$50M Settlement Reached: The Impact Of Ripple's SEC Case On XRP Price And Adoption

Table of Contents

Ripple vs. SEC Settlement: A Detailed Overview

The SEC's lawsuit against Ripple, filed in December 2020, alleged that Ripple had raised $1.3 billion through the unregistered sale of XRP, classifying it as an unregistered security. Ripple vehemently denied these accusations, arguing that XRP is a currency, not a security. The settlement, while not an admission of guilt, saw Ripple pay $50 million to resolve the SEC's claims without admitting or denying the allegations. This settlement, while significant, represents a fraction of the total amount raised through XRP sales.

- SEC's Accusations: The SEC claimed Ripple violated federal securities laws by selling unregistered securities.

- Ripple's Defense: Ripple argued XRP is a decentralized digital asset, functioning as a currency and not subject to SEC regulations.

- Key Settlement Terms: Ripple paid a $50 million penalty, agreed to certain stipulations regarding future sales, and pledged to cooperate with the SEC.

- Implications of Not Admitting Guilt: While avoiding a full-blown admission of guilt, the settlement carries a significant reputational cost and potentially impacts future regulatory dealings.

Immediate Impact of the Settlement on XRP Price

The announcement of the settlement caused immediate, albeit mixed, reactions in the XRP market. Initially, the price of XRP surged, reflecting a wave of relief among investors. However, the price subsequently experienced volatility, influenced by several factors.

- XRP Price Before the Settlement: XRP's price had been fluctuating significantly throughout the legal battle, heavily influenced by the case's progress.

- XRP Price Immediately After the Settlement: An initial price spike was observed, followed by a period of consolidation.

- Price Volatility in the Days Following the Settlement: The price continued to be volatile, reflecting the ongoing uncertainty and varied interpretations of the settlement's implications.

- Analysis of Trading Volume Changes: Trading volume increased significantly following the announcement, indicating heightened market activity. [Insert relevant chart/graph visualizing XRP price fluctuations].

Long-Term Implications for XRP Adoption and Regulatory Clarity

The long-term consequences of the $50 million settlement on XRP adoption and regulatory clarity remain to be seen. While the settlement offers some degree of resolution, it doesn't provide definitive answers regarding the classification of cryptocurrencies in the US.

- Increased Exchange Listings Post-Settlement: Some exchanges that previously delisted XRP might reconsider their positions, potentially increasing XRP's accessibility.

- Impact on Institutional Investment: The settlement could encourage more institutional investors to consider XRP, provided further regulatory clarity emerges.

- Regulatory Implications for Other Cryptocurrencies: The case sets a precedent, impacting how other crypto projects navigate regulatory challenges. It underscores the need for clear regulatory frameworks for digital assets.

- The Future of XRP as a Payment Solution: The settlement's impact on XRP's utility as a payment solution remains uncertain, depending on its future adoption and regulatory landscape.

Investor Sentiment and Future Market Outlook for XRP

Investor sentiment towards XRP is complex and divided. While some investors view the settlement as a positive development, others remain cautious.

- Positive Investor Sentiment Indicators: The initial price surge, renewed exchange listings, and potential for future institutional investment represent positive signs.

- Negative Investor Sentiment Indicators: Concerns remain about the lack of a clear regulatory framework and the potential for future legal challenges.

- Expert Predictions on Future Price: Expert opinions on XRP's future price vary considerably, reflecting the inherent uncertainty within the cryptocurrency market. [Include quotes from relevant experts].

- Risk Assessment for XRP Investment: Investing in XRP still carries significant risk, given the evolving regulatory landscape and the volatile nature of the cryptocurrency market.

Conclusion: The Ripple Case, the $50M Settlement, and the Future of XRP

The $50 million settlement between Ripple and the SEC marks a significant turning point in the XRP saga. While the settlement provides some clarity, it also highlights the ongoing challenges faced by the cryptocurrency industry in navigating the complex regulatory environment. The impact on XRP's price, adoption, and future remains subject to ongoing developments. The settlement's influence on investor sentiment and the overall regulatory landscape will continue to shape the future of XRP and other cryptocurrencies. To stay informed about the evolving situation and make informed investment decisions, continue researching "$50M Settlement Reached: The Impact of Ripple's SEC Case on XRP Price and Adoption." Further research into "XRP price prediction," "XRP regulation," and "Ripple SEC lawsuit outcome" will provide a more comprehensive understanding of this dynamic market.

