Apple Stock Forecast: One Analyst Sees $254 – Time To Buy?

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Forecast

One prominent analyst has projected an Apple stock price of $254, a significant increase from current levels. Their reasoning centers on several key factors contributing to a bullish Apple Stock Forecast. This prediction isn't based on mere speculation; it's rooted in a comprehensive analysis of Apple's business performance and future prospects.

- New Product Releases: The upcoming iPhone 15, the innovative Vision Pro headset, and other potential product launches are expected to drive significant revenue growth. These new products are predicted to tap into new markets and further solidify Apple's position as a tech leader.

- Market Share Growth: Apple continues to expand its market share in various sectors, including smartphones, wearables, and services. Their competitive advantage in design, user experience, and brand loyalty is expected to fuel further growth, influencing this Apple Stock Forecast positively. Competition from Samsung and Google, while present, is not seen as a major impediment to Apple's projected growth in this forecast.

- Financial Health: Apple consistently demonstrates strong financial health, with consistently high earnings reports, minimal debt, and robust cash reserves. This financial stability provides a strong foundation for future investment and supports this optimistic Apple Stock Forecast.

- Long-Term Growth Potential: Apple's services sector is experiencing rapid expansion, offering a significant revenue stream beyond hardware sales. Growth in wearables and other emerging technologies further contributes to the long-term growth potential considered in this $254 price target.

[Link to Analyst Report (if available)]

Analyzing the Risks and Potential Downsides

While the $254 Apple Stock Forecast presents a compelling case, it's crucial to acknowledge potential downsides. No investment is without risk, and several factors could negatively impact Apple's stock price.

- Global Economic Downturn: A global recession could dampen consumer spending, affecting demand for Apple products and impacting revenue. This could lead to a significant price correction, potentially impacting the $254 Apple Stock Forecast.

- Increased Competition: The technology sector is highly competitive. Aggressive strategies from competitors could erode Apple's market share, impacting its profitability and potentially causing the stock price to fall short of the predicted $254.

- Supply Chain Disruptions: Geopolitical instability or unforeseen events could disrupt Apple's supply chain, leading to production delays and negatively impacting the Apple Stock Forecast and its accuracy.

- Negative Publicity or Controversies: Negative news or controversies surrounding Apple (e.g., data privacy concerns, antitrust issues) could damage its brand image and negatively affect investor sentiment, potentially impacting the $254 price target.

Comparing the $254 Forecast to Other Apple Stock Predictions

The $254 price target isn't the only prediction in circulation. Various analysts offer a range of forecasts, highlighting the inherent uncertainty in stock market predictions. While some analysts share a similarly bullish outlook, others express more cautious opinions. Considering a range of predictions provides a more balanced perspective on the potential for an Apple Stock Forecast to hit its mark. For instance, some forecasts place the target significantly lower, while others might project even higher prices. Analyzing the average price target and the range of opinions can help investors develop a more informed perspective. (Cite reputable sources for each forecast).

Considering Current Market Conditions and Apple's Financial Health

Assessing the current market conditions and Apple's financial health is vital when evaluating the $254 Apple Stock Forecast. A strong macroeconomic environment generally benefits technology stocks, while a bearish market might negatively impact even the most robust companies.

- Apple's Recent Financial Performance: Examining Apple's recent financial reports (revenue, profit margins, earnings per share) offers valuable insights into its current financial strength. (Outline key financial metrics).

- Debt Levels: Apple's relatively low debt levels indicate a strong financial position, making it more resilient to economic downturns than companies with higher debt burdens.

