Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV Updates And Analysis

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

A UCITS (Undertakings for Collective Investment in Transferable Securities) ETF is a type of exchange-traded fund that complies with EU regulations, offering investors a high level of regulatory protection and transparency. The Amundi Dow Jones Industrial Average UCITS ETF aims to replicate the performance of the DJIA, providing investors with a cost-effective way to track the index's movements. The ETF's portfolio consists of the 30 constituent companies of the DJIA, a carefully selected group of leading American companies representing various sectors of the economy. This diversification helps to mitigate risk. The ETF boasts a competitive expense ratio, meaning a lower percentage of your investment goes to fees. Other key characteristics include its liquidity and ease of trading on major exchanges.

- Low-cost investment in the DJIA: Gain access to the top 30 US companies without high management fees.

- Diversification across leading US companies: Reduce investment risk through broad exposure to a variety of sectors.

- Transparency and regulatory oversight (UCITS compliant): Benefit from stringent EU regulations ensuring investor protection and fund transparency.

- Accessibility for various investors: Easy to buy and sell through brokerage accounts, making it accessible to a broad range of investors.

Daily NAV Updates and Their Significance

The NAV (Net Asset Value) of an ETF represents the market value of its underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the daily NAV reflects the combined value of the 30 constituent companies' shares, adjusted for expenses. Daily fluctuations in the NAV directly correspond to the movements of the DJIA. A rising DJIA generally leads to a rising NAV, and vice versa. Monitoring these daily updates is critical for several reasons: it allows investors to track the ETF's performance against the benchmark index, gauge potential investment timing, and assess the overall risk and return of their investment.

- Daily NAV provides a snapshot of the ETF's value: A daily update allows you to see the current worth of your investment.

- Changes in NAV indicate the ETF's performance relative to the DJIA: Tracking the NAV helps you evaluate how effectively the ETF tracks the DJIA.

- Tracking NAV helps investors assess risk and return: By analyzing NAV movements over time, investors can get a better understanding of the ETF's volatility.

- Where to find reliable daily NAV data: Consult Amundi's official website, reputable financial news sources, or your brokerage platform for accurate daily NAV information.

