$900 Million Tariff Bite: Apple Stock Takes A Dive

Table of Contents

The $900 Million Tariff: A Breakdown

Origin and Impact

The origin of this significant tariff lies in [Insert country/region that imposed the tariff and the specific reason, e.g., ongoing trade disputes between the US and China]. This action directly affects Apple's bottom line by increasing the cost of manufacturing and importing various products. The increased costs are passed down the supply chain, ultimately impacting Apple's profitability and potentially its pricing strategies.

- Specific Apple products affected: The tariff primarily impacts [List specific products, e.g., iPhones, iPads, Apple Watches].

- Percentage increase in cost due to tariffs: The estimated increase in cost per unit ranges from [Insert percentage range] depending on the product and its components.

- Regions most impacted: The impact is most acutely felt in regions heavily reliant on Apple imports, including [Mention specific regions, e.g., the European Union, certain Asian markets].

Apple's Response to the Tariffs

Apple has responded to the tariffs with a multifaceted strategy. While the company hasn't issued a formal statement explicitly detailing their entire strategy, their actions suggest a focus on mitigating the impact on profit margins and consumer prices. Lobbying efforts are likely ongoing, though specifics remain undisclosed.

- Examples of cost-cutting measures: Apple may explore streamlining its supply chain, negotiating better deals with suppliers, or optimizing its manufacturing processes to offset some of the increased costs.

- Potential price increases for consumers: To maintain profit margins, Apple might be forced to increase prices on certain products, potentially reducing consumer demand.

- Changes in manufacturing locations: While a significant shift in manufacturing is unlikely in the short term, Apple might consider diversifying its manufacturing base in the long run to reduce its dependence on tariff-affected regions.

Impact on Apple Stock and Investor Sentiment

Immediate Stock Market Reaction

The immediate reaction to the tariff announcement was a sharp decline in Apple's stock price. [Insert specific data points, e.g., Apple stock fell by X% on the day of the announcement, trading volume increased by Y%]. This reflected investor concern regarding the impact of the tariffs on Apple's future earnings.

- Comparison to previous market fluctuations: Compare the drop to previous market corrections and fluctuations, providing context to the severity of the impact.

- Analyst predictions post-tariff: Include a summary of analysts' predictions and their outlook on Apple stock's future performance in light of the new tariffs.

- Impact on Apple's market capitalization: Quantify the monetary impact of the stock drop on Apple's overall market capitalization.

Long-Term Implications for Investors

The long-term implications for investors are complex and depend on various factors, including the duration of the tariffs, Apple's ability to mitigate the impact, and the overall economic climate.

- Risks and opportunities for investors: Discuss the risks associated with holding Apple stock during this period of uncertainty, but also highlight potential opportunities for long-term investors if Apple successfully navigates these challenges.

- Potential for stock recovery: Analyze the likelihood of a stock price recovery and what conditions might contribute to or hinder such a recovery.

- Diversification strategies: Suggest diversification strategies to mitigate the risks associated with investing heavily in a single stock, especially during periods of economic uncertainty.

Broader Economic and Geopolitical Context

The Trade War's Influence

The $900 million tariff on Apple products is not an isolated incident. It's part of a larger trade war impacting global supply chains. [Elaborate on the broader context of the trade disputes, mentioning specific countries and industries affected]. This exemplifies the interconnectedness of the global economy and the far-reaching implications of trade policies.

- Impact on other tech companies: Discuss how other tech companies are affected by these trade tensions and the broader implications for the technology sector.

- Potential ripple effects across global supply chains: Explain the cascading effects of tariffs on various industries and the potential disruption to global supply chains.

Future Predictions and Potential Resolutions

Predicting the future is challenging, but several scenarios are possible. The tariffs could be removed through negotiation, or they could remain in place for an extended period. Alternative resolutions, such as trade agreements or adjustments to Apple's supply chain, are also possible.

- Potential outcomes for future trade negotiations: Discuss different possible outcomes of ongoing trade negotiations and their potential influence on Apple's financial performance and stock price.

- Predictions for Apple stock price in different scenarios: Offer speculative predictions for Apple stock based on various potential future scenarios, emphasizing the uncertainty inherent in such predictions.

Conclusion

The $900 million tariff on Apple products has significantly impacted Apple's financial performance and sent its stock price into a dive. The incident underscores the vulnerability of global companies to trade wars and highlights the complexities of navigating the international economic landscape. This has implications not just for Apple, but for the broader tech sector and global investors. Understanding the broader economic and geopolitical context is crucial for assessing the long-term implications for investors.

Call to Action: Stay informed on the evolving situation surrounding the $900 million tariff on Apple and its impact on Apple stock. Continue monitoring market trends and consider diversifying your investment portfolio to mitigate risks associated with trade wars and global economic uncertainty. Learn more about effective investment strategies during times of economic volatility to protect your investments. Regularly review your investment portfolio and adjust your strategy as needed based on market developments related to Apple stock and tariffs.

