

Investment Strategies and Risk Assessment for XRP

Investing in XRP, like any cryptocurrency, involves significant risks.

Assessing the Risks and Rewards:

- Volatility: The cryptocurrency market is inherently volatile, and XRP is no exception. Price swings can be dramatic.

- Regulatory Risks: Regulatory changes could negatively impact XRP's price and utility.

- Market Competition: Competition from other cryptocurrencies and payment systems could affect XRP's adoption and price.

- Technological Risks: Technological issues or vulnerabilities in the XRP Ledger could affect its price.

Diversification and Risk Management:

- Diversified Portfolio: It's crucial to diversify your investment portfolio, minimizing your exposure to any single asset, including XRP.

- Risk Tolerance: Only invest an amount you're comfortable losing. Your investment strategy should align with your risk tolerance.

- Research: Always conduct thorough research and understand the risks before investing in any cryptocurrency.

Conclusion:

The Ripple-SEC settlement's impact on XRP's price remains a complex issue with both short-term and long-term implications. While the reduced settlement is generally viewed as positive, regulatory uncertainty and broader market conditions continue to play crucial roles. Investors should carefully consider these factors and diversify their portfolio to mitigate risk. Conduct thorough research and only invest what you can afford to lose before making any decisions regarding an XRP price prediction or investing in XRP. Remember to do your own research before investing in any cryptocurrency. A well-informed XRP price prediction is only part of a successful investment strategy.

Featured Posts

-

Ftc To Appeal Microsoft Activision Merger Ruling Whats Next

May 01, 2025

Ftc To Appeal Microsoft Activision Merger Ruling Whats Next

May 01, 2025 -

The Unexpected Inflationary Effect Of A Viral Pregnancy Chocolate Craving

May 01, 2025

The Unexpected Inflationary Effect Of A Viral Pregnancy Chocolate Craving

May 01, 2025 -

Russias Spring Offensive Warmer Weather A Potential Game Changer

May 01, 2025

Russias Spring Offensive Warmer Weather A Potential Game Changer

May 01, 2025 -

Project Muse Cultivating Shared Reading Experiences

May 01, 2025

Project Muse Cultivating Shared Reading Experiences

May 01, 2025 -

The Ukraine Wars Effect On Global Military Spending Europes Increased Defense Budgets

May 01, 2025

The Ukraine Wars Effect On Global Military Spending Europes Increased Defense Budgets

May 01, 2025

Latest Posts

-

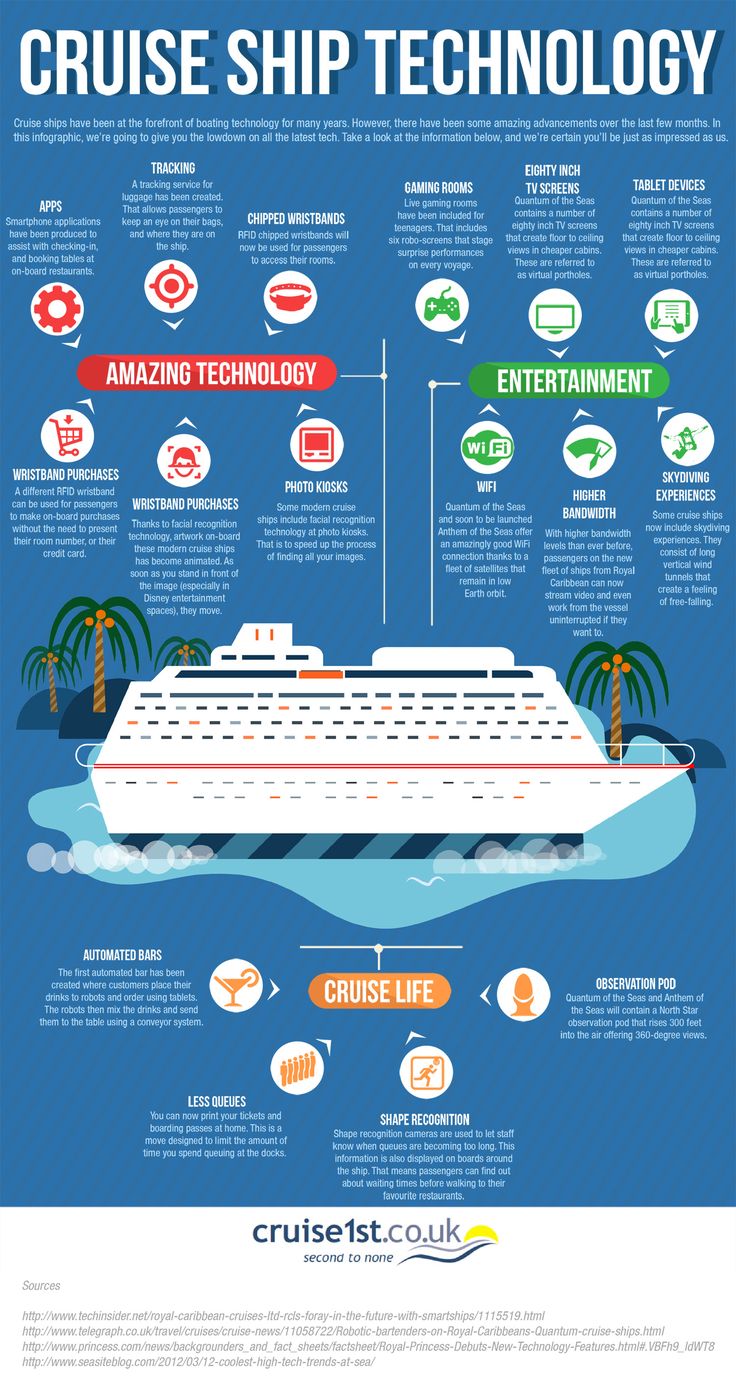

2025 Cruise Ship Technology A Look At The Latest Advancements

May 01, 2025

2025 Cruise Ship Technology A Look At The Latest Advancements

May 01, 2025 -

Cruises And Complaints Avoiding A Permanent Ban

May 01, 2025

Cruises And Complaints Avoiding A Permanent Ban

May 01, 2025 -

Nclhs Q Quarter Earnings Exceed Expectations Driving Stock Higher

May 01, 2025

Nclhs Q Quarter Earnings Exceed Expectations Driving Stock Higher

May 01, 2025 -

Could Your Cruise Complaint Result In A Ban

May 01, 2025

Could Your Cruise Complaint Result In A Ban

May 01, 2025 -

Carnival Corporation Brands A Complete List Of Cruise Lines

May 01, 2025

Carnival Corporation Brands A Complete List Of Cruise Lines

May 01, 2025