Amundi MSCI All Country World UCITS ETF USD Acc: Daily NAV Updates And Analysis

Table of Contents

Daily NAV Updates and Where to Find Them

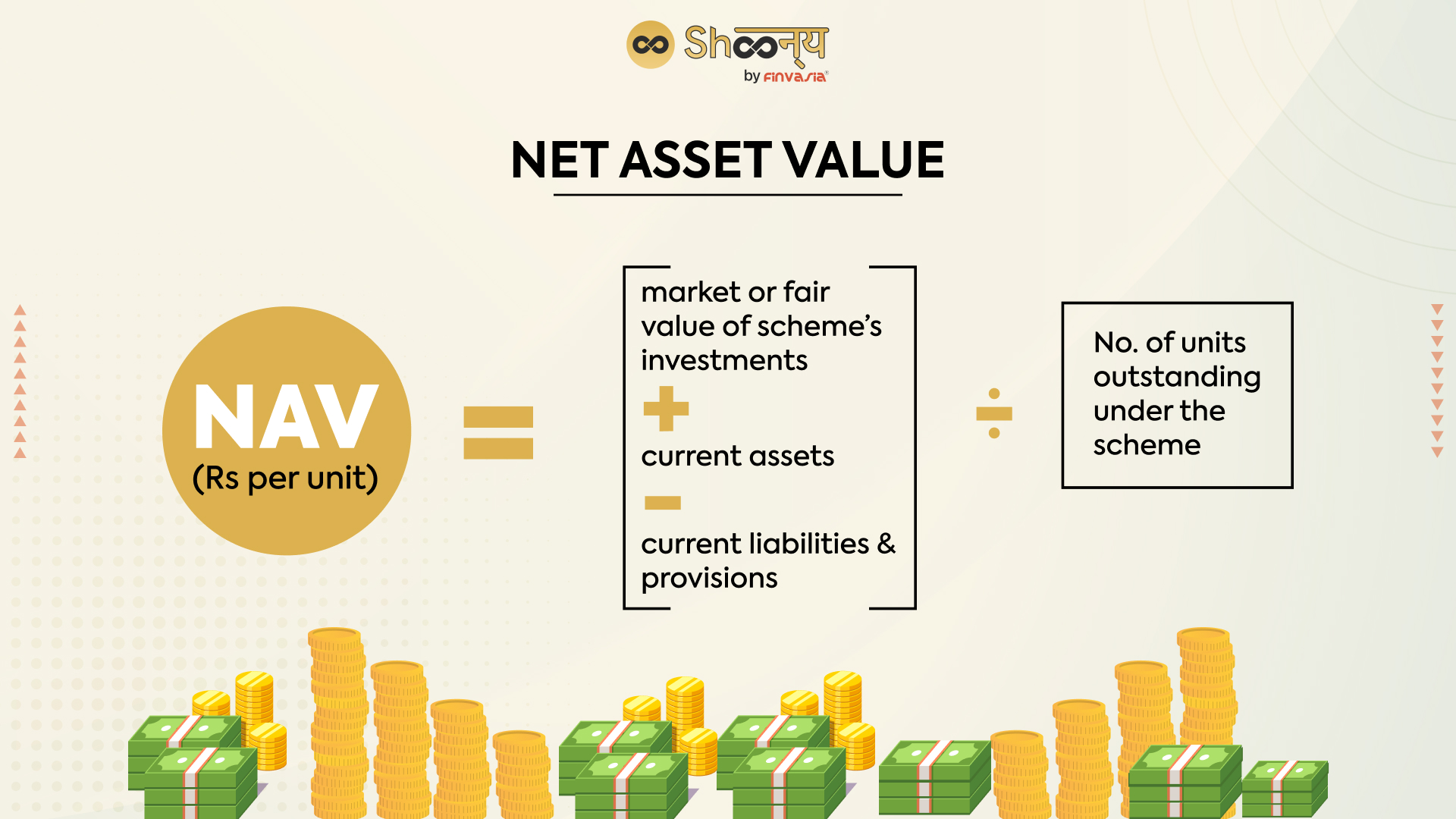

The daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc reflects the current market value of the ETF's underlying assets. Understanding this value is critical for assessing your investment's performance and making informed decisions. Regularly tracking the NAV allows you to monitor your investment's growth or decline relative to the benchmark index and other market indicators.

Reliable sources for accessing the ETF's daily NAV include:

- Official Amundi Website: The Amundi website is the primary source for official NAV data. You'll typically find this information within the ETF's fact sheet or dedicated product page.

- Major Financial Data Providers: Reputable financial data providers like Bloomberg, Refinitiv, and Yahoo Finance often include real-time or delayed NAV data for major ETFs.

