A Deep Dive Into The Monaco Corruption Scandal: The Prince And His Money Manager

Table of Contents

The Key Players: Prince Albert II and His Alleged Money Manager

At the heart of the Monaco Corruption Scandal lie two central figures: Prince Albert II and his alleged money manager (whose name will be withheld pending legal proceedings). The accusations involve a complex web of alleged financial irregularities, raising significant concerns about the governance and transparency within the principality.

Prince Albert II's Role

While Prince Albert II has not been directly accused of criminal activity, his alleged indirect involvement through his close association with the money manager has placed him under intense scrutiny. The scandal raises questions about potential conflicts of interest and the overall oversight within the royal family's financial dealings.

- Official Statements: The Palace of Monaco has issued several statements denying any direct knowledge or involvement in the alleged illicit activities. These statements often emphasize the Prince's commitment to upholding the rule of law and maintaining Monaco's reputation.

- Impact on Public Image: The scandal has undeniably tarnished the Prince's previously carefully cultivated public image as a modern and responsible leader. Public opinion has been divided, with some expressing unwavering support for the Prince, while others question his leadership in light of the accusations.

- Legal Actions: While Prince Albert II himself hasn't faced direct legal action, the ongoing investigations and potential future revelations could significantly impact his position and the monarchy's standing.

The Money Manager's Allegations

The money manager at the center of the scandal faces a multitude of serious accusations, including money laundering, fraud, and embezzlement. The scale of the alleged financial irregularities is substantial, potentially involving millions, if not billions, of euros.

- Alleged Crimes: Specific accusations include facilitating the movement of illicit funds through offshore accounts and shell companies, deliberately concealing the origins of funds, and actively participating in fraudulent schemes.

- Scale of Irregularities: The alleged financial irregularities are reported to be widespread, involving numerous transactions and a network of international connections, raising serious concerns about the extent of the corruption.

- Evidence Presented: The investigation reportedly uncovered significant evidence, including incriminating financial documents, witness testimonies, and potentially leaked communications, suggesting a strong case against the money manager.

The Allegations and Evidence: Unveiling the Network of Corruption

The allegations in the Monaco Corruption Scandal are supported by a substantial amount of evidence pointing towards a complex network of financial irregularities designed to conceal illicit activities.

Financial Irregularities

Investigators have reportedly uncovered a series of suspicious financial transactions involving offshore accounts in tax havens and the use of shell companies to obscure the true beneficiaries of the funds.

- Flow of Money: The alleged scheme involved a complex flow of money, with funds originating from various sources being channeled through a series of intermediaries before ultimately reaching their intended destination.

- Methods of Concealment: Sophisticated methods were allegedly used to conceal the transactions, including the use of encrypted communications, false documentation, and complex layers of offshore entities.

- Leaked Information: Leaks of confidential documents and financial records are reported to have played a significant role in uncovering the extent of the alleged criminal activities.

Witness Testimony and Investigations

The investigation relies heavily on witness testimony and extensive forensic accounting analysis of financial transactions. The challenges of investigating such a high-profile case involving international connections are considerable.

- Key Witnesses: Several individuals, including former associates of the money manager and potentially those involved in the alleged transactions, have reportedly provided crucial testimony to investigators.

- Investigative Methods: The investigation employs advanced forensic accounting techniques to trace the flow of funds and identify the individuals involved in the alleged schemes. International cooperation is crucial to tracing assets and pursuing legal action across jurisdictions.

- Challenges in Investigation: The complexity of the alleged financial schemes, the involvement of offshore accounts and shell companies, and the high-profile nature of the case present considerable challenges to investigators.

The Impact and Ramifications: Monaco's Image and Future

The Monaco Corruption Scandal has had a profound impact on the principality's image and its future trajectory. The allegations have raised serious questions about the effectiveness of its regulatory framework and its commitment to transparency.

