Apple Price Target Lowered, But Wedbush Stays Bullish: Is It A Good Time To Buy?

Table of Contents

The Lowered Apple Price Target: What it Means

Several factors contribute to the recent reduction in the Apple price target. Understanding these is crucial before making any investment decisions.

Reasons Behind the Price Target Reduction:

- Slower iPhone Sales Growth: Concerns about slowing iPhone sales growth, particularly in key markets like China, are a major factor. Analysts point to a potential saturation of the high-end smartphone market and increased competition as contributing factors. Some estimates suggest a percentage decrease in year-over-year iPhone sales.

- Macroeconomic Headwinds: The current global economic climate, characterized by inflation and potential recessionary pressures, is impacting consumer spending. This decreased consumer confidence can translate to lower demand for Apple products, affecting the Apple stock forecast.

- Increased Competition: Intense competition from Android manufacturers, offering increasingly sophisticated and affordable alternatives, is putting pressure on Apple's market share and potentially impacting its profitability.

The specific source of the price target reduction varies, with several investment banks and analysts independently revising their Apple share price projections downwards. For example, Goldman Sachs recently lowered its price target by X%, while Morgan Stanley reduced theirs by Y%. These figures highlight the overall trend of decreased optimism surrounding Apple's short-term prospects.

Analyzing the Impact of the Price Target Drop:

The impact of the price target drop is multifaceted. Short-term, we can expect some volatility in Apple's stock price. Investor sentiment will likely fluctuate, reflecting the uncertainty surrounding the company's near-future performance. In the long term, the impact depends largely on Apple's ability to address the challenges mentioned above. A successful launch of new products, effective cost management, and a resilient global economy could mitigate the negative effects of the lowered price target. Conversely, a prolonged period of slower sales growth could lead to further downward pressure on the Apple stock price.

Wedbush's Bullish Outlook: Why They Remain Positive

Despite the widespread downward revisions, Wedbush Securities maintains a bullish outlook on Apple. Their reasoning offers a counterpoint to the prevailing pessimism.

Wedbush's Rationale:

Wedbush's confidence stems from several key factors:

- Strong Brand Loyalty: Apple boasts exceptionally strong brand loyalty, allowing it to command premium pricing and maintain a significant customer base.

- Innovation Pipeline: Wedbush highlights Apple's ongoing innovation, particularly the potential for substantial growth in areas like AR/VR and the development of autonomous vehicle technology. They emphasize the significant revenue streams anticipated from these ventures. The launch of the new iPhone 15 series and updated Apple Watch models are cited as near-term catalysts for growth.

- Robust Services Revenue: Apple's Services segment, encompassing Apple Music, iCloud, and the App Store, continues to deliver strong and consistent revenue growth. This diversification of revenue streams provides a buffer against potential weakness in the hardware sector.

Wedbush analysts have stated (paraphrased): "While near-term headwinds exist, Apple's long-term growth potential remains compelling, underpinned by its innovative product pipeline and loyal customer base."

Comparing Views: Contrasting Opinions on Apple's Future:

The contrasting opinions on Apple's future highlight the inherent uncertainty in the stock market. While some analysts adopt a bearish stance due to immediate challenges, others, like Wedbush, focus on the company’s long-term growth prospects and the strength of its brand. Analyzing various Apple analyst ratings and understanding the reasoning behind differing Apple stock predictions is crucial for informed decision-making. This diversity of opinion emphasizes the need for thorough individual research before making investment choices.

Is It a Good Time to Buy Apple Stock? A Practical Assessment

Deciding whether to buy Apple stock requires careful consideration of various factors.

Weighing the Pros and Cons:

Pros:

- Lower Entry Price: The reduced Apple price target presents a potentially lower entry point for investors.

- Strong Brand and Ecosystem: Apple's strong brand and integrated ecosystem offer long-term stability and growth potential.

- Diversified Revenue Streams: Apple's diversification beyond hardware sales reduces its vulnerability to market fluctuations.

Cons:

- Economic Uncertainty: The current macroeconomic climate poses significant risks to consumer spending and overall market performance.

