XRP Regulatory Status: Latest News And Impact On Investors

Table of Contents

The SEC Lawsuit Against Ripple: A Deep Dive

The core of the uncertainty lies in the SEC's lawsuit against Ripple Labs, filed in December 2020. The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. This claim hinges on the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security. The SEC argues that XRP meets the criteria of the Howey Test, implying an expectation of profits based on Ripple's efforts.

Ripple, on the other hand, vehemently denies these allegations, arguing that XRP is a decentralized digital asset, functioning more like a currency or utility token rather than a security. Their defense strategy centers on proving XRP's decentralized nature and its lack of reliance on Ripple's efforts for its value.

The legal proceedings are complex and multifaceted, involving extensive discovery and witness testimonies. The potential outcomes range from a complete SEC victory, potentially leading to significant penalties for Ripple and a negative impact on XRP's price, to a complete dismissal of the case or a negotiated settlement. A ruling could have far-reaching consequences for the entire cryptocurrency industry.

- SEC's Claims: The SEC contends that Ripple engaged in an unregistered securities offering, benefiting financially from the sale of XRP while failing to comply with registration requirements.

- Ripple's Defense: Ripple argues that XRP is a decentralized digital asset, traded on numerous exchanges independently of Ripple's activities, therefore not falling under securities law definitions.

- Key Legal Precedents: The court's interpretation of existing case law related to the Howey Test and digital assets will be crucial in determining the outcome.

- Potential Timelines: While uncertain, the case could conclude within the next year or extend for several more years, depending on appeals.

Impact on XRP Price and Market Sentiment

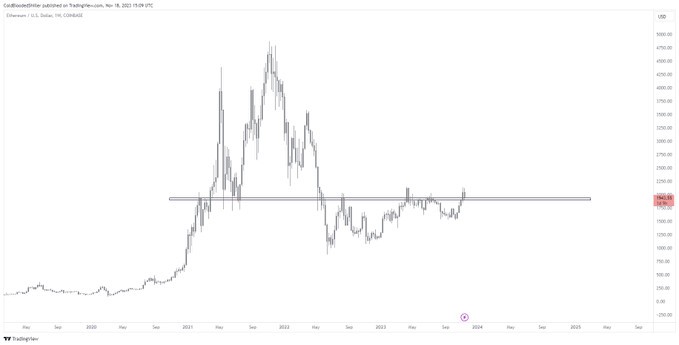

The SEC lawsuit has had a dramatic impact on XRP's price and overall market sentiment. Price fluctuations directly correlate with significant legal developments in the case. Positive news, such as favorable court rulings or statements, tends to boost XRP's price and investor confidence. Conversely, negative developments often lead to price drops and increased volatility.

Market speculation and trading volume also play a significant role. Anticipation surrounding potential outcomes fuels trading activity, influencing price swings. Periods of uncertainty frequently see increased trading volume as investors react to news and try to anticipate future price movements.

- Historical Price Analysis: Examining XRP's price chart alongside key events in the lawsuit reveals a clear correlation between legal developments and price fluctuations.

- Investor Confidence: Investor sentiment shifts dramatically based on perceived legal risks and potential outcomes. Periods of uncertainty can lead to reduced investor confidence.

- Trading Volume Changes: Significant legal updates frequently trigger spikes in trading volume as investors adjust their positions.

- Price Predictions: Predicting future price movements is inherently speculative, but analyzing different legal scenarios can offer potential price ranges.

Global Regulatory Landscape and its Influence on XRP

The regulatory landscape for cryptocurrencies varies significantly across jurisdictions. While the US grapples with the SEC's approach, other countries have adopted more lenient or nuanced regulatory frameworks. The EU, for instance, is developing a comprehensive regulatory framework (MiCA) for cryptocurrencies, potentially offering a clearer path for digital assets like XRP. Japan and other nations have established licensing and compliance requirements for crypto exchanges but with varying levels of scrutiny on individual crypto assets.

This divergence in regulatory approaches impacts XRP's adoption and use. Greater regulatory clarity in a particular region may lead to increased adoption within that market. Uncertainty, conversely, often hinders wider acceptance and use. The potential for international regulatory harmonization in the future could significantly alter XRP's global landscape.

- Regulatory Comparisons: Examining regulatory approaches across the US, EU, Japan, Singapore, and other key markets reveals a diverse range of regulatory styles.

- Impact of Clarity: Clear and consistent regulatory frameworks facilitate broader adoption and greater institutional participation. Ambiguity hampers growth and attracts less institutional involvement.

- International Harmonization: The possibility of globally consistent regulations could significantly stabilize the crypto market and potentially boost XRP adoption.

- Long-Term Implications: The evolving global regulatory environment will define the long-term prospects for XRP's acceptance and functionality.

Strategies for XRP Investors Amidst Uncertainty

Navigating the uncertain XRP regulatory environment requires a cautious and informed approach. Investors should prioritize risk management strategies and diversify their cryptocurrency portfolios to mitigate potential losses associated with XRP's price volatility. Due diligence and staying updated on legal developments and market trends are crucial.

- Portfolio Diversification: Spreading investments across different cryptocurrencies and asset classes reduces reliance on any single asset's performance, including XRP.

- Risk Management: Implementing stop-loss orders and setting realistic investment goals can help control potential losses.

- Staying Informed: Regularly monitoring news, legal updates, and market analysis is essential for making informed decisions.

- Responsible Investing: Only invest what you can afford to lose and thoroughly research any cryptocurrency before investing.

Conclusion: Understanding the XRP Regulatory Status for Informed Decisions

The SEC lawsuit against Ripple remains a significant factor shaping XRP's future. The outcome will have far-reaching consequences for XRP's price, investor sentiment, and the broader cryptocurrency landscape. Staying updated on legal developments and market trends is paramount for making informed decisions. Remember, investing in cryptocurrencies like XRP carries significant risks, and investors should carefully consider their risk tolerance before making investment choices. Continue researching the XRP regulatory status and revisit this site for updates to make informed investment choices based on your understanding of the situation and your individual risk appetite.

Featured Posts

-

Ethereums Bullish Run Analyzing Price Strength And Future Outlook

May 08, 2025

Ethereums Bullish Run Analyzing Price Strength And Future Outlook

May 08, 2025 -

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025 -

Stephen King Adaptation Contest From Hell Trailer Released

May 08, 2025

Stephen King Adaptation Contest From Hell Trailer Released

May 08, 2025 -

Leadership In The Nba Kenrich Williams Highlights A Thunder Star

May 08, 2025

Leadership In The Nba Kenrich Williams Highlights A Thunder Star

May 08, 2025 -

Check Daily Lotto Results For Wednesday April 16 2025

May 08, 2025

Check Daily Lotto Results For Wednesday April 16 2025

May 08, 2025