Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Analysis And Tracking

Table of Contents

This article provides a comprehensive analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist, focusing on its Net Asset Value (NAV) and how effectively it tracks its benchmark, the MSCI World Index. We'll explore key factors influencing its performance, including expense ratios and distribution yields, equipping you with the knowledge to make informed investment decisions.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Fund's Objective and Investment Strategy

The Amundi MSCI World II UCITS ETF USD Hedged Dist aims to replicate the performance of the MSCI World Index, while simultaneously hedging against fluctuations in the US dollar. This means the ETF invests in a portfolio of global equities mirroring the composition of the MSCI World Index, designed to provide broad exposure to developed market equities.

- Benefits of a USD Hedged Strategy:

- Reduced Currency Risk: For investors whose base currency is not the USD, a hedged ETF mitigates the risk of losses stemming from currency exchange rate movements. If the USD strengthens against your home currency, your returns won't be diminished by unfavorable exchange rates.

- Improved Performance Consistency: By neutralizing currency fluctuations, the hedged strategy aims for a more consistent return profile, making it easier to compare performance to other investments denominated in your local currency.

- Replication Methodology: The ETF typically employs a full replication strategy, meaning it aims to hold all the securities in the MSCI World Index in the same proportion as the index itself. This approach aims for maximum tracking accuracy.

Key Features and Characteristics

Understanding the key features is crucial for assessing the Amundi MSCI World II UCITS ETF's suitability for your portfolio.

- Expense Ratio: The expense ratio represents the annual cost of owning the ETF. Compare this to similar ETFs tracking the MSCI World Index to ensure it's competitive. A lower expense ratio means more of your investment returns are retained.

- Minimum Investment: Check the minimum investment requirement before purchasing shares of this ETF. This will vary depending on your brokerage account and platform.

- Currency Exposure: While the USD hedge aims to minimize USD exposure, residual currency risk may still exist due to the timing of hedging adjustments.

- Distribution Yield: The distribution yield represents the dividend payments distributed to investors. This income stream is a crucial component of total return and should be factored into your overall investment strategy. Remember that dividend payments can affect the NAV.

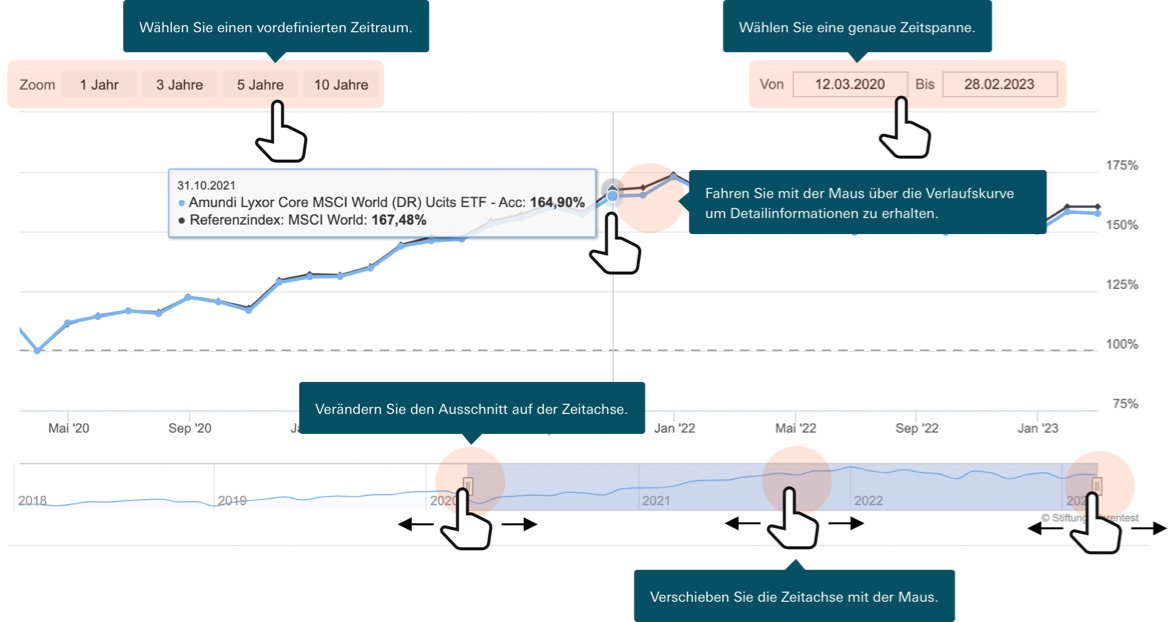

NAV Analysis: Deconstructing the Net Asset Value

Factors Affecting NAV

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist fluctuates based on several factors:

- Market Movements: Changes in the prices of the underlying equities significantly influence the NAV. A rising market generally leads to a higher NAV, and vice versa.

- Currency Fluctuations: Despite the USD hedge, minor fluctuations in exchange rates can still impact the NAV, although the impact is intended to be substantially reduced compared to an unhedged ETF.

- Dividend Distributions: When the ETF receives dividend payments from its underlying holdings, the NAV is typically adjusted downward to reflect the distribution to shareholders.

Interpreting NAV Changes

Monitoring NAV changes provides valuable insights into the ETF's performance:

- Positive NAV Changes: Generally indicate positive performance of the underlying assets, reflecting gains in the market value of the equities held by the ETF.

- Negative NAV Changes: Often point to negative market movements or adverse currency fluctuations. It's essential to analyze the reasons behind any significant drops.

- Examples of NAV Fluctuations: A significant market downturn, such as a global recession, could cause a sharp drop in NAV. Conversely, a strong bull market could result in substantial NAV growth.

