Amundi MSCI All Country World UCITS ETF USD Acc: Daily NAV And Its Significance For Investors

Table of Contents

Daily NAV Calculation and its Components

The Amundi MSCI All Country World UCITS ETF USD Acc daily NAV represents the value of the ETF's underlying assets per share. It's calculated at the end of each trading day, reflecting the market value of all the holdings within the ETF, which tracks the MSCI All Country World Index. This index provides broad exposure to global equities, offering diversification across various sectors and countries.

Several factors influence the daily NAV:

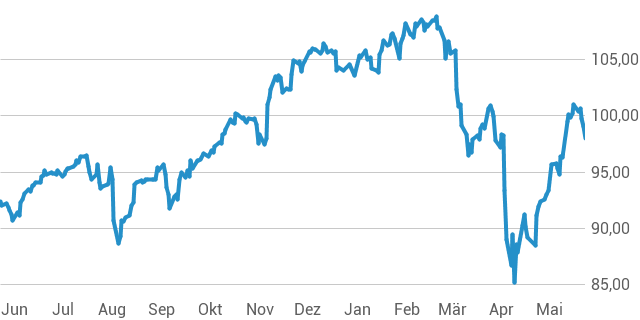

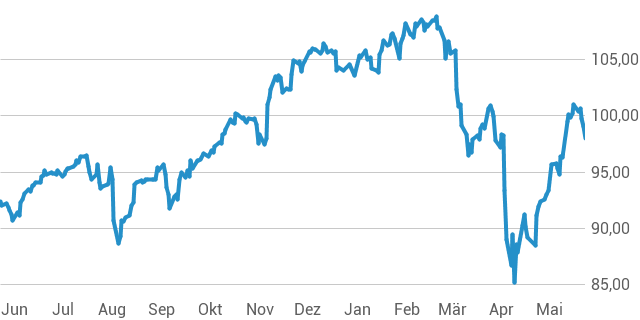

- Market Fluctuations: The primary driver of NAV changes is the daily performance of the stocks within the MSCI All Country World Index. A rising market generally leads to a higher NAV, while a falling market leads to a lower NAV.

- Currency Exchange Rates: As the ETF is denominated in USD, fluctuations in exchange rates between the USD and other currencies impact the value of non-USD assets held within the ETF.

- Dividend Payouts: When companies within the index pay dividends, the ETF receives these payments, which are then reinvested or distributed to shareholders, affecting the NAV.

- Underlying Assets: The NAV is directly determined by the combined market value of all the individual securities (stocks, bonds, etc.) that make up the ETF’s holdings. Changes in the value of these assets directly translate into changes in the ETF's NAV. Keywords: NAV calculation, underlying assets, market fluctuations, currency exchange rates, dividend reinvestment.

Interpreting the Daily NAV for Investment Decisions

Investors use the daily NAV to monitor their investment performance in the Amundi MSCI All Country World UCITS ETF USD Acc. By tracking NAV changes over time, they can calculate their returns. This is done by comparing the initial purchase price (based on the NAV at the time of purchase) to the current NAV.

- Return Calculation: (Current NAV - Purchase NAV) / Purchase NAV * 100% = Percentage Return

It’s essential to remember that daily NAV fluctuations can be volatile. While monitoring daily changes is informative, focusing solely on short-term movements can be misleading. Long-term performance should be the primary focus when evaluating the success of your investment in this ETF. Keywords: Investment performance, return calculation, long-term investment, portfolio monitoring, ETF returns.

Accessing Amundi MSCI All Country World UCITS ETF USD Acc Daily NAV Data

Reliable access to accurate daily NAV data is crucial. Investors can find this information from several sources:

- Official ETF Website: The Amundi website is the most reliable source for official NAV data.

- Financial News Websites: Many reputable financial news sources provide ETF data, including daily NAVs. However, always verify the accuracy of the information.

- Brokerage Platforms: If you hold the Amundi MSCI All Country World UCITS ETF USD Acc through a brokerage account, the platform will typically display the daily NAV.

Remember to choose a credible and reputable source to ensure data accuracy. The NAV is usually updated at the close of each trading day. Keywords: NAV data sources, reliable data, brokerage platforms, financial news, ETF website, data accuracy.

The Significance of Daily NAV for Long-Term Investment Strategies

Consistent monitoring of the Amundi MSCI All Country World UCITS ETF USD Acc daily NAV is vital for long-term success. It helps inform strategic investment decisions:

- Portfolio Rebalancing: By tracking the NAV, you can monitor your portfolio's allocation and rebalance as needed to maintain your desired asset allocation.

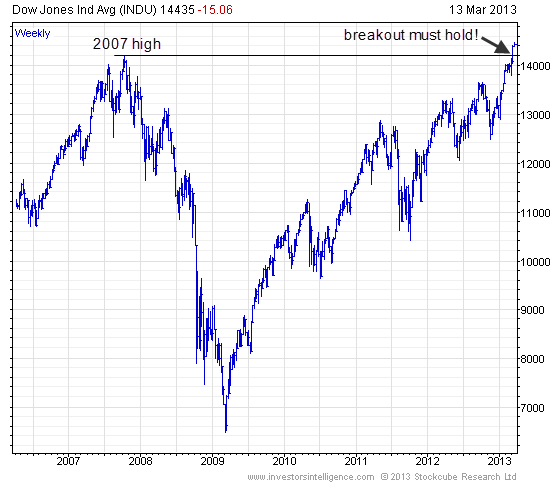

- Market Trend Analysis: Analyzing NAV movements over time can help you understand broader market trends and adjust your investment strategy accordingly.

- Informed Investing: Understanding how the daily NAV is influenced by global market events allows for more informed and timely investment decisions. Keywords: Long-term strategy, portfolio rebalancing, market trends, investment decisions, informed investing.