Damage to Monaco's Reputation

The scandal has undeniably damaged Monaco's reputation as a wealthy and reputable jurisdiction. The allegations of widespread financial misconduct could negatively impact its standing as a desirable location for investment and tourism.

- Tourism and Investment: The scandal could deter high-net-worth individuals and businesses from investing in Monaco, potentially impacting the principality's economy. Concerns about transparency may lead to a decline in tourism.

- Diplomatic Repercussions: The scandal has the potential to strain Monaco's relationships with other countries, particularly those actively involved in combating financial crime.

- Public Opinion and Media Coverage: International media coverage of the scandal has been extensive, with many outlets highlighting the contrast between Monaco's image of luxury and opulence and the alleged corruption within its financial system.

Legal and Political Consequences

The legal and political consequences of the scandal are still unfolding. Depending on the outcome of ongoing investigations and any subsequent trials, significant changes in legislation and governance may be implemented.

- Legislative Reforms: The scandal could lead to reforms aimed at strengthening Monaco's regulatory framework, improving transparency, and enhancing its ability to combat financial crime.

- Future of Transparency and Accountability: The scandal underscores the importance of transparency and accountability within Monaco's financial system and its governing institutions. Greater openness and more stringent regulations are likely to be demanded in the wake of the scandal.

- Impact on the Monarchy: The long-term impact of the scandal on the monarchy's power and influence remains to be seen. The extent to which the public continues to support the Prince and the royal family will be critical in determining the future political landscape.

Conclusion

The Monaco Corruption Scandal is a complex and evolving situation with far-reaching implications for the principality's reputation, governance, and future. The alleged involvement of Prince Albert II's close associate and the scale of the alleged financial irregularities highlight the vulnerabilities even within seemingly impenetrable systems. The scandal serves as a stark reminder of the importance of transparency and accountability in combating corruption, regardless of the individuals or institutions involved. The key takeaways center on the need for stronger regulatory frameworks, enhanced international cooperation in tackling cross-border financial crime, and the crucial role of independent investigations in uncovering the truth. Stay informed about the ongoing developments in the Monaco corruption scandal. Further research into this complex case is crucial to understanding the implications for wealth management, international finance, and the future of Monaco. Continue to follow the unfolding narrative surrounding the Monaco corruption scandal.

Featured Posts

-

Sharp Decline In Amsterdam Stock Index Lowest Point In Over A Year

May 25, 2025

Sharp Decline In Amsterdam Stock Index Lowest Point In Over A Year

May 25, 2025 -

Accessibility And Affordability Examining Over The Counter Birth Control In A Post Roe Landscape

May 25, 2025

Accessibility And Affordability Examining Over The Counter Birth Control In A Post Roe Landscape

