Action Needed: Important Messages From HMRC Regarding Child Benefit

Table of Contents

Verifying Your Child Benefit Claim Information

HMRC regularly reviews Child Benefit claims to ensure accuracy and prevent fraud. This verification process is vital for maintaining the integrity of the system and protecting taxpayer funds.

Why HMRC Needs to Verify Your Details

HMRC needs to verify your details for several reasons:

- Data Protection: Ensuring your information is accurate and up-to-date protects your identity and benefits.

- Fraud Prevention: Regular checks help HMRC identify and prevent fraudulent claims.

- Changes in Circumstances: Life events such as changes of address, income changes, or changes in family circumstances (e.g., a child turning 16) trigger a review of your entitlement.

Here are some common reasons why HMRC might request information:

- Change of address

- Changes to your income

- Changes in your family circumstances (e.g., birth, death, marriage)

- Discrepancies in your previously submitted information

How to Respond to HMRC's Verification Requests

Responding promptly and accurately to HMRC's requests is essential. Here's how to do it:

- Respond Online: The quickest and easiest way is usually through your online HMRC account.

- Respond by Post: If you don't have online access, you can respond by post using the address provided in their letter.

- Respond by Phone: In some cases, you may be able to clarify information over the phone. However, always keep a record of the call.

Ensure you provide:

- Accurate information: Double-check all details before submitting.

- Complete information: Provide all requested documentation to avoid delays.

- Supporting evidence: This may include payslips, bank statements, or other relevant documents.

Failure to respond or providing inaccurate information can lead to delays or suspension of your benefits.

Understanding Changes to Your Child Benefit Payments

Your Child Benefit payments might change due to various reasons. Understanding these changes is critical to managing your finances effectively.

Potential Reasons for Payment Changes

Several factors can affect your Child Benefit payments:

- Number of Qualifying Children: Changes in the number of children in your care will directly affect the amount you receive.

- Income Changes: If your income exceeds a certain threshold, you might be subject to the High Income Child Benefit Charge. This is a tax on Child Benefit received where one or both parents have an income over £50,000.

- Changes in Circumstances: As mentioned previously, life events can trigger adjustments to your payments.

Here are some examples of scenarios that can affect your payments:

- A child turning 16

- A new child joining your family

- A change in your employment status

- A significant change in your income

Checking Your Payment Details and Reporting Discrepancies

Regularly check your Child Benefit payment details online through your HMRC account. This allows you to identify any discrepancies early.

If you notice any errors or delays:

- Check your account for messages: HMRC often communicates updates and explanations through your online account.

- Contact HMRC directly: If you cannot resolve the issue yourself, contact HMRC using the contact details provided on their website. Keep a record of your contact.

- Gather relevant information: Prepare any documentation that supports your claim, such as payslips or bank statements.

Promptly reporting discrepancies ensures you receive the correct payments and prevents potential future issues.

Avoiding Penalties and Staying Compliant with HMRC

Ignoring HMRC communications regarding your Child Benefit can lead to serious penalties.

Consequences of Ignoring HMRC Communications

The consequences of failing to respond to HMRC requests or providing inaccurate information can be significant:

- Financial penalties: You may face fines for non-compliance.

- Suspension of payments: Your Child Benefit payments may be suspended until the issue is resolved.

- Further investigation: HMRC may conduct a more thorough investigation into your claim, which can be time-consuming and stressful.

Here’s a summary of the potential penalties:

- Late submission penalties: Fines for late responses to requests for information

- Incorrect information penalties: Penalties for providing inaccurate or misleading information

- Potential fraud investigation: Severe consequences for deliberately providing false information

Proactive Steps to Maintain Compliance

Taking proactive steps will help you avoid issues and maintain compliance:

- Update your details promptly: Inform HMRC of any changes to your circumstances immediately.

- Regularly check your HMRC online account: This ensures you're aware of any messages or requests.

