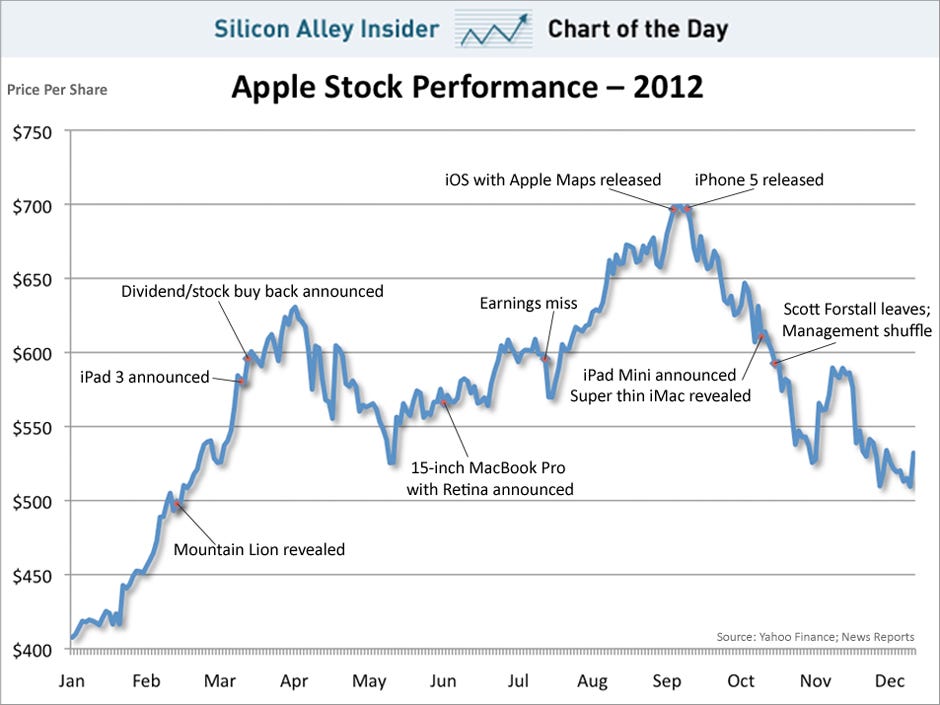

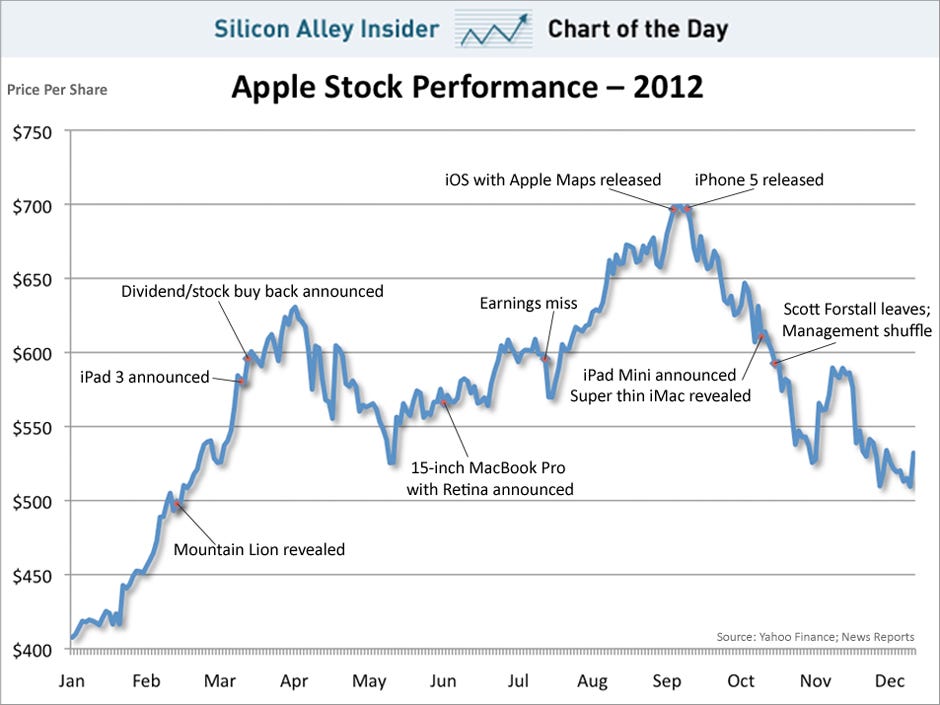

Apple Stock Performance: Exceeding Q2 Expectations

Table of Contents

Revenue Growth Across Key Segments

Apple demonstrated robust revenue growth across its major product categories. This wasn't a case of one area carrying the weight; instead, a balanced performance across the board contributed to the overall success. This diversified strength is a key indicator of Apple's enduring appeal and market dominance.

- iPhone sales: Despite ongoing supply chain challenges impacting the global tech industry, iPhone sales remained remarkably strong, showcasing the continued demand for Apple's flagship product. This highlights Apple's effective management of its supply chain and the enduring appeal of the iPhone brand.

- Services revenue: Apple's Services segment continued its impressive upward trajectory, demonstrating strong user engagement and significant subscription growth. This recurring revenue stream provides stability and contributes significantly to overall profitability and Apple stock performance. The expansion of services like Apple Music, Apple TV+, and iCloud are key drivers in this sector.

- Mac sales: Mac sales experienced a notable increase, likely boosted by the introduction of new Apple silicon chipsets and strong demand for high-performance laptops and desktops. This segment's performance underscores the success of Apple's transition to its own processors.

- iPad sales: Despite the mature nature of the tablet market, iPad sales also showed positive momentum, demonstrating the continued relevance of the product and Apple's ability to innovate and maintain market share.

- Wearables, Home, and Accessories revenue: This segment continued its strong performance, driven by popular products like the Apple Watch and AirPods. The growth in this area indicates the increasing integration of Apple products into users' daily lives.

Stronger-Than-Expected Profit Margins

Apple's Q2 results weren't just about exceeding revenue projections; the company also demonstrated improved profit margins, indicating efficient cost management and strong pricing power. This is a crucial aspect for investors assessing Apple stock performance.

- Earnings per share (EPS): Higher-than-predicted earnings per share (EPS) significantly impressed investors, boosting confidence in the company's financial health and future growth potential. This directly impacts Apple share price and investor sentiment.

- Operating margin: Effective cost control measures contributed to improved operating margins, reflecting Apple's efficiency in managing its operations and supply chain. This showcases strong financial discipline.