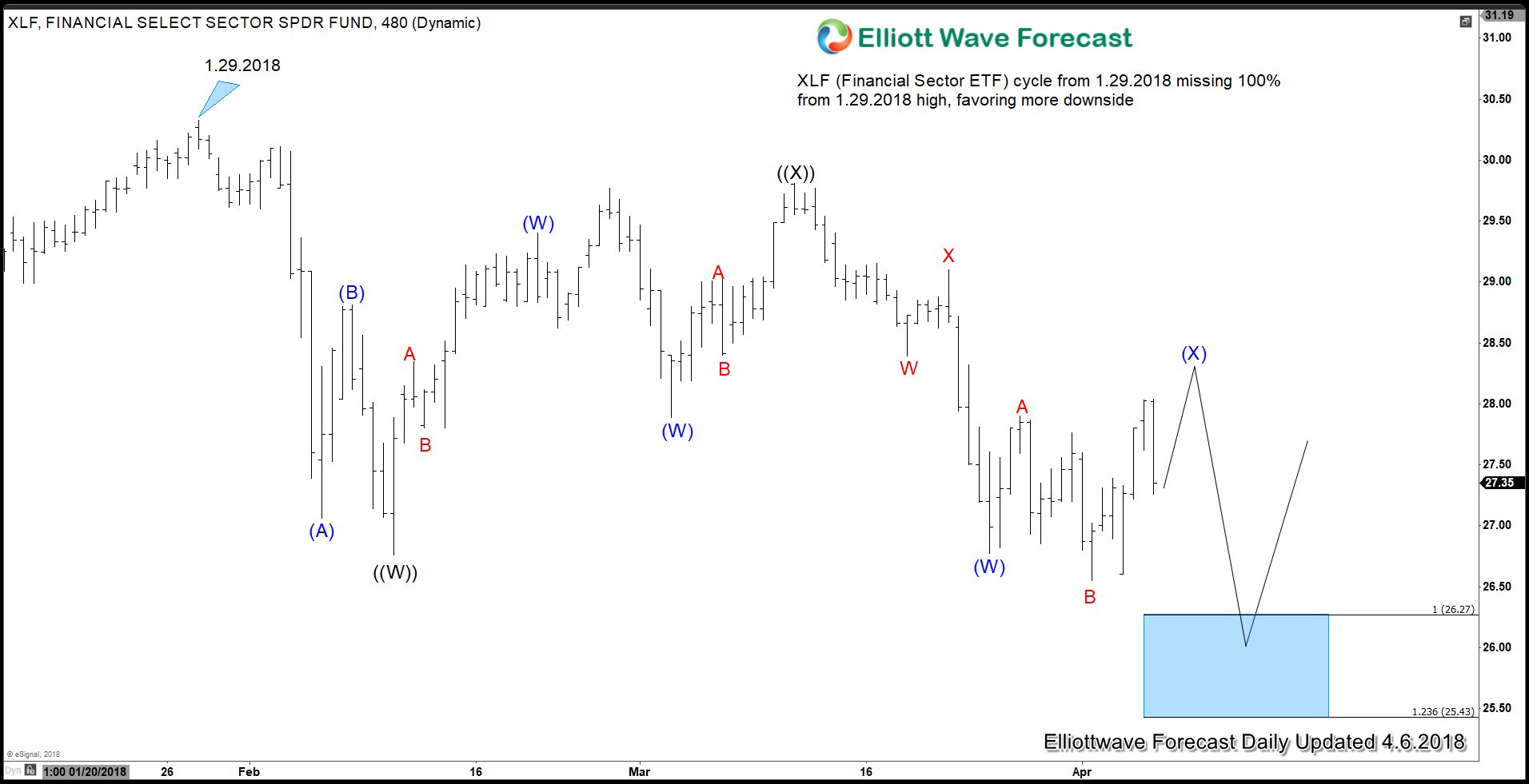

Technical Analysis of Apple Stock (Optional)

Technical analysis, using indicators such as chart patterns and moving averages, can offer additional insights that might support or contradict the $254 Apple Stock Forecast. (If applicable, include a brief overview and reference reputable sources).

Conclusion: Is it Time to Buy Apple Stock?

The $254 Apple Stock Forecast presents a compelling opportunity, but it’s crucial to weigh the potential rewards against the inherent risks. While strong fundamentals and exciting new product releases suggest potential upside, external factors like economic downturns and increased competition represent significant challenges. The diversity of opinions amongst analysts further emphasizes the uncertainties involved in any stock market prediction.

Ultimately, the decision of whether or not to buy Apple stock rests solely on your own investment strategy, risk tolerance, and financial goals. Consider your own investment strategy before making decisions regarding Apple Stock. Learn more about Apple's financial performance to inform your Apple stock forecast. Conduct thorough due diligence before investing in Apple stock. Remember that past performance is not indicative of future results.

Featured Posts

-

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

Get Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park

May 25, 2025

Get Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park

May 25, 2025 -

7 Plunge For Amsterdam Stocks Trade War Uncertainty Creates Market Volatility

May 25, 2025

7 Plunge For Amsterdam Stocks Trade War Uncertainty Creates Market Volatility

May 25, 2025 -

Annie Kilner Spotted Following Husband Kyle Walkers Night Out

May 25, 2025

Annie Kilner Spotted Following Husband Kyle Walkers Night Out

May 25, 2025 -

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025

Latest Posts

-

A Review Of Expenditures Presidential Seals Luxury Goods And High Profile Gatherings

May 25, 2025

A Review Of Expenditures Presidential Seals Luxury Goods And High Profile Gatherings

May 25, 2025 -

The Elon Musk Dogecoin Relationship An Analysis

May 25, 2025

The Elon Musk Dogecoin Relationship An Analysis

May 25, 2025 -

Dogecoin Price And Elon Musks Actions Correlation Or Causation

May 25, 2025

Dogecoin Price And Elon Musks Actions Correlation Or Causation

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deeper Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deeper Dive

May 25, 2025 -

Presidential Seals Expensive Gifts And The Issue Of Transparency

May 25, 2025

Presidential Seals Expensive Gifts And The Issue Of Transparency

May 25, 2025