Featured Posts

-

7 Fall In Amsterdam Stock Market As Trade War Anxiety Mounts

May 24, 2025

7 Fall In Amsterdam Stock Market As Trade War Anxiety Mounts

May 24, 2025 -

Peremozhtsi Yevrobachennya Ostanni 10 Rokiv De Voni Zaraz

May 24, 2025

Peremozhtsi Yevrobachennya Ostanni 10 Rokiv De Voni Zaraz

May 24, 2025 -

Mia Farrow And Sadie Sink A Broadway Encounter

May 24, 2025

Mia Farrow And Sadie Sink A Broadway Encounter

May 24, 2025 -

Dow Jones Steady Climb Positive Pmi Data Fuels Market Confidence

May 24, 2025

Dow Jones Steady Climb Positive Pmi Data Fuels Market Confidence

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Net Asset Value Nav Explained

May 24, 2025

Latest Posts

-

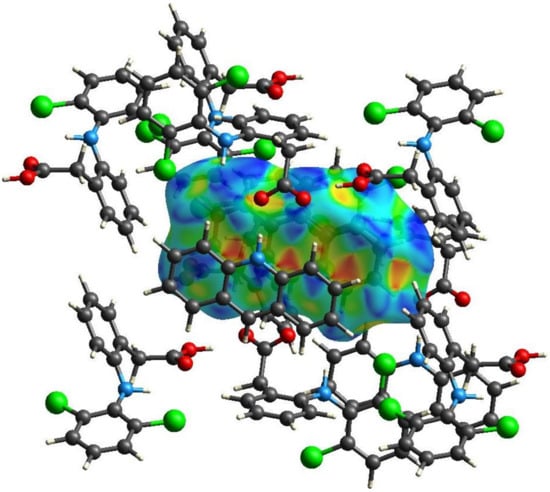

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025 -

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025 -

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025 -

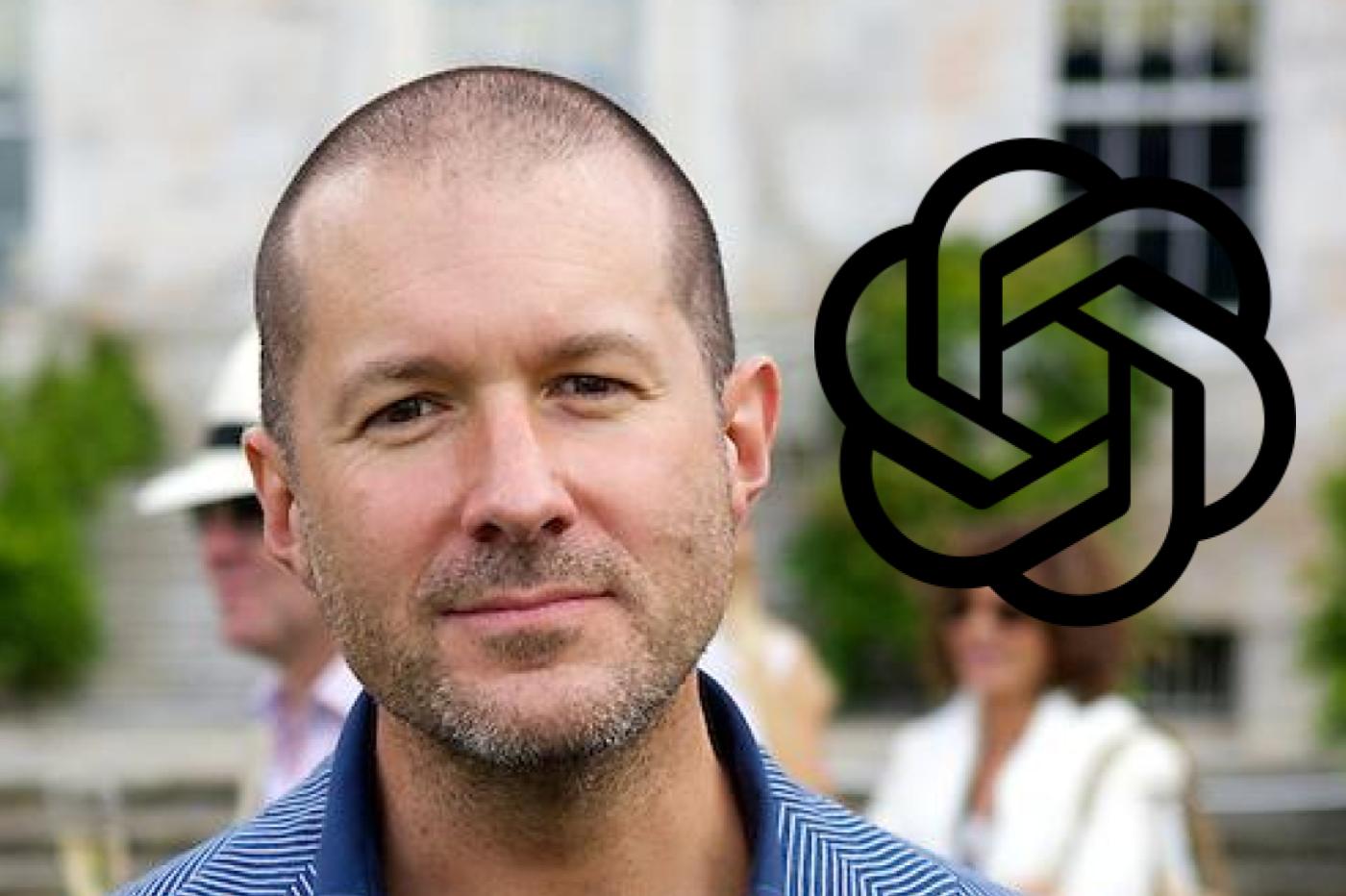

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025 -

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025