Conclusion: Daily NAV and Your Amundi MSCI All Country World UCITS ETF USD Acc Investment

Understanding the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for effective investment management. We've explored how it's calculated, the factors influencing it, and how to access reliable data. Remember that while daily fluctuations are informative, long-term performance should be the primary focus. This globally diversified ETF offers exposure to a wide range of markets, providing potential for growth over the long term. Regularly monitoring your Amundi MSCI All Country World UCITS ETF USD Acc daily NAV will empower you to make informed decisions and effectively manage your investment portfolio. Start researching the Amundi MSCI All Country World UCITS ETF USD Acc today, monitor its daily NAV, and consider incorporating it into your investment strategy. Keywords: Amundi MSCI All Country World UCITS ETF, Daily NAV, Global Diversification, Investment Strategy, ETF Investment, Portfolio Management.

Featured Posts

-

The Undervalued Gems Of News Corp Uncovering Hidden Potential

May 24, 2025

The Undervalued Gems Of News Corp Uncovering Hidden Potential

May 24, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc A Guide To Net Asset Value

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Latest Posts

-

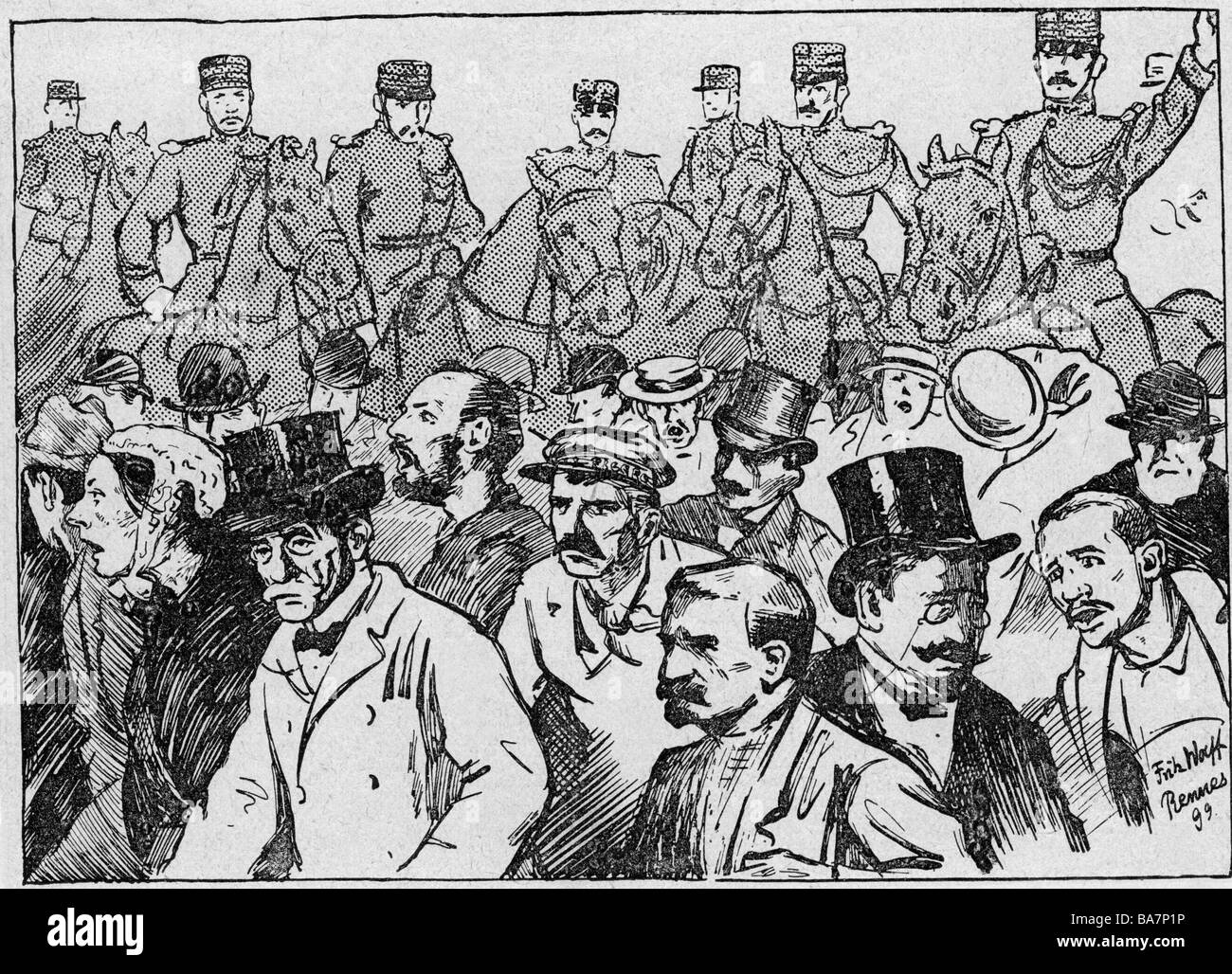

France To Reassess Dreyfus Affair Proposal For Posthumous Military Promotion

May 24, 2025

France To Reassess Dreyfus Affair Proposal For Posthumous Military Promotion

May 24, 2025 -

French Pms Policies Under Scrutiny Former Pm Speaks Out

May 24, 2025

French Pms Policies Under Scrutiny Former Pm Speaks Out

May 24, 2025 -

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Promotion

May 24, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Promotion

May 24, 2025 -

Macron Faces Criticism From Former French Prime Minister

May 24, 2025

Macron Faces Criticism From Former French Prime Minister

May 24, 2025 -

Seeking Change Facing Punishment Navigating Reprisals

May 24, 2025

Seeking Change Facing Punishment Navigating Reprisals

May 24, 2025