Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Analysis And Investment Implications

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

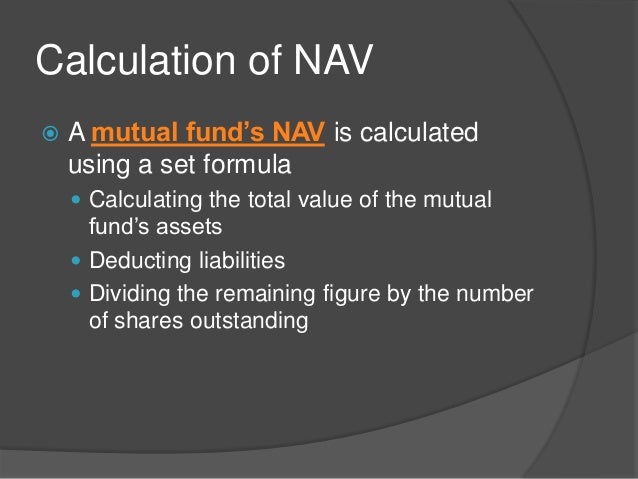

The Net Asset Value (NAV) represents the underlying value of an ETF's assets per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV calculation considers the value of its holdings (a diversified portfolio of global equities mirroring the MSCI World Index) and then applies a currency hedge to mitigate fluctuations against the US dollar. This is a critical distinction, as the hedging directly impacts the final NAV figure.

Several factors influence the daily NAV fluctuations of this ETF:

- Market Movements: The primary driver is the performance of the underlying global equities. Positive market movements generally increase the NAV, and vice-versa.

- Currency Exchange Rates: Even with hedging, subtle shifts in exchange rates can impact the NAV, although the effect is significantly reduced compared to an unhedged ETF.

- Dividend Distributions: Dividend payments from the underlying companies in the ETF's portfolio affect the NAV. After a dividend distribution, the NAV will usually decrease slightly, reflecting the payout.

Bullet points:

- Impact of currency fluctuations on the hedged NAV: While hedging reduces the impact, residual currency movements still exert minor influence.

- Relationship between NAV and ETF share price: The ETF's share price typically tracks the NAV closely, though minor discrepancies can exist due to trading activity.

- Importance of tracking the NAV over time for performance assessment: Monitoring the NAV trend helps investors gauge the ETF's long-term performance and compare it to benchmarks and other investment options.

