Amundi MSCI World Catholic Principles UCITS ETF Acc: NAV Performance And Analysis

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc

This ETF aims to track the performance of the MSCI World Index while adhering to specific investment criteria rooted in Catholic principles. It achieves this by meticulously selecting stocks that align with these principles while excluding companies involved in activities deemed contrary to them.

- ESG Integration with Catholic Social Teaching: The ETF incorporates ESG factors aligned with Catholic social teaching, prioritizing companies demonstrating strong environmental stewardship, social responsibility, and good governance. This involves considering factors like fair labor practices, human rights, and environmental protection.

- Exclusion Criteria: Companies involved in activities such as the production of weapons, alcohol, gambling, pornography, and other ethically questionable industries are excluded from the ETF's portfolio. This exclusionary approach shapes the portfolio's composition and risk profile.

- UCITS Structure and Acc (Accumulation) Share Class: The ETF's UCITS (Undertakings for Collective Investment in Transferable Securities) structure ensures regulatory compliance within the European Union, providing investors with a level of investor protection. The Acc (Accumulation) share class means that all dividends earned are reinvested, leading to potential compounding and long-term NAV growth.

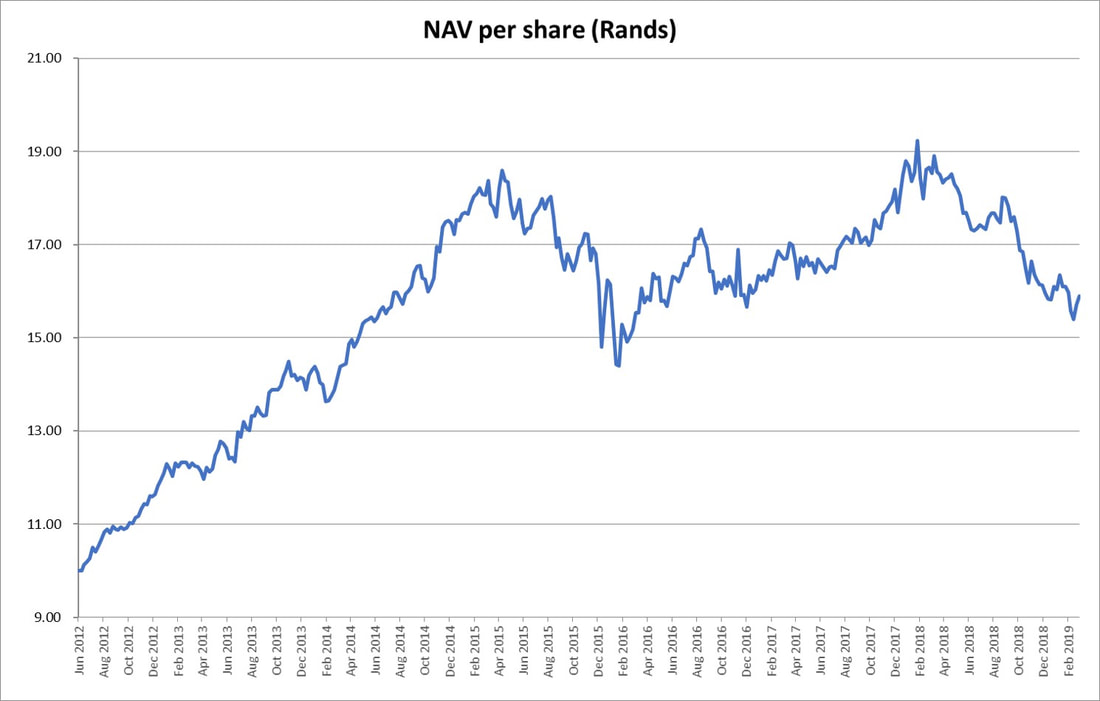

Analyzing NAV Performance: Historical Trends and Volatility

Analyzing the historical NAV performance of the Amundi MSCI World Catholic Principles UCITS ETF Acc provides crucial insights into its investment potential. [Insert chart/graph showcasing 1-year, 3-year, and 5-year NAV performance].