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Analysis And Interpretation

May 25, 2025 -

Jordan Bardella And The 2027 French Presidential Election A Realistic Assessment

May 25, 2025

Jordan Bardella And The 2027 French Presidential Election A Realistic Assessment

May 25, 2025 -

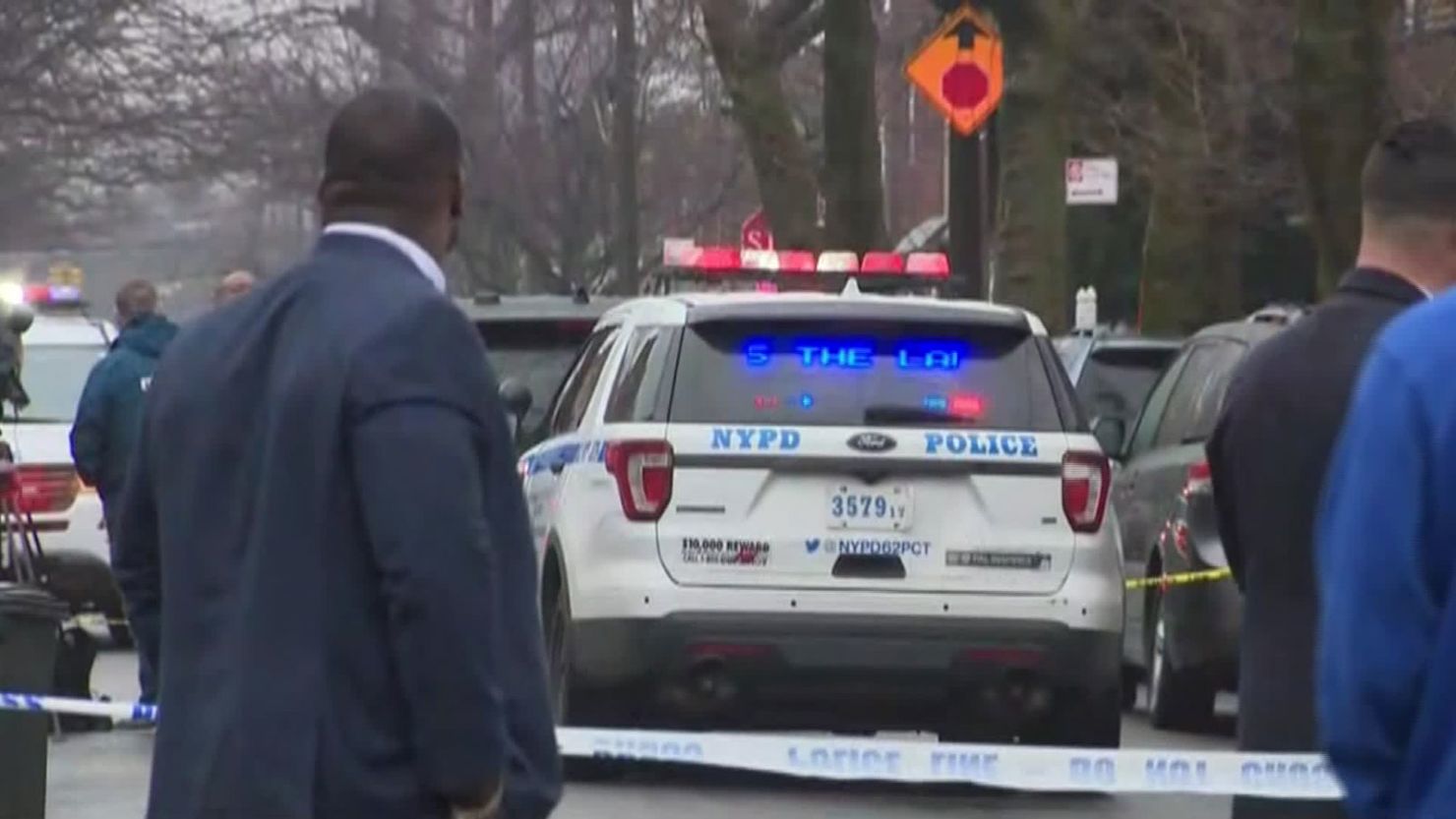

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 25, 2025

Southern Vacation Hotspot Rebuts Negative Safety Rating After Shooting Incident

May 25, 2025

Latest Posts

-

Southern Tourist Destination Rebuts Claims Following Recent Shooting

May 25, 2025

Southern Tourist Destination Rebuts Claims Following Recent Shooting

May 25, 2025 -

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting

May 25, 2025

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting

May 25, 2025 -

Southern Vacation Hot Spot Fights Back Against Negative Safety Assessment

May 25, 2025

Southern Vacation Hot Spot Fights Back Against Negative Safety Assessment

May 25, 2025 -

Sled Investigating Fatal Myrtle Beach Officer Involved Shooting 11 Injured

May 25, 2025

Sled Investigating Fatal Myrtle Beach Officer Involved Shooting 11 Injured

May 25, 2025 -

Southern Vacation Area Fights Back Against Negative Safety Report Following Shooting

May 25, 2025

Southern Vacation Area Fights Back Against Negative Safety Report Following Shooting

May 25, 2025