Oil Price Analysis: Market News For April 23, 2024

Table of Contents

The unexpected shutdown of a major pipeline in the North Sea sent ripples through the global energy market, causing significant oil price volatility on April 23, 2024. This event underscores the critical need for comprehensive oil price analysis to understand and navigate the complexities of this dynamic market. This article provides a detailed oil price analysis for April 23, 2024, examining the key factors influencing crude oil prices and offering insights for investors and consumers alike. Understanding these price movements is crucial for informed decision-making in various sectors, from energy investment to transportation planning.

Main Points:

H2: Global Crude Oil Supply and Demand Dynamics on April 23, 2024

Global crude oil supply and demand dynamics are constantly shifting, creating fluctuations in oil prices. On April 23, 2024, the picture was further complicated by the aforementioned pipeline disruption. Let's analyze the situation:

-

Global Oil Supply: Key producers like Saudi Arabia, Russia, and the USA experienced varying production levels. While Saudi Arabia maintained its production quota, the Russian oil output faced continued pressure from sanctions, leading to reduced exports. US shale oil production, however, saw a slight uptick due to increased drilling activity. Precise figures from the EIA (Energy Information Administration) would be needed for a definitive assessment.

-

Global Oil Demand: Global oil demand was robust, driven primarily by strong economic growth in Asia and continued recovery in air travel post-pandemic. Seasonal factors, such as increased summer driving in the Northern Hemisphere, also contributed to higher consumption.

-

Bullet Points:

- OPEC+ largely adhered to its production quotas, although the pipeline incident created unforeseen supply constraints.

- Sanctions on Russian oil exports continued to impact global supply, causing price increases.

- US shale oil production showed modest growth, but not enough to offset the supply disruptions.

- Global refinery operations were largely unaffected, but potential future issues are a factor in price projections.

H2: Geopolitical Factors Influencing Oil Prices on April 23, 2024

Geopolitical events significantly influence oil prices. The pipeline shutdown, attributed to a suspected sabotage event, highlights the vulnerability of global oil supply chains to political instability and conflict.

-

Geopolitical Tensions: The pipeline incident in the North Sea injected considerable uncertainty into the market. The investigation into the cause of the shutdown is ongoing, adding to market volatility and speculation about future disruptions.

-

Supply Chain Disruptions: The pipeline shutdown demonstrated the immediate and substantial impact of disruptions to oil transportation routes on global prices. This incident underscored the need for diversification of supply chains and robust infrastructure.

-

Bullet Points:

- The North Sea pipeline incident caused immediate upward pressure on Brent crude prices.

- Potential for further disruptions in the region heightened market anxieties.

- Geopolitical risks in other major oil-producing regions also contribute to price uncertainty, such as ongoing tensions in the Middle East.

H2: Economic Indicators and their Influence on Oil Prices on April 23, 2024

Economic indicators play a crucial role in influencing oil prices through their impact on demand and investment. On April 23, 2024, the overall economic outlook was positive, supporting a robust oil demand.

-

Economic Growth & Inflation: Strong global GDP growth in Q1 2024, combined with persistent inflationary pressures, fuelled demand for energy resources, including oil. Higher inflation rates typically correlate with higher energy prices.

-

Interest Rates & Investment: Interest rate decisions by central banks influence investment in oil exploration and production. Higher interest rates generally discourage such investment, leading to potential future supply constraints.

-

Bullet Points:

- Positive economic growth forecasts supported strong oil demand.

- Inflationary pressures continued to push energy prices higher.

- Interest rate hikes by central banks might curb future oil production investments.

H2: Market Sentiment and Investor Behavior on April 23, 2024

Market sentiment shifted from cautiously optimistic to significantly more uncertain on April 23, 2024, due to the pipeline incident. Investor behavior reflected this shift.

-

Market Sentiment: The market exhibited a clear bearish reaction to the immediate supply shortage and uncertainty surrounding the pipeline incident, causing short-term price spikes.

-

Investor Behavior: Many investors reacted by buying futures contracts to hedge against potential further price increases, further exacerbating the price hike.

-

Bullet Points:

- Oil futures prices experienced a sharp increase immediately following news of the pipeline shutdown.

- Major investment banks revised their oil price forecasts upward, reflecting the increased uncertainty.

- Social media amplified concerns, contributing to heightened market volatility.

Conclusion: Key Takeaways and Future Oil Price Outlook

The oil price analysis for April 23, 2024, reveals that oil prices are influenced by a complex interplay of supply and demand dynamics, geopolitical events, economic indicators, and market sentiment. The pipeline shutdown served as a stark reminder of the vulnerability of the global oil market to unforeseen disruptions. While the immediate impact caused price increases, the long-term outlook depends on multiple factors, including the resolution of the geopolitical situation, economic recovery trajectory, and OPEC+ policies.

To make informed decisions in this volatile market, continuous monitoring of oil price analysis is crucial. Regularly reviewing up-to-date reports and expert analyses will help you stay ahead of the curve. Subscribe to our newsletter for the latest insights and in-depth oil price analysis reports to refine your investment strategies and stay informed about energy market trends.

Featured Posts

-

Shark Sightings Precede Swimmers Disappearance And Body Discovery On Israeli Beach

Apr 24, 2025

Shark Sightings Precede Swimmers Disappearance And Body Discovery On Israeli Beach

Apr 24, 2025 -

Independence Concerns Lead To 60 Minutes Executive Producers Resignation

Apr 24, 2025

Independence Concerns Lead To 60 Minutes Executive Producers Resignation

Apr 24, 2025 -

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

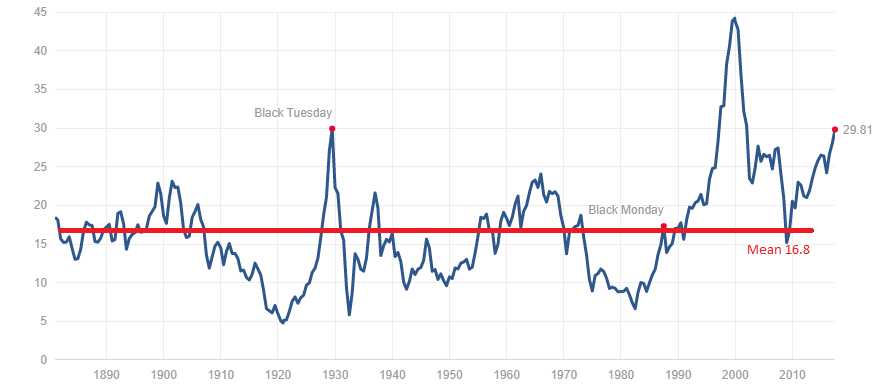

Understanding High Stock Market Valuations Bof As Perspective For Investors

Apr 24, 2025

Understanding High Stock Market Valuations Bof As Perspective For Investors

Apr 24, 2025 -

Is The 77 Inch Lg C3 Oled Tv Worth It A Honest Review

Apr 24, 2025

Is The 77 Inch Lg C3 Oled Tv Worth It A Honest Review

Apr 24, 2025