Airline Industry Faces Headwinds: The Impact Of Oil Supply Disruptions

Table of Contents

Soaring Fuel Costs and their Ripple Effect

Oil is the lifeblood of the aviation industry, and disruptions to its supply have immediate and far-reaching consequences. The resulting price spikes create a ripple effect throughout the sector, impacting everything from profitability to passenger travel.

Increased Operational Expenses

Oil price volatility directly impacts airlines' operational expenses, significantly eroding profitability.

- Increased fuel hedging costs: Airlines often use hedging strategies to protect against price fluctuations, but these strategies become increasingly expensive and less effective during periods of significant disruption.

- Reduced profit margins: The dramatic increase in fuel costs directly eats into already slim profit margins, leaving many airlines struggling to remain financially viable.

- Potential for route cancellations due to unaffordability: Some routes may become economically unviable to operate, leading to service reductions and impacting connectivity for passengers.

Impact on Ticket Prices

Airlines frequently pass on increased fuel costs to consumers, leading to higher airfares.

- Higher airfare prices deterring passengers: Increased ticket prices can significantly reduce demand, particularly impacting price-sensitive leisure travelers.

- Reduced demand: This decreased demand can lead to a vicious cycle, where airlines are forced to further reduce flights, leading to further price increases.

- Impact on leisure and business travel: Both leisure and business travel are affected, with business travel potentially more sensitive to price increases due to corporate travel budgets.

Financial Strain on Airlines

Many airlines operate on relatively thin profit margins, making them particularly vulnerable to significant fuel price increases.

- Difficulty securing loans: Financial institutions may be hesitant to lend to airlines facing increased financial strain due to fuel costs.

- Potential for bankruptcies: In extreme cases, some airlines may face bankruptcy if they are unable to manage the increased fuel costs.

- Reduced investment in fleet upgrades and expansion: Airlines may be forced to postpone or cancel plans for fleet upgrades and expansion, hindering their long-term growth and competitiveness.

Supply Chain Disruptions Beyond Fuel

The impact of oil supply disruptions extends beyond the direct cost of jet fuel; they also disrupt wider supply chains crucial for airline operations.

Aircraft Maintenance and Parts

Oil is a vital component in the manufacturing process of many aircraft parts. Disruptions to oil supply can lead to shortages and delays, affecting maintenance schedules.

- Delays in repairs: Shortages of essential parts can lead to significant delays in aircraft maintenance and repairs, potentially grounding aircraft.

- Increased maintenance costs: The scarcity of parts can drive up prices, increasing the overall cost of aircraft maintenance.

- Potential grounding of aircraft: If critical parts are unavailable, aircraft may need to be grounded, leading to further operational disruptions and financial losses.

Impact on Ground Handling and Services

Fuel supply issues at airports can create ripple effects, impacting ground handling and support services.

- Delays in baggage handling: Fuel shortages can disrupt ground support equipment, leading to delays in baggage handling and processing.

- Ground support equipment malfunctions: Many ground support vehicles rely on fuel, and disruptions can cause malfunctions and delays.

- Overall airport operational inefficiencies: These combined disruptions lead to overall inefficiencies in airport operations, potentially impacting passenger experience and flight schedules.

Strategies for Mitigation and Adaptation

While the challenges posed by oil supply disruptions are significant, airlines are not powerless. Several strategies can be employed to mitigate the impact and adapt to this new reality.

Fuel Hedging and Diversification

Airlines can implement various strategies to manage fuel price volatility.

- Locking in fuel prices: Hedging involves entering into contracts to purchase fuel at a fixed price, protecting against price spikes.

- Exploring alternative fuel sources (biofuels, sustainable aviation fuels): Investing in research and development of alternative, more sustainable fuels can reduce reliance on traditional jet fuel.

- Improving fuel efficiency: Investing in more fuel-efficient aircraft and implementing fuel-saving operational practices can reduce fuel consumption.

