Analysis Of Tesla's Q1 Earnings: 71% Net Income Drop And Political Factors

Table of Contents

Deep Dive into Tesla's Q1 Financial Performance

Tesla's Q1 financial performance paints a concerning picture. While the company continues to dominate the EV market in many regions, a combination of factors led to this substantial decrease in net income.

Revenue Analysis

Tesla's revenue, while still substantial, fell short of analysts' expectations. Several key revenue streams contributed to this shortfall:

- Vehicle Sales: Despite strong demand for certain Tesla models, overall vehicle sales were lower than projected, partly due to increased competition and price cuts aimed at boosting sales volume.

- Energy Generation and Storage: Revenue from Tesla's solar energy and battery storage businesses showed modest growth, but not enough to offset the decline in vehicle sales revenue.

- Other Revenue: Revenue streams from services, such as Supercharger network usage and software updates, continued to contribute, but were insufficient to compensate for the overall drop in profitability.

Comparing Tesla's Q1 revenue to competitors like BYD and Volkswagen reveals a mixed picture. While Tesla maintains market leadership in certain segments, the competition is intensifying, impacting its overall market share and revenue generation. Unexpected shortfalls in vehicle deliveries due to supply chain disruptions also contributed significantly to lower-than-expected revenue.

Cost Analysis

A significant factor driving down Tesla's profitability was a substantial increase in production costs. This rise can be attributed to several factors:

- Raw Material Costs: Fluctuations in the prices of critical raw materials, such as lithium and nickel, used in EV battery production, significantly increased manufacturing expenses.

- Logistics Costs: Global supply chain disruptions led to higher transportation costs and longer delivery times, impacting both production and delivery schedules.

- Labor Costs: Increased labor costs, including wages and benefits, also played a role in pushing up overall production expenses.

Unlike some competitors, Tesla has so far been less successful in completely offsetting these increased costs through higher prices, leading to a compression of profit margins. The company is actively exploring various cost-cutting strategies, but their effectiveness remains to be seen.

Impact on Tesla Stock Price

The release of the Q1 earnings report immediately impacted Tesla's stock price, causing significant volatility. Investor sentiment turned negative, reflecting concerns about the company's financial performance and future prospects. Analyst predictions vary widely, with some forecasting a recovery while others express more cautious optimism. The short-term implications are uncertain, but the long-term impact on investor confidence and Tesla's stock valuation will depend heavily on the company's ability to address its challenges and regain momentum.

Geopolitical Factors Influencing Tesla's Q1 Results

Beyond internal financial issues, several significant geopolitical factors exerted considerable pressure on Tesla's Q1 performance.

China Market Challenges

China remains a crucial market for Tesla, but the company faced considerable headwinds there during Q1:

- Regulatory Hurdles: Navigating the complex regulatory landscape in China continues to present challenges for Tesla, leading to occasional production slowdowns and uncertainties.

- Intense Competition: Tesla faces fierce competition from established Chinese automakers and rising EV startups, squeezing its market share and pricing power in a rapidly evolving market.

- Economic Slowdown: The ongoing economic slowdown in China, coupled with decreased consumer confidence, negatively impacted vehicle sales, impacting Tesla’s overall performance in the region.

Tesla’s China strategy, while significant, needs to adapt more effectively to these ever-changing dynamics for sustained success.

Global Supply Chain Disruptions

The global supply chain continues to experience significant disruptions, directly impacting Tesla's production and profitability:

- Raw Material Shortages: Shortages of key raw materials, especially those needed for battery production, forced production cuts and hindered Tesla’s ability to meet demand.

- Logistics Bottlenecks: Port congestion, transportation delays, and other logistical challenges added to production costs and increased lead times for delivering vehicles.

- Geopolitical Instability: Unrest in various regions of the world further complicated supply chains and increased risks for Tesla's global operations.

Tesla’s efforts to diversify its supply chains and implement mitigation strategies are crucial to buffering against these persistent challenges.

Political and Regulatory Uncertainty

Political instability and shifting regulations in various markets created additional uncertainty for Tesla during Q1:

- Trade Wars and Tariffs: Ongoing trade tensions and tariffs in different regions affected production costs and market access, impacting pricing and profitability.