- Regular NAV Monitoring: Regular monitoring helps track the fund’s progress against its benchmark and your investment goals. This data, coupled with analysis of the MSCI World Index, allows for better decision-making.

Tracking Error Analysis: How Well Does it Track the MSCI World Index?

Defining Tracking Error

Tracking error measures the difference in performance between the ETF and its benchmark index (MSCI World Index). It quantifies how closely the ETF's returns match the index's returns over a given period.

- Calculating Tracking Error: Tracking error is often expressed as a standard deviation of the difference between the ETF's returns and the index's returns.

- Acceptable Levels: Generally, lower tracking error indicates better performance alignment with the benchmark. The level deemed "acceptable" depends on the investor's tolerance for deviation.

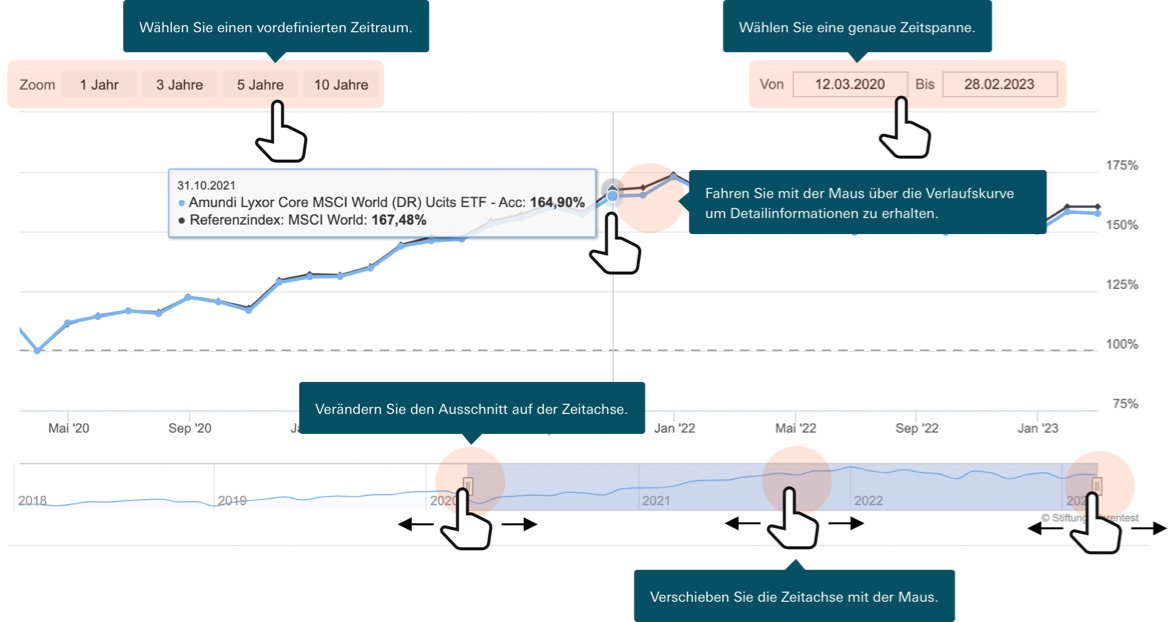

Analyzing Historical Tracking Performance

Analyzing the historical tracking performance of the Amundi MSCI World II UCITS ETF against the MSCI World Index is vital:

- Visual Aids: Charts and graphs visualizing the ETF's and the index's performance over time will offer a clear comparison, highlighting periods of strong and weak tracking.

- Significant Deviations: Significant deviations should be investigated to identify underlying causes, such as sector-specific market movements or temporary deviations in the replication strategy. Understanding these deviations is vital for evaluating the effectiveness of the fund's strategy.

Conclusion

This analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist highlights the importance of understanding its NAV and tracking error. Consistent NAV monitoring provides crucial insights into performance, particularly considering the impact of both market movements and the USD hedge. While the ETF aims for close tracking of the MSCI World Index, remember that some degree of tracking error is inherent.

Call to Action: Before investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist, conduct thorough research and consult with a financial advisor to determine if it aligns with your investment goals and risk tolerance. Regularly monitor the Amundi MSCI World II UCITS ETF's NAV and tracking performance to ensure it continues to meet your expectations. Remember to consider the implications of both the NAV and the USD hedge when making your investment decisions concerning the Amundi MSCI World II UCITS ETF.

Featured Posts

-

Hawaiis Keiki Artists Shine In Memorial Day Lei Poster Contest

May 24, 2025

Hawaiis Keiki Artists Shine In Memorial Day Lei Poster Contest

May 24, 2025 -

Huge Diamond Ring Annie Kilners Public Display After Walker Spotting

May 24, 2025

Huge Diamond Ring Annie Kilners Public Display After Walker Spotting

May 24, 2025 -

Your Escape To The Country A Step By Step Guide To Relocation

May 24, 2025

Your Escape To The Country A Step By Step Guide To Relocation

May 24, 2025 -

The Simple Pleasures Of An Escape To The Country

May 24, 2025

The Simple Pleasures Of An Escape To The Country

May 24, 2025 -

Porsche 956 Nin Uestten Asili Goeruenuemuenuen Hikayesi

May 24, 2025

Porsche 956 Nin Uestten Asili Goeruenuemuenuen Hikayesi

May 24, 2025

Latest Posts

-

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Calculation And Implications

May 24, 2025 -

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Net Asset Value Nav Of Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 24, 2025

Net Asset Value Nav Of Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 24, 2025 -

The Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Nav

May 24, 2025

The Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Nav

May 24, 2025