Operational Efficiency and Cost Reduction

Airlines can pursue various initiatives to improve efficiency and reduce overall operational costs.

- Streamlining processes: Identifying and eliminating inefficiencies in various operational areas can free up resources.

- Optimizing flight routes: Careful route planning and optimization can minimize fuel consumption.

- Implementing fuel-saving technologies: Adopting advanced technologies that improve fuel efficiency can yield significant savings.

Government Support and Policy

Government intervention plays a vital role in helping the airline industry navigate this challenging period.

- Financial aid packages: Government assistance can provide much-needed financial support during times of crisis.

- Tax breaks: Tax incentives can encourage investment in fuel-efficient technologies and alternative fuel sources.

- Regulatory reforms to encourage fuel efficiency: Government regulations can incentivize the adoption of more fuel-efficient practices and technologies.

Conclusion

Oil supply disruptions pose a serious threat to the airline industry, causing soaring fuel costs, financial instability, and operational challenges. Airlines must proactively implement strategies such as fuel hedging, operational efficiency improvements, and exploration of alternative fuels to navigate these headwinds. Crucially, government support and policy changes are essential in mitigating the impact of oil supply disruptions on the airline industry. Understanding the intricate relationship between oil supply disruptions and the airline industry is vital for ensuring its long-term sustainability. To stay updated on the latest developments and their implications for air travel, continue to monitor news and analysis on the effects of oil supply disruptions on the airline industry.