Featured Posts

-

Bio Based Scholen Afhankelijk Van Een Dieselgenerator

May 02, 2025

Bio Based Scholen Afhankelijk Van Een Dieselgenerator

May 02, 2025 -

Levenslang Of Tbs Voor Fouad L Een Juridische Verklaring

May 02, 2025

Levenslang Of Tbs Voor Fouad L Een Juridische Verklaring

May 02, 2025 -

Perfekta Kycklingnuggets Friterade I Majsflingor Och Laettlagad Kalsallad

May 02, 2025

Perfekta Kycklingnuggets Friterade I Majsflingor Och Laettlagad Kalsallad

May 02, 2025 -

Review Of Rust The Films Production And Aftermath

May 02, 2025

Review Of Rust The Films Production And Aftermath

May 02, 2025 -

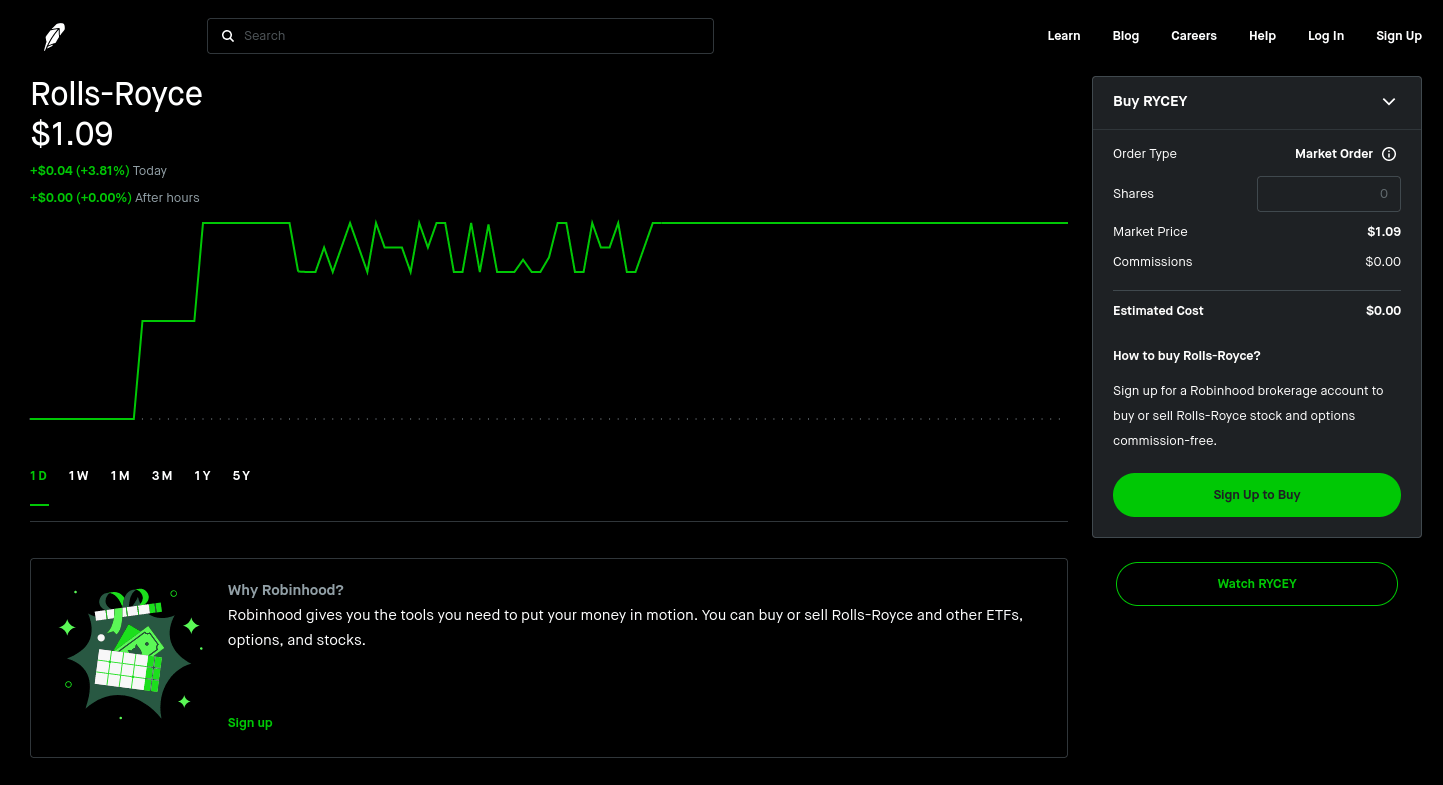

Rolls Royce Maintains 2025 Outlook Amidst Trade Tariff Concerns

May 02, 2025

Rolls Royce Maintains 2025 Outlook Amidst Trade Tariff Concerns

May 02, 2025

Latest Posts

-

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025

Riot Platforms Stock Riot A Deep Dive Into Recent Performance

May 02, 2025 -

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025

Understanding The Riot Platforms Inc Irrevocable Proxy And Waiver

May 02, 2025 -

Esir Yakinlarinin Protestosu Israil Meclisi Nde Arbede

May 02, 2025

Esir Yakinlarinin Protestosu Israil Meclisi Nde Arbede

May 02, 2025 -

Riot Platforms Stock Whats Happening With Riot And The Crypto Market

May 02, 2025

Riot Platforms Stock Whats Happening With Riot And The Crypto Market

May 02, 2025 -

Riot Platforms Inc Early Warning Report Key Details And Implications

May 02, 2025

Riot Platforms Inc Early Warning Report Key Details And Implications

May 02, 2025