- Set reminders: Set reminders for important deadlines, such as annual reviews or income updates.

By taking these proactive steps, you'll significantly reduce the risk of facing penalties and ensure the smooth continuation of your Child Benefit payments.

Conclusion: Take Action on Your HMRC Child Benefit Messages Today

Responding promptly to HMRC communications, verifying your information, and understanding potential changes to your Child Benefit payments are crucial for avoiding penalties and maintaining your entitlement. Ignoring HMRC messages related to your HMRC Child Benefit claim can have serious financial repercussions. Check your HMRC online account immediately and respond to any pending requests related to your Child Benefit updates from HMRC. Understanding your HMRC Child Benefit responsibilities ensures you receive the correct payments and avoid unnecessary complications.

For further information and assistance, visit the official HMRC website: [Insert Link to Relevant HMRC Page Here]. Don't delay – take action on your Child Benefit responsibilities today!

Featured Posts

-

La Chanson De Louane Pour L Eurovision 2024 France

May 20, 2025

La Chanson De Louane Pour L Eurovision 2024 France

May 20, 2025 -

Novo Dijete Jennifer Lawrence Objava I Prve Fotografije

May 20, 2025

Novo Dijete Jennifer Lawrence Objava I Prve Fotografije

May 20, 2025 -

Where Hamilton Falls Short Analyzing Leclercs 2023 Advantage

May 20, 2025

Where Hamilton Falls Short Analyzing Leclercs 2023 Advantage

May 20, 2025 -

Michael Schumacher Une Petite Fille Pour Le Septuple Champion Du Monde

May 20, 2025

Michael Schumacher Une Petite Fille Pour Le Septuple Champion Du Monde

May 20, 2025 -

Un Nou Membru Al Familiei Schumacher Imagini Exclusive

May 20, 2025

Un Nou Membru Al Familiei Schumacher Imagini Exclusive

May 20, 2025

Latest Posts

-

Understanding The Countrys Newest Business Hubs A Data Driven Approach

May 20, 2025

Understanding The Countrys Newest Business Hubs A Data Driven Approach

May 20, 2025 -

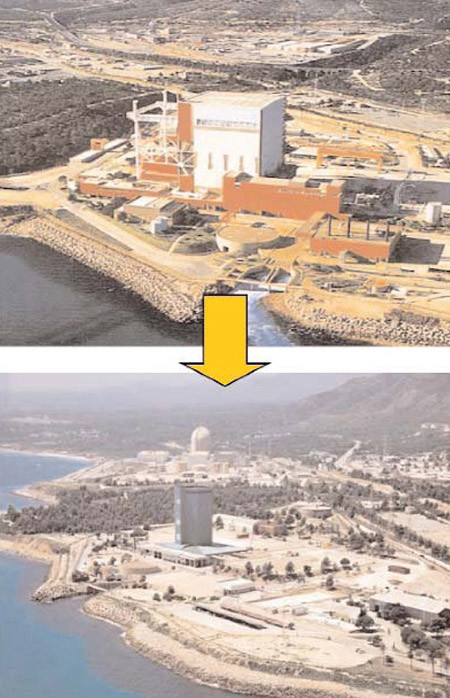

Taiwans Energy Future A Focus On Lng Following Nuclear Plant Decommissioning

May 20, 2025

Taiwans Energy Future A Focus On Lng Following Nuclear Plant Decommissioning

May 20, 2025 -

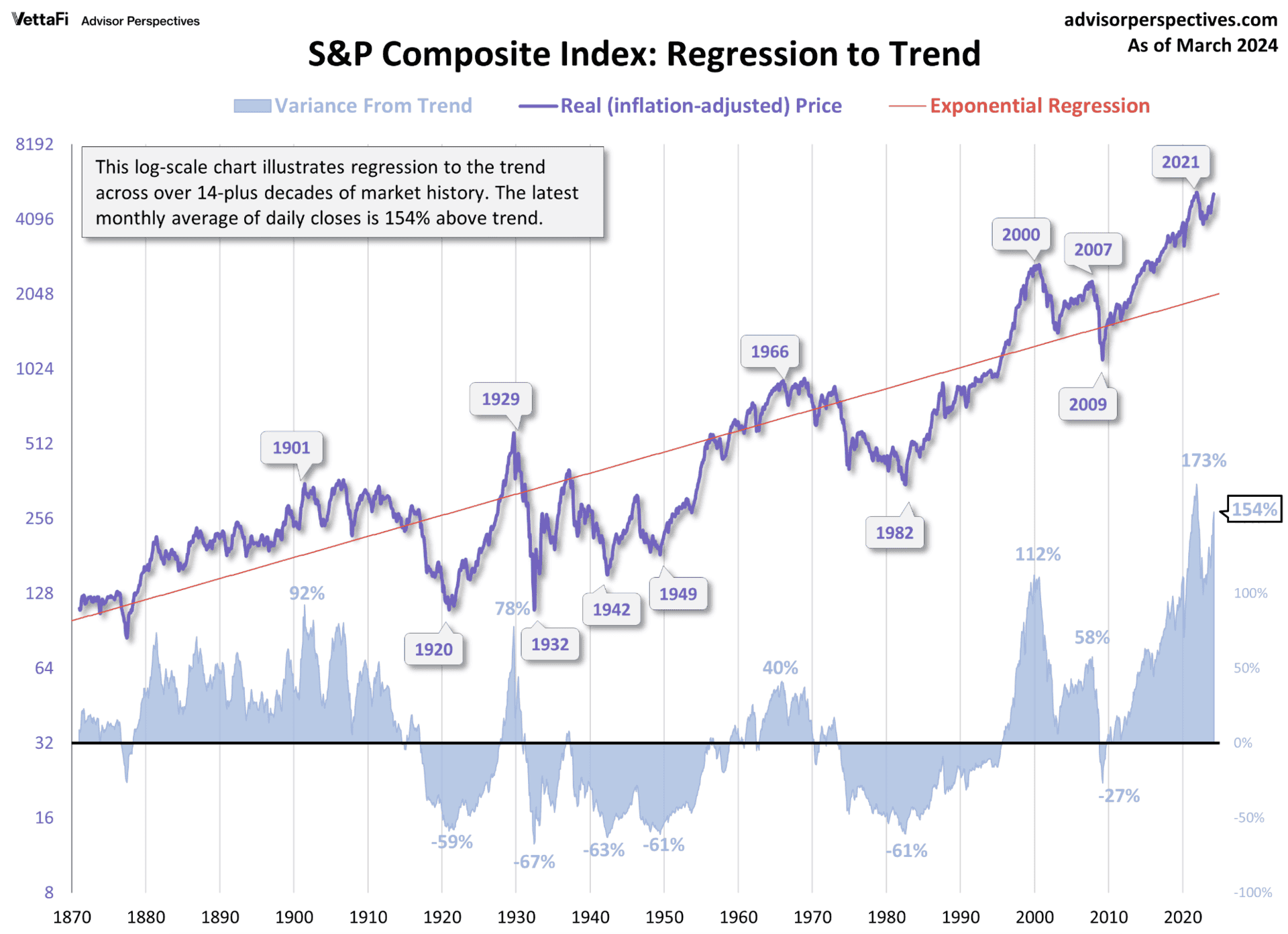

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 20, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 20, 2025 -