- Your Brokerage Account: Most brokerage platforms display the NAV of your held investments, offering convenient access to your Amundi MSCI All Country World UCITS ETF USD Acc holdings.

The NAV is typically updated at the end of the trading day, reflecting the closing prices of the underlying assets. It's important to note the distinction between the bid and ask prices. The bid price is what a buyer is willing to pay, while the ask price is what a seller is willing to accept. The NAV represents the theoretical price per share, sitting between the bid and ask.

Factors Influencing the Amundi MSCI All Country World UCITS ETF USD Acc NAV

The Amundi MSCI All Country World UCITS ETF USD Acc aims to track the performance of the MSCI All Country World Index, a broad market capitalization-weighted index representing large, mid, and small-cap equities across developed and emerging markets globally. Therefore, several factors influence its daily NAV:

- Global Economic Growth: Strong global economic growth generally leads to higher company earnings and subsequently, a higher NAV.

- Interest Rate Changes: Interest rate hikes can impact stock valuations, potentially influencing the ETF's NAV.

- Inflation Rates: High inflation can erode purchasing power and affect company profits, impacting the ETF's NAV.

- Geopolitical Risks: Geopolitical instability and global events can cause significant market volatility and affect the NAV.

- Currency Exchange Rates: As the ETF is USD-denominated, fluctuations in exchange rates against other currencies can affect the value of the underlying assets and, consequently, the NAV.

- Individual Stock Performance: The performance of individual companies within the MSCI All Country World Index directly impacts the ETF's overall NAV.

Analyzing the Amundi MSCI All Country World UCITS ETF USD Acc NAV Trends

Analyzing NAV trends over various timeframes is crucial for understanding the ETF's performance and potential investment strategies.

- Short-Term Trends (Daily, Weekly): These trends can reveal short-term market volatility and sentiment.

- Medium-Term Trends (Monthly, Quarterly): Analyzing these trends provides insights into the ETF's performance relative to broader market movements.

- Long-Term Trends (Yearly): Long-term trends illustrate the ETF's overall growth potential and help in assessing long-term investment strategies.

Visualizing NAV trends through charts and graphs is essential. Comparing the ETF's performance to its benchmark, the MSCI All Country World Index, is equally critical to understand how well it’s tracking its target. Tools like moving averages and other technical analysis methods can enhance your understanding of NAV trends.

Risks Associated with Investing in the Amundi MSCI All Country World UCITS ETF USD Acc

Like any investment, the Amundi MSCI All Country World UCITS ETF USD Acc carries inherent risks:

- Market Risk: The potential for investment losses due to market fluctuations is a primary risk.

- Currency Risk: Fluctuations in USD exchange rates can negatively impact the value of the ETF for investors holding other currencies.

- Counterparty Risk: There's a risk associated with the ETF issuer, Amundi, potentially defaulting on its obligations.

- Geopolitical Risk: Unforeseen global events and geopolitical tensions can significantly impact the ETF's performance.

Conclusion: Staying Informed about the Amundi MSCI All Country World UCITS ETF USD Acc

Regularly monitoring the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for informed investment decisions. Understanding the factors influencing the NAV, utilizing analytical tools to interpret trends, and acknowledging the associated risks are all essential for successful investing. Remember to carefully consider your investment goals and risk tolerance before investing. To make well-informed choices, regularly check the Amundi MSCI All Country World UCITS ETF USD Acc's daily NAV and conduct thorough research, including reviewing the ETF's prospectus and other relevant documentation. Track the Amundi MSCI All Country World UCITS ETF USD Acc NAV and monitor your Amundi MSCI All Country World UCITS ETF USD Acc investment to make the most of your investment strategy.

Featured Posts

-

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025 -

Sew A Lei Win A Prize Hawaii Keiki Art Contest For Memorial Day

May 24, 2025

Sew A Lei Win A Prize Hawaii Keiki Art Contest For Memorial Day

May 24, 2025 -

Glastonbury 2025 Headliners A Controversial Choice

May 24, 2025

Glastonbury 2025 Headliners A Controversial Choice

May 24, 2025 -

Memorial Day 2025 Air Travel Avoid These Crowded Days

May 24, 2025

Memorial Day 2025 Air Travel Avoid These Crowded Days

May 24, 2025 -

Live Concert Conchita Wurst And Jj At Eurovision Village Esc 2025

May 24, 2025

Live Concert Conchita Wurst And Jj At Eurovision Village Esc 2025

May 24, 2025

Latest Posts

-

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 24, 2025 -

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Net Asset Value Nav Of Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 24, 2025

Net Asset Value Nav Of Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 24, 2025 -

The Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Nav

May 24, 2025

The Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Nav

May 24, 2025