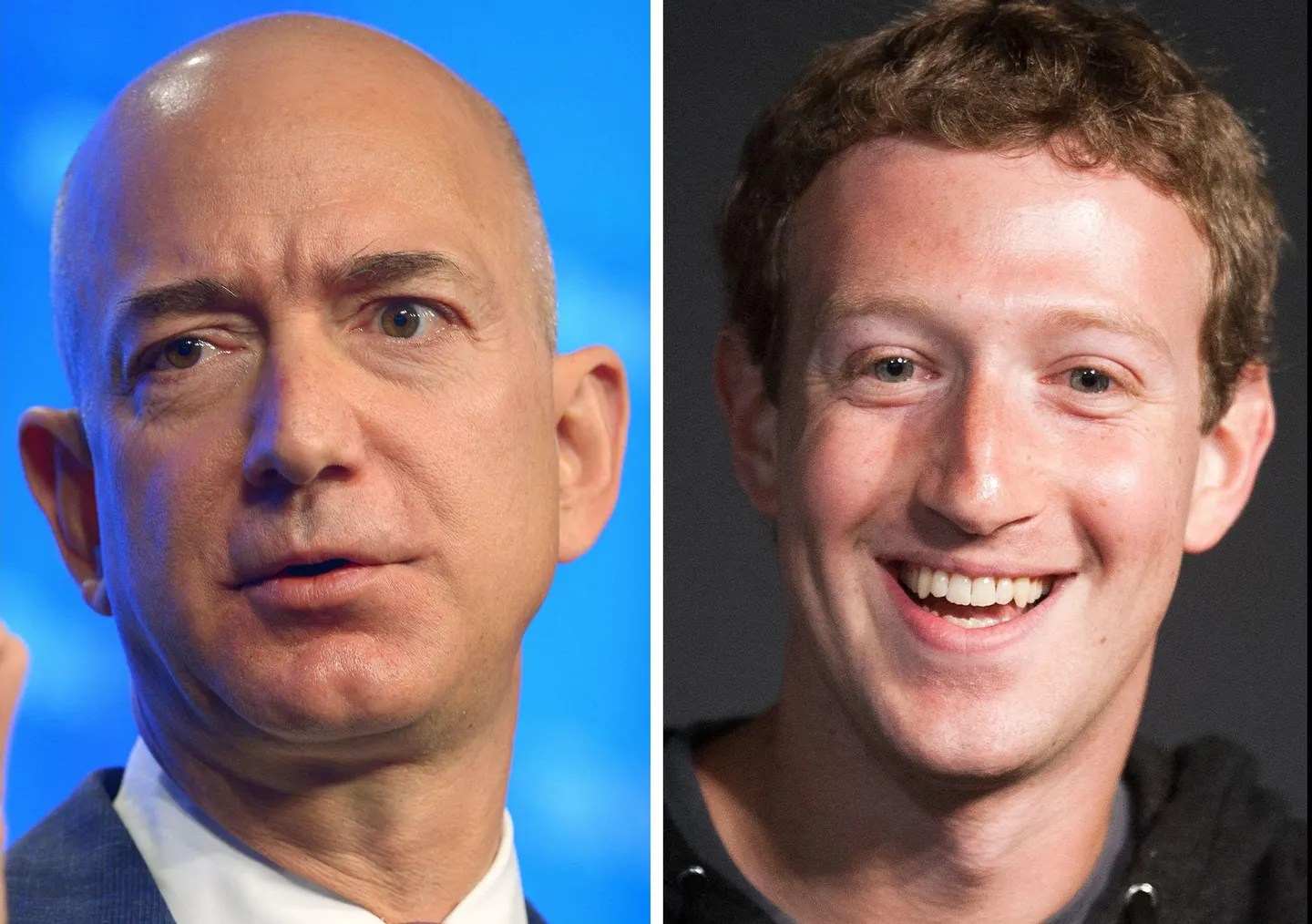

$194 Billion And Counting: Tech Billionaires' Post-Inauguration Losses

Table of Contents

The Impact of the Inauguration and Subsequent Policy Changes

The inauguration ushered in a new era of governance, marked by significant policy shifts impacting the tech sector. This section will delve into the major factors contributing to the wealth decline experienced by tech billionaires.

Regulatory Scrutiny and Antitrust Concerns

Increased regulatory scrutiny and antitrust concerns have significantly impacted the valuations of major tech companies. The new administration's focus on curbing the power of large tech corporations has translated into increased investigations and stricter regulations.

- Increased Antitrust Investigations: Several tech giants face ongoing antitrust lawsuits and investigations, potentially leading to hefty fines and structural changes.

- Stringent Data Privacy Regulations: New data privacy laws and regulations place greater restrictions on how tech companies collect, use, and share user data, impacting their business models and revenue streams.

- Government Oversight of Algorithmic Practices: Growing concerns about algorithmic bias and the potential for misuse of artificial intelligence have spurred government oversight, leading to increased compliance costs and potential limitations on technological advancements.

Keywords: antitrust, regulation, data privacy, government oversight, tech regulation, antitrust lawsuits

Changes in Economic Climate and Investor Sentiment

The economic climate following the inauguration played a crucial role in shaping investor sentiment and market trends. Shifts in economic policies and overall economic uncertainty contributed to the decline in tech stock valuations.

- Increased Interest Rates: Rising interest rates make borrowing more expensive, impacting investment in the tech sector and potentially slowing down growth.

- Inflationary Pressures: High inflation erodes purchasing power and can lead to decreased consumer spending, negatively affecting the performance of tech companies reliant on consumer demand.