- Benchmark Comparison: The ETF's performance should be compared against relevant benchmarks, such as the MSCI World Index and other similar ethically-focused ETFs. This comparison highlights its relative strengths and weaknesses during various market conditions. [Insert comparative chart/graph].

- Performance Analysis: Periods of strong and weak performance should be analyzed, identifying potential contributing factors. For example, market downturns may impact the ETF's NAV, but the specific composition of its portfolio may offer some resilience compared to the broader market.

- Volatility and Risk Profile: Examining the ETF's volatility and risk profile compared to its benchmarks allows investors to gauge its suitability within their risk tolerance. Metrics like the Sharpe ratio can offer valuable insights into risk-adjusted returns. [Include data on annualized returns and Sharpe Ratio].

Factors Influencing NAV Performance

Several factors influence the ETF's NAV, including both internal and external elements.

- Market Conditions: Global economic growth, interest rate fluctuations, and inflationary pressures all significantly impact market performance, including the ETF's NAV.

- Sector Performance: The performance of specific sectors within the ETF's portfolio (e.g., technology, healthcare, energy) directly influences the overall NAV. Changes in investor sentiment or technological advancements can drastically impact these sectors.

- ESG Performance of Underlying Holdings: The ESG performance of the companies included in the ETF influences the long-term sustainability and returns of the investment. Strong ESG scores typically correlate positively with long-term value creation.

- Impact of Company Exclusions: The exclusion of certain companies due to ethical concerns might impact overall portfolio returns. However, this aligns with the ETF's investment philosophy, prioritizing ethical considerations.

Comparing Amundi MSCI World Catholic Principles UCITS ETF Acc with Competitors

Comparing the Amundi MSCI World Catholic Principles UCITS ETF Acc with similar ethically-focused ETFs is essential for making informed investment decisions.

- Comparative Table: [Insert a table comparing key metrics such as expense ratio, asset size, 1-year, 3-year, and 5-year performance, and other relevant data for several similar ETFs].

- Unique Selling Points: The Amundi ETF's unique selling points should be highlighted, such as its specific focus on Catholic principles or its particular exclusion criteria.

- Investor Suitability: The suitability of each ETF for different investor profiles should be discussed, considering factors like risk tolerance and investment goals.

Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc: Considerations and Risks

Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc presents both benefits and risks.

- Alignment with Catholic Values: A key benefit is the alignment with Catholic values, providing investors with a means of integrating their faith with their investment decisions.

- Potential for Lower Returns: Due to the exclusion criteria, the ETF may have lower returns compared to non-ESG funds that invest more broadly. This is a trade-off many investors are willing to make for ethical reasons.

- Diversification: The ETF should be considered as part of a diversified investment portfolio, as relying solely on a single ETF, regardless of its ethical focus, can be risky.

- Currency Fluctuations: Depending on the investor's base currency, currency fluctuations can impact the return on investment.

Conclusion

This analysis of the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV performance highlights its potential as an ethically responsible investment option for investors seeking alignment with Catholic values. While it may present slightly lower returns compared to broader market indices in some periods, its performance is comparable to similar ethical ETFs. The exclusionary approach and commitment to ESG principles make it a compelling choice for investors who prioritize both financial goals and values. Learn more about the Amundi MSCI World Catholic Principles UCITS ETF Acc and explore ethical investing options to assess whether it aligns with your portfolio and investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostannye Desyatilittya

May 25, 2025

Yevrobachennya Scho Stalosya Z Peremozhtsyami Za Ostannye Desyatilittya

May 25, 2025 -

Shes Still Waiting By The Phone A Personal Account

May 25, 2025

Shes Still Waiting By The Phone A Personal Account

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Analysis And Implications

May 25, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Analysis And Implications

May 25, 2025 -

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 25, 2025

Avrupa Borsalari Karisik Bir Guenuen Ardindan Kapandi

May 25, 2025 -

80 Millioert Extrazott Porsche 911 Erdemes

May 25, 2025

80 Millioert Extrazott Porsche 911 Erdemes

May 25, 2025

Latest Posts

-

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav And Performance

May 25, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav And Performance

May 25, 2025 -

Waiting For The Call A Reflection

May 25, 2025

Waiting For The Call A Reflection

May 25, 2025 -

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025