New Business Hotspots Regional Trends And Investment Opportunities

May 20, 2025

New Business Hotspots Regional Trends And Investment Opportunities

May 20, 2025 -

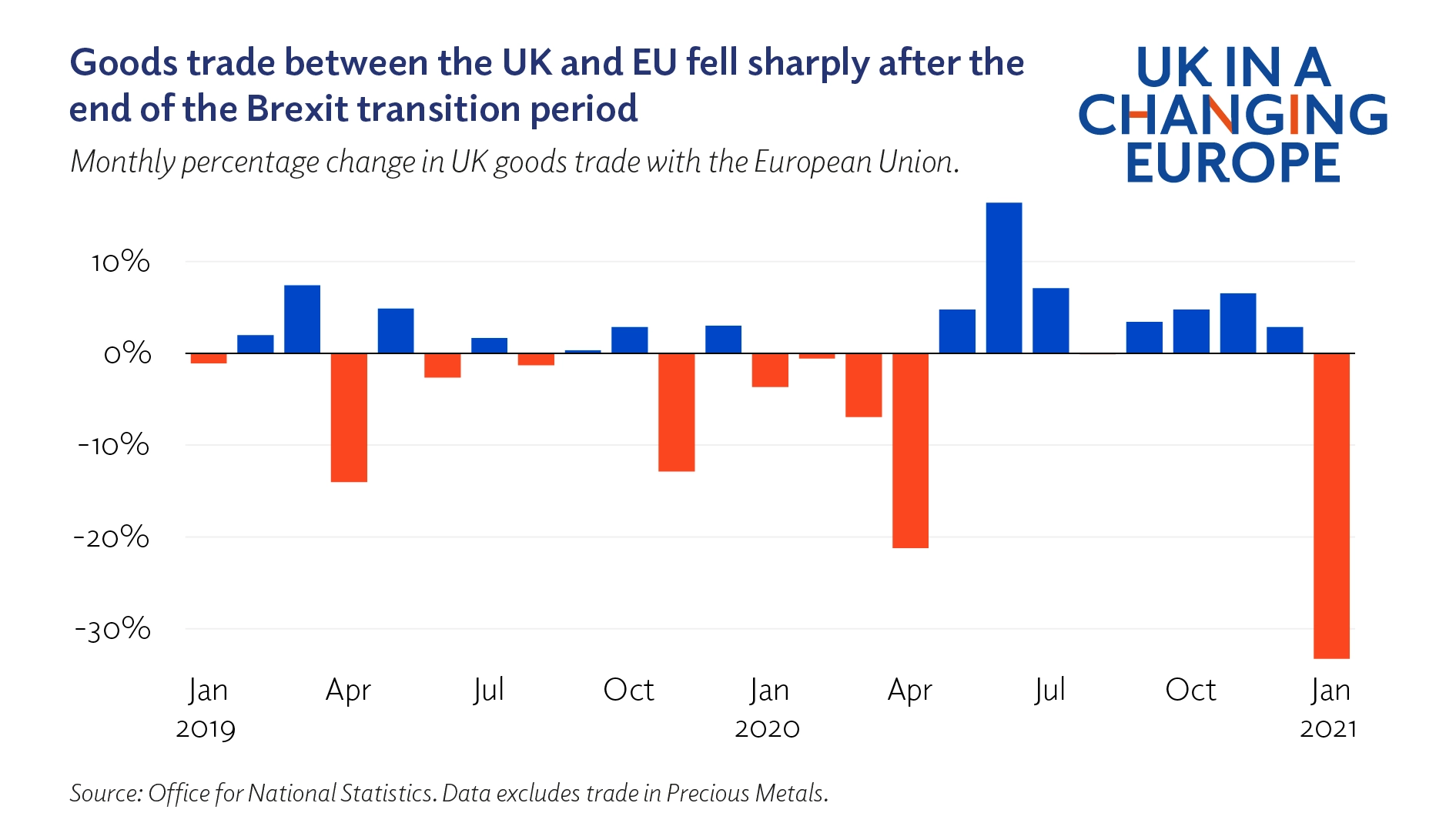

Brexit How Its Hampering Uk Luxury Exports To The Eu

May 20, 2025

Brexit How Its Hampering Uk Luxury Exports To The Eu

May 20, 2025