- Pricing strategy: The strong performance suggests a healthy pricing strategy and efficient supply chain management, allowing Apple to maintain profitability even in a challenging global economic environment.

Future Outlook and Investor Sentiment

The positive Q2 results have significantly impacted investor sentiment, leading to a positive outlook for Apple's stock in the coming quarters. However, it's crucial to acknowledge potential challenges.

- Stock price forecast: Analysts have raised their price targets for Apple stock, reflecting confidence in future growth and the continued strength of the Apple brand. This indicates a positive outlook for Apple stock in the short and long term.

- Investor sentiment: Positive investor sentiment suggests continued strong demand for Apple products and a belief in the company's long-term strategic vision.

- Challenges: Potential challenges remain, including global economic uncertainty and ongoing supply chain issues. These factors should be carefully considered in any investment strategy and should inform any long-term Apple stock outlook.

Analyzing the Impact on the Broader Tech Sector

Apple's stellar performance serves as a positive indicator for the broader tech sector, although a nuanced perspective is needed.

- Consumer spending: Apple's success may signal a renewed strength in consumer spending on technology, suggesting a positive trend for the overall tech market.

- Market analysis: However, the performance of other tech companies must be individually analyzed to fully grasp the market landscape. A broad generalization based solely on Apple's success would be misleading.

- Competitor analysis: Comparison with competitor performance is crucial for gaining a comprehensive understanding of market dynamics and identifying potential opportunities and risks within the tech stock market.

Conclusion

Apple's Q2 earnings report showcased exceptional performance, exceeding expectations across various key metrics. The robust revenue growth across product segments, improved profit margins, and positive investor sentiment all contribute to a positive outlook for Apple stock. While challenges remain, Apple's Q2 results offer compelling reasons for investors to remain interested in Apple stock performance. Stay informed about the latest news and analysis to make informed decisions about your investment strategy and potential Apple stock investment opportunities. Understanding the nuances of Apple stock performance is crucial for navigating the dynamic tech market.