Featured Posts

-

Hong Kong Monetary Authoritys Us Dollar Purchases Maintaining The Currency Peg

May 04, 2025

Hong Kong Monetary Authoritys Us Dollar Purchases Maintaining The Currency Peg

May 04, 2025 -

Honjo Sheung Wan Hong Kong Modern Japanese Restaurant Review

May 04, 2025

Honjo Sheung Wan Hong Kong Modern Japanese Restaurant Review

May 04, 2025 -

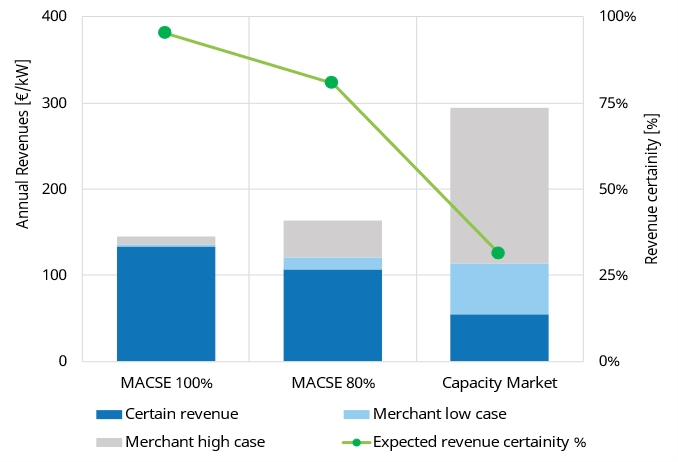

Investment Strategies For A 270 M Wh Bess In The Belgian Merchant Market

May 04, 2025

Investment Strategies For A 270 M Wh Bess In The Belgian Merchant Market

May 04, 2025 -

Jet Zeros Triangular Aircraft Projected 2027 Launch

May 04, 2025

Jet Zeros Triangular Aircraft Projected 2027 Launch

May 04, 2025 -

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025

Navigating The Turbulence Airlines Struggle Amidst Oil Supply Shocks

May 04, 2025

Latest Posts

-

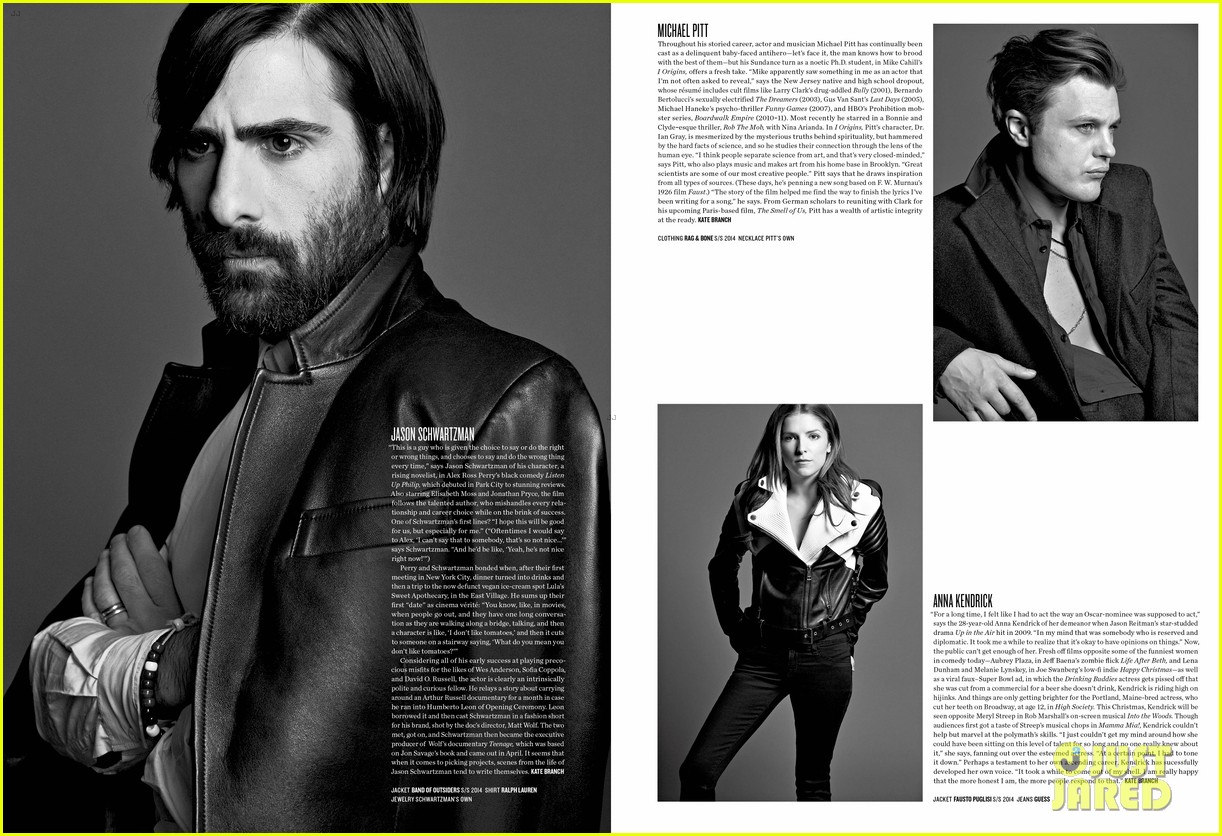

This Summers It Top Anna Kendricks Shell Crop Top

May 04, 2025

This Summers It Top Anna Kendricks Shell Crop Top

May 04, 2025 -

Anna Kendricks Shell Crop Top Trend A Fashion Editors Pick

May 04, 2025

Anna Kendricks Shell Crop Top Trend A Fashion Editors Pick

May 04, 2025 -

I Want Anna Kendricks Glittering Shell Crop Top This Summer

May 04, 2025

I Want Anna Kendricks Glittering Shell Crop Top This Summer

May 04, 2025 -

Did Anna Kendrick Diss Blake Lively At A Simple Favor Screening

May 04, 2025

Did Anna Kendrick Diss Blake Lively At A Simple Favor Screening

May 04, 2025 -

Anna Kendrick Shades Blake Lively A Simple Favor Premiere Moment

May 04, 2025

Anna Kendrick Shades Blake Lively A Simple Favor Premiere Moment

May 04, 2025