Amundi MSCI World Ex-US UCITS ETF Acc: NAV Calculation And Implications

Table of Contents

Components of the Amundi MSCI World ex-US UCITS ETF Acc NAV

The Amundi ETF's NAV represents the net value of its underlying assets. Understanding its components is vital for grasping the overall value of your investment. The Amundi ETF primarily invests in a diversified portfolio of equities from developed markets excluding the United States, as reflected in the MSCI World ex-US index.

-

Market Value of Underlying Assets: This is the primary component, reflecting the current market prices of all the equities held within the ETF. These prices are typically determined by the closing prices on relevant stock exchanges.

-

Accrued Income: This includes any dividends or interest earned on the underlying assets but not yet distributed to the ETF. These amounts are added to the NAV calculation.

-

Expenses: The ETF incurs various expenses, including management fees, administrative costs, and other operational expenses. These are deducted from the total asset value.

-

Currency Conversion Effects: As the Amundi ETF invests globally, currency fluctuations between the base currency (likely EUR) and the currencies of the underlying assets can influence the NAV. These effects are incorporated into the calculation.

-

Liabilities: This encompasses any outstanding obligations or liabilities the ETF may have, such as payable expenses or other financial commitments. These are subtracted from the total asset value.

Therefore, the NAV is calculated as: Total Market Value of Assets + Accrued Income - Expenses - Liabilities ± Currency Conversion Effects.

The NAV Calculation Process for the Amundi MSCI World ex-US UCITS ETF Acc

The Amundi ETF's NAV is calculated daily, usually at the close of the relevant market. This process ensures the NAV reflects the most up-to-date market valuation of the underlying assets.

-

Daily Market Data Collection: The ETF's administrator collects the closing prices for all the underlying equities from the respective exchanges.

-

Aggregation of Asset Values: These individual market values are then aggregated to determine the total market value of the ETF's holdings.

-

Deduction of Expenses and Liabilities: The aforementioned expenses and liabilities are deducted from the total market value.

-

Publication of NAV: The calculated NAV is then published and made available to investors, often through the ETF provider's website and financial data platforms. Independent valuation agents may be involved to ensure accuracy and transparency.

This daily calculation ensures that the price of the ETF shares reflects the true value of the underlying assets.

Implications of NAV for Amundi MSCI World ex-US UCITS ETF Acc Investors

The NAV significantly impacts several aspects of your investment in the Amundi ETF.

-

Daily Price Fluctuations: Changes in the NAV directly affect the ETF's share price, leading to daily price fluctuations.

-

Return Calculation: Your investment return is calculated based on changes in the NAV over your holding period.

-

Investment Timing: Understanding NAV trends can help you make informed decisions regarding investment timing (buying or selling).

-

Tax Implications: NAV is crucial for determining capital gains or losses for tax purposes at the time of sale.

-

Performance Comparison: By tracking the NAV, you can effectively compare the Amundi ETF's performance against similar ETFs and benchmarks.

Comparing the Amundi MSCI World ex-US UCITS ETF Acc NAV to Competitors

While the Amundi ETF employs a standard NAV calculation methodology, a comparison with similar World ex-US ETFs is valuable. Variations might exist in the frequency of calculation, currency conversion practices, or the treatment of specific expenses. The Amundi ETF's specific methodology, as outlined above, aims for transparency and accuracy, reflecting the true value of the underlying assets. This thorough approach may offer certain advantages over ETFs with less detailed methodologies. However, it’s important to compare the total expense ratio (TER) and the tracking error to ensure it's competitive.

Conclusion: Making Informed Decisions with Amundi MSCI World ex-US UCITS ETF Acc NAV Data

Understanding the Amundi MSCI World ex-US UCITS ETF Acc's NAV calculation is essential for informed investment decisions. By grasping the components of NAV, the calculation process, and its implications, you can better assess the ETF's performance, manage your investment effectively, and optimize your portfolio. Regularly reviewing the NAV alongside other performance indicators empowers you to make confident choices. Learn more about the Amundi MSCI World ex-US UCITS ETF Acc and its NAV calculation by visiting [link to relevant resource]. Understand your ETF investments better by regularly reviewing the Net Asset Value.

Featured Posts

-

Finding Your Dream Country Home For Under 1 Million

May 24, 2025

Finding Your Dream Country Home For Under 1 Million

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Life

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Life

May 24, 2025 -

Astonishing 90mph Refueling Police Chase Ends In Dramatic Text And Refuel

May 24, 2025

Astonishing 90mph Refueling Police Chase Ends In Dramatic Text And Refuel

May 24, 2025 -

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Latest Posts

-

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025 -

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025 -

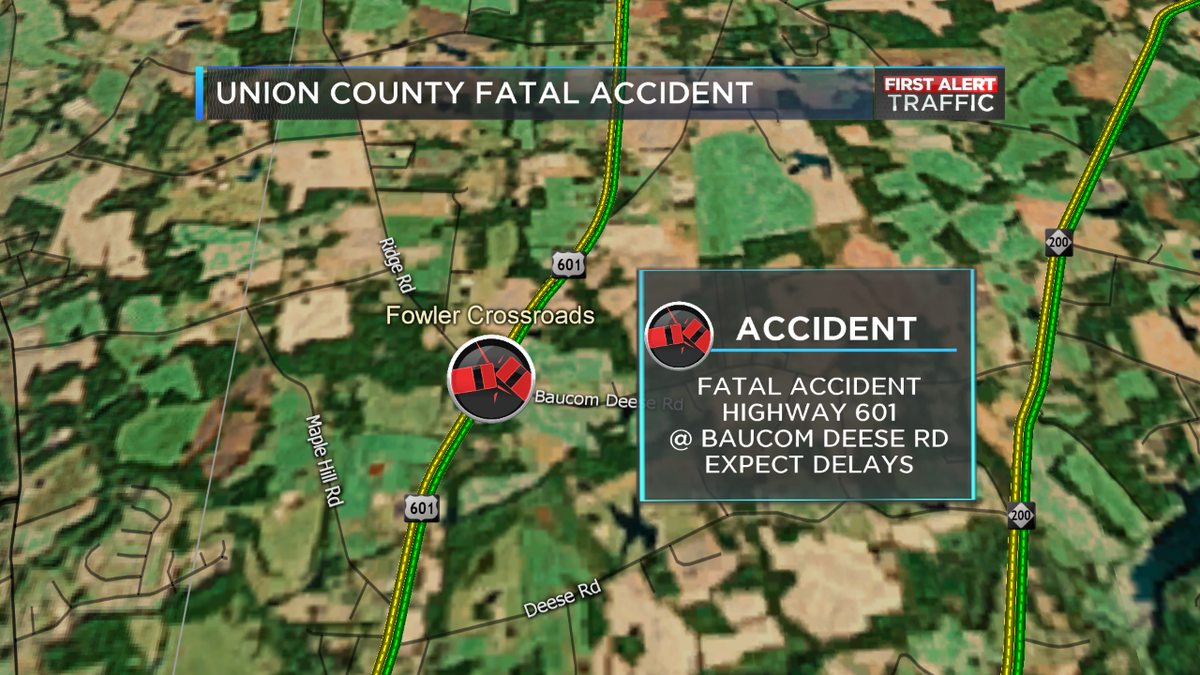

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025