Apple Price Target Lowered, But Is Wedbush Right To Remain Bullish?

Table of Contents

The Wedbush Bull Case: Why They Remain Optimistic Despite Lowered Price Target

Wedbush Securities maintains a bullish stance on Apple despite the recent reduction in the Apple price target by other firms. Their optimism is rooted in several key factors:

Strong iPhone Sales and Services Revenue Growth

- Recent iPhone sales figures have shown remarkable resilience, exceeding expectations in several key markets. While overall smartphone sales may be slowing, Apple continues to command a premium price point and high customer loyalty.

- Projections for the upcoming iPhone cycle remain positive, with analysts predicting strong demand for new models, particularly in emerging markets.

- Apple's services revenue stream, encompassing the App Store, iCloud, Apple Music, and Apple TV+, continues to exhibit robust growth. This recurring revenue provides a stable foundation for future earnings, mitigating some of the cyclical nature of hardware sales. Growth in this segment is expected to continue at a double-digit pace.

The Potential of Upcoming Products and Innovation

- Anticipated new product releases, including the next generation of iPhones, a potential AR/VR headset, and continued advancements in Apple Silicon technology, promise to fuel future growth. These innovative products are expected to capture significant market share and drive premium pricing.

- Analysts predict the AR/VR headset could open up a new revenue stream and solidify Apple's position as a leader in emerging technologies. The advancements in Apple Silicon chips are also expected to bolster sales across the entire Apple product ecosystem.

- Market research suggests a strong appetite for Apple's innovative products, indicating a potential for significant revenue growth driven by these upcoming launches.

Long-Term Growth Opportunities in Emerging Markets

- Apple's expansion into emerging markets represents a significant long-term growth opportunity. These regions offer a large untapped customer base with growing disposable income.

- Market analysis points towards increasing Apple product adoption in developing economies, fueled by rising affluence and improved infrastructure.

- This strategic focus on emerging markets could significantly contribute to Apple's future revenue and profitability, potentially offsetting any slowdown in mature markets.

Counterarguments and Reasons for the Lowered Price Target

Despite the bullish outlook from Wedbush, several factors contribute to the lowered Apple price target from other analysts:

Concerns about Global Economic Slowdown

- The current global economic climate, characterized by persistent inflation and recessionary fears, poses a significant risk. Consumer spending may decrease, impacting demand for high-priced electronics like iPhones and Macs.

- Economic indicators suggest a potential slowdown in consumer spending in several key markets, raising concerns about the demand for Apple products.

- Expert opinions vary, but there's a growing consensus that macroeconomic headwinds could negatively affect Apple's financial performance in the near term.

Supply Chain Challenges and Production Costs

- Ongoing supply chain disruptions and rising production costs continue to present challenges for Apple. These factors can affect profitability margins and pricing strategies.

- The impact of geopolitical instability and potential disruptions to manufacturing and logistics could negatively influence Apple's ability to meet demand and control costs.

- Rising component costs and manufacturing expenses could force Apple to increase prices, potentially impacting demand in a price-sensitive market.

Competition in the Smartphone Market

- The smartphone market remains fiercely competitive, with major players like Samsung and Google constantly innovating and vying for market share. This intense competition could put pressure on Apple's sales and profitability.

- The success of competing Android devices offering comparable features at lower price points poses a challenge to Apple's premium pricing strategy.

- Apple needs to maintain a strong innovative edge and effective marketing strategies to counter competitive pressures and protect its market leadership.

Analyzing the Discrepancy: Wedbush's Perspective vs. Other Analysts

The discrepancy between Wedbush's bullish outlook and the more cautious assessments of other analysts highlights the inherent uncertainty in predicting future market performance. While Wedbush emphasizes long-term growth opportunities and Apple's innovative capacity, other analysts are more focused on near-term economic headwinds and competitive pressures. The differing price targets reflect these varying perspectives and weighting of different factors. This divergence underscores the importance of thorough due diligence and consideration of multiple viewpoints before making investment decisions.

Conclusion: Weighing the Evidence – Apple Price Target and the Future

The debate surrounding the Apple price target reflects a complex interplay of positive and negative factors. While Wedbush's bullish outlook is supported by strong iPhone sales, robust services revenue, and the promise of innovative products, counterarguments highlight concerns about global economic slowdown, supply chain challenges, and intense competition. The future Apple price target will ultimately depend on how effectively Apple navigates these challenges and capitalizes on emerging opportunities. Staying informed on the latest developments regarding the Apple price target is crucial. Continue your research into Apple's financial reports and analyst opinions to make informed investment decisions.