Featured Posts

-

Is Kyle Walker Peters Headed To West Ham Latest Transfer Updates

May 24, 2025

Is Kyle Walker Peters Headed To West Ham Latest Transfer Updates

May 24, 2025 -

The Woody Allen Controversy Sean Penns Endorsement And The Renewed Focus On Sexual Abuse Claims

May 24, 2025

The Woody Allen Controversy Sean Penns Endorsement And The Renewed Focus On Sexual Abuse Claims

May 24, 2025 -

10 Let Pobediteley Evrovideniya Tvorcheskie Puti I Nyneshnyaya Zhizn

May 24, 2025

10 Let Pobediteley Evrovideniya Tvorcheskie Puti I Nyneshnyaya Zhizn

May 24, 2025 -

Planning Your Escape To The Country A Practical Guide

May 24, 2025

Planning Your Escape To The Country A Practical Guide

May 24, 2025 -

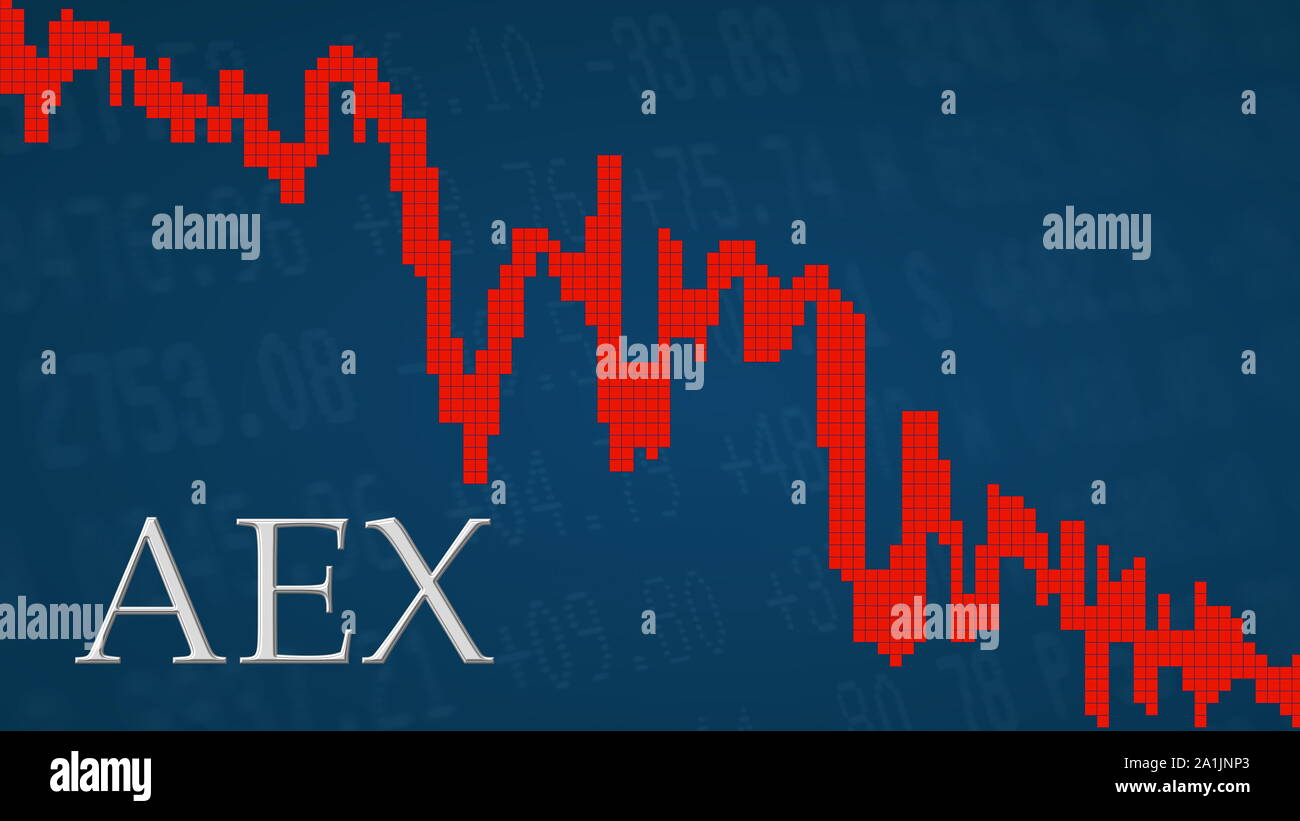

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Latest Posts

-

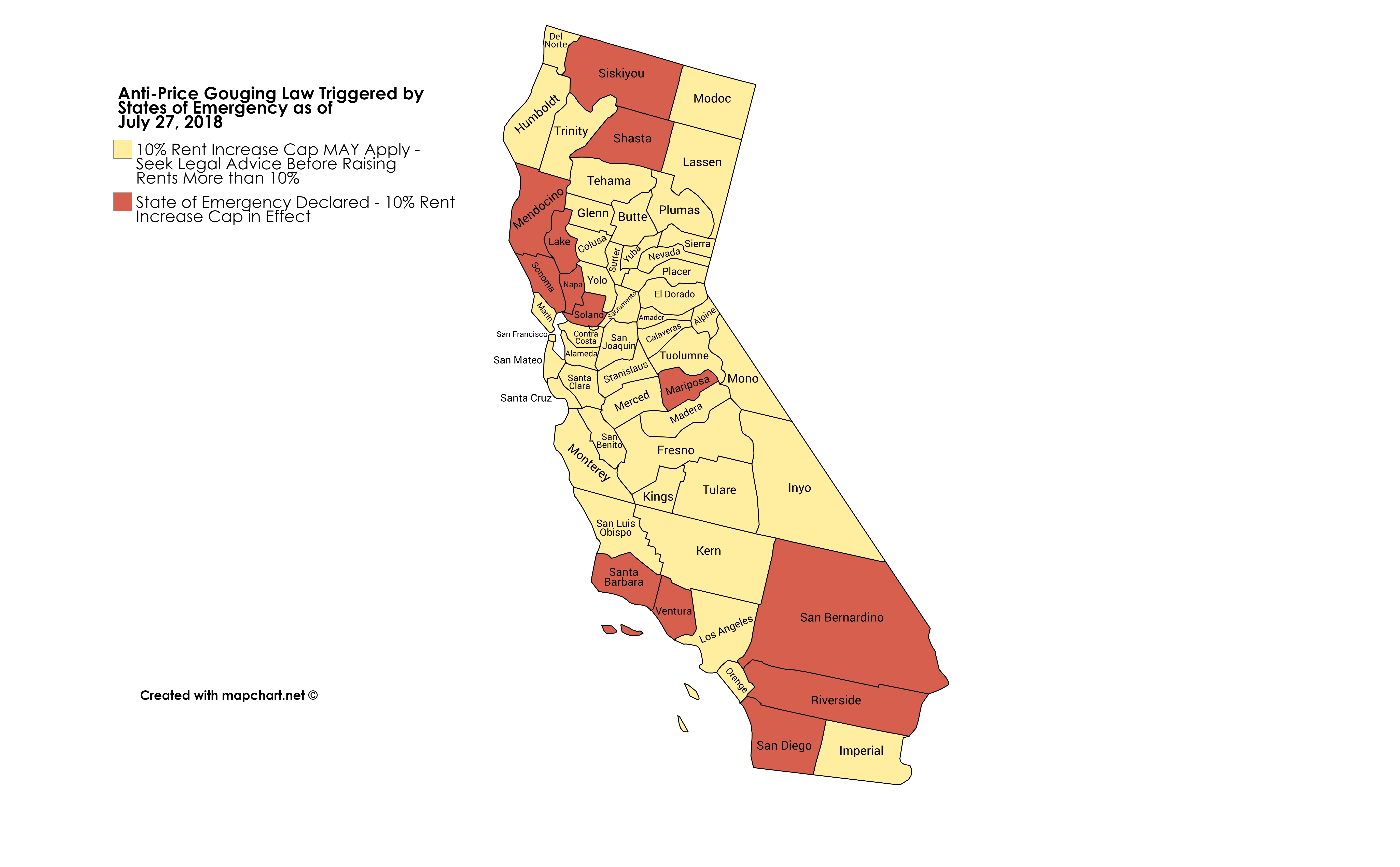

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

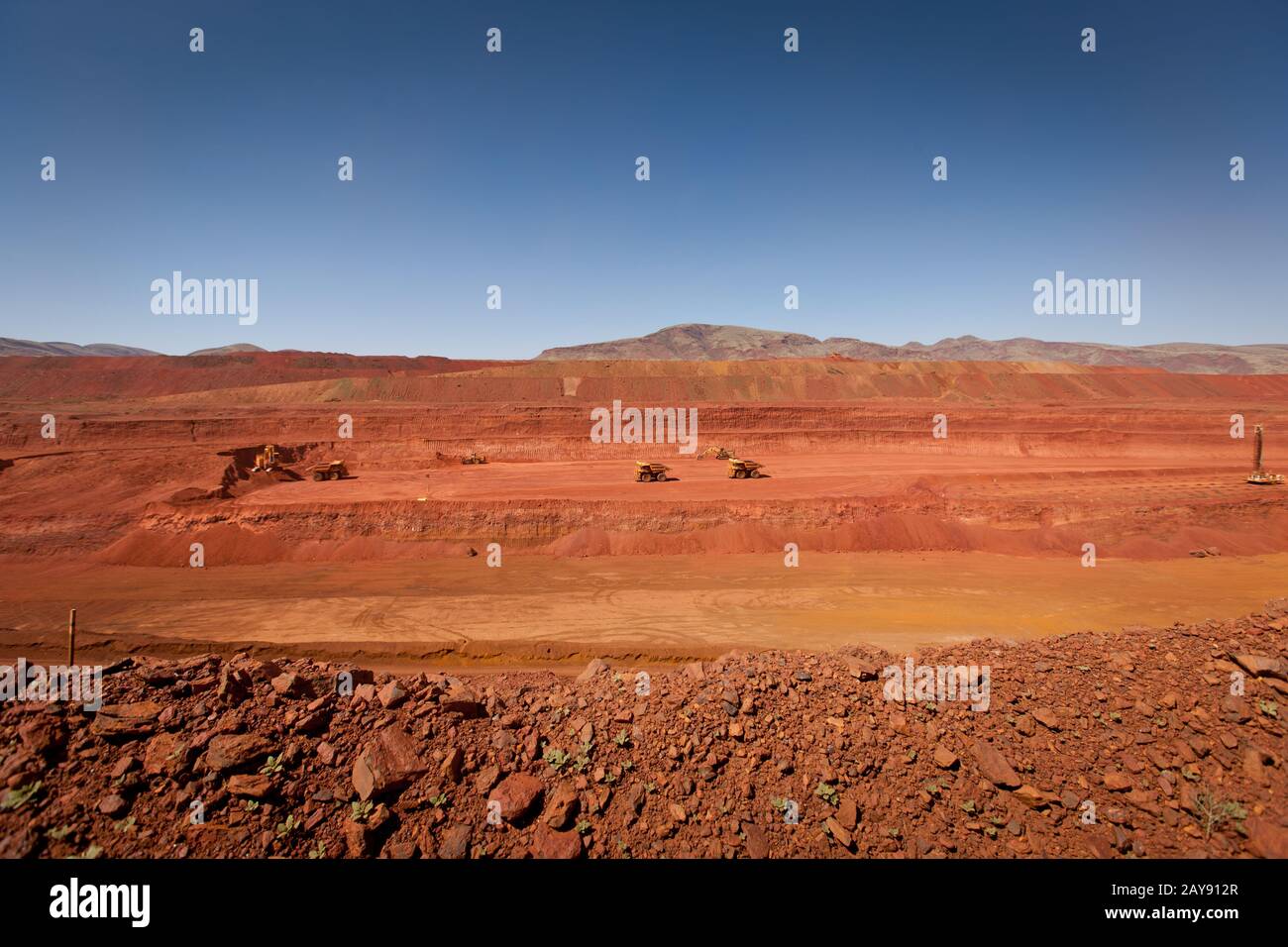

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025