Analyzing NAV Trends and Performance

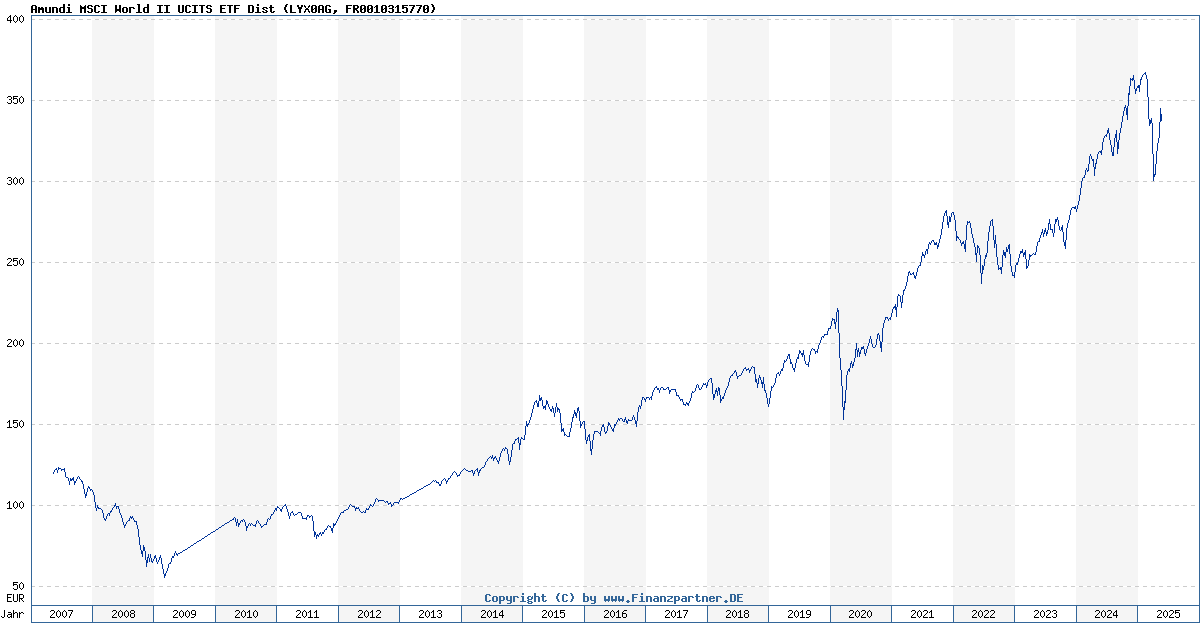

Analyzing the daily NAV data involves examining patterns and trends over time. Visualizing these movements using charts and graphs can be particularly helpful in identifying significant changes and potential turning points. Comparing the ETF's NAV to the DJIA's performance reveals the tracking error – the difference between the ETF's returns and the index's returns. This helps determine how effectively the ETF mirrors the index. Several factors, including overall market sentiment, economic news announcements, and the individual performance of the 30 constituent companies, influence the ETF's NAV fluctuations.

- Comparing NAV to the DJIA index: Assess the ETF's tracking accuracy against its benchmark.

- Identifying upward and downward trends: Spot long-term growth or decline patterns.

- Assessing volatility and risk: Understand how much the NAV fluctuates and its implications for your investment.

- Long-term performance analysis vs. short-term fluctuations: Distinguish between short-term market noise and meaningful long-term trends.

Using Daily NAV for Investment Strategies

Investors can use daily NAV updates to refine their investment strategies. Dollar-cost averaging, a strategy involving regular investments regardless of market fluctuations, can be employed. However, attempting market timing based solely on daily NAV changes is risky and generally not recommended without thorough analysis and professional advice. Remember that diversification is essential; the Amundi Dow Jones Industrial Average UCITS ETF should be part of a well-diversified portfolio, not your sole investment.

- Regular investment based on NAV trends: Employ dollar-cost averaging for consistent investment.

- Rebalancing portfolio based on NAV fluctuations: Adjust your holdings based on performance to maintain your desired asset allocation.

- Risk management and stop-loss orders: Protect your capital by setting limits on potential losses.

- Importance of professional financial advice: Consult a financial advisor for personalized guidance tailored to your investment goals and risk tolerance.

Conclusion

Monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is vital for making informed investment decisions. By analyzing NAV trends, comparing it to the DJIA's performance, and understanding the factors influencing these fluctuations, investors can better assess risk and return. Remember that daily NAV changes should be considered within a broader investment strategy, encompassing diversification and a long-term perspective. Stay updated on the Amundi Dow Jones Industrial Average UCITS ETF's daily NAV and optimize your investment strategy. Utilize resources like Amundi's website and reputable financial news sources to stay informed and make sound investment choices.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 24, 2025 -

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025

Onko Tuukka Taponen F1 Kuljettaja Jo Taenae Vuonna Uudet Tiedot

May 24, 2025 -

Bbc Big Weekend 2025 Sefton Park A Ticket Buyers Guide

May 24, 2025

Bbc Big Weekend 2025 Sefton Park A Ticket Buyers Guide

May 24, 2025 -

Assessing The National Rallys Sunday Demonstration A Lower Than Expected Turnout For Le Pen

May 24, 2025

Assessing The National Rallys Sunday Demonstration A Lower Than Expected Turnout For Le Pen

May 24, 2025

Latest Posts

-

Onrust Op Wall Street Waarom Presteert De Aex Beter

May 24, 2025

Onrust Op Wall Street Waarom Presteert De Aex Beter

May 24, 2025 -

Aex Stijgt Terwijl Amerikaanse Beurzen Dalen Analyse Van De Markttrends

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurzen Dalen Analyse Van De Markttrends

May 24, 2025 -

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025 -

Amsterdam Stock Market Trade War Fears Trigger 7 Opening Drop

May 24, 2025

Amsterdam Stock Market Trade War Fears Trigger 7 Opening Drop

May 24, 2025 -

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025