XRP's 400% Surge: Where Could It Go Next?

Table of Contents

XRP, the native cryptocurrency of Ripple Labs, has experienced a dramatic 400% price surge, leaving investors wondering about its future trajectory. This astonishing rise has sparked considerable interest, prompting many to ask: where could XRP go next? This article delves into the reasons behind this significant increase and explores potential future scenarios for XRP, considering both bullish and bearish perspectives. We'll analyze market trends, regulatory updates, and technological advancements to provide informed insights into the future of XRP.

Factors Driving XRP's Recent Surge

Ripple's Legal Victory

The recent legal developments in the SEC vs. Ripple case have significantly impacted investor sentiment and XRP's price. The partial victory for Ripple, with the court ruling that XRP sales on exchanges did not constitute unregistered securities offerings, has dramatically reduced the legal uncertainty surrounding the cryptocurrency.

- SEC lawsuit conclusion: The court's decision alleviated major concerns regarding XRP's regulatory status.

- Ripple win implications: This positive outcome boosted investor confidence, leading to a surge in demand and consequently, price.

- Court decision impact: The decreased legal risk significantly improved XRP's market outlook.

- Legal uncertainty reduced: This clarity has attracted institutional investors who were previously hesitant due to regulatory risks.

Increased Institutional Adoption

Growing institutional interest in XRP is another key driver of its recent surge. RippleNet, Ripple's payment network, has seen increased adoption by financial institutions for cross-border payments. The On-Demand Liquidity (ODL) solution, which uses XRP to facilitate faster and cheaper international transactions, is becoming increasingly popular.

- Institutional investors: More financial institutions are recognizing the potential of XRP for streamlining international payments.

- Cross-border payments: XRP's efficiency in facilitating faster and cheaper cross-border transactions is a major advantage.

- RippleNet adoption: The expansion of RippleNet signifies a growing acceptance of XRP within the financial industry.

- On-Demand Liquidity (ODL): This innovative solution is a crucial factor in attracting institutional adoption.

Overall Market Sentiment

The broader cryptocurrency market conditions also played a significant role in XRP's performance. The recent positive sentiment within the crypto market, often referred to as "altcoin season," has positively influenced XRP's price. Furthermore, a correlation exists between Bitcoin's price movements and the performance of altcoins like XRP.

- Crypto market: Positive market sentiment generally boosts the prices of most cryptocurrencies, including XRP.

- Bull market conditions: A bullish market environment is usually favorable for altcoin performance.

- Altcoin season: Periods of strong altcoin performance often coincide with upward trends in Bitcoin's price.

- Market capitalization increase: The rising market cap of XRP reflects increased investor confidence and demand.

Potential Future Scenarios for XRP

Bullish Predictions

Several factors suggest potential continued price growth for XRP. Technical analysis indicates potential upward trends, while increasing adoption rates and strategic partnerships could further propel its value.

- Price prediction: Some analysts predict further price increases based on current market trends and adoption rates.

- Technical analysis: Positive indicators on price charts suggest potential upward momentum.

- Future price: Sustained institutional adoption and positive regulatory developments could significantly drive the price up.

- Bullish outlook: Many analysts hold a bullish outlook for XRP in the medium to long term.

Bearish Predictions

Despite the positive momentum, bearish scenarios remain a possibility. Regulatory risks, competition from other cryptocurrencies, and potential market corrections could negatively impact XRP's price.

- Regulatory risk: Increased regulatory scrutiny or a negative court ruling could negatively affect XRP's price.

- Market correction: The cryptocurrency market is volatile, and corrections are common, potentially impacting XRP's price.

- Bearish outlook: Some analysts remain cautious, citing potential headwinds that could hinder XRP's growth.

- Price decline: A market downturn or negative regulatory developments could lead to a price decline.

Analyzing XRP's Technical Indicators

Chart Analysis

(Include relevant charts and graphs showing XRP's price action, support/resistance levels, trendlines, RSI, and MACD indicators.)

Analyzing XRP's price chart reveals key support and resistance levels, offering insights into potential price movements. Technical indicators like RSI and MACD can provide further signals. Trading volume also plays a crucial role in confirming price trends.

- Support levels: These indicate potential price floors where buying pressure might outweigh selling pressure.

- Resistance levels: These represent potential price ceilings where selling pressure might overcome buying pressure.

- Trading volume: High trading volume often confirms price movements, while low volume suggests less conviction.

- Technical indicators: RSI and MACD can help identify overbought or oversold conditions, potential trend reversals, and momentum shifts.