- Changing Environmental Regulations: The evolving landscape of environmental regulations globally requires significant investments and adjustments in Tesla’s operations to comply with evolving standards.

- Geopolitical Risks: Unpredictable geopolitical events in different regions impacted Tesla’s operations, creating further uncertainty and risks.

The long-term implications of these uncertainties remain a significant concern for Tesla's overall strategic planning and financial forecasting.

Conclusion

Tesla's Q1 2024 earnings report reveals a concerning picture, marked by a dramatic 71% drop in net income. This significant decline stems from a combination of factors, including reduced revenue, increased production costs, and significant headwinds from geopolitical challenges. While the company continues to be a leader in the electric vehicle market, addressing these internal financial issues and navigating the complex geopolitical landscape will be crucial for its future success. The impact on Tesla stock is undeniable, and investors will be closely monitoring future performance.

Stay tuned for our next analysis of Tesla's financial performance, focusing on Q2, and how the company addresses the challenges highlighted in this report. Follow us for continued coverage of Tesla's Q2 earnings and beyond, deepening your understanding of Tesla's challenges and opportunities by subscribing to our newsletter. Learn more about the complexities of the electric vehicle market by reading our other articles on Tesla and its competitors.

Featured Posts

-

Liberal Fiscal Irresponsibility A Threat To Canadas Economic Vision

Apr 24, 2025

Liberal Fiscal Irresponsibility A Threat To Canadas Economic Vision

Apr 24, 2025 -

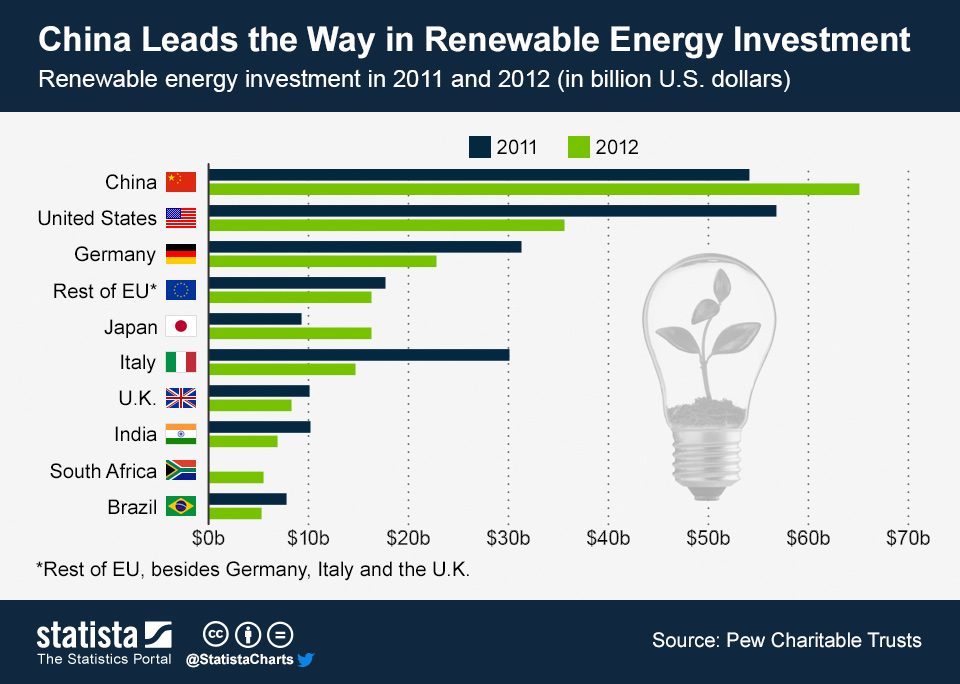

Chinas Energy Strategy Middle Eastern Lpg As A Us Tariff Alternative

Apr 24, 2025

Chinas Energy Strategy Middle Eastern Lpg As A Us Tariff Alternative

Apr 24, 2025 -

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025 -

Price Gouging Allegations Surface In La Following Devastating Fires A Selling Sunset Perspective

Apr 24, 2025

Price Gouging Allegations Surface In La Following Devastating Fires A Selling Sunset Perspective

Apr 24, 2025 -

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market The Ai Advantage

Apr 24, 2025