Featured Posts

-

Dutch Economy Feels The Pinch Us Trade Dispute Impacts Stock Market

May 24, 2025

Dutch Economy Feels The Pinch Us Trade Dispute Impacts Stock Market

May 24, 2025 -

Marks And Spencers 300 Million Cyber Security Breach A Detailed Analysis

May 24, 2025

Marks And Spencers 300 Million Cyber Security Breach A Detailed Analysis

May 24, 2025 -

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025 -

Dazi Usa Su Abbigliamento Previsioni Prezzi E Consigli Per Gli Acquisti

May 24, 2025

Dazi Usa Su Abbigliamento Previsioni Prezzi E Consigli Per Gli Acquisti

May 24, 2025 -

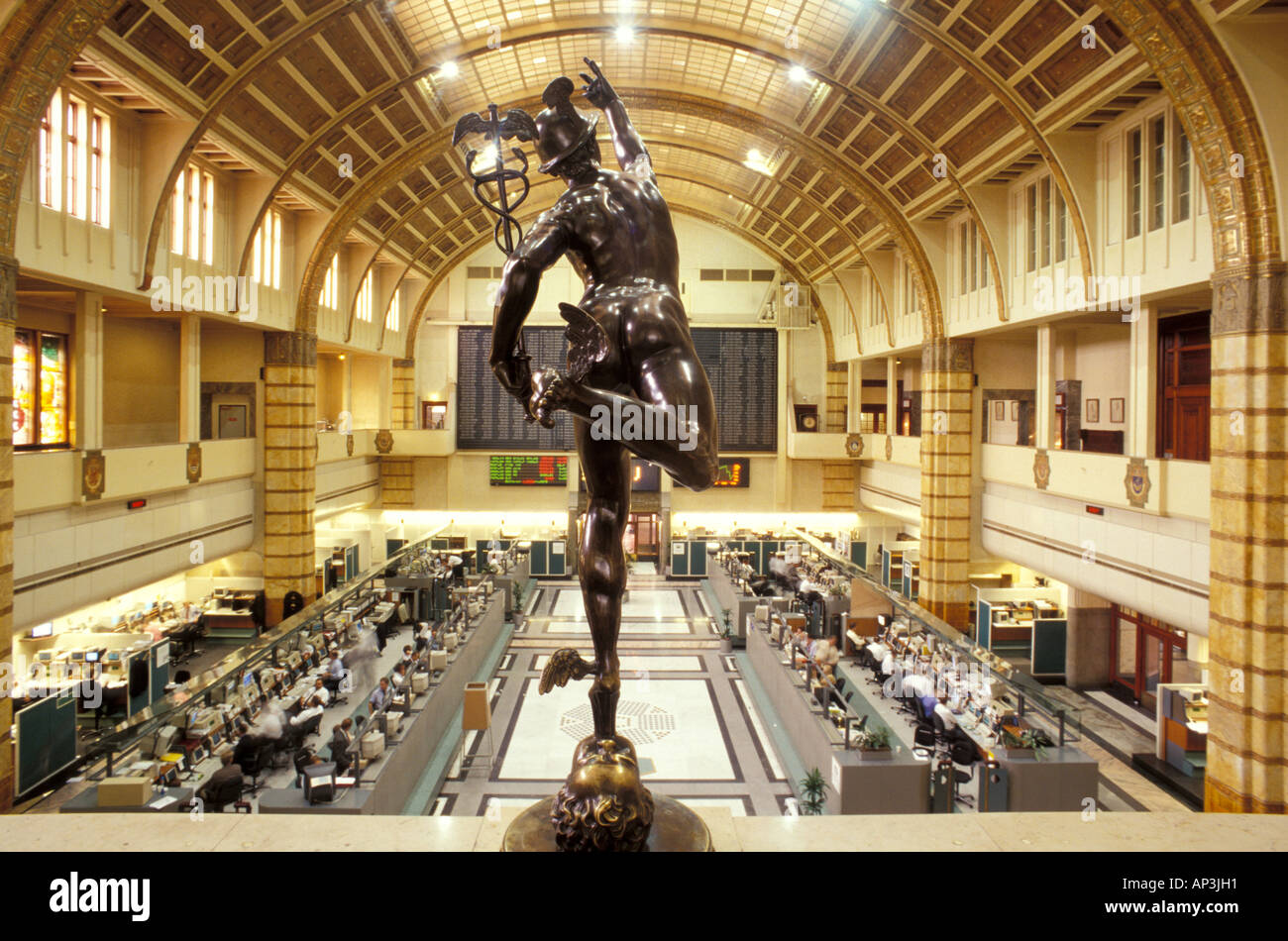

Amsterdam Stock Exchange Plunges Three Consecutive Days Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Plunges Three Consecutive Days Of Heavy Losses

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025