Trading Volume and Liquidity

High trading volume and sufficient liquidity are essential for price stability and sustainable growth. Increased exchange listings and improved market depth are critical factors influencing liquidity.

- Liquidity: High liquidity ensures smooth buying and selling of XRP without significant price fluctuations.

- Trading volume: High trading volume confirms market interest and price action.

- Exchange listing: More exchange listings increase accessibility and liquidity.

- Market depth: Significant market depth suggests sufficient buyers and sellers at various price levels, minimizing volatility.

Conclusion

XRP's recent 400% surge is primarily attributed to the partial victory in the SEC lawsuit, increased institutional adoption fueled by RippleNet and ODL, and positive overall market sentiment. While bullish predictions point to sustained growth driven by further adoption and technical analysis, bearish scenarios involving regulatory risks and market corrections should also be considered. The cryptocurrency market is inherently volatile, and careful analysis of technical indicators like chart patterns, trading volume, and key indicators such as RSI and MACD remains crucial for informed decision-making.

Stay informed about XRP's future price movements by regularly checking our website for the latest updates and analysis. Understand the risks involved before investing in XRP. Do your own thorough research before making any investment decisions concerning XRP.

Featured Posts

-

Kripto Para Satislari Artti Duesuesuen Yatirimcilar Uezerindeki Etkisi

May 08, 2025

Kripto Para Satislari Artti Duesuesuen Yatirimcilar Uezerindeki Etkisi

May 08, 2025 -

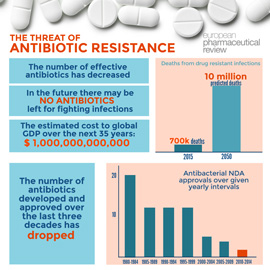

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025 -

Zenit Predlagaet Zhersonu Kontrakt Na 500 Tysyach Evro Podrobnosti Ot Zhurnalista

May 08, 2025

Zenit Predlagaet Zhersonu Kontrakt Na 500 Tysyach Evro Podrobnosti Ot Zhurnalista

May 08, 2025 -

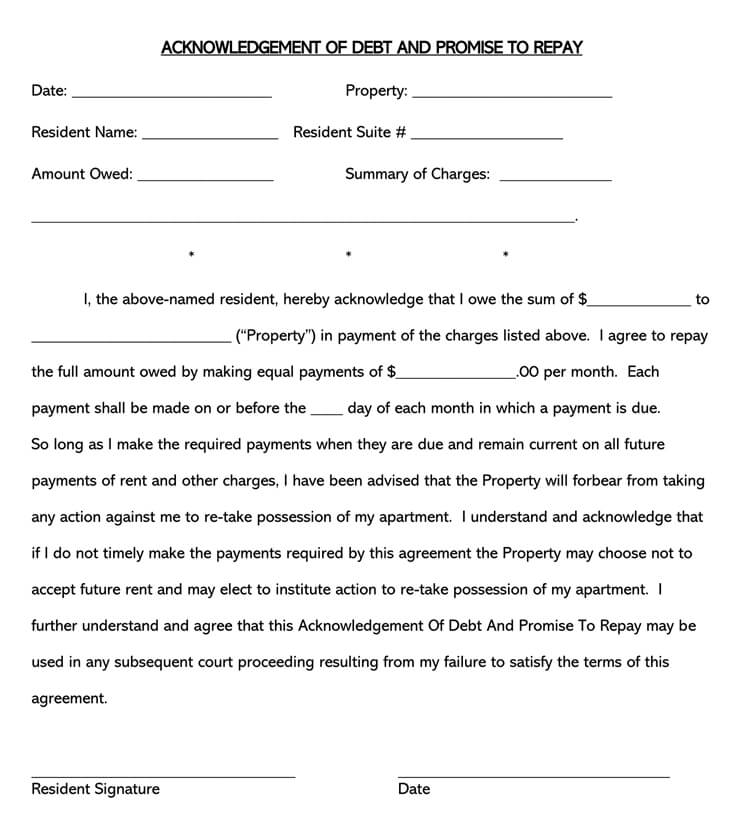

Universal Credit Overpayments Could You Be Owed Money

May 08, 2025

Universal Credit Overpayments Could You Be Owed Money

May 08, 2025 -

Bitcoin Madenciliginde Yeni Bir Doenem Son Mu Baslangic Mi

May 08, 2025

Bitcoin Madenciliginde Yeni Bir Doenem Son Mu Baslangic Mi

May 08, 2025