- Shifting Investor Confidence: Uncertainty surrounding economic policies and geopolitical stability can cause investors to become risk-averse, leading to a sell-off in tech stocks.

Keywords: economic policy, investor confidence, market volatility, stock market, interest rates, inflation, economic uncertainty

Company-Specific Performance and Market Fluctuations

The post-inauguration period witnessed significant fluctuations in the stock prices of major tech companies, directly impacting the net worth of their founders and CEOs.

Decline in Stock Prices of Major Tech Companies

Several major tech companies experienced substantial declines in their stock prices, resulting in billions of dollars wiped off the net worth of their leaders.

- Meta (formerly Facebook): Experienced a significant drop in stock price following concerns about slowing user growth and increased competition.

- Tesla: Stock prices fluctuated dramatically due to factors including supply chain disruptions, Elon Musk's controversial tweets, and broader market volatility.

- Amazon: While remaining a dominant player, Amazon also saw its stock price decline, partly due to concerns about slowing e-commerce growth and increased costs.

Keywords: stock prices, market capitalization, tech stock performance, Meta, Facebook, Tesla, Amazon, Apple, Google

Impact of Global Events and Geopolitical Uncertainty

Global events and geopolitical uncertainty significantly impacted the tech sector and billionaire net worth.

- The War in Ukraine: The war caused widespread market uncertainty, impacting global supply chains and investor confidence, negatively affecting tech stock performance.

- Supply Chain Disruptions: Continued global supply chain issues hampered the production and distribution of tech products, leading to decreased revenue and profit margins.

- Geopolitical Tensions: Rising geopolitical tensions increased uncertainty and risk aversion among investors, leading to a sell-off in tech stocks.

Keywords: geopolitical risks, inflation, supply chain, global economy, global uncertainty, war in Ukraine

Long-Term Implications for the Tech Industry and Billionaires

The post-inauguration wealth losses raise questions about the long-term implications for the tech industry and its billionaires.

Potential for Future Growth and Recovery

Despite the significant losses, the tech sector retains its potential for future growth and recovery.

- Technological Innovation: Continued innovation in areas like artificial intelligence, cloud computing, and renewable energy could drive future growth and recovery.

- Emerging Markets: Expanding into new and emerging markets offers significant opportunities for growth and diversification.

- Strategic Acquisitions and Partnerships: Strategic acquisitions and partnerships can provide access to new technologies, markets, and talent.

Keywords: tech innovation, future growth, market recovery, emerging markets, technological advancements

Shift in Business Strategies and Adaptations

Tech companies are likely to adapt their business strategies in response to the changing economic and political landscape.

- Increased Focus on Regulation Compliance: Companies may need to invest heavily in compliance measures to meet stricter regulatory requirements.

- Diversification of Revenue Streams: Reducing reliance on a few key products or services may become a priority to mitigate risks.

- Corporate Restructuring and Efficiency Improvements: Companies may restructure their operations to improve efficiency and reduce costs.

Keywords: business strategy, market adaptation, corporate restructuring, regulatory compliance, diversification

Conclusion: The Ongoing Saga of Tech Billionaires' Post-Inauguration Losses

The $194 billion in losses suffered by tech billionaires post-inauguration highlights the interconnectedness of political policy, economic conditions, and the performance of the tech industry. The combined impact of increased regulatory scrutiny, market fluctuations, and global events has significantly altered the financial landscape for these influential figures. While the future remains uncertain, the potential for recovery and growth within the tech sector remains, albeit with a necessary shift in strategies and adaptations to the changing environment. To stay abreast of the ongoing developments impacting tech billionaires' wealth and the post-inauguration market analysis, be sure to follow our future articles on tech billionaires' wealth and market trends.

Featured Posts

-

Sensex Live Market Rally Adani Ports Up Eternal Down Latest Stock Updates

May 10, 2025

Sensex Live Market Rally Adani Ports Up Eternal Down Latest Stock Updates

May 10, 2025 -

Fentanyl Crisis Record Seizure Announced By Pam Bondi

May 10, 2025

Fentanyl Crisis Record Seizure Announced By Pam Bondi

May 10, 2025 -

Trump To Announce Major Trade Agreement With Uk

May 10, 2025

Trump To Announce Major Trade Agreement With Uk

May 10, 2025 -

Record Fentanyl Seizure Bondis Announcement And Its Implications

May 10, 2025

Record Fentanyl Seizure Bondis Announcement And Its Implications

May 10, 2025 -

Davids Potential Uncovering Morgans Critical Flaw

May 10, 2025

Davids Potential Uncovering Morgans Critical Flaw

May 10, 2025

Latest Posts

-

Sensex And Nifty Today Market Trends And Analysis 100 Point Gain

May 10, 2025

Sensex And Nifty Today Market Trends And Analysis 100 Point Gain

May 10, 2025 -

Indian Stock Market Soars Sensex And Niftys 1 400 And 23 800 Point Rally Explained

May 10, 2025

Indian Stock Market Soars Sensex And Niftys 1 400 And 23 800 Point Rally Explained

May 10, 2025 -

Stock Market Update Sensex Gains 100 Points Nifty Above 17 950

May 10, 2025

Stock Market Update Sensex Gains 100 Points Nifty Above 17 950

May 10, 2025 -

Sensex Jumps 1 400 Points Nifty Above 23 800 Top 5 Reasons For Todays Market Surge

May 10, 2025

Sensex Jumps 1 400 Points Nifty Above 23 800 Top 5 Reasons For Todays Market Surge

May 10, 2025 -

Sensex Live Market Rebounds Up 100 Points Nifty At 17 950

May 10, 2025

Sensex Live Market Rebounds Up 100 Points Nifty At 17 950

May 10, 2025