Analyzing Historical NAV Performance

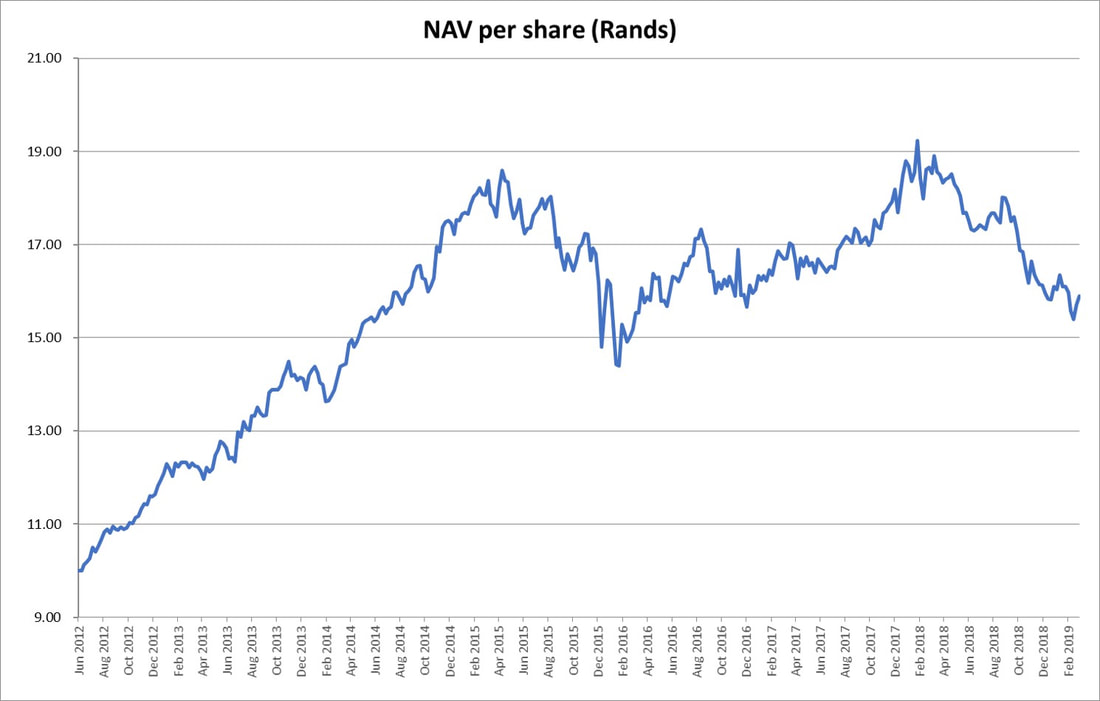

[Insert a historical chart of Amundi MSCI World II UCITS ETF USD Hedged Dist NAV here. The chart should show at least 3-5 years of data].

The chart above illustrates the historical NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Analysis reveals periods of robust growth, often correlated with positive global market sentiment, and periods of decline, typically linked to global economic downturns or geopolitical events.

Bullet points:

- Highlight periods of strong and weak NAV performance: Identify specific events (e.g., market corrections, economic crises) that significantly impacted the NAV.

- Discuss the impact of global events on NAV: Analyze how factors like interest rate changes, inflation, and global conflicts affected the ETF's NAV.

- Compare performance against similar ETFs: Compare its performance with other globally diversified ETFs to determine its relative strength and weaknesses. Analyzing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV against similar unhedged ETFs will highlight the benefits of the currency hedge.

Investment Implications of NAV Analysis

Analyzing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV plays a crucial role in formulating informed investment decisions. Regular monitoring allows investors to assess the ETF's performance against their expectations and adjust their investment strategy accordingly.

Bullet points:

- Strategies for using NAV data for long-term investment: Long-term investors can use consistent NAV tracking to assess the ETF’s long-term growth potential and make adjustments based on broader economic trends.

- Using NAV to identify potential entry and exit points: While not a standalone indicator, NAV trends can inform potential buy or sell decisions in conjunction with other market analyses.

- Importance of diversification in mitigating NAV-related risks: Diversifying your overall investment portfolio reduces the impact of any single asset’s NAV fluctuations.

Currency Hedging and its Impact on NAV

The USD-hedged feature of the Amundi MSCI World II UCITS ETF USD Hedged Dist is designed to mitigate the impact of currency fluctuations on the NAV for investors whose base currency is the US dollar. This minimizes the risk associated with holding international equities.

Bullet points:

- Explain the mechanics of currency hedging: The ETF likely uses financial instruments like forward contracts or options to offset currency risks.

- How hedging mitigates currency risk: Hedging reduces the volatility caused by changes in exchange rates between the currencies of the underlying assets and the USD.

- Potential downsides of currency hedging (e.g., hedging costs): While hedging protects against currency risk, it also incurs costs which can slightly reduce overall returns.

Conclusion

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is fundamental for successful investing. Careful analysis of historical NAV performance, combined with an awareness of the factors influencing its fluctuations, helps investors assess risk and return, make informed buy/sell decisions, and optimize their investment strategies. Remember that the NAV is only one piece of the puzzle; consider the expense ratio, management fees, and your overall investment goals before investing in this or any ETF. Conduct thorough research and regularly monitor the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and other relevant metrics to ensure your investment aligns with your financial objectives. Remember that consistent monitoring of your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is key to long-term success.

Featured Posts

-

Leeds United And Kyle Walker Peters Latest Transfer News

May 25, 2025

Leeds United And Kyle Walker Peters Latest Transfer News

May 25, 2025 -

2023 Porsche Macan Buyers Guide A Comprehensive Overview

May 25, 2025

2023 Porsche Macan Buyers Guide A Comprehensive Overview

May 25, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Performance And Analysis

May 25, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Performance And Analysis

May 25, 2025 -

Porsche 911 80 Millio Forintert Csak Az Extrak

May 25, 2025

Porsche 911 80 Millio Forintert Csak Az Extrak

May 25, 2025 -

A Relaxing Escape To The Country Choosing The Right Property

May 25, 2025

A Relaxing Escape To The Country Choosing The Right Property

May 25, 2025

Latest Posts

-

Analyzing The Amundi Dow Jones Industrial Average Ucits Etfs Net Asset Value Nav

May 25, 2025

Analyzing The Amundi Dow Jones Industrial Average Ucits Etfs Net Asset Value Nav

May 25, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav And Performance

May 25, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav And Performance

May 25, 2025 -

Waiting For The Call A Reflection

May 25, 2025

Waiting For The Call A Reflection

May 25, 2025