- Increased Competition: The competitive landscape for smartphones and other tech products is intensifying.

- Potential for Further Price Drops: There's always the risk that the Apple share price could decline further in the short term.

Ultimately, the decision of whether or not to buy Apple stock depends heavily on your personal risk tolerance, investment timeline, and overall investment strategy. Consider your diversification strategy – is Apple already a significant part of your portfolio?

Recommendations & Next Steps:

Based on the analysis, a balanced approach is recommended. Dollar-cost averaging, investing a fixed amount of money at regular intervals, can help mitigate the risk associated with market volatility. Alternatively, waiting for further price movements before investing allows for a more informed decision based on evolving market conditions. Remember, conducting thorough research and potentially consulting with a financial advisor is crucial before making any investment decisions.

Conclusion: Apple Price Target and Your Investment Decision

The lowered Apple price target presents a complex scenario. While some analysts express concerns about near-term challenges, Wedbush remains bullish, highlighting Apple’s long-term potential. Ultimately, the decision of whether this dip in the Apple price target represents a buying opportunity rests on your individual financial goals and risk tolerance. Make informed decisions about your Apple investment strategy by carefully weighing the pros and cons discussed above, and remember that seeking professional financial advice is always a wise course of action. Learn more about the current Apple price target and potential investment opportunities through reputable financial news sources and analyst reports.

Featured Posts

-

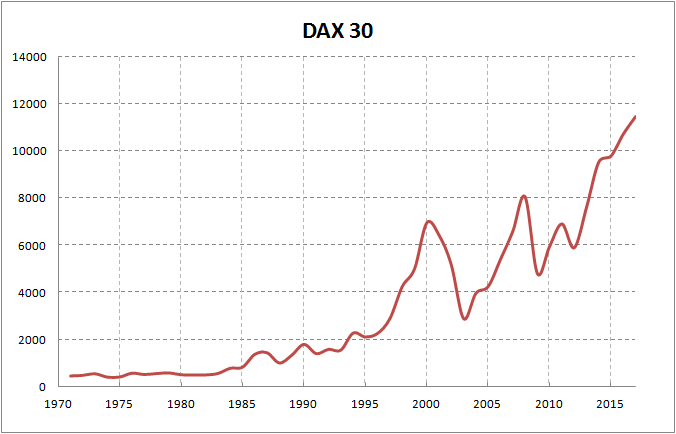

Steady Start For Frankfurt Stock Market Dax Maintains Position Post Record

May 25, 2025

Steady Start For Frankfurt Stock Market Dax Maintains Position Post Record

May 25, 2025 -

M56 Collision Near Cheshire Deeside Border Current Traffic Updates

May 25, 2025

M56 Collision Near Cheshire Deeside Border Current Traffic Updates

May 25, 2025 -

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Budget Friendly Country Living Homes Under 1 Million

May 25, 2025

Budget Friendly Country Living Homes Under 1 Million

May 25, 2025 -

Heinekens Strong Revenue Growth Reaffirming Outlook In Challenging Market

May 25, 2025

Heinekens Strong Revenue Growth Reaffirming Outlook In Challenging Market

May 25, 2025

Latest Posts

-

Analyzing Trumps Sharp Criticism Of European Trade Practices

May 25, 2025

Analyzing Trumps Sharp Criticism Of European Trade Practices

May 25, 2025 -

Nippon Steels U S Acquisition Trump Administrations Decision And Its Implications

May 25, 2025

Nippon Steels U S Acquisition Trump Administrations Decision And Its Implications

May 25, 2025 -

Trumps Campaign Against Top Law Firms Faces Another Defeat

May 25, 2025

Trumps Campaign Against Top Law Firms Faces Another Defeat

May 25, 2025 -

Will Trumps Pressure Secure A Republican Deal

May 25, 2025

Will Trumps Pressure Secure A Republican Deal

May 25, 2025 -

Trump Vs Europe The Trade Disputes And Their Underlying Causes

May 25, 2025

Trump Vs Europe The Trade Disputes And Their Underlying Causes

May 25, 2025